Investment Ideas From the Edge of the Bell Curve

ASX News Live | ASX Down; RBA Governor In Hot Seat; JB Hi-Fi’s Bellwether Half-Yearly

Callum Newman: there’s good news out there if you look for it

Our editorial director Greg Canavan may think the Aussie consumer is cooked, but our small-caps guru Callum Newman still thinks there’s good news out there, if you look for it.

After all, it’s not a stock market but a market of stocks.

***

Put Wednesday down in your calendar as important.

That’s when Commonwealth Bank [ASX:CBA] tells us how many billions it’s raked in and how the average Aussie borrower is coping with life.

It’s going to be a ‘bumper’ profit, say analysts cited in the Australian Financial Review. Dividends could be 17% higher over the full financial year too.

The market knew this was coming a while back. That’s why the share price pushed up to new highs.

What investors can’t anticipate exactly is the current outlook.

The market will be keen for guidance on any rise in bad debts as higher interest rates really kick in.

I wonder if CBA will surprise everyone with how low loans in distress remain. Aussies are apparently doing everything except worrying about spending money.

We’ve seen ripping results from the retail sector. And check out this recent graph of car sales:

Source: CommSec

Such a chart is just not consistent with an impending recession…and neither is CBA trading around a record high.

I know. I know. All the mainstream press does is hammer us with how rising rates will wreck the economy and the housing market.

Beware: The market has now largely ‘discounted’ the rise in interest rates. It’s built into prices. That’s why 2022 was such a rough ride for a bit!

It’s where we go from here that matters.

What we want to see is inflationary pressure cooling off.

We’re getting that, in part, from coal all of a sudden.

See this report from Friday:

‘Newcastle coal futures tumbled 6 per cent overnight to US$225.50 per tonne amid reports that embattled coal developer Adani is offering discounted volumes.

‘Prices have halved from a record high around $US450 in September as Russia’s war in Ukraine fuelled a comeback for coal.’

That burnt Aussie coal producers on the ASX last week. Pun intended!

But it can’t be anything but good news for China and India, who still rely so much on coal power. What’s good for them is good for global growth.

That, in turn, may help discretionary spending feedback to Australia in other ways and industries, such as wine.

We’re not quite there yet, but there are reports that Chinese authorities are considering removing the punitive tariffs on Australian wine.

Point being: there’s good news out there if you look for it.

https://www.dailyreckoning.com.au/2023-shares-to-recover-to-new-highs/2023/02/13/

Why the Aussie consumer is cooked | Greg Canavan

Excerpt from Greg Canavan’s latest Insider piece

***

There is a reason why the sharpest rise in interest rates in decades has so far proved ineffective. It’s called excess savings. But the RBA needs to be very careful in turning up the hawkish rhetoric at a time when the savings rate is falling back to historical levels.

Let me explain what I mean…

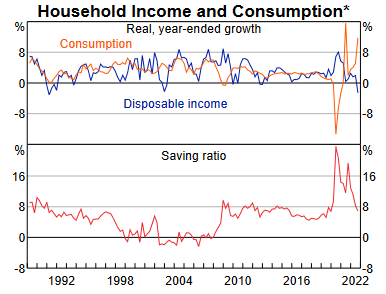

The chart below shows a few things. The orange line shows consumption running at a very strong clip…around 9%. Yet disposable income growth (blue line) is running at a negative pace.

Consumption, therefore, is being funded by savings. As you can see, the savings ratio (red line) has dropped sharply recently and is now back to levels consistent with the post-2008 era.

Source: RBA

Source: RBA

So while consumer spending is healthy on the surface, keep in mind that it’s not sustainable at the current pace.

Consumer discretionary heavyweight JB Hi Fi [ASX:JBH] today reported slowing sales for January. Its share price dropped more than 3%.

Meanwhile, as the chart below shows, consumer sentiment is in the toilet. In fact, it’s worse than it was in 2008. And with more interest rate rises coming, it’s hard to see any improvement on the horizon.

The Aussie consumer is cooked!

Vulcan outlines key risk — industrial capability of key technology ‘still to be demonstrated’

Vulcan Energy’s big point of differentiation from the traditional hard rock lithium miners is its new and seemingly revolutionary direct lithium sorption technology.

Vulcan has argued that this sorption technology can be faster and more efficient in bringing lithium to market, while being more environmentally friendly (a point it likes to stress given its hopes to serve the European market).

But the DFS released today for the first phase of its Zero Carbon Lithium Project outlined a key risk in the appendix.

Vulcan’s proprietary VULSORB technology’s ‘industrial manufacturing capability [is] still to be demonstrated’ and has ‘limited pilot scale testing so far’.

In an entry on how it plans to mitigate this risk, Vulcan said:

“Currently in discussions with a local toll manufacturer to manufacture VULSORB™, who is already supplying Vulcan for its Demo Plant. Similar to other sorbents which have also been tested in Vulcan’s pilot plants, are commercially available and could be used instead.”

So VULSORB is similar to other sorbents that are commercially available and could be used instead.

That doesn’t sound very proprietary nor like a source of a competitive advantage in an industry dealing with fungible commodities.

In today’s presentation, Vulcan described VULSORB as an in-house sorbent ‘shown to be best performing option’.

Vulcan Energy releases Phase One DFS — footnotes and all

Aspiring clean energy lithium developer Vulcan Energy (ASX:VUL) released its phase one definitive feasibility study for its Zero Carbon Lithium Project in Germany.

Investors have taken a quick look at the 110-page Phase One DFS document and their initial reactions were downbeat.

VUL shares are currently down ~5%.

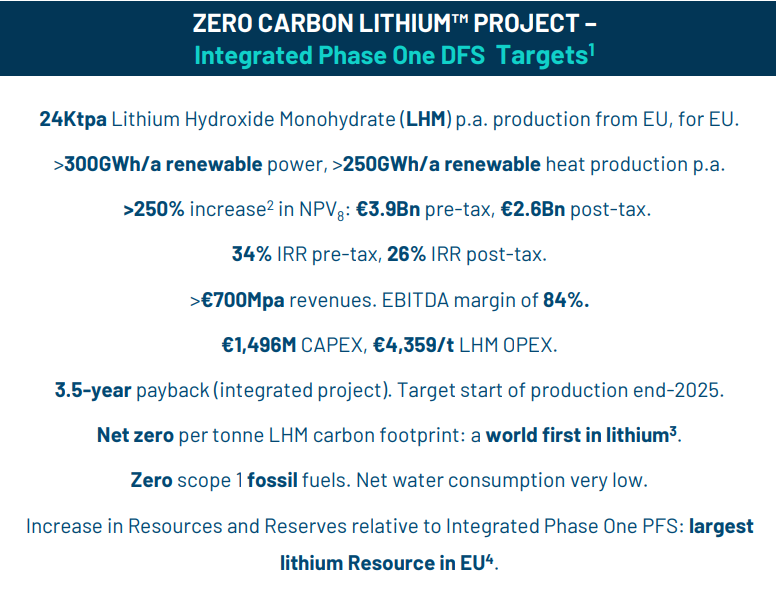

The brochure numbers — numbers Vulcan will happily emboss on an investor presentation — look like this.

Source: Vulcan Energy

Annual production up.

Renewable power capacity up.

Net present value up.

Internal rate of return up.

So why are investors selling the stock today?

Because of the terms and conditions numbers — numbers Vulcan wouldn’t emboss on an investor presentation.

While the phase one net present value for VUL’s flagship project rose 250% to €2.6 billion post-tax (at 8% discount rate), capex also rose, doubling to €1.5 billion.

OPEX, likewise, rose from €3,200/t to €4,359/t.

How does the production target rise 60% while revenue and net present value both rise over 200%?

A big revision in Vulcan’s pricing assumptions. Vulcan now forecasts to sell its lithium product for ~€30,000/t, with a long term price of €37,000/t.

Vulcan’s previous price assumption was €15,000.

So if the pricing assumptions prove too bullish, Vulcan’s NPV starts to look way to optimistic relative to the projected capital costs.

As a rule, a company is less likely to undershoot its capital cost projections so you know its CAPEX forecast is at least a reliable floor to the eventual figure. The same cannot be said with the same confidence for a company’s NPV forecast.

$VUL is down after releasing its phase 1 DFS.

While NPV and production targets rose, so did CAPEX and OPEX.

A big driver of the jump in NPV was a material revision in pricing assumptions. #ASX #lithium pic.twitter.com/8LEfjD6tfd

— Fat Tail Daily (@FatTailDaily) February 13, 2023

Ross Gittins: we can do better than using mortgage interest rates to control the economy

Sydney Morning Herald’s economics editor Ross Gittins just published an interesting column on the wrongheaded approach of blaming the bloke running the Reserve Bank of Australia.

For Gittins, the issue isn’t any one figurehead, but the system itself that thinks monetary policy can be subsumed in whole by manipulating mortgage interest rates.

“When interest rates seem likely to be raised more than they need to be, it’s only human to blame the bloke with his hand on the lever, Reserve Bank governor Dr Philip Lowe. But it’s delusional to imagine that fixing the problem with “monetary policy” is simply a matter of finding a better person to run it.

This assumes there’s nothing wrong with the policy of using the manipulation of mortgage interest rates as your main way of managing the economy and keeping inflation low and employment high. In truth, there’s a lot wrong with it.

It ought to be a happy coincidence that, just as our central bank is making heavy weather of its first big inflation problem in decades, the Albanese government had already commissioned a review of its performance.”

We can do better than using mortgage interest rates to control the economy https://t.co/zXLMy6ogd2 #ausecon #ausbiz #auspol

— Ross Gittins (@1RossGittins) February 12, 2023

The secret life of banks | Ryan Dinse

Excerpt from Ryan Dinse’s latest editorial.

***

I’m going to peel back the lid on banks and show you why they’re so stingy with your savings. Their greedy motivations won’t surprise you, but the mechanics might.

I’ll also show you an important health indicator to watch if you’re a bank investor, as well as some impending regulatory changes that spell opportunity…

Now, there’s a major misconception of how banks operate.

People think banks use deposits to make loans, that the bank sits between borrowers and savers, taking a cut on the way through.

If that was true, we’d see banks ‘competing’ for deposits in the spirit of free market competition. Otherwise, they wouldn’t be able to lend.

The net margin — the difference between borrowing and saving — would shrink to the point where uncompetitive banks would fade away.

But this isn’t how it works in one very important way.

The truth is, deposits aren’t a constraint on a bank’s ability to lend money in any way.

The mechanics here might surprise you.

For one, it all works in reverse!

Bank loans create deposits, not the other way around.

To see how this makes sense, imagine you get a $500k mortgage from the bank. That $500k is a loan for you but it’s also been sent to the bank account of the person who sold you the house.

Where did that $500k come from?

Nowhere!

It was simply new money created at the press of the button.

The bank didn’t have to check they had a pile of money ‘in the back’ to cover it.

(Note, this is actually one of the main ways by which new money is injected into the economy. Government spending through debt is the other one.)

But I hear you say, doesn’t that mean the bank can just create as many loans as they want?

I mean, if the money for these new loans doesn’t come from deposits, where does it come from?

Well, banks do have some constraints on how much they can lend, but it’s not from deposits.

It’s more related to profitability.

But I repeat, the number of deposits on the books has no bearing on how much a bank can lend out.

Instead, banks have to maintain certain regulatory capital ratios.

https://www.moneymorning.com.au/20230213/the-secret-life-of-banks.html

ChatGPT is a blurry JPEG of the Web

A New Yorker essay by Ted Chiang on ChatGPT is doing the rounds on social media … and rightly so.

The essay is the best piece of writing on the technology behind ChatGPT I’ve read to date. And I recommend you read it, too.

Here is an excerpt:

“Think of ChatGPT as a blurry jpeg of all the text on the Web. It retains much of the information on the Web, in the same way that a jpeg retains much of the information of a higher-resolution image, but, if you’re looking for an exact sequence of bits, you won’t find it; all you will ever get is an approximation. But, because the approximation is presented in the form of grammatical text, which ChatGPT excels at creating, it’s usually acceptable. You’re still looking at a blurry jpeg, but the blurriness occurs in a way that doesn’t make the picture as a whole look less sharp.

“Can large language models take the place of traditional search engines? For us to have confidence in them, we would need to know that they haven’t been fed propaganda and conspiracy theories—we’d need to know that the jpeg is capturing the right sections of the Web. But, even if a large language model includes only the information we want, there’s still the matter of blurriness. There’s a type of blurriness that is acceptable, which is the re-stating of information in different words. Then there’s the blurriness of outright fabrication, which we consider unacceptable when we’re looking for facts. It’s not clear that it’s technically possible to retain the acceptable kind of blurriness while eliminating the unacceptable kind, but I expect that we’ll find out in the near future.”

Chiang’s essay also contains a clever test case for ChatGPT. It was a real ‘Aha!’ moment for me:

“Indeed, a useful criterion for gauging a large language model’s quality might be the willingness of a company to use the text that it generates as training material for a new model. If the output of ChatGPT isn’t good enough for GPT-4, we might take that as an indicator that it’s not good enough for us, either. Conversely, if a model starts generating text so good that it can be used to train new models, then that should give us confidence in the quality of that text. (I suspect that such an outcome would require a major breakthrough in the techniques used to build these models.) If and when we start seeing models producing output that’s as good as their input, then the analogy of lossy compression will no longer be applicable.”

Rising mortgages threaten household buffers

Last week, ANZ Bank chief executive Shayne Elliott warned that some Australian households are about to face some stern tests as rising interest rates push up mortgage repayments and threaten to exceed some household’s buffers.

Elliott said the Reserve Bank of Australia’s latest 25 basis point hike meant that in some cases customers will pay more than the buffer ANZ built in when it first calculated the customers’ ability to meet repayments.

Speaking to 3AW Radio, Elliot elaborated:

“The lowest rate we ever gave anyone was 1.94 per cent as a fixed rate.

“We assumed rates could go up to 5.25%, so we built a buffer which is about where we are now, so that buffer has worked.

“[W]e are at a very difficult pivot point.

“Up to now people have been managing OK … but it’s really from here on it gets very difficult because we are over that buffer, and it starts to really bite into people’s savings.”

Households approaching their buffer limits is one way to track the stress a mortgage-heavy economy is under. What about others?

In December, the Reserve Bank released a bulletin on measures to assess financial stress.

The central bank admitted ‘high-frequency and timely indicators of emerging signs of financial stress are not readily available.’

But the RBA is developing ‘novel measures’ to counteract this, including using social media data.

Source: RBA

Twitter is one source of data the RBA is now tracking:

“We construct measures of financial stress based on Twitter data by tracking the proportion of all tweets from Australian users that contain keywords suggesting financial difficulties. The queries are constructed to capture both the relevant topic and negative sentiments. We do so by counting all tweets that contain pair-wise combinations of words related to household or business debt with associated negative connotations. For example, the tweet ‘feeling overwhelmed by my mortgage’ would be counted in our indicator.”

Source: RBA

The central bank’s research found that Google Trends and Twitter data correlated highly with the bank’s chosen measure — the mortgage arrears rate.

News coverage did not correlate well and was too sensitive to overseas stories.

“These results suggest that the Google Trend and Twitter indices could help provide an early-warning indicator of the overall level of household financial stress that is relevant both for financial stability and in anticipating how households may respond to income shocks. The Bank’s new Google- and Twitter-based measures of household stress are strongly associated with, and for Google Trends lead, the household arrears rate.”

Does the reporting season even matter?

We’re well into earnings season as companies release their latest numbers and analysts check them against expectations.

Some stocks manage to exceed expectations and surge. Others don’t … and sink.

But does the reporting season matter?

In the short run, yes.

As Morningstar’s Mark LaMonica pointed out last week, in the short-term, the absolute performance of a company doesn’t really matter as much as the company’s performance relative to expectations.

(There’s a whole book about exploiting investor expectations for profitable analysis called, you guessed it, Expectations Investing).

But in the long run, any given reporting season is not that important. As LaMonica writes:

“[The] long-term perspective diminishes the importance of a single additional data point.

“If you’ve held CSL for the last 10 years does the result reported in February of 2014 matter? Of course not. 10 years from now the February 2023 report will matter little as well.”

But the reporting season does offer opportunities for the long-term investor. The shorter time horizon for traders offers time arbitrage opportunities for the patient investor.

“Earnings releases that are perceived as bad news can create buying opportunities as investors stampede away from a company based on a poor six months.

“As long-term investors this can be an entry point into a great company even if the short-term looks rocky and patience is required for the pessimistic narrative to pass.

“As long-term investors we should care little about short-term volatility except when it is an opportunity to find a great company that is temporarily beaten down.”

Quick market recap

Time for the espresso recap.

Last week, US stocks recorded their biggest weekly decline in two months, arresting what was a very strong start to the year. Investors are mulling over both the mixed corporate earnings and the prospect of further interest rate hikes.

US Treasury yields climbed, deepening the the yield inversion.

The inversion between the two-year and the ten-year US Treasury notes hit the deepest level since 1981.

So are we actually going to have a US recession after all?

It is shaping up to be an interesting week as markets are about to get more clues as to the mood of central banks on interest rates.

The US is set to release important inflation data this week and our own beleaguered RBA governor will front two parliamentary committees, answering questions about monetary policy and potentially also why he shunned the public for a private event hosted by Barrenjoey.

In commodity news, last week a basket of industrial metals trading in London recorded its best January in more than a decade. For instance, US copper futures had their best first month of the year since 2003. Aluminum and zinc were also strong performers.

In retail news, JB HI FI’s latest results suggest a slowdown in spending. Chief executive Terry Smart said January trading was moderating:

“While we are pleased with the January trading result, with sales continuing to be well above pre-COVID January 2020, we have seen sales growth start to moderate from the elevated levels seen in the first half of FY23,”

Is this a normalisation of trade or are interest rate hikes starting to hit? Or a little of both?

Good morning!

Good morning, investors.

It’s a new week on the markets but the perennial stories informing it.

So let’s get to them.

Key Posts

-

4:46 pm — February 13, 2023

-

4:35 pm — February 13, 2023

-

4:01 pm — February 13, 2023

-

3:10 pm — February 13, 2023

-

12:48 pm — February 13, 2023

-

12:34 pm — February 13, 2023

-

12:20 pm — February 13, 2023

-

11:44 am — February 13, 2023

-

11:18 am — February 13, 2023

-

10:34 am — February 13, 2023

-

10:26 am — February 13, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988