Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX Opens Flat; Gold and Bitcoin Surge to Highs

Market close update

The ASX 200 closed down -0.15% at 7,724.2 in a very muted day of trading.

Healthcare and Gold stocks were the main two performers on the index today as health insurance premiums lifted the sector 1%.

As gold and bitcoin prices continued to push towards record highs, traders bought in heavily to the mid-cap gold miners today.

Seven out of eleven sectors were in the red today with the biggest losses seen by Discretionary (-1.21%) as Coles fell -3.29%.

Wider losses were seen by last week’s darlings, lithium producers, which fell sharply today. The biggest losses among the producers was Pilbara Minerals, down 7%, IGO down 5.3%, Sayona falling 6.7%, and Liontown down 4.1%.

Midday market update

The ASX 200 is flat at 7,740.3 around midday as the Healthcare (+1.01%) and Materials (+0.92%) sectors hold up the index.

The biggest contributors to healthcare today are pathology company Healius, which is up over 13% as its CEO steps down, and the government allowing insurance premiums to rise from April.

Early estimates of the insurance premium costs put them at an increase of $30-70 per year depending on the level of cover.

Gold miners outperformed their mining peers as gold touched three-month highs.

Overseas, China set a GDP growth target of 5%, matching last year’s forecast and released its first annual budget, which increased local government bonds to spend on infrastructure.

Healius jumps on CEO exit

Struggling pathology group Healius [ASX:HLS] has seen its shares jump by 15.5% in trading this morning as the company announced the acceleration of its strategic review.

The major change today is the resignation of CEO Maxine Jaquet, who is replaced by CFO Paul Anderson who is leading the review which is aimed at maximising shareholder value.

The shakeup comes as the company’s share price bled off nearly 50% of its value in the past year as profit margins collapsed in a post-pandemic market.

Healius, formally known as Primary Health Care, runs 2,000 pathology collection centres and 100 testing and imaging laboratories.

The company saw a loss of $636 million in the six months ending 31 December after a $600+ million goodwill impairment on its pathology division as returns softened after COVID testing.

The change today has been welcomed by investors who have been waiting for progress in the company’s Pathology Transformation Reset Program.

‘Despite operating in a tough industry environment, we have heard our shareholders loud and clear. We will focus on structuring and operating the business with a clear goal to

maximise their investment,’ Mr Anderson said today.

Gold miners shine as spot price jumps

While the ASX 200 has a weak start to the trading session, down -0.31% to 7,711, Aussie gold miners are having a field day.

The price of gold surged to a new all-time high overnight, gaining +1.53% to trade at US$2,115.33.

Market expectations for the Federal Reserve’s monetary policy have shifted in recent weeks. Fed fund futures now imply a 78% chance of a rate cut in June, compared to less than 50% last week.

This surge in anticipation reflects a broader market belief that the Fed will implement a total of three quarter-point rate cuts this year, amounting to 84 basis points of easing. This aligns closely with the Fed’s own projections of 75 basis points of cuts in 2024.

This shift in monetary policy expectations could impact gold prices. Typically, higher interest rates make holding non-interest-bearing assets like gold less attractive to investors so its clear the market is once again moving ahead of the Fed.

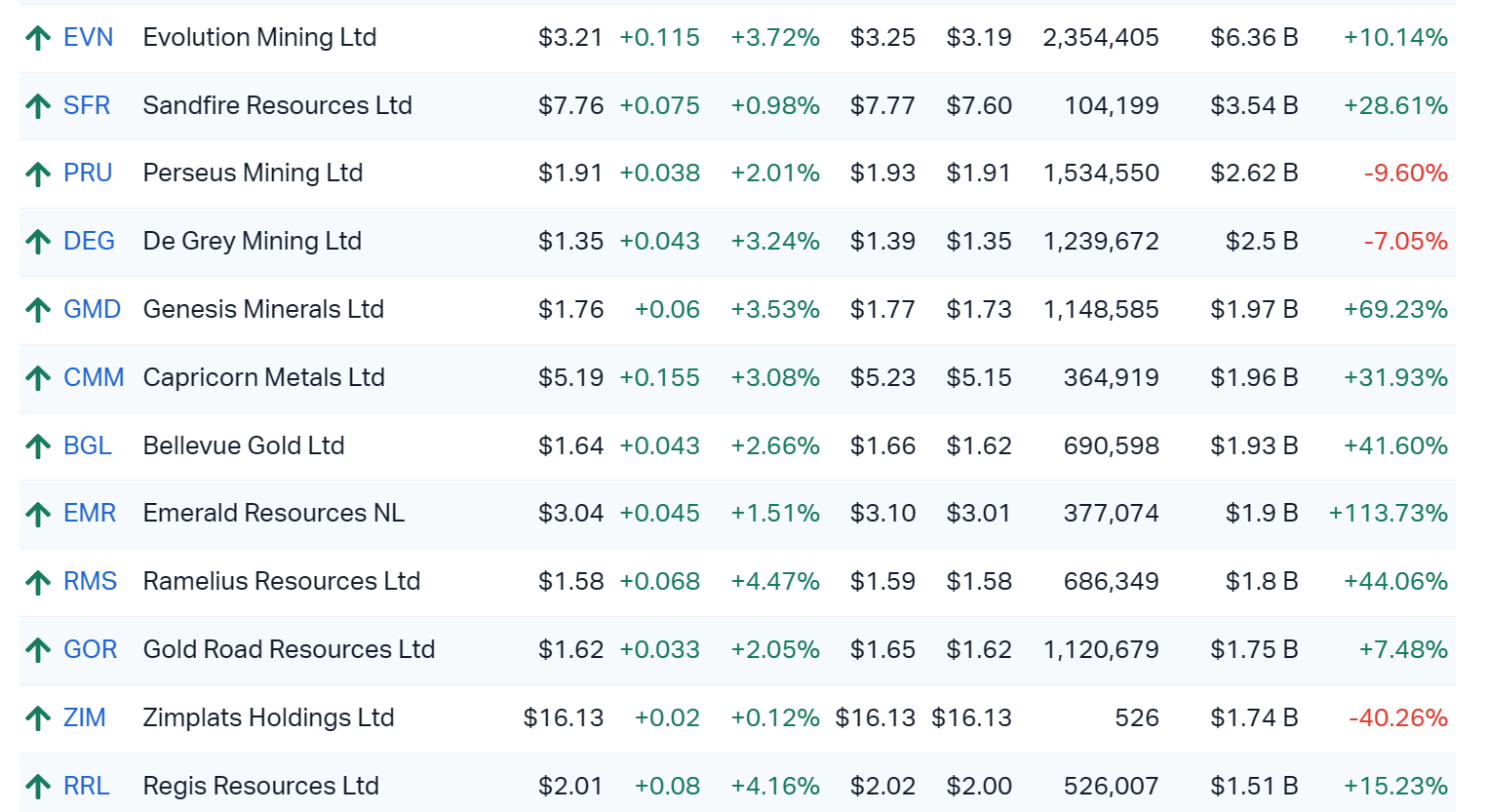

Major miners’ share price has followed suit on the ASX today:

Source: Market Index

Consumer confidence low

Australian consumer confidence, as measured by the ANZ-Roy Morgan index, has hit its lowest point so far in 2024.

This decline is likely due to a combination of factors, including weak retail sales figures and falling sentiment for the future of the Aussie economy.

The inflation rate, at 3.4% year-on-year, is the lowest it’s been since early 2022. While this might be positive news on the inflation front, it seems to have dampened consumer optimism about the economy’s future.

Interestingly, confidence among homeowners who are still paying off their mortgages remains positive, while renters and those who own their homes outright are feeling less confident.

Time to buy a major household item remained unchanged, with 21% saying now is a ‘good time to buy’ major items, while 50% said now is ‘a bad time to buy’.

Short-term economic confidence is extremely low, with only 11% expecting ‘good times’ for the Australian economy over the next 12 months compared to 32% expecting ‘bad times’.

Source: ANZ – Roy Morgan

Source: ANZ – Roy Morgan

Morning market update

Good morning. Charlie here,

The ASX 200 opened down -0.13% to 7,725.4, following a weak lead from Wall Street.

In the US, investors took profits as both the S&P 500 and Nasdaq sold off in the last hour of trade to close down for the session.

Bitcoin continues to surge after passing the hard resistance of US$64k. The price is currently less than 1.0% away from its all-time high.

In Australia, investors are watching the gold price, which touched all-time highs again as traders bet on a clearer case of interest rate drops around June.

Meanwhile, those hoping for more clarity from Chinese leaders yesterday were disappointed that number two Li Qiang became the first premier in three decades to not hold a press briefing after the annual parliamentary meetings.

Investors saw this event as one of the few windows into China’s forward policy and have interpreted the no-show in one of two ways:

Either the leaders don’t want the market to speculate and trade off their forward guidance moving forward, or it’s just another way President Xi Jinping is consolidating power.

‘This is a big loss and yet another sign the government slowly becoming ever-more opaque, both to outsiders and even those within the system,’ said Christopher Beddor, deputy China research director at Gavekal Dragonomics.

Wall Street: S&P 500 -0.12%, Dow -0.25%, Nasdaq -0.41%.

Overseas: FTSE -0.55%, STOXX +0.37%, Nikkei +0.50%, SSE +0.41%.

The Aussie dollar fell -0.26% to US 65.10 cents.

US 10-year bond yields +3bps to 4.21%.

Australian 10-year bond yields -2bps to 4.11%.

Gold is up +1.50% to US$2,114.51, while Silver is up +3.40% to US$23.90.

Bitcoin rose +8.36% to US$68,030, while Ethereum rose +4.41% to US$3,626.

Oil Brent fell -0.87% to US$82.82, while WTI Crude fell -1.53% to US$78.75.

Iron ore rose +2.08% to US$115.60 a tonne.

Key Posts

-

5:08 pm — March 5, 2024

-

1:27 pm — March 5, 2024

-

11:53 am — March 5, 2024

-

11:01 am — March 5, 2024

-

10:49 am — March 5, 2024

-

10:16 am — March 5, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988