Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX 200 Opens Down; Court Approves ANZ’s Suncorp Takeover, BHP Profits Fall

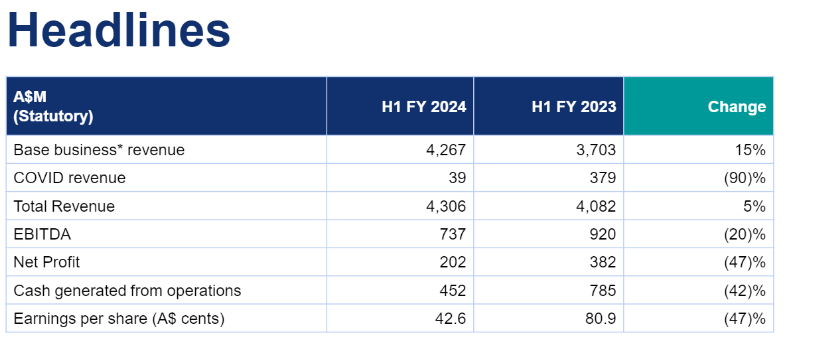

Sonic Healthcare falls on disappointing half-year results

Pathology provider Sonic Healthcare [ASX:SHL] fell by nearly 8% in trading today as its half-year profits failed to impress investors.

Here are the latest results.

Source: Sonic Healthcare Presentation 20/02/24

With the falling revenues from a post-covid era the company has struggled to regain momentum.

The company blamed poor currency exchange and labour costs for its poor performance and said that looking ahead its recent acquisitions and contract wins will secure future earnings.

A rollout of an enhanced revenue collection system in the USA is also expected to make a material improvement to results in FY25.

The company posted an interim dividend of 43 cents per share, up only 1 cent from H123.

Gold rush coming

Editor Brian Chu takes a look at the coming gold prices and thinks there is a lot to be excited for in his latest piece.

With all of the attention elsewhere at the moment, it could be a great time to accumulate some gold before the focus swings back to the world’s oldest asset.

As Brian puts it:

‘Corporate insiders have been busy in this space running their ruler over their peers and their assets. Several have completed deals in the last 18 months, and there’s more to come.

I’ve written about many of these deals as they occurred including Newmont Corporation [NYSE:NEM] buying our biggest gold producer, Newcrest Mining, Ramelius Resources [ASX:RMS] buying Breaker Resources and Musgrave Minerals, Genesis Minerals [ASX:GMD] buying the Gwalia mine in Leonora and taking over Dacian Gold, and the recent agreement by Red 5 [ASX:RED] and Silver Lake Resources [ASX:SLR] to combine in a merger of equals.

It’s clear that gold stocks aren’t at the top of the market so the odds are that we’re coming out of the lull.

The corporate insiders look like they’re positioning themselves for big benefits ahead.

I reckon that this is the right time for you to do the same.’

Read the full article below.

Judo Bank CEO steps down

Judo Bank [ASX:JDO] co-founder and CEO Joseph Healy will depart the SME bank in the coming months.

Shares in the bank in early trading but have recovered somewhat to be down -1% around early afternoon.

In a statement, Judo Bank Chairmain, Peter Hodgson called Mr Healy a ‘visionary,’ and went on to say:

‘Joseph has successfully led the bank through all its important foundational milestones since 2016 — proving the customer value proposition, recruiting an industry leading team, obtaining a banking licence, raising $1.5 billion in equity, and transitioning the bank to the public equity markets.’

Current deputy CEO Chris Bayliss is set to replace Mr Healy, while he will remain as an advisor.

Mr Healy has been with the Bank for seven years.

News of Healy’s departure arrives at the same time as the bank’s half-year report, which shows pre-tax profits of $67.4 million, up from $54.3 million in the PCP.

Its loan book value sits at $9.7 billion, up from the $8.9 billion in loans in June 2023.

Midday market update

The ASX 200 is down by -0.16% around midday at 7,652.5 in a very mixed day of trading.

The index has regained some ground lost at open but is still being dragged down by miners and energy sectors as commodity prices fall.

Overnight Iron ore futures fell -3.1% to US$127.25, which weighed on the markets, while poor earnings also hurt BHP, which is down -0.33%.

ANZ is also down -3.18% after courts approved its appeal in the takeover of Suncorp’s banking arm. Investors are obviously wary of the $4.9 billion price tag.

Meanwhile, the RBA minutes for February were released today, showing the RBA considered raising the cash rate by a quarter of a percent in its last meeting.

Minutes of the meeting showed a cagey RBA with comments like:

‘Members noted that it would take some time before they could have sufficient confidence that inflation would return to target within a reasonable timeframe.’

In other disappointing news, sports clothing brand KMD Brands is down over 10% in trading today as the company’s half-year report showed a 14.5% drop in sales.

Star Entertainment tanks

Star Entertainment [ASX:SGR] plunged 22% today after the shares came out from a trading halt.

Shares were trading at 43.8 cents this morning, a fresh all-time low for the troubled casino operator.

On Monday, the NSW gaming regulator launched a fresh inquiry into whether the $1.6 billion company had fixed major cultural failures at its Sydney casino.

Star opened today with a statement to investors:

‘The Star intends to participate in the inquiry in an open, transparent and facilitative manner.’

The company was expected to release its half-year earnings tomorrow, but the company said it needs more time to consider the impact of the inquiry.

Barrister Adam Bell of the first inquiry has been commissioned to launch a 15-week inquiry into the Star to assess the progress made since his damning first report, which found extensive money laundering, criminal gambling and large-scale fraud.

The inquiry’s report is due to be handed down by May 31.

BHP half-year profits collapse

Mining giant BHP’s half-year profits fell by an astonishing 86% to $1.4 billion.

That result is despite revenue rising 6% to $41.6 billion, in part thanks to new projects and higher iron ore and copper prices.

Underlying profit was largely unchanged at $10.1 billion, but $8.7 billion in impairments and charges left statutory profits at just $1.4 billion.

In the half-year report, BHP warned:

‘We expect the lagged impact of global inflation to continue into the second-half, particularly in relation to labour, and as we negotiate long-term supply arrangements.’

As a result, the miner cut its interim dividend to $1.10 fully franked, a big downgrade from last year’s $1.36 per share.

BHP chief Mike Henry said demand for commodities had not met expectations over the past six months, but the long-term future still looked positive.

‘We’ve seen volatility in global commodity prices and demand in the developed world has been softer than expected. That said, China demand is healthy despite weakness in housing and India remains a bright spot.’

Shares in BHP are down by -0.62% in trading this morning. Also weighing on prices is a 3% slump in iron ore prices today as Chinese markets return from the Chinese New Year.

Court approves ANZ Suncorp Banking takeover bid

The Australian Competition Tribunal has overturned the ACCC’s August 2023 decision and ruled in favour of ANZ’s takeover bid for Suncorp Groups [ASX:SUN] banking arm.

The $4.9 billion dollar bid has now cleared its first major hurdle in its planned takeover. There still is a possibility that the ACCC could appeal the decision and take the decision to a higher court.

In the court’s decision, it said that the deal would not substantially lessen competition in any markets, and the tribunal also found that the deal would create ‘significant public benefits’ due to the merger’s efficiencies.

Tribunal deputy president Justice John Halley said today:

‘The tribunal has concluded that the small increase in the market share of ANZ, if the proposed acquisition proceeds, would not have a meaningful impact on the degree of likelihood of the major banks engaging in successful coordination.’

The deal still requires approval from TreasurerJim Chalmers, who also put out a statement today saying:

‘ANZ now requires further approval under the Financial Sector (Shareholdings) Act 1998 (FSSA) to proceed with the acquisition.’

‘As is the case with Tribunal decisions like these, applicants and other interested parties can now seek a review by applying to the Federal Court.’

‘Once I receive ANZ’s FSSA application and Treasury advice, I will carefully and methodically consider whether the proposed acquisition is in the national interest under the FSSA and then announce a decision in due course.’

Suncorp is planning to use the sale proceeds to build up its main insurance business which has been facing challenges due to recent weather events.

Morning market update

Good morning. Charlie here

The ASX 200 opened down -0.40% to 7,635.6 this morning as US stocks remained closed for Presidents Day overnight. Without a real catalyst for movement, things remain muted as earnings season remains a mixed bag, with many mining stocks struggling to impress investors.

Things are looking better, according to Goldman Sachs, which upgraded its S&P 500 target for the second time in the past six months.

Meanwhile, the Pan-European Stoxx 600 hit its highest level in two years while commodity prices continued to ease.

Wall Street: closed

Overseas: FTSE +0.22%, STOXX flat, Nikkei flat, SSE 1.56%.

The Aussie dollar fell -0.03% to US 65.32 cents.

US 10-year bond yields flat at 4.28%.

Australian 10-year bond yields flat at 4.19%.

Gold is up +0.14% to US$2,016.84, while Silver is down -1.90% to US$22.96.

Bitcoin fell -0.61% to US$51,814, while Ethereum rose 2.80% to US$2,953.

Oil Brent flat at US$83.42, while WTI Crude fell -1.20% to US$78.24.

Iron ore slumped -3.1% to US$127.25 a tonne.

Key Posts

-

2:37 pm — February 20, 2024

-

1:52 pm — February 20, 2024

-

1:48 pm — February 20, 2024

-

12:08 pm — February 20, 2024

-

11:56 am — February 20, 2024

-

11:09 am — February 20, 2024

-

10:59 am — February 20, 2024

-

10:36 am — February 20, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988