Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX Opens 0.5% Higher; Zip, Allkem, Flight Centre, Qantas, Woolworths Feature

Twitter’s revenue down 40% YoY

Zoe Schiffer, managing editor at tech news site Platformer, has reported that Twitter’s revenue is down 40% year over year.

The steep drop comes at an inopportune time for new owner Elon Musk, who has a hefty interest payment looming at the end of the month.

Tiny scoop: We learned today that Twitter’s revenue is down 40 percent year over year (& Musk’s first giant interest payment on the company is due at the end of the month): https://t.co/IH7lJiQ0Dw

— Zoë Schiffer (@ZoeSchiffer) January 18, 2023

Zip CEO Larry Diamond — “We’ll take our medicine”

In an interview on Thursday with Ausbiz, Zip CEO Larry Diamond said his company won’t shy away from making tough decisions to reduce cash burn and target profitability.

Full interview here.

Zip: unpacking its key BNPL metrics

BNPL stock Zip ended Thursday 2% lower, as its FY22 results revealed a $1 billion net loss.

Zip was optimistic, despite the ballooning net loss, arguing that its unit economics were improving, especially in the mature Australian market.

ZIP said FY22 was a “record” result for its Australia segment, which posted cash EBTDA of $28 million, up 250% year on year.

The BNPL stock said this “demonstrates the profitability of strong unit economics and Zip’s unique model as the business continues to scale.”

Of course, ZIP has been scaling for years … and touting its unit economics just as long.

In FY18, Zip reported achieving cash flow breakeven on a monthly basis in Q4 2018, a “clear demonstration of operating leverage as volume scales.”

Zip’s top line growth has never been in doubt. But at what level will volume scale has been a defining valuation question — not just for Zip, but BNPL stocks in general.

It is instructive to look at ZIP’s ANZ segment, however, as it does throw up interesting results.

With exactly half the customers, ZIP’s ANZ segment generated 5% more revenue on almost identical transaction volume.

Thought another way, Zip generated $92 in revenue per ANZ customer and $44 per USA customer.

How?

Zip’s ANZ customers made nearly 90% more transactions than their USA counterparts, having nearly 100% more merchants to choose from.

There were 14.6 transactions per ANZ customer and 3.6 transactions per USA customer.

That means the average USA transaction was $176.5 million and the average ANZ transaction was $92.

ASX 200 closes 0.71% higher on Thursday

The S&P/ASX 200 closed 0.71% higher on Thursday, led by the real estate sector, which gained 2.23%.

The best performers on Thursday:

- Paladin Energy, up 11.6%

- Insignia Financial, up 11.4%

- Nine Entertainment, up 9%

- Qube, up 8.5%

- Pendal, up 8.4%

The worst ASX performers on Thursday:

- City Chic Collective, down 19.3%

- Kelsian, down 12.3%

- Domino’s Pizza, down 9.6%

- Perpetual, down 9.4%

- Deterra Royalties, down 7%

Nobody knows how interest rates affect inflation: John Cochrane

In an editorial for the Wall Street Journal, prominent economist John Cochrane pondered whether the Federal Reserve can contain inflation without raising interest rates too much higher than they are now.

Conventional wisdom says that as long as interest rates are below the rate of inflation, inflation will rise. Inflation in July was 8.5%, measured as the one-year change in the consumer price index. The Fed has raised the federal funds rate only from 0.08% in March to 2.33% in August. According to the conventional view, that isn’t nearly enough. Higher rates are needed, now.

This conventional view holds that the economy is inherently unstable. The Fed is like a seal, balancing a ball (inflation) on its nose (interest rates). To keep the ball from falling, the seal must quickly move its nose.

In a newer view, the economy is stable, like a pendulum. Even if the Fed does nothing, so long as there are no more shocks, inflation will eventually peter out. The Fed can reduce inflation by raising interest rates, but interest rates need not exceed inflation to prevent an inflationary spiral. This newer view is reflected in most economic models of recent decades. It accounts for the Fed’s projections and explains the Fed’s sluggish response. Stock and bond markets also foresee inflation fading away without large interest-rate rises.

Which view is correct?

For Cochrane, the answer is up in the air and the next months ahead will make for an interesting monetary experiment.

Economists don’t know for sure whether the economy is stable or unstable, whether inflation can fade away without interest rates substantially above inflation. In that light, the Fed’s actions make some sense. If you really don’t know how interest rates affect inflation, it’s natural to raise rates slowly. Inflation may subside on its own. If not, you can keep raising rates.

If inflation fades, the conventional view will be seriously undermined. If it spirals, absent other shocks, the new view is in trouble. But a good experiment requires everyone to leave the test tube alone.

Read full article here.

Bloomberg: BNPL stocks squeezed as big banks muscle in

Overnight, Bloomberg published a story on the mounting pressure facing standalone BNPL firms as losses mount and big competitors roll in.

“BNPL transactions reached about $147 billion in 2021, nearly doubling in a year to represent about 2.7% of global commerce transactions, according to GlobalData. The data firms believes this has room to rise to about 7.1% of global commerce by 2026. With more providers big and small joining the market, growth looks set to continue “especially in a macro-economic environment with inflationary pressures where consumers need to look for alternative sources of credit to cover living expenses,” said Jeff Tijssen, a partner at Bain & Co.”

Big banks are elbowing into the sector not only because of BNPL’s growing popularity but also to stave off the risk millennials and Gen Z consumers abandon traditional players for fintechs like Afterpay, Klarna, and Revolut.

“The rising popularity of BNPL also creates another risk for banks — losing access to millennial and Gen Z consumers attracted to this alternative form of financing.”

Read full article here.

Lithium stocks to watch from the RRS Conference with Hedley Widdup

Back in June, our small-caps guru Callum attended the Resource Rising Stars (RRS) conference in Queensland.

Cal decided to sit down with the conference’s main presenter, Hedley Widdup, to chat about 12 projects from the RRS.

Hedley, a trained geologist, runs Lion Selection Group, an investment fund that invests exclusively in the resource sector.

In this video, Cal and Hedley discuss the lithium sector and lithium developer Essential Metals (ASX:ESS) in particular.

As Hedley noted, lithium is a “very, very common element.” However, lithium deposits rarely concentrate themselves in ways that make extraction economic.

Russian economy ‘keeps beating expectations’

The Economist‘s analysis of data from a variety of sources suggests “Russia’s economy is doing better than even the most upbeat forecasts predicted, as sales of hydrocarbons have fuelled a record current-account surplus.”

“Parts of Russia’s economy have long been fairly detached from the West. That comes at the cost of lower growth, but it has made the recent increase in isolation less painful. In 2019 the stock of foreign direct investment in the country was worth about 30% of gdp, compared with the global average of 49%. Before the invasion only about 0.3% of Russians with a job worked for an American firm, compared with more than 2% across the rich world. The country requires relatively few foreign supplies of raw materials. Thus the extra isolation has not had much of an impact on the figures to date.”

Parts of Russia’s economy have long been fairly detached from the West. That comes at the cost of lower growth, but it has made the recent increase in isolation less painful https://t.co/co3UQYRXds

— The Economist (@TheEconomist) August 24, 2022

Nuclear age is coming … and investors need to be prepared

Energy has quickly become the talk of the Money Morning office.

Between the existing breakdown of fossil fuel markets, emerging renewable technologies, and a smattering of other alternatives, energy is at the heart of a lot of issues at hand. It’s a conclusion that every person can certainly see and feel if you’ve received a power bill recently.

Between the pandemic, inflation, and the invasion of Ukraine, energy has become scarce. Or at least a hell of a lot scarcer than what it was.

This has resulted in a massive global scramble to shore up energy supplies. And if you’ve been paying any attention to market updates, you’ll know it isn’t going well for most…

It is simply too hard to accommodate the kind of upheaval that we’re seeing.

Europe, in particular, is facing a deeper crisis than most due to the cut-off of Russian gas. Many of the proud economies in the region have even been forced to turn to coal. It’s a turn of events that flies in the face of the progressive image much of Europe likes to portray.

And even then, as the cost of coal soars, it can’t sustain energy needs alone…

Desperate times, desperate measures

No matter how you look at it, the world clearly needs a new energy alternative.

Fossil fuels certainly aren’t going anywhere, but underinvestment has hamstrung short-term output. As for the long-term outlook, opinion varies on whether supplies will remain sufficient. Either way, I’d wager that oil, gas, and coal are viewed more as stopgap solutions.

After all, if 2022’s energy issues have proved anything, it’s that energy security is imperative. And unlike Australia, many of the world’s nations aren’t blessed with such rich commodity reserves.

I suspect that before this decade is over, almost every developed economy is going to ensure they don’t have to rely on external energy supplies for the majority of their power. And love it or hate it, that means that going nuclear is going to be the best option for many.

Read full article here.

https://www.moneymorning.com.au/20220825/a-new-nuclear-age-is-comingand-investors-need-to-be-prepared.html

ASX uranium stocks pop on reports of nuclear power plant restarts in Japan

Local uranium stocks are rising on Thursday following reports of power plant restarts in Japan and possibly Germany.

Deep Yellow is currently up 13%.

Paladin Energy (ASX:PDN) is up 11.5%.

Lotus Resources is up 10.8%.

Boss Energy is up 6.5%.

🚨 HUGE JAPAN NUCLEAR POLICY REVERSAL 🚨

➡️ Japan will consider building next-generation nuclear power plants, Nikkei reports

➡️ This is important because Japan essentially barred construction of new nuclear plants after the 2011 Fukushima disasterhttps://t.co/cQDvXuYkYV— Stephen Stapczynski (@SStapczynski) August 24, 2022

Nine Entertainment up 9% as advertising sector remains resilient

Nine Entertainment [ASX:NEC] is currently up 9% in midday trade on Thursday after releasing FY22 results.

Nine reported revenue of $2.7 billion and net profit after tax of $315 million.

Peter Costello, chairman of Nine, commented:

“2022 has been a record year for Nine, on many levels. From a profit perspective, we have reported the highest ever Group EBITDA as well as Total TV and Publishing EBITDA and margin. At the same time, our ambition to accelerate profitable growth from our digital businesses is being realised, with more than 50% of EBITDA now attributed to our digital expansion, tracking ahead of the long-term targets we have previously communicated. For our shareholders, from our FY22 profit, we have also paid or announced a record, fully franked dividend of 14 cents per share.”

The advertising sector appears resilient this reporting season with Seven West Media [ASX:SWM], News Corp [ASX:NWS] and Ooh! Media [ASX:OML] also rallying off recent lows.

Nine corroborated this by noting that the advertising market has “remained resilient” to date.

In fact, NEC said it was confident its FY23 advertising revenues will “grow more strongly than the underlying markets in which they operate.”

ASX Gold Index up strongly in morning trade

The ASX Gold Index is up 2.5% as Thursday trade nears midday.

Gold producer Regis Resources [ASX:RRL] reported its full-year results today, with a significant decline in gross profit and net profit after tax.

However, management foreshadowed this last Thursday, causing shares to tumble then.

Today, RRL shares are up over 4%, paring back half of last week’s selloff.

Resolute Mining [ASX:RSG] also reported full-year results today, with a modest net profit after tax.

As we approach the Jackson Hole Summit speech by Chairman Powell on Friday, commodities are rallying as the US Dollar Index retreats from its 20-year record high of 109.

Humm opens 3% lower, gross income flat

Fintech Humm is currently down 3% on Thursday following the release of its FY22 results.

The key financials:

- Gross income fell 0.8% to $440.4 million

- Total income of $69.9 million in FY21 fell to a net loss of $117.9 million in FY22

- Net cash outflow from operating activities rose 370% to $520.9 million

- Cash and cash equivalents rose 29% to $281 million largely due to $619 million worth of non-recourse borrowings

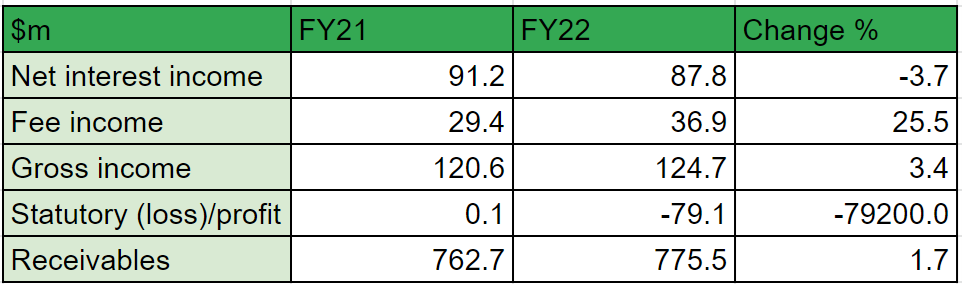

How did Humm’s BNPL segment fare in FY22?

Tabling the BNPL segment data into Google Sheets, we get the following breakdown:

BNPL Zip opens 8% higher despite net loss hitting $1 billion

BNPL stock Zip is currently up 8.5% despite its FY22 net loss ballooning to over $1 billion.

Zip has now accumulated over $1.8 billion in losses.

The key metrics:

- Group revenue rose 57% to a record $620 million

- Transaction volume rose 51% to a record $8.7 billion

- Transaction numbers rose 80% to a record 74.3 million

- Customer numbers rose 56% to 11.4 million

- Merchant numbers rose 77% to 90,700

The key financials:

- Cash gross profit up 12% to $203.7 million

- Cash EBITDA loss of $207 million

- Net loss up 45% to $1.02 billion

- Available cash and liquidity of $279 million as of 30 June 2022

- Net cash outflows from operating activities fell 15% to $752.4 million

Zip’s total equity has now shrunk from $1.1 billion to $437.7 million.

Qantas and IDP Education soar, City Chic Collective plummets

The S&P/ASX 200 is currently up 0.5% on a big reporting day, with Qantas currently up 7.5% as its recovery plan is “on track for completion”, announcing a $400 million on-market share buy-back.

IDP Education is up 11.5% after reporting a “record financial result”, notching revenue of $793 million, up 50% on FY21.

Net profit after tax came in at $102.8 million, up 161%.

Outgoing CEO Andrew Barkla said IDP’s FY22 performance was boosted by a resumption in global mobility.

“This year, as global mobility resumed, IDP customers reignited their international dreams. When they did, our teams were by their side with new innovations that helped them fast track their goals.”

However, women’s apparel retailer City Chic Collective is currently down 18% despite reporting strong revenue growth in FY22.

Key Posts

-

1:27 pm — January 18, 2023

-

5:59 pm — August 25, 2022

-

5:43 pm — August 25, 2022

-

4:55 pm — August 25, 2022

-

1:37 pm — August 25, 2022

-

1:23 pm — August 25, 2022

-

1:07 pm — August 25, 2022

-

12:56 pm — August 25, 2022

-

12:29 pm — August 25, 2022

-

12:22 pm — August 25, 2022

-

12:14 pm — August 25, 2022

-

12:03 pm — August 25, 2022

-

11:31 am — August 25, 2022

-

11:02 am — August 25, 2022

-

10:43 am — August 25, 2022

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988