Investment Ideas From the Edge of the Bell Curve

ASX News Live | ASX Flat; Market Girding Itself for Big Earnings Week and US Fed Decision

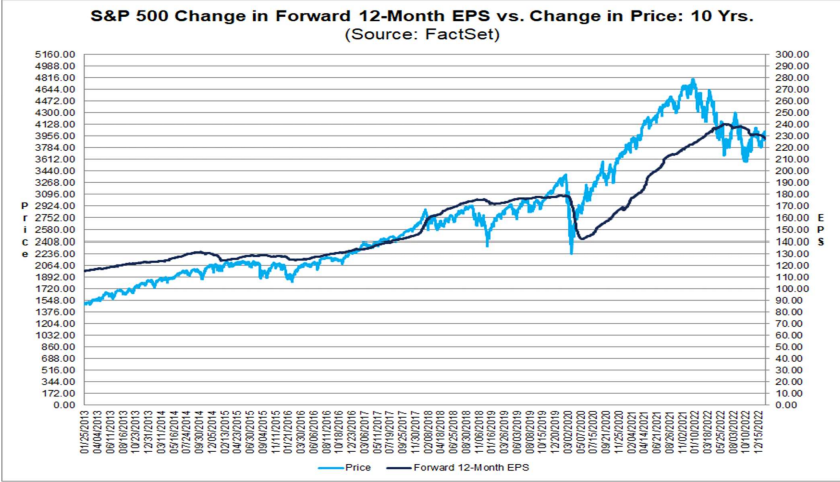

Factset: 4Q22 S&P 500 earnings continue to be ‘subpar’

S&P 500 earnings are on track to fall 5% in Q4 2022, which will be the first time the index reported such a year-on-year earnings decline since Q3 2020.

Factset labelled the earnings quarter so far as ‘subpar’.

Source: Factset

Looking ahead, data compiled by Factset has S&P 500 earnings declining for the first half of 2023 but rising in the second half of 2023.

Analysts expect earnings to grow 10.3% in Q4 2023.

Factset’s report had some interesting sector breakdowns.

For one, the consumer discretionary sector reported the second-largest year-over-year earnings decline of -20.6%.

YoY earnings for the Internet & Direct Marketing Retail component of the sector fell -84%!! But what’s interesting is the impact of Amazon.

Ex-Amazon, the consumer discretionary sector would be reporting positive YoY earnings growth of +16.1% instead of the actual decline of -20.6%.

Factset: $AMZN is the largest contributor to the earnings decline for the consumer discretionary sector.

Ex-Amazon, the consumer discretionary sector would be reporting YoY earnings growth of 16.1% instead of an earnings decline of -20.6%!!— Fat Tail Daily (@FatTailDaily) January 30, 2023

A similar weighting issue hurt the communication services sector.

This sector is reporting the third-largest earnings declines year on year, down -19.6%. But if you exclude Alphabet and Meta Platforms, the sector’s earnings improve to -6.7%.

One other interesting thing from the report.

The energy sector is reporting net profit margins above its 5-year average (12.9% versus 7.4%). The communication services sector is reporting net profit margins below their 5-year average (9.7% versus 12.1%).

Finally, Factset had some telling data on the current prevalence of negative EPS guidance.

‘At this point in time, 19 companies in the index have issued EPS guidance for Q1 2023. Of these 19 companies, 17 have issued negative EPS guidance and 2 have issued positive EPS guidance. The percentage of companies issuing negative EPS guidance for Q1 2023 is 89% (17 out of 19), which is above the 5-year average of 59% and above the 10-year average of 67%.‘

Callum Newman: watch out for property stocks

Property stocks are still, by and large, on the floor from the 2022 bear market. They haven’t rallied up in the same way as retailers recently, or miners.

But I don’t think it will be long before they begin to rumble.

The market is always looking nine months ahead. But occasionally, investors need to glance back as well.

They’ll realise they became too negative in 2022 and the stocks will price in a more moderate outcome.

We’re already seeing inklings of this in the commercial sector via Real Estate Investment Trusts (REITs).

Take this story from the Australian Financial Review (AFR) the other week:

‘Some big-name property stocks could bounce back strongly enough to deliver investors total returns of up to 15 per cent this year, a welcome recovery after rising rates caused havoc for real estate investment trusts last year…

‘With much of the pain priced into property already, and with the rate rising cycle expected to ease by mid-year, analysts are tipping strong gains in the sector, notwithstanding economic uncertainty.’

Personally, I picked up some exposure to REITs last year in my self-managed super fund on the assumption something like this would play out.

On the whole, I probably could’ve been more aggressive and bought into some of the other sectors with bigger potential for capital gains.

But hindsight is 20/20 and at the time I reasoned most of the damage had been inflicted on REITs despite them being fundamentally robust.

I didn’t know the market would recover as strongly as it has, or that iron ore would rally so strongly, either.

Now I see the same opportunity brewing in the housing sector. The market may already be sniffing this out.

One economist cited in the AFR today says he thinks the Reserve Bank of Australia will be the first central bank across the developed world to cut rates, and this year too…to take the pressure off the housing market.

I concur.

https://www.dailyreckoning.com.au/for-my-money-the-next-sector-to-bounce-is-here/2023/01/30/

The Federal Reserve, expectations, and reality

A thing about markets that often confuses people is that markets react to differences between expectations and reality, not to reality itself.

It’s why markets can jump higher on seemingly bad news, and vice versa.

Knowing what markets expect before key events is therefore crucial in gauging what could come next in terms of stock market prices.

Which brings me back to this week’s Fed meeting.

The consensus is that we’ll see a 0.25 percentage point raise from Fed Chief Jerome Powell and his board colleagues.

If we get any different decision from the Fed, markets will react hard.

For example, if the Fed surprise us with a 0.5% rise, you should expect to see sharp falls across most major markets.

If they decide not to raise at all — the so-called pivot the bulls are banking on — then this rally might go into overdrive.

As my colleague and our Editorial Director Greg Canavan remarked in an internal discussion:

‘If the Fed caves and goes all dovish, cover your shorts!’

But the odds-on result is they do indeed raise by 0.25%.

If that happens, the market will go back to trying to guess what they’ll do in future meetings and we may see a period of volatile sideways action as bets are made on this.

Look to the signals the market is giving you, as this is people putting down actual cold, hard cash.

And on that note, things are starting to look very interesting…

Believe it or not, the market is pricing in big rate cuts by the end of the year, despite the Fed’s insistence it won’t be cutting any time soon.

As Atlas Financial’s Chief Strategist, Jeff Snider, explains:

The market is clearly starting to price in a big recession. A recession that’ll only worsen if the Fed ignores reality and hikes too far for too long.

Is the Fed starting to see this too?

Or will they double down on their current path and raise rates regardless?

We’ll find out this week.

How many tests has ChatGPT passed?

Not a day goes by without headlines about OpenAI’s generative text chatbot ChatGPT passing some test or other.

Here is the list so far.

- Wharton’s MBA exam

- ‘Chat GPT3 would have received a B to B- grade on the exam. This has important implications for business school education, including the need for exam policies, curriculum design focusing on collaboration between human and AI, opportunities to simulate real world decision making processes, the need to teach creative problem solving, improved teaching productivity, and more.’

- United States Medical Licensing exam

-

‘ChatGPT performed at or near the passing threshold for all three exams without any specialized training or reinforcement. Additionally, ChatGPT demonstrated a high level of concordance and insight in its explanations. These results suggest that large language models may have the potential to assist with medical education, and potentially, clinical decision-making.’

-

- A law school bar exam

- ‘A quartet of law professors at the University of Minnesota used the popular artificial intelligence chatbot to generate answers to exams in four courses last semester, then graded them blindly alongside actual students’ tests.ChatGPT’s average C+ performance fell below the humans’ B+ average, the authors said. If applied across the curriculum, that would still be enough to earn the chatbot a law degree—though it would be placed on academic probation at Minnesota, ranked as the 21st best law school in the country by U.S. News & World Report.’

-

#ChatGPT writes 10 jokes in the style of Jerry Seinfeld about #AI taking over human jobs. #OpenAIChatGPT pic.twitter.com/9Ocm5JRJH5

— Fat Tail Daily (@FatTailDaily) January 30, 2023

Ryan Dinse: does the bull trap unravel this week?

A bull trap is a false price signal that ‘traps’ investors who buy in thinking the move marks a reversal of a downtrend, and the start of a new uptrend.

The reason so many remain wary is continuing high inflation.

Here in Australia last week, the figure came in above expectations at 7.8%.

This could be bad news for mortgage holders because the cure for high inflation is even higher interest rates.

And until the inflation genie is firmly back in the bottle, the sceptics think central banks will keep putting up rates, regardless of market conditions.

The Reserve Bank of Australia (RBA) next meets on 7 February, and current consensus is for a 0.25% rise in interest rates.

We’ll see what happens…

But in the grand scheme of things, it only matters to markets what one central bank does next.

And that is the US Federal Reserve (the Fed).

Their decision to increase interest rates at a record pace to combat inflation at home has led to a surge in the value of the US dollar versus other countries.

And because many goods — especially oil — are priced in US dollars, this has the effect of ‘exporting’ inflation to other countries.

As everyone tries to get their hands on US dollars, this causes the US dollar to strengthen and inflation to spiral out of control.

Which, in turn, means other central banks have to raise interest rates to try and protect the value of their currency.

That’s a simplified explanation perhaps, but you can see the importance of US policy to the rest of the world.

Which is why all eyes are on the US this week.

The Fed, as it’s known, meets on Wednesday and Thursday our time.

And what comes out of this meeting could set the tone for the next few months.

There are a few outcomes to prepare for…

https://www.moneymorning.com.au/20230130/does-the-bull-trap-unravel-this-week.html

Philadelphia Fed’s ‘anxiety index’ still elevated

Despite markets betting on the US Fed executing a ‘soft landing’, anxiety over a recession is still elevated among economists.

As Bloomberg’s John Authers relayed last week:

‘To start with, the Philadelphia Fed’s regular “anxiety index” that asks economists and investors about the chance of a recession in the next year is showing record levels of angst — quite a remarkable fact given that the survey started in 1969, and plenty of really bad things have happened to the economy since then. This chart is from Yardeni Research.’

"The Philadelphia Fed 'anxiety index' that asks economists and investors about the chance of a recession in the next year is showing record levels of angst — a remarkable fact given the survey started in 1969, and plenty of really bad things happened to the economy since then." pic.twitter.com/Us5n896aNk

— Fat Tail Daily (@FatTailDaily) January 30, 2023

Stocks are up, but is the current rally justified?

The ASX 200 is up nearly 8%.

The ASX All Tech Index is up 13%.

In the US, the S&P 500 is up 6.5% while the tech-heavy NASDAQ is up nearly 12%.

Cathy Wood’s under-performing ARK Innovation ETF is up 30%! While Mr Tweet’s Tesla is up 60%.

Bitcoin is up 40%.

What is happening?

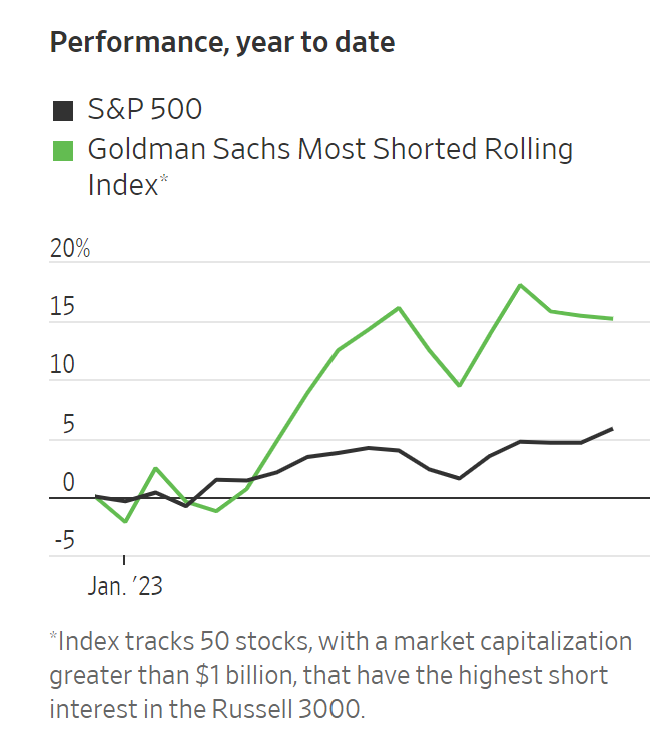

For one, short-sellers are losing money.

Goldman Sachs index tracking the 50 most shorted stocks in the US is up 15% in 2023.

Source: WSJ

But more broadly, why the rally?

Investors are betting inflation has peaked and therefore central banks will slow rate hikes or even reverse them in the medium-term.

The markets are betting the world’s most predicted recession will not materialise. A ‘soft landing’ is likely in the eyes of traders.

But are investors’ bets too casual about the risks still remaining?

Bloomberg columnist John Authers wrote last week the ‘market has stopped making sense’.

Yes, inflation in much of the world is cooling. Although the latest CPI print from Australia isn’t great.

Yes, the latest GDP data from the US is encouraging in its banality.

But risks linger.

It seems the market is speeding blind through fog on the optimism the fog is bound to dissipate soon. But in the meantime, a high-speed collision is still possible.

Good morning, investors

Good morning, investors.

Here’s today’s morning greeting from OpenAI’s ChatGPT:

“Good morning, Australian investors! Today is a new day full of opportunities and possibilities in the markets. Let’s start the day by sharpening our analytical skills, staying informed, and making smart trading decisions. Let’s make today a profitable one!”

Key Posts

-

4:46 pm — January 30, 2023

-

2:53 pm — January 30, 2023

-

2:39 pm — January 30, 2023

-

1:39 pm — January 30, 2023

-

12:35 pm — January 30, 2023

-

12:30 pm — January 30, 2023

-

11:47 am — January 30, 2023

-

11:28 am — January 30, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988