ASX News LIVE | ASX Opens Up as Miners Recover; Santos and Woodside Report Today

Market close

The ASX 200 closed +0.48% today at 7,642.1, its first green day in five days as Iron ore miners carry the day.

Eight of the eleven sectors finished higher today as Energy (-0.10%), Telecoms (-0.25%), and Health Care (-0.47%) finished lower.

Gold stocks, in general, faced some resistance on the ASX with Northern Star inching to $16.

Top performing stock today was Hutchinson Telecommunications up +15.15% followed by TELIX up nearly 10%.

Ainsworth Game Technology fell -8.46%, the biggest faller, followed by Horizon Oil, down -8.11% as crude oil prices sold off as traders felt the initial fears of a wider war in the Middle East had eased slightly.

Santos reports

Oil and gas giant Santos [ASX:STO] reported today showing sales revenue of US$1.4 billion for the quarter.

This came with the production of 21.8 mmboe despite severe weather events and planned maintenance activities throughout the quarter.

Santos Managing Director and Chief Executive Officer Kevin Gallagher was positive today, saying:

‘The first quarter brought strong free cash flow which provides a solid foundation for the year ahead. It positions us well to fund shareholder returns, backfill and sustain our existing business, complete our major projects and grow our Santos Energy Solutions business,’ Mr Gallagher said.

The company also said its controversial Barossa Gas Project is now 76% complete and the gas export pipeline is due for completion within next week.

BHP up on iron ore and quarterly report

BHP’s latest quarterly report is out with the company reporting a 10% increase in copper production as well as highlighting the completed sale of its coal projects Blackwater and Daunia.

The two sales were part of its divestments to Whitehaven Coal on 2 April for a total cash consideration of US$4.1 billion.

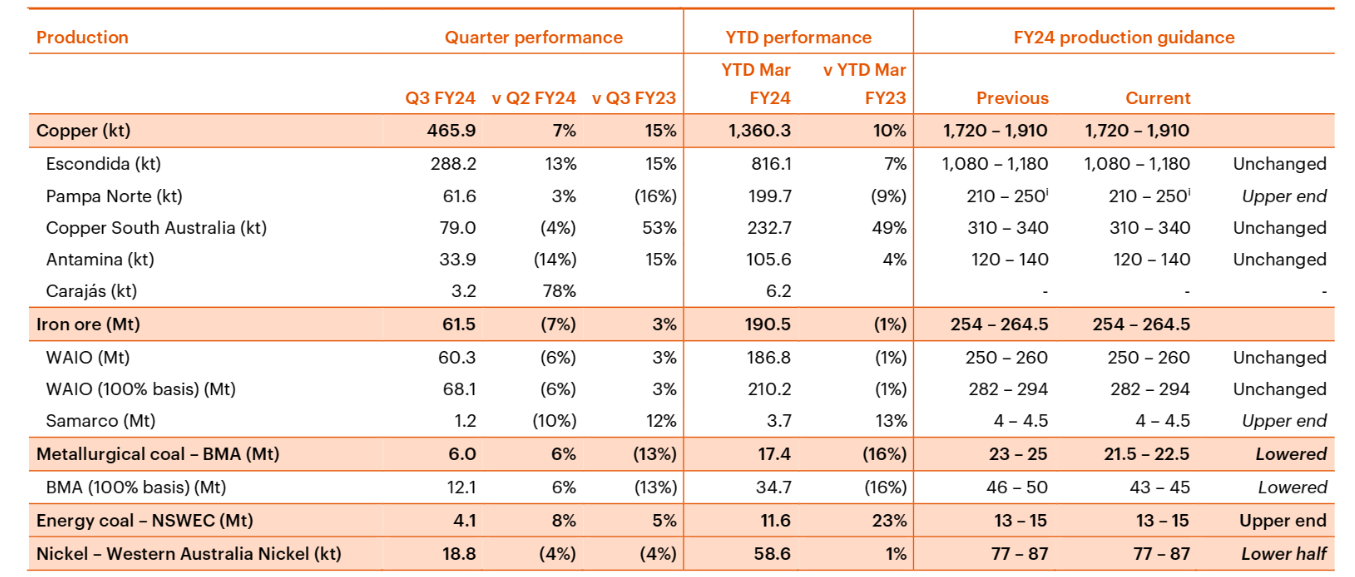

Here is what their latest production guidance looks like:

Source: BHP

The stock is up by over 1% around today’s close as the company sees a boost from rising Iron ore futures. This comes even as the RBA warns that Chinese demand for Australian iron ore may have peaked, saying:

‘The weak long-term outlook for steel demand from urban residential construction is consistent with the RBA’s previous assessment that growth in overall Chinese steel demand is likely to slow in the future and may be near its peak,’ RBA economist Adam Baird wrote.

Latest robot from major firm Boston Dynamics

Here’s a short teaser for the upcoming robot from Google-owned Boston Dynamics.

The company became famous for its prior generation of quadruped robots, as seen here.

Boston Dynamics reveals its new, improved all-electric Atlas robot, and @bheater has all the details right here: https://t.co/03DalEhXq2 pic.twitter.com/U8HY4Whvko

— TechCrunch (@TechCrunch) April 17, 2024

Market update

The ASX 200 is up +0.54% around 2pm as a strong bounce in the Mining sector (+1.41%) carries the market today after five consecutive days of losses.

A jump in Iron Ore Futures (+0.80%) to US$116.30 per tonne has helped the major players as a pre-holiday restocking by Chinese steelmakers has helped prices.

The coming May Day holiday break often pushes steelmakers to stock up so the uplift may not be a longer-term uplift but then things could shift in China.

While construction steel demand remains relatively weak in China compared with a year earlier, Huatai Futures analysts said steel consumption from the manufacturing sector has been ‘robust‘.

So far today, BHP (+2.03%) Fortescue (+1.08%) Rio Tino (+2.36%) are the major things to watch as the other sectors remain relatively subdued.

Some gains in the Big Four Banks is also lifting the index with CBA (+0.98%) NAB (+1.37%) and Westpac (+0.84%).

ResMed falls on fears from obesity drug

Ozempic the diabetes drug has taken the world by storm as a weight-loss treatment and is now at risk of hurting medical companies.

Sleep apnoea specialists and ASX-listed ResMed [ASX:RMD] have continued to see selling pressure as fears of reduced demand knock the share price.

Whether the further demand for sleep apnoea (an often obesity-linked condition) is really going to see a significant shift is in question. There has been no shortage of reports of potential industries that could be affected by Ozempic.

Everything from fast food to alcohol, and farmers are expecting knock-on effects if the drug’s popularity continues.

Domino’s Group chief executive Don Meij recently said he was watching the US adoption of Ozempic, saying:

“While it’s still too early to determine any substantial changes to consumer behaviour in Australia as a result of appetite-suppressing drugs, we have been monitoring this trend in other markets – particularly the US – closely.”

ResMed is due to release its third-quarter 2024 results on the 25th of April.

Unemployment rises in latest data

Australian employment experienced a slight decline in March, with around 7,000 fewer people employed compared to the previous month.

The unemployment rate rose to 3.8%, up from 3.7% in February, according to seasonally adjusted figures.

This uptick in unemployment defied analysts’ expectations of a 10,000 increase in employment and a forecasted unemployment rate of 3.9%.

The labour market’s strength is under close scrutiny by the RBA as it works to rein in inflation and bring it back to target levels. A low unemployment rate could potentially allow the central bank to hold off on anticipated rate cuts.

The Australian Bureau of Statistics attributed the small employment drop in March to a return to more typical employment patterns, following an unusually large influx of people entering the workforce in February, after smaller-than-usual flows in December and January.

Looking ahead, consumer price data will be released next week, providing crucial insights before the RBA’s next cash rate decision scheduled for May 7.

Morning market update

Good morning. Charlie here,

The ASX 200 opened up +0.43% to 7,638.0, recovering slightly from a five-day losing streak as bond yields eased slightly.

However the risk-off narrative remains as a hawkish Fed and geopolitical fears weigh on markets.

Oil prices fell ~3% as a rise in commercial inventories and signs of further weakness in China outweighed any Middle East supply concerns.

On the ASX, Woodside and Santos are due to report their first-quarter results.

Wall Street: S&P 500 –0.58%, Dow -0.12%, Nasdaq -1.15%.

Overseas: FTSE +0.35%, STOXX flat, Nikkei -0.60%, SSE +2.14%.

The Aussie dollar gained +0.27% to US 64.34 cents.

US 10-year bond yields -8bps to 4.59%.

Australian 10-year bond yields flat at 4.33%.

Gold fell -0.61% to US$2,368.13, while Silver rose +0.19% to US$28.23.

Bitcoin fell -4.16% to US$61,086, while Ethereum fell -4% to US$2,962.

Oil Brent rose +0.15% to US$87.42, while WTI Crude rose +0.16% to US$82.82.

Iron ore rose +0.98% to US$115.65 a tonne.

Key Posts

-

4:41 pm — April 18, 2024

-

4:09 pm — April 18, 2024

-

4:03 pm — April 18, 2024

-

2:16 pm — April 18, 2024

-

2:04 pm — April 18, 2024

-

1:54 pm — April 18, 2024

-

11:43 am — April 18, 2024

-

10:32 am — April 18, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988