Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | ASX 200 To Rise as S&P 500 Nears All-Time High, Bitcoin ETF Approved by SEC

Market close update

The ASX 200 closed up +0.50% at 7,506 today, with 8 of the 11 sectors in the green.

Only Utilities (-0.23%) finished down, with minor losses seen in AGL Energy (-0.75%) and Origin Energy (-0.12%).

Mirroring gains seen on Wall St, the biggest gainers today were in Technology (+1.20%) with broad gains across the sector.

Investors will be eagerly awaiting US CPI data, which is due out on Thursday (US time), for a clearer indication of the progress in the battle against inflation.

US core CPI is forecast to rise 0.3% in December, putting annual inflation at 3.8%, down from 4%.

Back to the ASX in individual company news, JB Hi-Fi jumped 3.8% to finish just shy of its all-time high, while Harvey Norman was up 1%.

Mining majors fell with the dropping price of Iron ore. Rio Tinto fell -0.4% to $128.4, while Fortescue Metals dropped -1.9% to $27.04.

Global engineering giant Worley fell 2% after Ecuador accused the company of ‘engage[ing] in corruption and bad faith‘ in securing contracts with its national oil corporation.

Meanwhile, BTC saw huge trading volume increases after the SEC’s approval of Spot BTC ETFs. Furious selling and buying volumes have seen the price slowly trend down throughout the session today, with the price only down -0.50% since this morning. .

Pinnacle Investment jumps on market update

Pinnacle Investment has jumped by 2.57% after releasing a positive market update where the company said it was entering the second half of 2024 with ‘cautious optimism‘.

While that old throwaway line has little meaning in this day and age, investors were more interested in the numbers.

Principal investments totalled approximately $136 million at the end of 2023, compared to $164 million at the end of 2022. But the higher figures were due to a new draw facility, which was repaid last year.

The company said that funds under management are expected to be higher in the second half of FY24 and will contribute to stronger results for the second half of the year, but it didn’t give hard numbers.

Andrew Forrest commits to further green initiatives

Andrew Forrest’s Squadron Energy has committed to 14 gigawatts(GW) of new renewable energy after signing a $2.75 billion strategic alliance for wind turbine supply with GE Vernova.

The deal will equal one-third of Australia’s 2030 target of 82% renewables, the company said today.

The news came as Squadron held a groundbreaking ceremony for the $820 million Uungula wind farm project in NSW.

Fortescue Metals Group chairman Andrew Forrest commented today:

‘The time for talk is over. We are investing right now in Australia’s green energy transition and creating jobs and economic development for regional Australia,” the Fortescue Metals Group chairman said in a statement.’

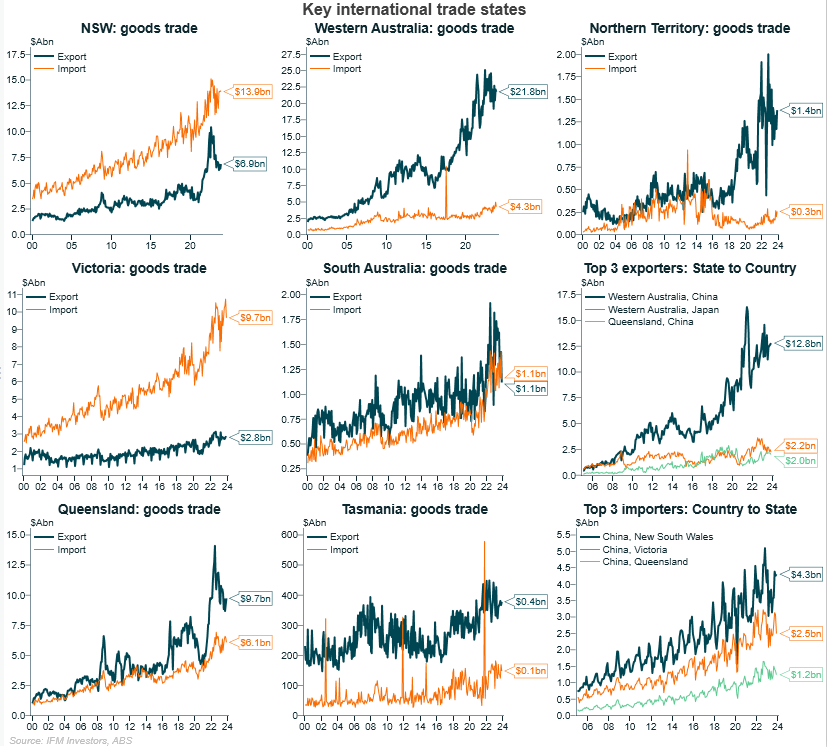

Latest international trade data

The Australian Bureau of Statistics released the latest statistics on Australia’s international trade today.

The seasonally adjusted balance on goods (exports) increased by $3.77 billion. That’s from $7.7 billion in October to $11.4 billion, well above expectations of $7.5 billion, thanks largely to gains in coal and iron ore.

Meanwhile, imports fell 7.9% as automobile sales fell by nearly $1 billion.

Source: IFM Investors – ABS

Midday market update

The ASX 200 is up by +0.40% at 7,498.7 around midday, as a tech rally in on Wall St lifted markets.

Most sectors are positive today, with only Energy (-0.31%) and Industrials (-0.13%) suffering from lower oil prices and scandals.

In the industrial sector, global engineering firm Worley dragged the sector down as the $8.43b market cap company was accused of corruption by Ecuador today, which the company denied.

Positive movements have also been seen in Discretionary (+0.91%) and Financials (+0.89%) with JB Hi-Fi among the top performers today, up +3.55%.

Spot Bitcoin ETF approved by SEC

Huge news from the US today as the SEC approves Spot Bitcoin exchange-traded-funds (ETF).

Regulators approved all 11 outstanding applications for spot bitcoin ETFs from firms, including Cathie Wood’s Ark Invest, Greyscale, BlackRock, and Fidelity.

While many had expected the approval, it is still worth acknowledging how far Bitcoin has come.

The decision is a historic step in the acceptance and institutionalisation of cryptocurrencies.

While this could be a double-edged sword in many ways, for now, it is very bullish for BTC.

The potential inflows of capital into the space from new investors, as well as the upcoming halving in April, should get investors very excited.

Still, from here, the road may not be only up.

Pre-halving has seen significant corrections of -20-35% in the past, but those usually shake out weaker hands for others to accumulate.

The price reaction to today’s news was muted, with BTC up by 1.12%, mainly due to fake starts yesterday.

The SEC’s Twitter social media account was hacked on Wednesday, and a fake approval was announced, spiking and crashing the price in quick succession.

Once the jitters settle, expect more price action.

Avita Medical jumps after releasing unaudited Q4 results

Avita Medical [ASX: AVH] has seen its share price jump by 7% in early trading after the company announced its unaudited results for Q4.

Highlights of the announcement include:

- Commercial revenue for the fourth quarter of 2023 is expected to be approximately $14.1 million, an increase of approximately 50% compared to the same period in 2022.

- Commercial revenue for the full year 2023 is expected to be approximately $49.8 million, an increase of approximately 46% compared to the full year 2022.

- Gross margin for the full-year 2023 is expected to be approximately 84.5%.

- As of December 31, 2023, approximately $89.1 million in cash, cash equivalents, and marketable securities.

The company also gave guidance for FY24, saying they expect Q1FY24 to be between $14.8−15.6 million.

Meanwhile, full-year revenue from 2024 is expected to be in the range of $78.5−84.5 million, reflecting growth of between 57%−69% over FY23.

Investors have been following closely news of its upcoming post-market study of TONE, a repigmentation treatment for people with stable vitiligo.

The company has enrolled 109 patients in the US and is planning to follow them over a 12-month period, with a follow-up period of 6 months after treatment.

Morning market update

Good morning. Charlie here

The ASX 200 opened up +0.34 % to 7,493.5, following Wall St as US markets moved higher as many traders expect hopeful numbers from CPI data due out tomorrow.

The Nasdaq is now just below its November 2021 all-time high. If inflation numbers tomorrow are lower, expect a new high to be made.

Bitcoin’s long-awaited ETF has been approved by the SEC, with 11 competing ETFs now competing for space.

Meanwhile, the Nikkei index reached a 35-year high as the yen continued to weaken.

US Crude Oil stockpiles unexpectedly edged up, further easing oil prices, which are now down over -20% from their September 2023 local high.

Wall Street: Dow +0.45%, Nasdaq +0.75%, S&P 500 +0.57%.

Overseas: FTSE -0.42%, STOXX flat, Nikkei +2.01%, SSE -0.54%

The Aussie dollar rose +0.19% to US 66.99 cents.

US 10-year bond yields +2bps to 4.03%.

Australian 10-year bond yields +4bps to 4.14%.

Gold fell -0.33% to US$2,024.37. Silver fell -0.39% to US$22.90.

Bitcoin rose +1.15% to US$46,427, while Ethereum rose by 7.74% to US$2,544.

Oil Brent fell sharply, down -1.02% to US$76.80, while WTI Crude fell -1.26% to US$71.33.

Iron ore fell sharply -4.0% to US$132.30 a tonne.

Key Posts

-

4:54 pm — January 11, 2024

-

2:50 pm — January 11, 2024

-

2:33 pm — January 11, 2024

-

2:03 pm — January 11, 2024

-

12:39 pm — January 11, 2024

-

10:43 am — January 11, 2024

-

10:35 am — January 11, 2024

-

10:13 am — January 11, 2024

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988