Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX Inches Higher; Allkem, EML, Telix, Redbubble Feature

City Chic jumps as retail billionaire Brett Blundy accumulates 7.3% stake

City Chic finished 16% higher on Wednesday after billionaire retail mogul Brett Blundy accumulated a 7.3% stake in the downtrodden CCX stock over December 2022 and January this year.

Blundy is a big name in Australian retail, finding success backing names like Lovisa, Bras N Things, and Honey Burdette.

Blundy now owns about 17.5 million shares, or 7.3% of the plus-size women’s apparel retailer.

City Chic has had a tough 12 months, down a mammoth 85%.

But bargain hunters — and Bretty Blundy — are seeing value. CCX shares are up nearly 40% so far this month.

Solar stocks in the spotlight

The BetaShares Solar ETF [ASX:TANN], which follows global solar companies like First Solar, is up close to 9% since the beginning of the year.

Solar stocks spiked recently after Q Cells said it would invest more than US$2.5 billion to expand its solar module manufacturing operations in the state of Georgia in the US.

Q Cells is owned by South Korea-based Hanwha Group. With this investment, Q Cells is looking to take advantage of tax credits from the recently passed Inflation Reduction Act in the US to build out a US solar supply chain.

As Canary Media writes (emphasis added):

‘Under the 45X production tax credit structure created by the Inflation Reduction Act, each domestically produced part of this solar manufacturing process will receive its own tax benefits, said Scott Moskowitz, Qcell’s head of market strategy and public affairs.

‘The goal of this tax-credit structure, first put forward by U.S. Senators Jon Ossoff (D) and Raphael Warnock (D) of Georgia and other Democrats as the Solar Energy Manufacturing for America (SEMA) Act, is to make each stage of the solar production process cost-competitive with materials and products coming from overseas.

‘“All these credits stack,” Moskowitz said, with each stage in the process adding tax-credit value to the final product. Taken together, these credits could cover about half the cost of producing a solar panel.’

At the moment, the main competitor is China, with an around 80% share in all key areas of solar panel manufacturing.

But Q Cells is the latest company to put money into clean energy manufacturing in the US.

Granted, much of the investment has been in boosting the US’s EV and battery manufacturing sector, but the IRA is certainly attracting plenty of investment into the US.

For instance, Honda and LG have said they are planning to build a US$4.4 billion electric battery factory in Ohio to make batteries in the US…

…BMW plans to invest US$1.7 billion to build EVs and batteries in South Carolina…

…and Panasonic has pledged US$4 billion to build a battery plant in Kansas.

So, you can see how the Act could really be a catalyst for accelerating investment into EV supply chains in the US…but money is also flowing into some Aussie companies involved in developing some of those supply chains.

For example, on Friday, Ioneer got a conditional loan commitment for $1 billion to develop its Rhyolite Ridge lithium-boron project in Nevada.

In short, the IRA has pledged billions in energy security and climate spending, and it’s already boosting clean energy stocks.

And the effects of the IRA will be felt for years to come as private investment starts to pour in to match government spending actions.

https://www.moneymorning.com.au/20230118/dont-miss-out-on-this-growth-story.html

Investing in exponential themes and picking winners

Big shifts in technology or behaviour don’t only excite culture wars. Investors, too, get giddy at the prospect of catching a wave that will deliver them glory and riches.

You could even classify some investors as big wave surfers. Monster wave surfers scour the world, seeking to catch the improbable and rare 100-footers.

And some investors hunt plays to capitalise on exponential themes in pursuit of the improbable and rare 100-baggers.

Often, we call these thematic investors.

Identify a theme about to crest…and catch the exhilarating ride.

The logic is simple and alluring.

When done well, it’s also almost mythical. A great thematic investor is like a time traveller cashing winning lottery tickets.

But spotting trends forming on the horizon isn’t easy. And the work doesn’t stop once the spotting is done.

Picking winning themes is not the same as picking winners

To be a successful thematic investor requires at least two great skills — foresight and business acumen.

You need to be clairvoyant enough to spot the true societal or technological shifts. But you also need the business sense to figure out who stands to benefit.

And what do I mean by benefit? A business should profit from the tectonic shift in a way that creates vast shareholder value.

Investing is a strange topic.

It lies at the intersection of so many others — business, finance, economics, technology, science, etc. — yet it has its own core, too.

At the end of the day, a successful investor makes money (and doesn’t lose money). That usually means backing companies that make money.

And that boils down to cash flows.

It seems so banal that investing — often exciting and multi-disciplinary — is headquartered in the accountant’s office.

That’s why I said thematic investing requires business acumen. Being right about a rising trend is not enough. You must also pick businesses that leverage the trend into profitable enterprises.

The internet is one of the most profound technological advances and societal shifts. But seeing the advent of the internet early was not enough.

Many early internet companies failed. Scores of others took years to turn a profit.

Picking winning themes is not the same as picking winning stocks.

https://www.moneymorning.com.au/20230117/investing-in-exponential-themes-and-picking-winners.html

Redbubble to suspend promotional spend — but will revenue growth suffer?

Redbubble likes to speak about the flywheel effect that in theory should spin its marketplace business to great success as more customers attract more artists and more artists in turn attract more customers.

RBL described its flywheel model in its FY22 annual report:

It is a flywheel because the greater number of artists in the marketplace, the higher the volume of relevant content which creates more reasons for customers to come to the marketplace. More customers enables the fulfilment network to scale, lowering costs and improving services, thus attracting additional customers. With more customers, comes more artist revenue, encouraging new artists to the platform adding more content and the cycle continues

Yet Redbubble’s flywheel has wobbled and seems to be propped up not by its own momentum but marketing expenditure.

To attract both customers and artists, Redbubble spends big on promotional activity.

In FY22, Redbubble spent $76.4 million on paid acquisition costs and $4 million more on other marketing expenses. In total, FY22 marketing outlay was 44% of gross profit.

But Redbubble’s revenue has fallen in FY22, despite spending on promotional activity higher in FY22 than FY21.

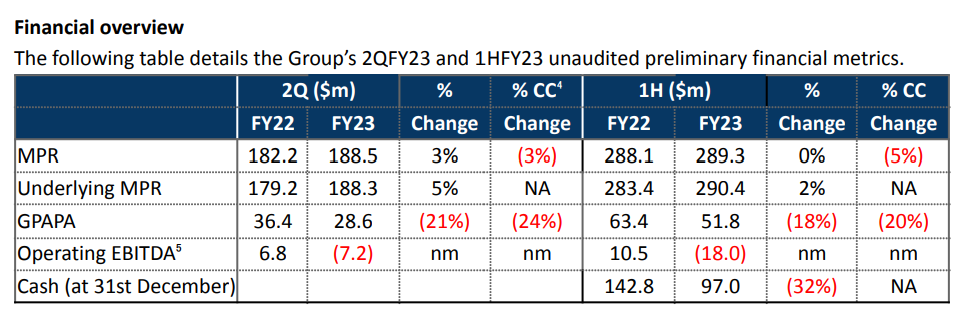

Conditions haven’t improved in 1H23. Redbubble’s latest trading update flagged ‘increasingly challenging’ trading conditions:

Trading conditions were increasingly challenging during the half year. Consumers were value driven in a tougher economic environment and as a result, competitive intensity in the market was high. To compete in this environment, the Group increased its promotional activities, which drove Marketplace Revenue growth of 3% in 2QFY23 (5% on an Underlying basis). The step-up in promotional activity, as well as offering free shipping above a certain threshold, drove a reduction to the Group’s 1HFY23 GPAPA margin to 17.9% from 22.0% in 1HFY22.

How long can Redbubble eke out low-digit revenue growth with margins steadily falling?

Not long.

After increasing its promotional activities in 1H23 to little avail, RBL admitted defeated and said it will suspend investment in ‘brand awareness’ and cut its staff by 20%.

But what will happen to revenue with reduced promotional spending?

Redbubble CEO: consumer demand to remain ‘challenging’, workforce to be reduced

Michael Ilczynski, CEO of Redbubble, admitted his company is facing near-term hurdles and announced staff cuts.

In a trading update, Ilczynski told investors:

“Looking ahead, we expect consumer demand to remain challenging in the near term. As a result, we have decided to reduce the cost base within the Redbubble marketplace to accelerate the Group’s return to cash flow positive. These are hard decisions and I am sorry for the impact this will have on our people. The steps we are taking, however, will put our business on stronger footing and position us to capitalize on the tremendous potential of the Group as the consumer landscape improves.”

With revenue stalling despite ‘increased promotional activity’ in 1H23, Redbubble is taking a step back and cutting costs.

First, Redbubble will suspend investment in its ‘brand awareness project’.

Second, it will cut its workforce by 20%.

Finally, RBL will reign in ‘general costs to align with business priorities and scale’.

These cost cutting measures are expected to bring in between $20-$25 million in cost savings on an annualised basis. The full benefit will be realised ‘from the beginning of FY24’.

Redbubble down 11% on guidance downgrade

Online marketplace Redbubble (ASX:RBL) is down 11% on Wednesday after issuing a margin guidance downgrade in its trading update.

Redbubble’s gross profit after paid acquisition (GPAPA) margin is now expected to be below FY22 GPAPA margin, which was 22.1%.

But RBL didn’t specify how much below it expects FY23 GRAPA margin to be. The marketplace said ‘increased investment in promotional activities to attract new and existing customers’ hurt its GPAPA margin.

As for the trading update, Redbubble reported modest marketplace revenue (MPR) growth in 2Q23 and no growth in 1H23.

1H23 MPR stood at $289.3 million.

Allkem’s Mt Cattlin performance well down YoY

Allkem’s Mt Cattlin site under-performed in the December quarter compared to the same quarter last year but strong lithium prices compensated for the lower grades and shipped volumes.

Below is the operational breakdown for Mt Cattlin for the FY22 and FY23 December quarters.

Allkem: Argentina removes export benefits for lithium chemical production

Allkem — who has key lithium projects in Argentina — relayed in its latest quarterly that the Argentinian government intends to remove the export benefits currently accruing to lithium chemical production.

Allkem is unsure of the full effect of this change, but expects it will lead to the ‘loss of incentives in the range of 1.5% to 4% of revenue.’

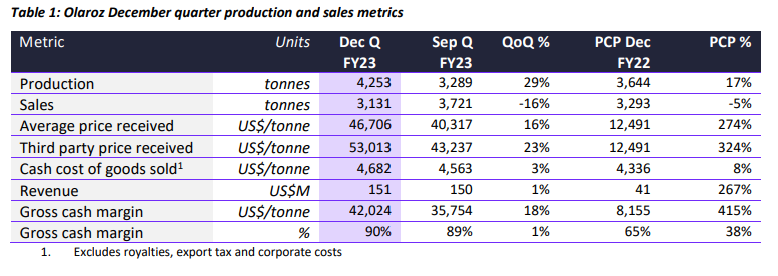

Allkem flat on December quarterly results despite strong margins

Lithium producer Allkem (ASX:AKE) reported US$265 million in revenue in the December quarter. Gross operating cash margin was about US$218 million, showing the strong margins Allkem is reaping in a hot lithium market.

Allkem has two main producing sites — Olaroz and Mt Cattlin. Both sites enjoyed big margins.

Olaroz produced a record 4,253 tonnes in the quarter, up 17% on the previous corresponding quarter. That said, Olaroz’s sales were down 16% quarter on quarter to 3,131 tonnes of lithium carbonate, of which 42% was battery grade.

AKE blames a build-up of inventory to supply its new Naraha hydroxide plant in Japan.

That said, while Olaroz sales were down, elevated lithium prices meant total sales revenue from Olaroz was a record US$151 million.

Allkem received an average price of US$53,013 a tonne with costs at US$4,682 a tonne. This cash cost did rise 8% on the prior corresponding period due to ‘inflationary impacts’. But all in all, Olaroz had a gross cash margin for the quarter of US$42,024 a tonne, or 90%.

Year on year, the average price received for Olaroz lithium has spiked 274% while costs have gone up a modest 8%.

Actual #lithium prices from $AKE. High prices for less than world class quality. pic.twitter.com/Djg2xG3iVX

— Joe Lowry (@globallithium) January 17, 2023

Things were less upbeat for Allkem’s Mt Cattlin site on a QoQ basis.

Spodumene concentrate produced at the site was 16,404 dmt, down ~7% from September quarter’s 17,606 dmt.

Concentrate shipped also took a dive, down 26% to 15,702 dmt.

As a result, revenue fell 22% to US$83 million.

And while the realised average price received rose 5% to US$5,284/dmt, cash costs rose 27% to US$1,016/t.

Allkem said performance waned because of ore availability and lower grades due to ‘patchy mineralisation intersected at the top margin of the main ore lens.’

The producer is now mining beyond this zone and expects ore grade to increase in the upcoming quarters.

Key Posts

-

5:21 pm — January 18, 2023

-

1:37 pm — January 18, 2023

-

1:30 pm — January 18, 2023

-

12:59 pm — January 18, 2023

-

12:17 pm — January 18, 2023

-

12:06 pm — January 18, 2023

-

11:32 am — January 18, 2023

-

11:09 am — January 18, 2023

-

10:25 am — January 18, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988