Investment Ideas From the Edge of the Bell Curve

ASX News Live | ASX Modestly Higher; ANZ, JB Hi-Fi, Core Lithium, Weebit Nano, Openpay, Humm Feature

BNPL Openpay has less than 2 quarters of available funding as cash pile shrinks

Buy now, pay later fintech Openpay (ASX:OPY) saw its available cash and cash equivalents dwindle to $8.9 million in 1Q23, leaving the BNPL stock with less than two quarters of cash runway left.

Here are the key highlights from OPY’s 1Q23 release:

- TTV up 56% on prior corresponding quarter to $114.3 million

- Total revenue (including Opypro) up 87% to $10 million

- Active BNPL plans up 46% to 1.9 million

- Active customers up 18% to 332,000

- Active merchants up 2.4% to 4,300

- Revenue margin up to 8.5%

- Net transaction loss up to -1.4%

While OPY’s top line growth was solid, its cash position is on shaky ground.

Openpay recorded cash outflows from operating activities of $19.7 million as receipts from customers ($113.9 million) were more than offset by payments to merchants ($116.1 million).

Were it not for a capital raise during the quarter, the fintech would have ended the quarter in overdraft.

As it stands, Openpay has 1.7 quarters of funding available.

OPY is confident it can improve its cash position:

The entity has high confidence in amending and increasing the cash available to be drawn under existing debt facilities in the very near term.

The entity continues to actively manage its funding requirements … and other measures as necessary. Operating losses are reducing following the exit of UK and US markets in calendar year 2022, and the entity is targeting cash EBITDA profitability in the Australia and New Zealand region on a monthly basis by June 2023

$OPY saw its available cash dwindle to $8.9m in 1Q23, leaving the #BNPL stock with less than 2 quarters of cash runway left. $OPY recorded cash outflows from operating activities of $19.7m and needed a capital raise in 1Q23 to keep its bank balance positive. #ausbiz pic.twitter.com/oUODi5vnY1

— Fat Tail Daily (@FatTailDaily) October 27, 2022

The ‘first truly global energy crisis’ is upon us

The International Energy Agency (IEA) has finally confirmed what the rest of us already knew…

Our world is in the midst of a global energy crisis.

What matters now is how long it lasts and how we solve it. Because as is always the case when it comes to energy solutions, opinions are heavily divided.

IEA Executive Director Fatih Birol sees two major trends, for instance.

He states that oil demand is set to only increase in 2023 and that it will be nearly impossible to meet without Russian oil supply. On the other hand, he also sees this crisis driving investment and development of renewables to unprecedented levels.

In the long term, the transition toward sustainable and reliable renewable energy is still very much a priority. And while they still have a long way to come, these technologies will likely one day become a cornerstone of energy abundance.

The problem is that in the short term, there is still no replacement for oil and gas. No consumer or investor can afford to ignore the fact that the West has largely ignored new exploration for these key resources.

And that is why energy is and will continue to be a key theme for the months ahead…

What many people need to realise is that the worst of this energy crisis is likely yet to come.

We’re only seeing the start of oil and gas price pain. Because while energy companies are profiting nicely, they’re not reinvesting in new production.

https://www.moneymorning.com.au/20221027/the-first-truly-global-energy-crisis-is-upon-us.html

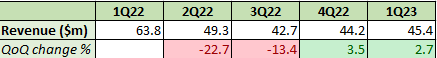

Adore Beauty falls on 1Q23 update

Online beauty retailer Adore Beauty’s (ASX:ABY) 1Q23 revenue fell 29% year on year to $45.4 million and active customers shrunk 9% YoY to 791,000.

Adore said YoY comparisons were not favourable because it was cycling a “period of significant growth when most of Australia was in lockdown.”

ABY CEO Tennealle O’Shannessy reiterated this messaging, saying:

“Year-on-year comparisons in isolation simply reflect the cycling of two consecutive periods of strong growth when part or most of the country was in lockdown.”

Adore Beauty QoQ revenue change

Sayona Mining up 5% on North American Lithium restart update

Lithium developer Sayona Mining (ASX:SYA) is up 5% after notifying the market of “further advances” in its restart of North American Lithium (NAL) operation in Quebec.

SYA said procurement and permitting is 96% complete, with NAL’s restart on track for Q1 FY23.

Sayona’s Managing Director Brett Lynch commented:

“It is pleasing to see the continued progress at NAL as we advance towards the restart of production in the first quarter of 2023. “Lithium demand from North America and globally continues to increase and Québec is well placed to deliver, with NAL set to become the first North American local producer next year and with further value‐ adding planned as we move into downstream processing.”

SYA shares are down 20% in the past six months.

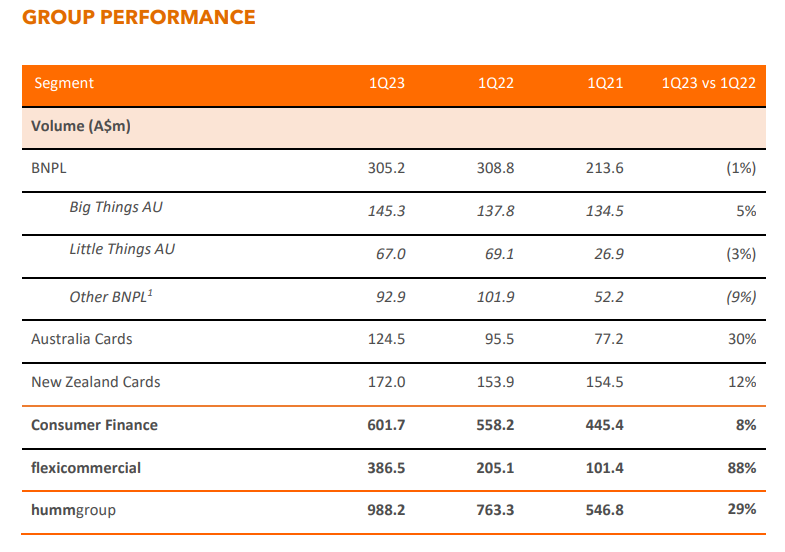

Humm rises 9% on 1Q23 as group volume up 29% YoY to $988.2 million

Fintech Humm (ASX:HUM) is up 9% after releasing a 1Q23 trading update.

Humm struggled in 2022 after board infighting and a failed sale of its consumer finance arm to Latitude Financial (ASX:LFS).

But the fintech is rising on Thursday after a reorientation to its “core business in bigger ticket financing”, flagging product closures of “non-core” products hummpro, bundll and humm BNPL in New Zealand.

HUM’s group volume in 1Q23 rose 29% YoY to $988.2 million, driving largely by growth in Flexicommercial segment. Flexicommercial volume rose 88% YoY to $386.5 million while the consumer finance volume rose a more modest 8% YoY to $601.7 million.

Humm chief executive Rebecca James commented:

“Our FlexiCommercial business recorded another strong quarter with volumes growing 88% on pcp, while also delivering improved credit quality, with net loss/ANR of 0.7%, a decrease of 20bps. Our Consumer business performed well this quarter with card volumes growing 19% pcp, reflecting a rebound in spend activity as travel and everyday spend returns post COVID. Our strategy to focus on bigger ticket financing is starting to gain traction with an 8% growth in volumes. As a result of planned product closures of non-core products hummpro, bundll and humm BNPL in New Zealand, we have experienced a large improvement in our net loss rate and the quality of our smaller ticket book, down 230bps to 2.9%. Looking ahead we will continue to focus on managing our margin in a rising rate environment, ensuring that we continue to grow our core businesses in a profitable and competitive manner, and reducing our operating cost base.”

Source: Humm

Weebit Nano up 15% after qualifying ReRAM module

Weebit Nano is up 15% on Thursday after completing “full technology qualification” for its Resistive Random-Access Memory (ReRAM) module.

WBT said this qualification was a “key step” for every semiconductor product and was the first full qualification of its ReRAM technology.

Weebit said the qualification “confirmed the suitability of Weebit’s embedded technology for volume production.”

WBT CEO Coby Hanoch commented:

“Successfully completing full qualification of our technology is a major milestone. As is customary for NVM qualification and semiconductors devices in general, tests are based on industry standards, providing confidence in the quality, repeatability and reliability of Weebit’s ReRAM. Leti’s state-of-the-art fab makes these qualification results significant and relevant for other foundries and potential customers and could be used by customers as a baseline for their qualification process. We are now engaged at various stages with multiple Tier-1 foundries and semiconductor companies, and having achieved this milestone, our activities with potential customers are accelerating.”

$WBT is up 14% after completing "full technology qualification" for its #ReRAM module. #Weebit said this was a "key step" for every semiconductor product.

The qualification "confirmed the suitability of $WBT's embedded technology for volume production." #ausbiz

— Fat Tail Daily (@FatTailDaily) October 26, 2022

Will Reserve Bank revise its inflation forecast?

Inflation was hotter than expected in the September quarter, with trimmed mean inflation especially running well ahead of forecasts.

Will this affect the Reserve Bank’s own inflation forecasts?

Currently, the RBA expects headline inflation to be around 7.75% over 2022.

The September quarter CPI print showed annual headline inflation at 7.3%.

Will this trigger the central bank to nudge its 2022 inflation forecast higher?

The #RBA's central forecast for CPI #inflation is to be around 7.75% over 2022.

Will yesterday's #CPI release trigger an upward revision in that forecast? #ausbiz #economy #auspol

— Fat Tail Daily (@FatTailDaily) October 27, 2022

Core Lithium falls on failed Tesla deal

Core Lithium’s potential offtake with Tesla has fallen through after the deadline to finalise terms passed yesterday.

In March, CXO entered into a term sheet with Tesla for a mooted supply of 110,000 tonnes of lithium spodumene concentrate over four years.

That term sheet set up the parameters and conditions for signing a binding offtake.

For instance, the March term sheet was conditional on ‘completing negotiations and execution of a definitive product purchase agreement by 27 August 2022.’

Two days after the August deadline, CXO announced the extension of the termination date for the term sheet to October 26, 2022.

Today, the lithium developer revealed an agreement could not be reached.

The 110,000 tonne lithium spodumene supply deal between CXO and Tesla is off.

Core Lithium CEO did leave the door ajar for future agreements:

“I want to thank Tesla for the time taken to negotiate with Core and look forward to maintaining an open and ongoing dialogue.”

$CXO and $TSLA offtake negotiations chronology. #ausbiz #lithium #EVs pic.twitter.com/xjDlOexIWl

— Fat Tail Daily (@FatTailDaily) October 26, 2022

Syrah Resources releases Balama update

Graphite producer Syrah Resources (ASX:SYR) released a brief update on the industrial action affecting its Balama operations in Mozambique.

On Thursday, SYR revealed that mining and processing operations as well as “unrestricted logistics movements have resumed at Balama with the full complement of Syrah’s employees and contractors on site.”

Syrah did hint the reasons behind the industrial action are not resolved yet.

The producer noted that it is still working through the “periodic renewal of employment conditions” with designated representatives of its unionised workforce.

SYR shares were flat at the time of writing.

On Thursday, $SYR announced that mining and processing operations, along with "unrestricted logistics movements have resumed at Balama with the full complement of #Syrah's employees and contractors on site." #ausbiz #graphite https://t.co/AZDk8CDglp

— Fat Tail Daily (@FatTailDaily) October 26, 2022

Key Posts

-

3:53 pm — October 27, 2022

-

1:50 pm — October 27, 2022

-

1:12 pm — October 27, 2022

-

12:49 pm — October 27, 2022

-

12:22 pm — October 27, 2022

-

12:05 pm — October 27, 2022

-

11:46 am — October 27, 2022

-

11:40 am — October 27, 2022

-

11:09 am — October 27, 2022

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988