Investment Ideas From the Edge of the Bell Curve

ASX News Live | ASX Flat; Cettire, Webjet, Mineral Resources Feature

5 tips to protect your crypto

Not your keys, not your crypto.

If Mt Gox didn’t hammer home that lesson, FTX likely will. The Mt Gox exchange — the first big-name exchange — lost everyone’s funds in 2014, and it was an early lesson that you couldn’t trust central parties.

Which is the whole point of crypto after all!

Unfortunately, a lot of people keeping their crypto on Celsius, FTX, BlockFi, and many more centralised platforms are learning this lesson too late.

But as I’ve always said, you should never trust central parties to store your crypto.

It’s just not safe, and it’s not the crypto ethos either.

And it’s especially important now. Because if the contagion from FTX is indeed widespread, things could deteriorate very fast in all sorts of exchanges, including some here in Australia.

On Thursday, prominent crypto broker Genesis halted withdrawals at its lending unit, after ‘abnormal withdrawal requests which have exceeded our current liquidity’.

Eyes are now on Crypto.com, with its Chief Executive Kris Marszalek saying he will publish proof of the Singapore-based exchange’s reserves ‘within weeks’.

Clearly, risk of contagion is rising.

And while I think this will be good for crypto long term, as it wipes out the bad actors, you don’t want to get caught in the fallout.

So your priority should be to store your crypto in wallets only you control.

This is not that hard to do but does involve you exercising common sense.

For one, correctly backing up your seed phrase is critical.

Remember, your seed phrase acts like your crypto wallet’s master key and can help you access your wallet.

Lose your wallet but have your seed phrase? Recoverable.

Lose your seed phrase but have your wallet? Transferable.

Lose both? Regrettable. All your funds are gone.

You know you need to back up your seed phrase. But what you might not realise is there are many wrong ways to back up your seed phrase.

How can you be sure if you made any mistakes? Read on below.

https://www.moneymorning.com.au/20221117/5-tips-to-protect-your-crypto.html

Small cap Droneshield up 6% on $3.7 million Epirus investment

Small cap drone tech manufacturer Droneshield (ASX:DRO) received a binding a binding commitment from US tech firm Epirus to raise $3.7 million via the issue of 18.5 million fully paid ordinary DRO shares at 20 cents per share.

Droneshield’s last closing price was 20.3 cents a share.

Epirus will acquire a 4.1% stake in DRO following the transaction.

Droneshield described Epirus as a high-growth company ‘developing software-defined directed energy systems that enable unprecedented counter-electronics effects and power management solutions to optimize power efficiency in defense and commercial applications.’

DroneShield CEO, Oleg Vornik, commented:

“We welcome Epirus to our investor register. There are significant complementary areas between our companies, including combining DroneShield’s drone detection and soft defeat systems, with Epirus’ hard defeat solutions.”

DRO shares are up 20% year to date.

Cettire ‘continues strong, profitable global growth trajectory’

Online luxury goods retailer Cettire (ASX:CTT) reported a ‘strong and profitable global growth trajectory’ in a trading update for the month of October.

CTT shares were flat in late Thursday trade.

Cettire provided the following trading metrics for October:

- Gross revenue up 71% on October 2021 to $45.9 million

- Sales revenue up 82% on October 2021 to $34.8 million

- Active customers up 88% on October 2021 to 297,358

- Average order value up 13% on October 2021 to $839

- Adjusted EBITDA ‘at least $3 million’

Gross revenue in the four months to 31 October 2022 hit $130.5 million, up 65% on the prior corresponding period.

Sales revenue in the four months to 31 October 2022 hit $101 million, up 75% on the prior corresponding period.

Sales revenue as a percentage of gross revenue in October was 75.8%. Sales revenue as a percentage of gross revenue in the four months to 31 October 2022 was 77.4%, This was 73.2% for the four months to 31 October 2021.

Gross revenue exceeds sales revenue because the latter is net of returns and allowances.

Last month, Cettire released its 1Q23 results, divulging that its ‘net cash balance increased to approximately $30m at period ended 30 September 2022.’

In today’s update, CTT said its ‘net cash balance [is] greater than $40 million at 31 October 2022.’

FTX contagion — Genesis halts withdrawals

The liquidity-cum solvency crisis at FTX has spread to other parts of the crypto ecosystem.

Genesis Trading has halted withdrawals at its lending arm, blaming ‘unprecedented market turmoil’ caused by the collapse of FTX, triggering ‘abnormal withdrawal requests which have exceeded our current liquidity.’

Our #1 priority is to serve our clients and preserve their assets. Therefore, in consultation with our professional financial advisors and counsel, we have taken the difficult decision to temporarily suspend redemptions and new loan originations in the lending business.

— Genesis (@GenesisTrading) November 16, 2022

ASX ditches CHESS replacement project after independent review, draws RBA’s ire

The ASX has scrapped its CHESS clearing and settlement upgrade project, ‘derecognising’ ~$250 million along the way.

The exchange said it will ‘reassess all aspects of the CHESS replacement project’ following an independent review conducted by Accenture.

Accenture identified ‘significant challenges with the solution design and its ability to meet ASX’s requirements.’

The Reserve Bank of Australia was not happy.

In a statement, the RBA stated:

‘ASX has rightly recognised that pausing the program while it revisits the technology design for the CHESS replacement was a necessary decision. It opens the way for the resolution of the issues identified in the independent report and ASX securing the necessary capabilities to deliver the replacement,’ ASIC chair Joe Longo said.

‘The independent report has found significant gaps and deficiencies in ASX’s program delivery capabilities and that there are significant challenges in the technology design. That these findings can be made at this late stage of a critical replacement program is altogether unsatisfactory.

‘ASX has failed to demonstrate appropriate control of the program to date, and this has undermined legitimate expectations that the ASX can deliver a world-class, contemporary financial market infrastructure.’

The #ASX has scrapped its #blockchain CHESS clearing and settlement upgrade project, 'derecognising' ~$250 million. pic.twitter.com/lQlpnq6FZH

— Fat Tail Daily (@FatTailDaily) November 17, 2022

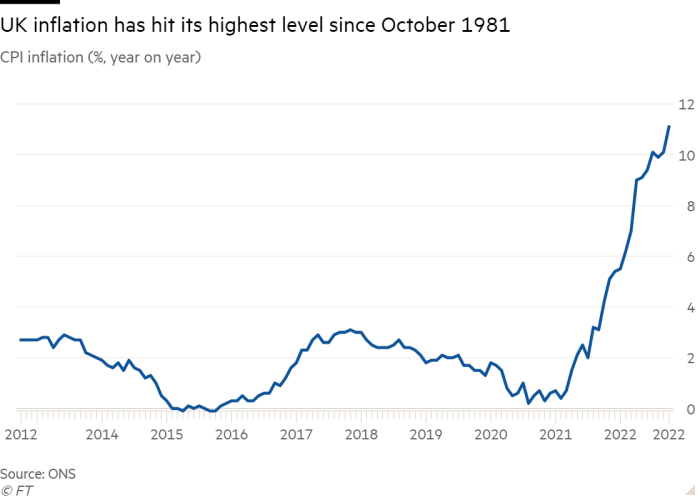

UK inflation at 11.1% — a 41-year high

Overnight, the UK’s Office for National Statistics released the latest UK CPI data. Inflation accelerated to 11.1% in October on an annualised basis, hitting a 41-year high, propelled by rising energy and food prices.

Economists polled by Reuters expected the October figure to be 10.7%, meaning actual inflation came in much hotter.

Inflation was 10.1% in September.

The Bank of England is now firmly expected to raise interest rates by 50 basis points in December, from the current level of 3%.

Source: Financial Times

As the UK Office for National Statistics explained:

The CPI monthly rate was 2.0% in October 2022, compared with 1.1% in October 2021. This means that, between September and October 2022, the prices of goods and services bought or consumed by UK households have increased by 2.0%. This matched the annual CPI inflation rate in July 2021, meaning prices rose between September and October 2022 by as much as they did in the entire year to July 2021.

UK ONS: Between Sep and Oct 2022, UK prices of goods and services bought or consumed by UK households rose 2%. This matched the annual #CPI #inflation rate in July 2021, __meaning prices rose between Sep and Oct 2022 by as much as they did in the entire year to July 2021__.

— Fat Tail Daily (@FatTailDaily) November 17, 2022

Webjet spikes — bookings return to pre-pandemic level

Travel business Webjet (ASX:WEB) is surging on Thursday after a ‘spectacular turnaround’ of $88.4 million in underlying EBITDA from the 1H22 loss of $15.9 million.

1H23 underlying EBITDA rose 557% YoY to $72.5 million. While a strong swing, the underlying EBITDA is still tracking at 69% pre-pandemic levels.

Interestingly, while underlying EBITDA is at 69% pre-pandemic levels, group bookings hit 101% pre-pandemic levels, rising 137% YoY to 3.4 million.

Total transaction volume hit 90% pre-pandemic levels, up 223% YoY to $2.1 billion on revenue of $175.7 million.

Revenue rose 217% YoY, tracking at 77% pre-pandemic levels.

Webjet managing director John Guscic commented:

“This result demonstrates a spectacular turnaround of $88.4 million in underlying EBITDA from the 1H22 loss of $15.9 million. It underpins the efforts we took as soon as the pandemic hit to ensure each business was optimally positioned to recapture demand once travel returned. Recovery is substantially accelerating and WebBeds is leading the charge. All WebBeds regions saw significant organic growth, particularly Europe which benefited from a strong northern hemisphere summer, and North America which is now more than three times larger than it was when the pandemic began. Search activity and conversions through the WebBeds platform continue to increase, and EBITDA margins are now higher than they were pre-pandemic. Despite a number of large markets yet to open, since May WebBeds bookings have exceeded what they were before the pandemic hit and profitability is getting close to pre-pandemic levels.

“Webjet OTA significantly increased in profitability during the period. Even with limited international capacity and higher airfares, bookings were 79% of what they were pre-pandemic, reflecting Webjet OTA’s strength in servicing the domestic travel market. Prior to the pandemic, Webjet was one of the most profitable online travel agents in the world and EBITDA margins are already back over 41%, despite inflationary wage pressures and after absorbing the loss of overrides and commission usually earned on international travel. The new GoSee brand is being rolled out in key markets and the rebrand strategy continues to go to plan.”

Webjet management said its WebBeds segment is on track to ‘exceed pre-pandemic profitability in FY23’.

Profitability for Webjet OTA and GoSee are expected to be ‘consistent with 1H23 results, reflecting macroeconomic environment.’

Elon Musk’s ‘extremely hardcore’ ultimatum to Twitter staff

Elon Musk gave Twitter staff an ultimatum and a deadline in a late-night email last night.

Employees who don’t commit to being ‘extremely hardcore’ by 5pm ET Thursday will be given the boot and three months severance.

Here’s the text of the email Musk sent to Twitter staff overnight.

Those who don’t commit to being “extremely hardcore” by 5pm ET today must leave the company. ‼️

Story: https://t.co/expt0d63dH pic.twitter.com/C8VDjRBvk1

— Donie O'Sullivan (@donie) November 16, 2022

While Musk’s email was finally leaked, many Twitter employees were fearful of being identified as the source and incurring the new boss’s wrath.

The fears aren’t unfounded.

Years ago, Musk outed a leaker at Tesla by sending a seemingly identical email to staff but in fact each email was ‘coded with either one or two spaces between sentences, forming a binary signature that identified the leaker.’

Extremely hardcore…

That is quite an interesting story. We sent what appeared to be identical emails to all, but each was actually coded with either one or two spaces between sentences, forming a binary signature that identified the leaker.

— Elon Musk (@elonmusk) October 9, 2022

Sam Bankman-Fried’s Vox interview: ‘F*** regulators’

Overnight, former FTX CEO Sam Bankman-Fried DMed a Vox journalist on Twitter.

Apparently, SBF wanted to talk.

And talk he did.

In a sprawling and revealing text exchange, SBF covered regulation, ethics, and his philosophy on winners and losers.

On the topic of regulators, SBF was fired up, saying ‘there’s no one really out there making sure good things happen and bad things don’t.’

He continued: ‘F*** regulators. They make everything worse. They don’t protect customers at all.’

Presumably, neither did FTX.

The Vox #SBF interview on the #FTX disaster is astonishing.

👇👇👇https://t.co/9es1K3wSYQ pic.twitter.com/7xCY0IapCY

— Fat Tail Daily (@FatTailDaily) November 16, 2022

Earlier today, SBF seemingly addressed the interview, denying the exchange was meant to be public.

25) Last night I talked to a friend of mine.

They published my messages. Those were not intended to be public, but I guess they are now. pic.twitter.com/yH9aKmESY8

— SBF (@SBF_FTX) November 16, 2022

Key Posts

-

4:20 pm — November 17, 2022

-

4:14 pm — November 17, 2022

-

3:41 pm — November 17, 2022

-

12:49 pm — November 17, 2022

-

12:26 pm — November 17, 2022

-

11:47 am — November 17, 2022

-

11:16 am — November 17, 2022

-

10:58 am — November 17, 2022

-

10:46 am — November 17, 2022

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988