Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX Hits Record High as Inflation Cools and Fed Cut Bets Lift

Commonwealth Surpasses BHP to largest Co. on ASX

Commonwealth Bank of Australia [ASX:CBA] shares reached a new all-time high of $131.63 today, pushing the bank’s market capitalisation to $221 billion.

This milestone pushes CBA ahead of mining giant BHP, making it the most valuable company listed on the ASX.

The 1.33% gain by CBA pushed the company’s gains to over 30% for the past 12 months, a value that many would not have believed considering its expensive versus the remaining Big Four.

NAB also had a strong day on the market, gaining +1.94% in trading so far to trade at $36.89 per share.

Market update

The ASX 200 hit a record high of 7,969 points today before settling back to 7,951.2 and up +0.78% in trading so far today.

This surge followed US data indicating deflation in June, fueling expectations of imminent Federal Reserve interest rate cuts. US inflation reached 3% for the year to June, with prices dipping 0.1% from May to June.

The news prompted a decline in US bond yields and a shift from mega-cap tech stocks to smaller caps, which typically benefit more from lower interest rates.

NAB reported that money markets now fully price in a September Fed rate cut, with a slight chance of a July move, and expect 60 basis points of cuts by year-end.

In Aussie markets, the tech sector was the sole decliner, down -1.31%, while real estate led gains, up 1.97%. The Small Ordinaries Index rose 1.51%.

The Australian dollar reached its highest level since January 2, trading at US67.6 cents, reflecting the market’s anticipation of US rate cuts.

Also, thanks to cuts coming sooner rather than later, Gold stocks jumped today, with the All Ords Gold index up +2.89%.

BHP Suspends Nickel Operations Amid Market Downturn

Mining giant BHP announced it would suspend its Nickel West operations in Western Australia for three years, citing a global nickel oversupply.

The decision comes as the company projects a $450 million full-year loss for its nickel business due to plummeting prices.

Starting in October, BHP will begin winding down operations, affecting around 1,600 frontline workers.

The company plans to either redeploy these employees or offer redundancy packages. A final decision on the future of BHP’s nickel business is expected by February 2027.

Shares in BHP are down by -0.14% in trading this morning, at $43.50 per share.

US market update: excerpt

Here’s an excerpt from my morning update to Alpha Tech Trader subscribers that I thought I could share with ASX Live readers:

What a week on the stock market it has been.

The Nasdaq saw its seventh straight record-high close and the S&P 500’s sixth.

That brings it to its 37th record high this year, truly amazing.

There is only one problem…

It’s crowded among some of the market’s largest (and most overpriced) stocks.

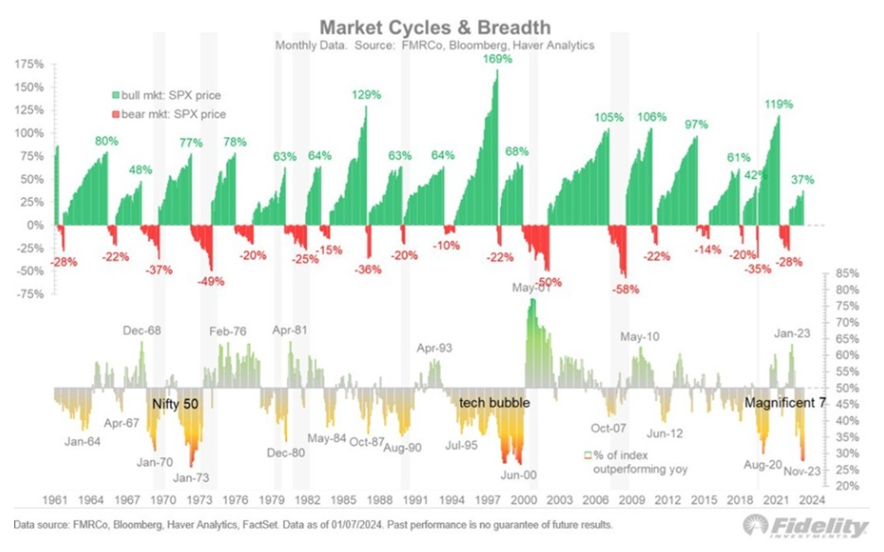

This top-heavy market is known as having ‘low-market breadth’ by pundits.

Here’s a slightly dated example that is worth seeing because it shows so much history:

Source: Fidelity

Source: Fidelity

The bottom shows that a few companies are advancing relative to the rest—a theme that has been evident for the past 24 months.

But today, we got the first significant signal that things are beginning to broaden.

Yes, it’s just one signal, but it could be the starting gun for a rally from smaller caps players—something we talked about last week.

What’s the signal?

Let me explain last night’s Wall Street moves.

The latest US CPI (inflation data) declined to 3% on a yearly basis in June from 3.3% in May.

While monthly figures are unreliable at best, they were still a signal to the market of a potential ‘goldilocks scenario.’

That’s a no-recession scenario with falling inflation and cuts coming soon. Traders are picking September for interest rate cuts from the Fed, but that could still shift.

What was the market reaction? The S&P 500 is down -0.88%, Nasdaq is down -1.95%.

Meanwhile, the smaller cap Russell 2000 index jumped an incredible 3.57%.

Traders are shifting their bets, selling their old mega-cap winners and betting that underperforming mid- and small-caps will next move.

Meanwhile, hedge funds are forced to unwind their hedged bets. These managers were clearly overweight growth and underweight small caps as hedging shorts.

That means we’ll likely continue to see a short squeeze for a time, and they rotate into small+mid cap stocks.

Something that’s great with our current positioning.

Iren Falls on Short Seller Report

Iris Energy [NASDAQ:IREN], an Australian-founded bitcoin mining company, experienced a significant setback overnight on the Nasdaq as its shares plummeted 13.2% following a critical report by short-selling firm Culper Research.

This sharp decline interrupted a remarkable rally that saw the stock surge of 64% since the beginning of the year.

Founded by Sydney-based brothers Will and Daniel Roberts, Iris Energy has recently claimed it could diversify into data centre operations to capitalise on the growing demand for AI-related applications. However, Culper Research’s report directly challenges this.

The short seller’s analysis suggests that Iris Energy may be substantially overvalued, potentially by 52% to 79%, leading to the overnight drop.

Iris Energy’s journey on the Nasdaq has been volatile since its initial public offering in November 2021, when it debuted at $28 per share during the peak of the last bitcoin boom, prices are now around US$11.20 per share.

Morning Market Update

Good morning. Charlie here,

Australian shares hit a record high of 7,55.4 points today, rising 0.83% following US inflation data showing deflation in June.

The annual US inflation rate dropped to 3%, with prices decreasing 0.1% from May to June. This sparked expectations of imminent Federal Reserve interest rate cuts, causing US bond yields to fall.

In the Australian market, the tech sector dipped 0.67%, while real estate led gains at 2.08%. The Small Ordinaries Index rose 1.19%. The Australian dollar strengthened to US67.6¢, its highest since January 2.

NAB noted this morning:

‘US money markets now price a September Fed rate cut with 100% confidence, with a 10% chance for a July move. Markets now expect 60bps of cuts by year-end, up from 50bps yesterday.’

| Name | Value | % Chg | |

|---|---|---|---|

| Major Indices | |||

| S&P 500 | 5,584 | -0.88% |

| Dow Jones | 39,753 | -0.08% |

| NASDAQ Comp | 18,283 | -1.95% |

| Russell 2000 | 2,125 | +3.57% |

| Country Indices | |||

| UK | 8,223 | +0.36% |

| Germany | 18,534 | +0.69% |

| Japan | 41,205 | -2.43% |

| Hong Kong | 17,523 | Flat |

| Euro | 4,976 | +0.35% |

| Name | Value | % Chg | |

|---|---|---|---|

| Commodities (USD) | |||

| Gold | 2,411 | +1.62% | |

| Silver | 31.28 | +1.36% | |

| Iron Ore | 107.80 | -0.13% | |

| Copper | 4.4997 | -0.49% | |

| WTI Oil | 82.81 | +0.24% | |

| Currency | |||

| AUD/USD | 67.56¢ | +0.07% | |

| Cryptocurrency | |||

| Bitcoin (USD) | 56,689 | -1.38% | |

| Ethereum (USD) | 3,064 | -0.68% | |

Key Posts

-

3:54 pm — July 12, 2024

-

2:10 pm — July 12, 2024

-

12:01 pm — July 12, 2024

-

11:49 am — July 12, 2024

-

11:36 am — July 12, 2024

-

11:07 am — July 12, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988