Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX and Wall St Rally After Fed Tips Rate Cuts in 2024

Market close update

The ASX 200 closed up 1.66% at an 18-week high of 7,377.9.

All sectors finished up today, with the biggest gainers being the interest rate-sensitive sectors of Real Estate (+4.01%) and Tech (+2.90%).

The dovish signs from the Fed pause last night, plus the signalling of three rate cuts next year, were enough to send both Wall St and the ASX benchmarks soaring today.

The Materials sector (+2.35%) also had a strong day trading as gold prices rose above US$2k again, reaching US$2,031.51 per ounce.

Many lithium miners also bounced off recent lows, with the standouts being IGO (+11.3%), Core Lithium (+8.2%), and Pilbara Minerals (+8.6%).

In ASX news today, Genesis Minerals jumped 5.1% to $1.75 after penning a deal with Kin Mining to buy two of its gold tenements in WA.

Viva Energy jumped 6.1% to $3.32 after the ACCC greenlit its plans to buy petrol retailer OTR from Peregrine Corp.

Orora fell 3% to $2.60 after the bottle maker released a statement hinting at headwinds that could dampen the results of its recent French acquisition Saverglass.

ACCC signs off on Woolworths stake in Perspiration Group

Woolworths Group [ASX:WOW] has been given the green light to purchase a 55% stake in PETstock owner’s Petspiration Group for approximately $586 million.

To fund the purchase, Woolworths will sell down a 5.5% stake in its pub business Endeavour.

The decision from the competition watchdog comes nearly a year after the first bid was thrown at PETstock by Woolworths. The supermarket giant has made moves into the pet sector after watching the boom in pet buying during the pandemic.

Woolworths has now invested $10 billion into the specialty pet sector since last December.

Midday market update

The ASX 200 is up by 1.56% to 7,370.8 in a roaring day on the market.

All sectors are well into the green, with the top performers at midday being interest rate-sensitive sectors Real Estate (4.13%) and Tech (2.61%).

Lagging behind today were Financials (+0.69%) and Staples (+0.80%).

Top performing stocks at midday in the ASX 200 were Emerald Resources, up 10.59% and Real Estate group Charter Hall, up 9.74%.

While the worst performers are QBE Insurance, down -3.67% and Metcash, down -2.79%.

Meanwhile, the US Dollar dropped to a four-month low after the Fed’s clear signals of peak interest rates. The Dollar Spot Index dropped 0.3% to its lowest since August.

Viva Energy rises on competition watchdog tick-off

Viva Energy [ASX:VEA] has seen its shares rise by 4.15% this morning. The move comes after the ACCC announced it would not oppose plans by petrol retailer Peregrine Corp’s OTR Group

The ACCC made that determination after accepting a court-enforceable undertaking from Viva Energy to divest 25 company-operated sites in South Australia to a purchaser approved by the ACCC.

The ACCC has approved Chevron Australia Downstream as an acceptable purchaser of those sites. In exchange for the 25 divestiture sites, Viva Energy will receive 13 Chevron sites located in QLD, NSW and WA.

Viva expects the acquisition to be completed in the first half of 2024, subject to the Foreign Investment Review Board’s approval.

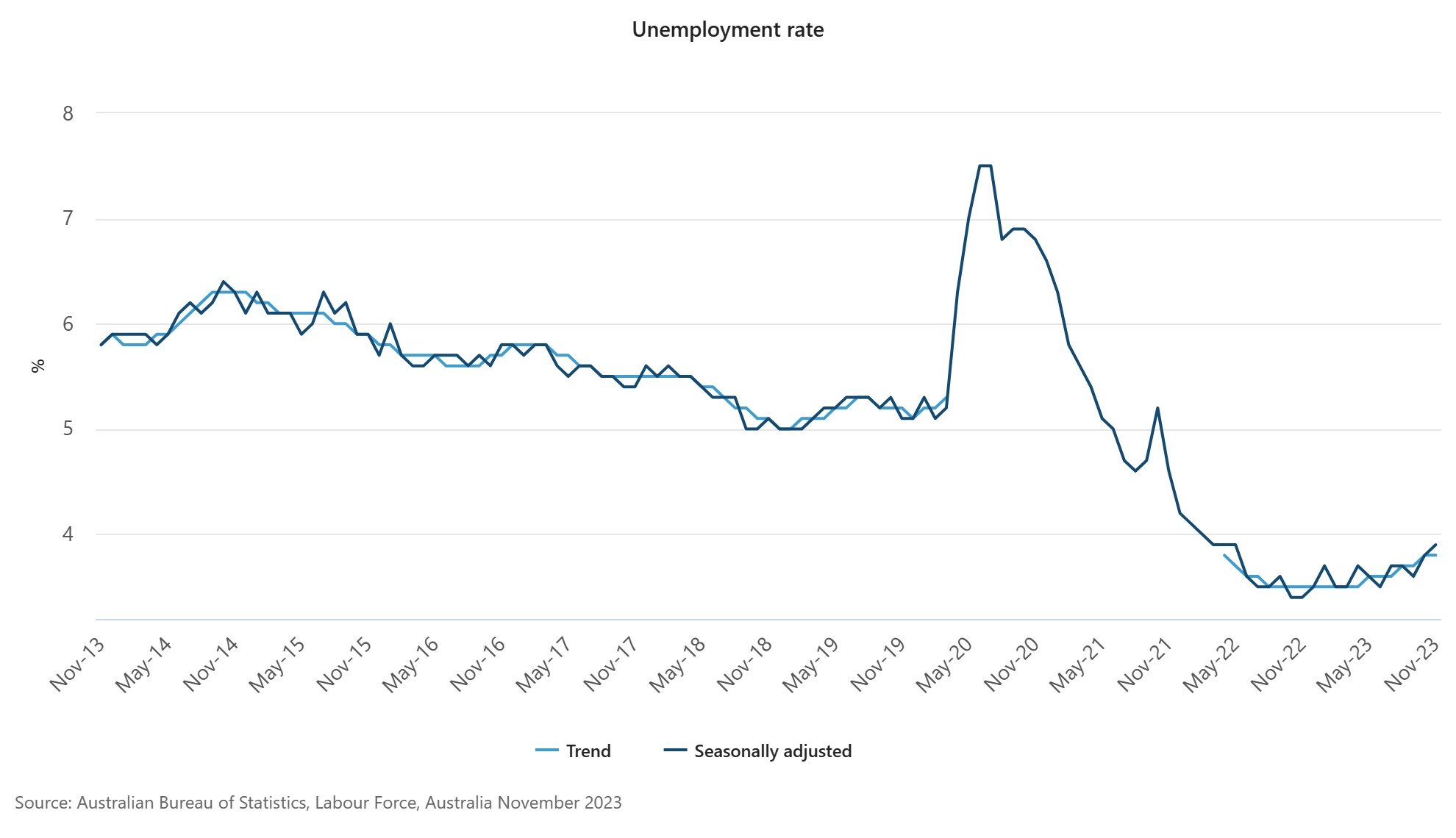

Unemployment rate rises

Australian unemployment rate rose to 3.9% from 3.8% last month.

Employment figures increased by 61,500 jobs in November, spurred by the population influx seen in the second half of the year.

The participation rate remained unchanged at 67.1%, while underemployment was also static at 6.4%.

Source: Australian Bureau of Statistics

Genesis completes another acquistion

Genesis Minerals [ASX:GMD] has penned a deal with Kin Mining [ASX:KIN] to buy Cardinia gold deposits for $53.5 million in cash and Genesis shares.

The deal is one of a spree of acquisitions Genesis has made in the past year as it quickly moves from a budding explorer to a mid-tier gold producer in 18 months.

The sale of 610,000 ounces of Kin’s 1.5 million-ounce total resource inventory positions the company with an ‘exceptionally strong‘ balance sheet and trajectory of growth.

These new deposits will be in trucking range of processing plants and unlock their value for Genesis moving forward.

Shares of Genesis are up by nearly 10% this morning.

ASX 200 jumps at open

The ASX 200 raced out of the gates this morning, up 1.33% in the first ten minutes.

The benchmarks are set to have a strong day as the US Fed kept rates on hold and signalled it was done with further hikes.

The Fed meeting also pencilled in three rate cuts for 2024, something that the markets had expected for some time but is clearly moving as a response anyway.

“Overall, the development of the labour market has been very positive. It’s been a good time for workers to find jobs and get solid wage increases.” Federal Reserve Chair Jerome Powell said during a press conference.

The move may work to undermine the Fed’s progress, by sending the market into overdrive and pushing inflation up. The comments have some analysts already shaking their heads.

Brad Conger, deputy chief investment officer at Hirtle Callaghan & Co, commented today:

“Today’s statement was Powell’s golden chance to press back on the markets’ undermining of his policy,” Conger said. “Instead, they used the occasion to congratulate themselves on a mission accomplished.”

“I fear history will not be kind to this FOMC,” he added.

Morning market update

Good morning all, Charlie here

The ASX 200 futures point to a strong day on the market. ASX 200 Futures are up 1.24% to 7,338.0.

In US stocks, Wall Street was firing on the news of potential cuts in 2024, with many making fresh highs for the year. S&P 500 is now only 2% away from all-time highs. Meanwhile, bonds fell sharply.

Small-cap Russell 2000 was the top performer, up 3.52%. Meanwhile, the Dow also closed above 37,000 points for the first time.

Gold rose above US$2,000 again. Gaining 2.02% to US$2,027.51

Wall Street: Dow +1.40%, Nasdaq +1.38%, S&P 500 +1.37%

Overseas: FTSE flat, STOXX -0.14%, Nikkei +0.25%, SSE -1.15%

The Aussie dollar rose sharply, up +1.47% to US 66.57 cents.

US 10-year bond yield -18bps to 4.02%. Australian 10-year bond yields -20bps to 4.12%.

Gold is up +2.27% to US$2,027.51. Silver jumped +4.35% to US$23.81.

Bitcoin saw a sharp recovery from its falls, up +5.28% to US$43,314.49, Ethereum rose +4.64% to US$2,279.98.

Oil Brent rose +1.87% to US$74.61, while WTI Crude rose +1.69% to US$69.77, with slight recoveries after sharp drops from fears of oversupply from expanded exports from Russia and Venezuela.

Iron ore is up +0.37% to US$135.66 a tonne. While Singapore futures are down 2% to US$133.40.

Key Posts

-

4:43 pm — December 14, 2023

-

1:37 pm — December 14, 2023

-

1:26 pm — December 14, 2023

-

12:01 pm — December 14, 2023

-

11:53 am — December 14, 2023

-

10:40 am — December 14, 2023

-

10:17 am — December 14, 2023

-

9:30 am — December 14, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988