Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX Gains as Wall St Rebounds; Central Banks in Focus as Markets Weigh Rate Cut Timing

Market close update

Australian shares continued their upward trend for the second consecutive session, mirroring an improving global sentiment as investors’ anxieties calmed and policymakers urged calm and helped traders reassess outlooks and interest rate expectations.

The ASX 200 finished the day up 0.3%, closing at 7,699.8 despite a weak start to the day as major miners saw some selling.

The market saw nine of the eleven sectors finish in the green, with only Financials (-0.14%) and Materials (+0.23%) closing lower, as the mega caps dragged their sectors down.

In the Big Four banks, only ANZ closed the day higher, gaining +0.22%. While Commbank fell -0.27%, NAB closed down -0.88%, and Westpac fell -0.72%.

In mining, BHP fell -0.58% to $41.02, while Fortescue fell -0.86% to $18.44 and Rio Tinto closed down by -1.39%.

Further concern for China’s iron ore demand outlook sent iron ore futures down through the session, with iron ore prices down by -1.02% to US$101.40 per tonne.

For now the question remains if China can maintain its steel exports at the current pace. The latest data today showed Chinese exports climbing to 7% in July from a year earlier.

That’s a slower pace than the forecasted 9.7% growth expected by economists as the world’s second-largest economy struggles to regain momentum.

The mood across Asia improved following reassuring comments from a Bank of Japan (BoJ) official, who stated that the central bank would refrain from raising interest rates during periods of financial market instability.

This statement came in the wake of Monday’s dramatic 13% plunge in the Nikkei index.

BoJ says it wont raise rates for now

Bank of Japan (BOJ) Deputy Governor Shinichi Uchida stated on today that the central bank will refrain from raising interest rates during periods of financial market instability.

Uchida noted that the recent strengthening of the yen would influence the BOJ’s policy decisions, as it reduces upward pressure on import prices and, consequently, overall inflation.

In a speech to business leaders Uchida emphasised the necessity of maintaining current levels of monetary easing for the time being, citing the recent sharp volatility in both domestic and overseas financial markets.

He explained that the BOJ’s interest rate trajectory would ‘obviously’ shift if market volatility were to impact its economic and price outlook, its risk assessment, or the likelihood of sustainably achieving its 2% inflation target.

Uchida finished, stating unequivocally, ‘We won’t raise interest rates when financial markets are unstable.’

Neuren Pharmaceuticals shares halted awaiting trial results

Neuren’s shares remain on halt pending the release of top-line results from its Phase 2 clinical trial for NN-2591 in Angelman syndrome.

The company saw its shares drop by -11.86% in the past week as market turmoil and short attacks have ravaged its share price.\

However, the company released its latest quarterly update, which showed that the short sellers’ ideas were largely wrong.

The US short-selling research organisation Culper Research released a report in February outlining their scepticism of Neuren’s drug Daybue.

In the report, they alleged there were many ‘horror stories‘ about the adverse effects of the drug and suggested revenues would drop sharply.

The update today put many of those concerns to bed with net sales from the second quarter at US$84.6 million, up from US$75.9 million in Q1.

“The rate of new patient starts was 12 per cent higher than the previous quarter and the rate of discontinuations was 46 per cent lower than in the previous quarter,’’ Neuren said.

The company said it would come out of a halt when an announcement is made, or until normal trading resumes on Friday.

Midday market update

The ASX 200 is up by +0.5%, at 7,719.5, around midday, as Energy stocks help lift the market after a slight dip in opening this morning.

All eleven sectors are in the green around noon as Energy leads, up by +1.86% thanks to bounces from prior selloff in the sector.

Woodside is up by +2% after dropping over 8% in the last two sessions amidst global recession fears and concerns about oil demand.

Santos gained +1.5% to trade at $7.69, while Yancoal gained +2.5% to trade at $7 per share.

Currently 148 of the 200 stocks on the ASX 200 are in positive terrirory, with fresh faced resteraunt chain Guzman Y Gomez leading the gains, up by +4.16%.

In currency markets the Australian dollar has bounced off an eight-month low, gaining +0.56% through the session to trade at US 65.49 cents.

Arcadium Lithium shares up after latest earning

Lithium hopeful Arcadium Lithium [ASX:LTM] shares are up by +6.7% to $4.28 per share after the company posted its latest quarterly earnings.

For the second quarter, the company’s revenue was US$254.6 million, and adjusted EBITDA was US$99.1 million.

The company saw an average realised price of US$17,200 per metric ton of Lithium Hydroxide in Q2 as prices remained low in the lithium market.

The company projected a 25% increase in volume in both 2024 and 2025 versus the prior year despite halting four of its expansions.

Arcadium Lithium president and chief executive officer Paul Graves, explained the pause, saying:

‘Despite where lithium market prices are today, we still see a strong long-term growth trajectory for lithium demand and expect a return to healthier market fundamentals over time.’

The company said it is pausing its investment in its Canadian Galaxy Lithium Project and is ‘exploring opportunities to recruit a partner interested in providing capital‘.

As a result of the changes the company will reduce its capex by approximately US$500 million less over the next two years.

‘While we remain fully committed to developing our highly attractive portfolio of expansion opportunities, each of which is expected to be amongst the lowest cost lithium operations globally when completed, we will seek to do so on a timeline that is supported by both the market and our customers.’

Shares are down by -57% in the past 12 months as lithium prices continue to squeeze developers in the sector.

When are cuts coming?

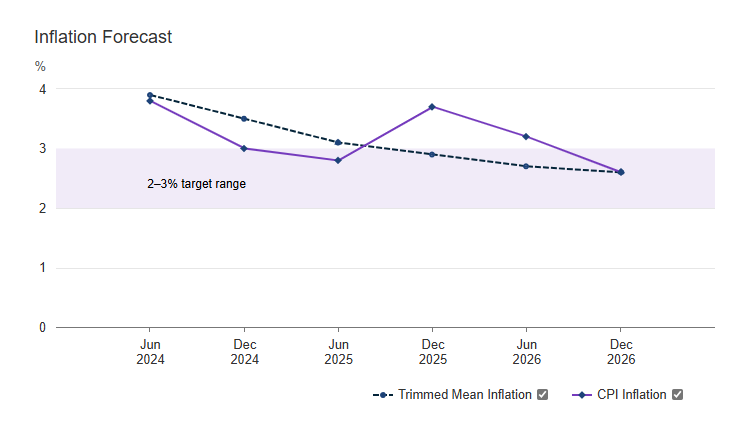

The RBA’s decision to keep rates on hold at 4.35% yesterday was widely expected; however, the shifting projections of inflation falling left some economists scratching their heads.

In the latest Statement on Monetary Policy, the RBA outlined their new projections that see inflation coming down to the midpoint of the target range of 2-3% at the end of 2026.

Source: RBA 6-08-24

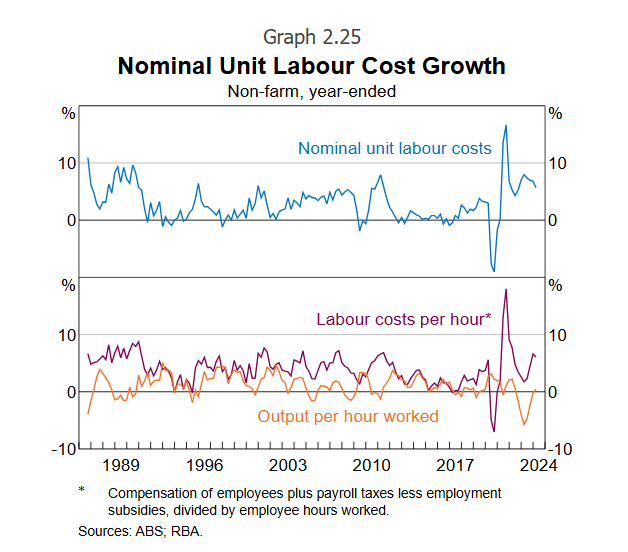

However as many pointed out, these assumptions rely on sustained productivity growth, something we are starting to see moderate.

Non-farm labour productivity increased by 0.4% over the year to the March quarter.

While wage growth appears to be past its peak but ‘remains higher than can be sustained by the trend growth rate of productivity’ the RBA admitted.

A big tell of this disparity can be seen in the labour costs per unit, as seen below.

Source: RBA 6-08-24

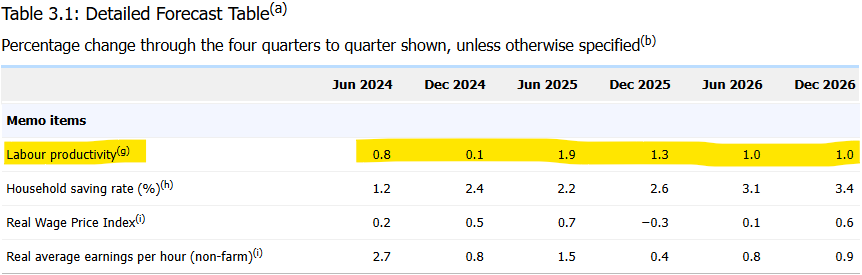

Yet the solution appears to be an out-of-the-blue spurt in labour productivity. See projections below:

Source: RBA 6-08-24

This may be hopeful thinking by the RBA, but these projections are at this stage, allowing them to stay the course on cuts later rather than sooner.

If things remain weak in the economy, keep an eye on these projections to shift and with it, the timing of cuts.

Morning Market Update

Good morning. Charlie here.

The Australian share market opened slightly lower this morning after US benchmarks bounced overnight after the Fed and Asian policymakers moved to ease global concerns of a US recession. The ASX 200 is currently down by -0.05%, trading at 7,677.0.

Heavy shifts in the last hour of the overnight session saw US stocks fall back from their earlier high levels, but all saw a bounce overnight as the Fed gave the market some breadcrumbs of future cuts.

San Francisco Fed President Mary Daly said at an event in Hawaii overnight that the latest job report’s details leave ‘a little more room for confidence that we’re slowing but not falling off a cliff.’

‘Our minds are quite open to adjusting the policy rate in coming meetings,’ she said. When and by how much will depend on incoming economic data, of which there is a lot before the Fed’s next meeting in mid-September, she said, adding, ‘it’s extremely important that we not let (the job market) slow so much that it tips itself into a downturn.’

| Name | Value | % Chg | |

|---|---|---|---|

| Major Indices | |||

| S&P 500 | 5,240 | +1.04% |

| Dow Jones | 38,997 | +0.76% |

| NASDAQ Comp | 16,366 | +1.03% |

| Russell 2000 | 2,064 | +1.23% |

| Country Indices | |||

| UK | 8,026 | +0.23% |

| Germany | 17,354 | +0.09% |

| Euro | 4,575 | +0.08% |

| Japan | 34,183 | -1.42% |

| Hong Kong | 16,647 | -0.31% |

| Name | Value | % Chg | |

|---|---|---|---|

| Commodities (USD) | |||

| Gold | 2,386 | -0.75% | |

| Silver | 27.01 | -0.89% | |

| Iron Ore | 102.30 | -0.15% | |

| Copper | 3.9842 | -0.35% | |

| WTI Oil | 72.81 | -0.51% | |

| Currency | |||

| AUD/USD | 65.32¢ | -0.08% | |

| Cryptocurrency | |||

| Bitcoin (USD) | 56,382 | +0.24% | |

| Ethereum (USD) | 2,465 | -3.18% | |

Key Posts

-

4:46 pm — August 7, 2024

-

2:10 pm — August 7, 2024

-

1:45 pm — August 7, 2024

-

1:19 pm — August 7, 2024

-

12:15 pm — August 7, 2024

-

11:49 am — August 7, 2024

-

11:13 am — August 7, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988