Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX Opens Up, Big Earnings Day; Cochlear, AGL, Transurban, REA Group Feature

Transurban Group earnings report

Transurban [ASX:TCL] ‘s net profits skyrocketed in its latest earnings report, jumping from $55 million to $230 million in the six months ending December 31st.

This surge was fueled by increased traffic on their toll roads in both the US and Australia, alongside reduced financing costs.

The company declared a first-half dividend of 30 cents per share and a full-year payout of 62 cents per share.

However, this dividend fell short of some investors’ expectations, leading to a 2 cent drop in Transurban’s share price in trading today.

CEO Michelle Jablko acknowledged that the recent opening of Sydney’s WestConnex toll road has diverted traffic from some of their other roads, impacting their performance.

Despite this, she maintained that WestConnex itself is performing as expected and ‘in line’ with forecasts.

REA Group shares down after dissapointment

REA Group [ASX:REA] shares are down by 3.61% today as the company released a mixed earnings report.

Highlights of the FY24 half-year results are:

Revenue: $726 million, up 18%

EBITDA: $439 million, up 22%

Net profit after tax: $250 million, up 22%

Reported Net Profit after tax: $127 million, down -37%.

The company also announced a raised dividend of 16 cents per share.

High employee costs saw operating costs climb 12% to $224 million, and technology costs jumped due to inflation.

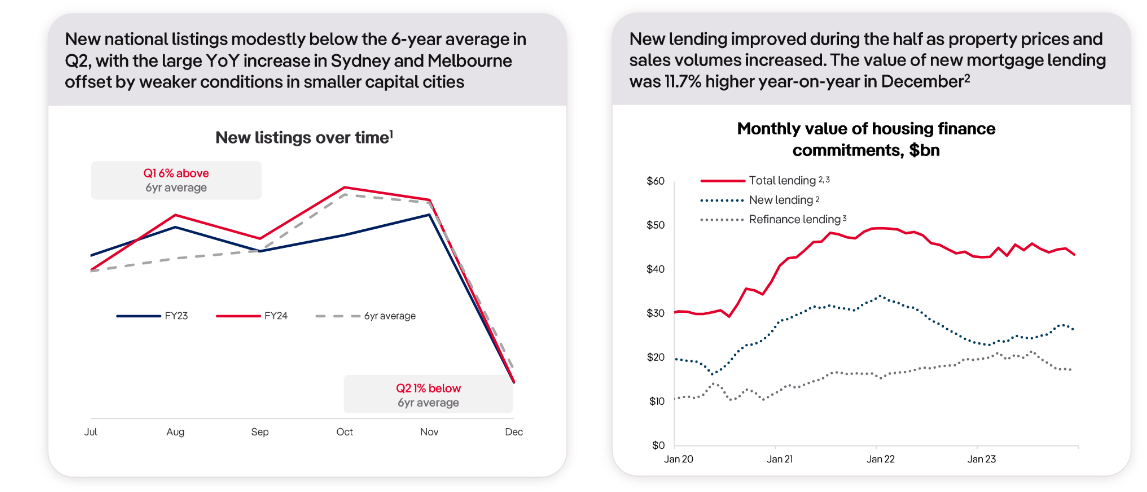

REA said that while listings were ‘moderately down‘, they noted that lending volumes have improved, with the value of new mortgage lending up 11.7% YoY.

Source: REA Group

Amazon Economists claim their new model can pick a recession in real time.

Economists have long sought to develop real-time recession indicators that can provide more timely warnings of downturns than traditional measures, which usually take many months.

Economists at Amazon claim they have developed a new method for forecasting recessions in real-time.

Their method uses two data series: one focused on real-economy activity and the other on financial conditions. The method is able to deliver a reading for a given month on the first business day of the next one, and it has been designed for both the US and Europe.

The economists’ approach is based on the idea that measures of financial conditions can provide early signals of distress encoded in asset prices. They use the Composite Indicator of Systemic Stress that’s published for both the US and the euro area by the European Central Bank.

For the real-economy side, they adopt the Purchasing Managers Index for manufacturing in the US and the European Commission’s Economic Sentiment Indicator for the euro area.

The economists’ method has some advantages over other recession-forecasting methods. For example, unlike unemployment figures, it is not subject to revisions.

However, it is also important to note that the method still hasn’t been extensively tested.

Uber reports first profit

The ubiquitous Uber has finally reached the lauded goal of its first annual profits.

For years, following the ‘Amazon model, ‘ the company has suffered billions of dollars in losses to gain market share.

What has sometimes been criticised as overly aggressive global expansion has seemingly paid off for the taxi app.

The company said it made US$1.1 billion in 2023, compared to a loss of $1.8 billion a year earlier.

It said customers booked 2.6 billion trips during just the past three months of 2023, that’s an astonishing 28 million per day.

Dara Khosrowshahi, Uber’s chief executive, said:

“2023 was an inflection point for Uber, proving that we can continue to generate strong, profitable growth at scale. Our audiences are larger and more engaged than ever, with our platform powering an average of nearly 26m daily trips last year.”

Uber’s stock was up 1% at one point overnight but closed up 0.26%.

So, how has the stock performed compared to its main competitor, Lyft?

Returns over last 2 years…

Uber $UBER: +93%

Lyft $LYFT: -67% pic.twitter.com/hrmPjovC5X— Charlie Bilello (@charliebilello) February 7, 2024

Midday market update

The ASX 200 is up by +0.54% at 7,657.2 around midday as a flood of corporate earnings come through.

Many analysts, including myself, are busy deciphering the messages of today’s large drop, with strong earnings upgrades among some of the ASX’s biggest.

Meanwhile, the AUD moved sideways for the first time in a while, as markets seem to have fully absorbed the message from central banks that rate rises are coming in the second half.

Crucially, the US dollar index [USDX] has begun to ease after spiking last Friday (US time) after Fed pushback on rate rises.

The hopeful easing of the USD should give some space to commodity markets and riskier assets, which have felt the brunt of the higher USD along with the Aussie dollar.

In individual performances on the ASX 200 today, AGL Energy is the top gainer, up +11.53%, followed by Mirvac Group, up +5.37%.

Utilities is the top sector at midday, up 2.09%, thanks largely to AGL, while tech also saw strong gains of +1.57%.

The Big Four saw near 1% gains overall, while the mining giants saw marginal gains of less than 1%.

Meanwhile, disappointing results from REA Group saw them as the worst performer this morning, dropping to 3.34%.

Cochlear upgrades guidance

Cochlear [ASX:COH] shares are up by nearly 5% in this morning’s trading as the company upgrades its FY24 earnings guidance.

The medical company said better-than-expected growth in cochlear implant revenue for the half-year ending December 2023 was the principal reason for the upgrade.

Underlying net profit for FY24 is now expected to be $385-400 million. That’s a 26-36% increase from FY23 results.

That upgrade is also 8% higher than the midpoint of the prior guidance of $355-375 million.

CEO & President Dig Howitt said:

“Cochlear implant trading conditions have been strong across the first half, with units growing 14%. We have maintained the market share gains made in FY23 and market growth has continued to be robust across both developed and emerging markets, as well as all age segments – children, adults and seniors.

The key change to our expectations is that we now expect to achieve 10-15% growth in our cochlear implant units for FY24 compared to the high single-digit growth expected in August.”

AGL Energy profits quadruple

AGL Energy [ASX:AGL] released its half-year earnings today with an astonishing +359% increase in its net profits to $399 million, up from $87 million last year.

The company said increased plant availability and the impact of higher wholesale energy prices were the key drivers of the astonishing improvement.

The improvements allowed the electricity provider to increase its full-year earnings guidance as well as up its dividend.

FY24 guidance was narrowed to the upper band with Underlying EBITDA between $2,025-2,175 million; previously, it was 1,875-2,175 million.

While guidance NPAT is set between $680-780 million, up from $580-780 million.

The company also gave an interim dividend of 26 cents per share (unfranked).

The share price is up by 12% in this morning’s trading.

AGL Managing Director and CEO, Damien Nicks said:

“In a period of heightened market activity, where we saw customer churn reach the highest levels for several years, I am pleased that we have seen growth in our overall customer services numbers, largely driven by our growing telecommunications business. We have also maintained positive customer advocacy, and improved Strategic NPS, finishing the half with a score of +7, and maintained a healthy spread to overall market churn.”

Morning market update

Good morning. Charlie here

The ASX 200 opened up +0.33% to 7,641.2 as the ASX earnings season began to ramp up.

Meanwhile in the US, tech pushed the S&P 500 to a record high, touching 4,999 just shy of the symbolic 5,000 point.

On the small caps, the Russell 2000 continued to underperform with the index down -0.17%.

Oil prices also jumped overnight as Israel’s PM Benjamin Netanyahu rejected the ceasefire deal, vowing to continue the war until ‘absolute victory’.

Wall Street: Dow +0.40%, Nasdaq +0.95%, S&P 500 +0.82%.

Overseas: FTSE -0.68%, STOXX -0.26%, Nikkei -0.11%, SSE +1.44%

The Aussie dollar fell -0.03% to US 65.21 cents.

US 10-year bond yields rose +2bps to 4.12%.

Australian 10-year bond yields were flat at 4.12%.

Gold is flat at US$2,036.18. Silver fell -1.01% to US$22.18.

Bitcoin rose +2.42% to US$44,191, while Ethereum rose +2.02% to US$2,425.

Oil Brent rose +0.97% to US$79.35, while WTI Crude rose +1.04% to US$74.07.

Iron ore flat at US$125.00 a tonne.

Key Posts

-

3:54 pm — February 8, 2024

-

2:23 pm — February 8, 2024

-

2:13 pm — February 8, 2024

-

1:14 pm — February 8, 2024

-

1:07 pm — February 8, 2024

-

11:35 am — February 8, 2024

-

11:30 am — February 8, 2024

-

10:24 am — February 8, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2026 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988