Investment Ideas From the Edge of the Bell Curve

ASX News Live | ASX Edges Higher; Myer’s FY22 Profit Rises, Tyro Appoints New CEO

Mergers and acquisitions — classic bear traps

There’s a long-held view in the world of finance that a flurry of business activity in the form of mergers and acquisitions, affectionately known as M&As, often mark the top of a long-drawn-out bull market.

It’s a signal that traders and savvy fund managers sometimes use to determine a market tipping toward the edge of being dangerously overvalued.

A phase in the business cycle that calls for discipline.

However, for the majority, M&A activity is usually a trap that pulls investors in at just the wrong time.

Directors, CEOs, and executives are equally vulnerable as the small-time investor when it comes to poorly timed investments.

FOMO is a powerful force across the business arena.

And in the corporate world the stakes are far, far greater when it comes to buying at the top.

The curse of the multibillion-dollar write-offs

I’d like to share with you an example from the tech world so we can relate this to where we sit in the upcoming commodity boom.

Buying at the top of a market has become the fabled legacy for many a prominent CEO.

He (or she) who decided to go ‘all-in’ at precisely the wrong moment will hold that stain for the remainder of their corporate career.

And in recent times there’s been no better example than the US$44 billion takeover of Twitter.

On 14 April, Tesla CEO Elon Musk offered a 38% premium to Twitter’s 1 April closing price.

And just nine days later, in his usual self-publicised style, Musk triumphantly ‘tweeted’ the deal had gone through with the Twitter board unanimously accepting his offer.

However, humility soon took hold…

On the backdrop of a Ukrainian crisis and rising interest rates, Twitter’s share price fell hard.

Adding weight to this was an industry that was starting to flounder as investors started to feel the pinch of holding overvalued assets that sat somewhere ‘in the cloud’.

Reality was starting to bite.

Buying for ‘future’ momentous profits was no longer a sound strategy.

And, as Twitter continued to fall, Musk attempted to scramble his way out of the takeover.

The chart below neatly summarises the events that took place against the Twitter share price, from April to July of this year:

And stunningly, it’s one of the most trusted computer brands we’ve all relied upon at some point that seems to have completely dropped the ball.

In January 2022, Microsoft agreed to buy a gaming company called Activision Blizzard for a staggering US$68.7 billion!

This was Microsoft’s largest deal ever.

And there’s no backing out like a regular investor.

Once the contract is signed, the deal is done.

https://www.dailyreckoning.com.au/mergers-and-acquisitionsclassic-bear-traps/2022/09/15/

Don’t let yesterday’s market bloodbath distract you from this huge development

I don’t need to tell you that yesterday was brutal for investors.

The US inflation shock — the fact that it isn’t easing — put US equities in a spin. Logically, the data suggests that Powell will have no other option than to keep raising interest rates…even if it means driving the US economy into the dirt to get what he wants.

Naturally, that is bad news for a lot of the market, which is why we saw such a vicious sell-off. And while Australia’s situation isn’t totally the same, it is impossible to avoid some spillover. That’s why the ASX followed US markets into the red yesterday.

It wasn’t just stocks feeling the pinch either. Almost every asset you can think of took a beating.

Even oil, which has been one of the big winners throughout 2022, couldn’t avoid the sell-off…

But, despite all the doom and gloom, it is worth reminding you that these tough times also lead to big opportunities. Because as hard as it can be to take a step back from the day-to-day movements of markets, you’ve got to remind yourself of the bigger picture sometimes.

After all, while everyone was transfixed by yesterday’s bloodbath, you probably missed a huge development…

Old money goes all in on new money

See, as the Nasdaq, NYSE, and Dow were getting trounced, a group of US investment firms made a rather unexpected announcement.

It seems as though American investors will soon have access to a new market exchange — a project that is known as EDX markets…

But this market isn’t for stocks, bonds, or commodities.

No, EDX is the newest cryptocurrency exchange set to launch in the US early next year.

And I know what you’re thinking — so what?

We’ve seen plenty of crypto exchanges come and go as the speculative sector peaks and troughs over the years. It isn’t exactly an industry that is known for stability.

Well, EDX is a little different. Or rather, its backers are a little different.

https://www.moneymorning.com.au/20220915/dont-let-yesterdays-market-bloodbath-distract-you-from-this-huge-development.html

A deeper look at Myer’s financials: FY22 ROC at ~1.95%

Myer’s management was eager to highlight the healthy total sales growth and a return to paying dividends on the back of net profit after tax rising to $49 million.

But what if we dig deeper into its FY22 accounts?

Then we’ll see a retailer highly geared. Its total liabilities of $2.28 billion dwarf its total equity of $267.4 million.

Meaning Myer’s FY22 debt to equity ratio is 8.6. MYR has $8.6 of debt for every dollar of equity.

This highly leveraged position means Myer can report a very healthy Return on Equity.

Myer’s average equity during FY22 was about $247 million. So MYR’s ROE was a solid 19.8%.

But since it employs more debt than equity to fund operations, a better measure would be Return on Capital (ROC).

ROC measures a firm’s returns against its total assets.

Myer’s average total assets during FY22 equalled $2.51 billion. Based on its FY22 net profit, ROC comes in at a measly 1.95%.

A quick check shows the 10-year Australian government has a yield of 3.65%.

For comparison, based on Harvey Norman’s FY22 accounts, its ROE was 19.98% but ROC was 11.75%.

Myer: first six weeks of FY23 ‘best sales start since 2006’

In its FY22 presentation, department store retailer announced that the first six weeks of FY23 have delivered Myer’s best sales start since 2006.

The first six weeks of 1H23 delivered sales growth of 74.8% on the prior year and 21.8% on FY20.

Lake Resources continues slide following Lilac dispute

Lithium developer Lake Resources (ASX:LKE) is currently down 4.5%, a day after closing 16% lower following a dispute with key technology partner Lilac Solutions.

Lilac and Lake disagree about the timelines of expected deliverables.

Lake argues Lilac must complete certain milestones by the end of this month. Lilac, on the other hand, thinks it has until November 30.

LKE said yesterday that the issue will be resolved either by a revised agreement between the pair or arbitration.

While the dispute seems minor — is the eight-week delay really that big of an issue — plenty is at stake.

If Lake is successful in arguing Lilac failed to achieve the milestones in time, Lilac stands to lose vital earn in rights for the Kachi project. Conversely, LKE stands to gain a bigger equity share of the project.

Both LKE and Lilac seemed to have had different ideas on key dates for milestone delivery for their shared Kachi project.

Lilac is expected to deliver the following milestones in order to achieve its 25% stake in Kachi:

- ‘Completing at least 1,000 hours of operations (including uptime, maintenance, monitoring, and other work that constitutes operations as determined by Lilac in its reasonable discretion) of the Lilac Pilot Unit onsite at Kachi provided; and

- ‘producing a Lithium carbonate feed totalling at least 2,500 kg of lithium carbonate equivalents from onsite operations’

LKE believes these milestones must be achieved by 30 September. As stated above, Lilac believes it has until 30 November.

How can the two parties — working so closely together — come to a disagreement over dates?

Wouldn’t the schedule be one of the first things nailed down in any contract?

Lake said the milestone terms were outlined in the Pilot Project Agreement ‘dated on or about 21 September 2021’.

However, investors weren’t privy to the details of this agreement, at least not the details about strict timelines.

In a release about the partnership, Lilac did sketch out the key commercial terms (emphasis added):

‘Lilac can earn up to a 25 percent interest in Lake Resource’s Kachi Lithium Project in Argentina through a shareholding in Lake’s subsidiary, Kachi Lithium Pty Ltd, which is the 100 percent indirect owner of the Kachi Lithium Project), in the following stages:

‘Stage 1

‘Lilac will earn 10 percent on committing to fund at its cost the completion of testing of its technology for the Kachi project in accordance with an agreed timeline.

‘Stage 2

‘Lilac will earn a further 10 percent on satisfying all agreed testing criteria using the demonstration plant at the Kachi Project in accordance with an agreed timeline.

‘Stage 3

‘Lilac may earn a further five percent on refined lithium chemical product from Kachi achieving the highest agreed qualification standards with certain potential offtake partners.’

How can a dispute arise over an ‘agreed timeline’?

Did exogenous delays create a misunderstanding about the enforcement of the timeline? After all, the pandemic has jolted supply chains. It seems LKE shareholders are in for another nervous period as they await further details from management.

This follows the sudden departure of former CEO Stephen Promnitz earlier in the year, whose exit caused much consternation from shareholders.

Select Harvest spikes 15% on market update

One of Australia’s largest Almond businesses, Select Harvests (ASX:SHV), is currently up over 15% on Thursday after providing a market update.

72% of SHV’s 2022 crop is committed, with the forecast fair value of $6t.75/kg coming in slight higher than previously provided fair valuation sales price of $6.64.

Select Harvests also provided a broader almond market update.

The producer noted that market pricing has strengthened in recent weeks as Spain and California suffer extremely hot conditions. Volumes from both regions are “significantly down”.

Select Harvests Managing Director, Paul Thompson commented:

“The strengthening of almond pricing is pleasing. The Select Harvests’ team have had to manage some difficult market and operational challenges over the last eighteen months. Market demand is beginning to build, and the Select Harvests’ team continues to focus on the basics: cost, quality, volume and price realization. The pollination of our 2023 crop is just another example of how having the right team makes the difference.”

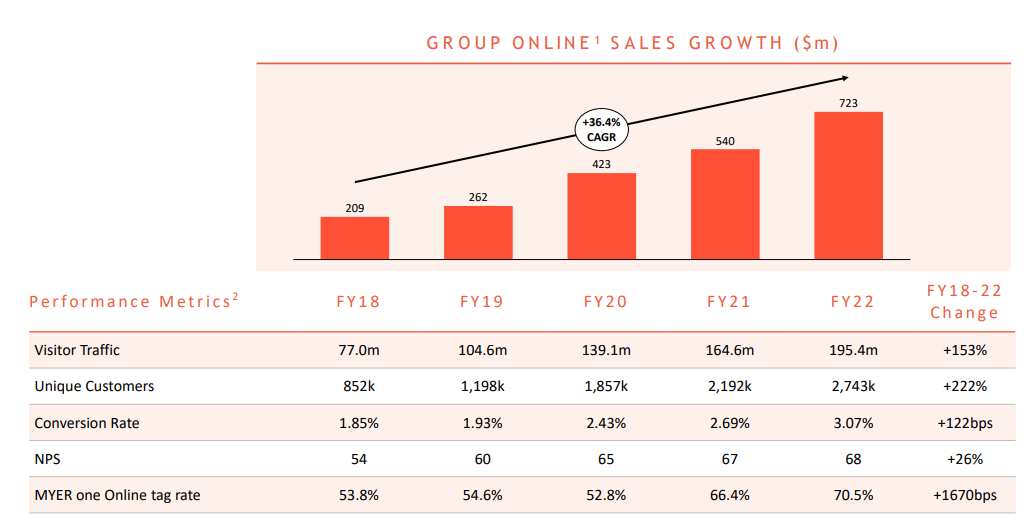

Myer’s FY22 profit grows as online sales continue to surge

Department store retailer Myer (ASX:MYR) has released its FY22 results on Thursday.

- Total sales up 12.5% to $2.99 billion

- Online sales up 34% to $723 million

- EBITDA up 2.6% to $400 million

- Net profit after tax pf $60.2 million, up 103.8% adjusted for JobKeeper

- Statutory NPAT up 5.7% to $49 million

- Total FY22 dividend of 4 cents per share

Myer was quick to note 2H FY22 was its best second half NPAT result since 2H FY13.

MYR’s total sales were in line with analyst expectations but EBITDA came in below consensus estimates of $423 million.

While operating gross profit rose 8.5% to $1.15 billion, operating gross profit margin fell 1.4% to 38.3%. Myer attributed the drop to Covid-19 supply chain costs and higher promotional activity.

Online sales now represent 24.2% of total sales, with the retailer recording 195 million website visits in FY22.

Myer said its online sales growth has outperformed the market by 27.7% since FY18.

MYR shares are currently down 4%.

Key Posts

-

4:06 pm — September 15, 2022

-

1:54 pm — September 15, 2022

-

12:46 pm — September 15, 2022

-

11:58 am — September 15, 2022

-

11:28 am — September 15, 2022

-

11:13 am — September 15, 2022

-

10:13 am — September 15, 2022

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988