Investment Ideas From the Edge of the Bell Curve

ASX News Live | ASX Closes Higher; Betmakers, Weebit Nano, Lynas Rare Earths, Mydeal All Feature

Weebit Nano: FY23 set to be ‘most important year’

Weebit Nano (ASX:WBT), developer of semiconductor memory technology, set next year will be pivotal in its journey to commercialize its ReRAM semiconductor tech.

Weebit said FY23 could bring the company’s first customers and first revenues.

CEO Coby Hanoch laid down the gauntlet:

“FY23 is shaping up to be the most important year in Weebit’s journey so far – one in which we will qualify our

technology, commence volume production with SkyWater, secure first customers and revenues, scale to 22nm,

and move closer to a discrete memory solution.

We remain confident in our growth outlook, and look forward to an exciting year ahead.

WBT shares ended 2.2% lower on Friday after the tech stock released its FY22 results, showing a net loss of $28 million.

Probability of recession rises to 52%: Bloomberg Economics

The probability of a US recession within the next 12 months jumped to 51.8%, according to Bloomberg Economics and the US 10-Year Treasury and 2-Year Treasury spread.

Recession probability in next 12 months has shot up to 51.8%, as per 2s10s spread and @Economics calculation pic.twitter.com/xFii0YXxYg

— Liz Ann Sonders (@LizAnnSonders) August 25, 2022

California’s plan to drag the US into the EV future

For most Aussie drivers, the concept of an electric car still seems like a futuristic pipedream.

I certainly know I’m surprised when I see a Tesla parked around my neighbourhood.

But the fact of the matter is that I am seeing it much more often.

Despite the preconceptions and perceived lack of infrastructure, electric vehicle (EV) adoption is slowly but steadily making headway in Australia. And while I don’t doubt that we’re still a long way away from a complete EV takeover, these spottings remind us that there is demand for battery-powered cars.

Right now, however, you should care less about whether you’ll ever own an EV and more about how to invest in them. Because while our nation may be lagging behind in the take-up of these cars, the manufacturers certainly aren’t lagging behind in the take-up of our resources to power them…

That’s why California’s latest decision is something that should have you on notice.

Whether you’re an EV believer or not, it seems the US is prepping for a battery takeover.

The decision I’m referring to will require all new cars sold in California to be powered by electricity or hydrogen by 2035. It’s a piece of policy that has been approved and passed into law already.

So this isn’t some hypothetical or potentiality.

In just over 12 years, the most populous US state will only sell new cars if they don’t run on petrol. This means the transition towards this goal is likely already underway.

After all, the manufacturing and supply chain process of automotive production isn’t exactly flexible. This reform is going to upend a lot of plans for all the major carmakers.

For investors, however, this should be seen as an opportunity.

Read full article here.

https://www.moneymorning.com.au/20220826/californias-plan-to-drag-the-us-into-the-ev-future.html

City Chic continues to slide on Friday as inventories rise

Women’s apparel retailer City Chic Collective is down a further 11% on Friday after a steep finish lower on Thursday, when it released its FY22 results, which came in below consensus estimates.

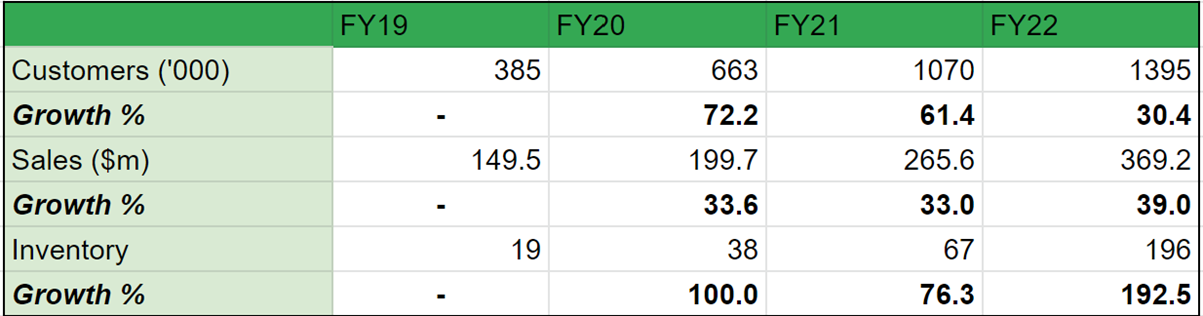

While CCX reported sales growth of 39% in FY22 to $369.2 million, the growth rate hasn’t really been taking off if you put City Chic’s last four years into perspective.

In fact, CCX’s customer growth rate has been slowing down.

And while the rate of customer growth is trending down, inventory growth has been consistently elevated, rising over 190% YoY in FY22.

On that topic, City Chic said it is “targeting closing inventory of $125m to $135m at 30 June 2023 as supply normalises.”

ASX 200 up 0.97% at midday as Bega and Qantas rise

The S&P/ASX 200 is currently up 0.97%, with most sectors in the green.

Bega Cheese is up 12% after revenue exceeded $3 billion on statutory earnings of $149.9 million.

While FY22 revenue rose 45%, profit after tax fell 69% to $24.2 million on a statutory basis.

Bega confirmed its July earnings guidance with normalised EBITDA expected to be between $160 million and $190 million.

But the dairy retailer did stress that competition for milk during June and July resulted in higher than expected milk price hikes — about 30% higher than FY22 farm gate milk prices.

Superloop: underlying EBITDA exceeds market guidance

Network provider Superloop saw its revenue jump 137% to $262.5 million, driven by the acquisition of Exetel.

Organic revenue in the broader Superloop business grew 17%.

SLC ‘s underlying EBITDA came in at $25.4 million, exceeding market guidance of $23-25 million.

While underlying EBITDA exceeded guidance, the figure excluded transaction costs related to the acquisition of Exetel and Acurus as well as share based payments.

Superloop ended FY22 with a net cash position of $42.8 million.

SLC shares are currently down 3.5%.

Apollo Tourism and Leisure eyes return to profitability in FY23

Apollo Tourism and Leisure [ASX:ATL] released its FY22 results this morning.

The global camper-van, caravan and motor-home rental company showed improved results over 2021 moving from a net loss of $17.9 million to a lower net loss of $4.7 million.

But with all markets in Australia, Europe, New Zealand, Canada and the USA now fully open for travel after COVID-19 restrictions last year, ATL sees a potential return to profitability in FY23 on improving market conditions.

However, Apollo faces a major current risk in the form of rising fuel costs on demand for ‘motor’ holidays.

While Apollo managed to shrink its net loss in FY22, revenue was down 9% on FY21, coming in at $265.9 million.

ATL said fleet sales revenue was crimped by “supply chain issues affecting stock supply and deliveries, and Australian dealership closures during lockdowns.”

Resimac’s net interest income falls on mortgage competition

Non-bank lender Resimac [ASX: RMC] released its full year results on Friday.

Resimac reported intense mortgage competition and higher funding costs, which pressed down its net interest income.

Net interest income fell 2% to $238 million, driven by lower home loan margins.

However, arrears remain low which is a positive sign for the overall housing market.

Statutory net profit after tax fell 5% to $102.1 million despite home loan settlements rising 30% to $6.3 billion.

Home loan AUM grew 11% to $15.3 billion.

Resimac CEO Scott McWilliam offered his thoughts:

“The resilience and quality of our portfolio sets us up well for the future. Arrears are at a record low, with home loans that have repayments 90-days past due declining by 4 basis points to 0.24 per cent. Further improvement was experienced in July. Dynamic LVRs are also low, currently at just under 60 per cent for prime and 65.9 per cent for specialist. Further, 65 per cent of our customers are ahead on their repayments, with one in four customers more than three years ahead of schedule.

“While we anticipate a period of subdued credit growth in FY23, we see opportunity to grow by targeting higheryielding specialist and asset finance segments, as well as focusing on niches in the prime segment.”

BNPL Splitit enters trading halt, flags capital raising

ASX BNPL stock Splitit entered a trading halt on Friday after announcing its intention to raise capital.

SPT shares rallied last month but are still down 57% over the past 12 months.

In July, Splitit gained over 80%, mirroring a wider rebound in BNPL stocks that took some market commentators by surprise.

The rally has since fizzled out, and SPT is currently down 18% in the past month.

Key Posts

-

4:39 pm — August 26, 2022

-

1:23 pm — August 26, 2022

-

1:16 pm — August 26, 2022

-

12:59 pm — August 26, 2022

-

12:29 pm — August 26, 2022

-

11:14 am — August 26, 2022

-

10:51 am — August 26, 2022

-

10:36 am — August 26, 2022

-

10:18 am — August 26, 2022

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988