Investment Ideas From the Edge of the Bell Curve

ASX News LIVE | Appen, Sayona Mining, Brainchip Plummet; Fortescue’s Surprise CEO Exit

A big day for individual stock falls

While the All Ords ended 0.45% higher on Monday, there were some big individual falls today, too.

Chief among them — Appen, Sayona Mining, Opthea, and Bowen Coking Coal.

Earnings season is pretty much done, what have we learned?

You’re reading an excerpt from Greg Canavan’s latest The Insider piece.

***

Earnings season is pretty much done.

What have we learned?

Well, there are the numbers, and then there is the interpretation of those numbers. For the numbers, The Weekend Australian has the details…

‘With the reporting season about 85 per cent complete, the June half has been a bit better than feared in terms of the number of companies beating consensus estimates for profits.

‘“Upside and downside surprises have been neck and neck with about 36 per cent surprising on the upside, which is below the norm of 43 per cent, and 37 per cent surprising on the downside, which is more than the norm of 26 per cent,” said AMP’s head of investment strategy and chief economist, Shane Oliver.

‘While 58 per cent of companies have seen earnings rise on a year ago, that’s below a norm of 63 per cent. Only 43 per cent have increased their dividends on a year ago, versus a norm of 58 per cent.

‘And corporate guidance has been cautious, with retailers warning of tougher conditions, with better-off customers turning to discount stores like Big W and Kmart for bargains.

‘“Partly reflecting the cautious outlook, consensus earnings expectations have been revised down since the reporting season started,” Oliver says.

‘The consensus is now for a 1.8 per cent rise in earnings for the fiscal 2022-23 year just ended. That represents a downgrade of 70 basis points from a 2.5 per cent rise forecast at the end of July.

‘The consensus estimate for the 2023-24 financial year has been lowered to minus 5.4 per cent, down from minus 0.8 per cent.’

As far as the stock market is concerned, that last data point is all you need to know. Earnings estimates for this financial year are expected to fall by 5.4%.

Whether that poor outlook is priced in is another question. In my view, it’s not. But as I’ve pointed out before, looking at ‘the market’ is tricky. You have ‘cheap’ looking iron ore miners — as well as some of the banks — all trading on single-digit or below market price-to-earnings ratios (P/E). But many other stocks are on hefty multiples.

This really is a stock pickers market. Which is an annoying cliché, I know. But the market is made up of plenty of disparate stocks with disparate earnings profiles right now.

Yes, another cliche

Which brings me to the interpretation of the numbers. This is THE key takeaway from this reporting season. And I’m sorry, but it’s another cliché.

That is, investors hate uncertainty. So they are paying up to the winners (those providing earnings certainty) and selling down those reporting numbers with greater uncertainty about the future.

For thoughtful investors, this raises an interesting question. Are investors putting too high a price on certainty and too low a price on uncertainty?

We looked at this in our latest episode of What’s Not Priced In, I profiled a number of stocks that reported good results, and the share price rallied…but it’s clear that investors are REALLY paying up for the certainty of this good performance.

Brainchip CEO: ‘results clearly not acceptable’

In a follow-up release to last Friday’s half-yearly results, Brainchip CEO Sean Hehir admitted the results are ‘clearly not acceptable’.

Brainchip said it was developing a second generation of its Akida chips.

This, it says, led to potential customers delaying any commercial dealings with the company until the new chips are ready for distribution.

Hehir said there’s been a ‘lot more traction from serious prospects and very detailed evaluations, however decisions are being delayed until formal release of the platform.’

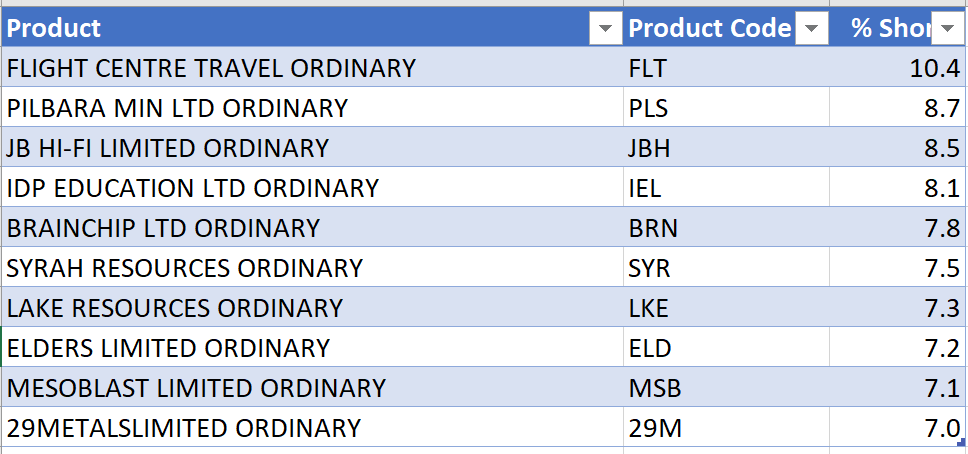

Most shorted stocks on the ASX

Here are the most shorted stocks on the ASX, according to the latest data from ASIC.

Flight Centre remains the perennial leader, with 10.4% of its stock sold short.

New entrants include lithium producer Pilbara Minerals and retail stalwart JB Hi-Fi.

Appen is the worst performer on the All Ords, Sayona not far behind

Appen describes itself as the ‘market leader in data for the AI lifecycle’.

Whether or not that’s true, Appen is definitely the leading loser on the All Ords on Monday.

The data services firm is down nearly 32% currently, falling to a new 52-week low.

Not far behind is Sayona Mining, down 29%, also plumbing new 52-week lows.

Eye disease therapy developer Opthea [ASX:OPT] is the other stock to record a big tumble, currently down 25%.

And, yes, it, too, hit a new 52-week low.

It’s one of those days!

This time IS different for commodities: Brian Chu

Our gold expert Brian Chu is flirting with danger, saying this time really is different for commodities.

***

One of the most well-known follies in investing is believing that ‘it’s different this time’.

However, I have a feeling that it is different this time for commodities.

I’m referring to the current commodities boom. It’s nothing like the last super cycle that was driven by a massive building boom in China that caused a surge in demand for iron ore and other materials. In turn that fuelled mining companies to explore, develop and produce.

Now you might think that I’ve got it wrong about what’s happening this time. Isn’t there an unprecedented demand for battery metals and critical minerals to drive the clean energy revolution?

Well, yes. But why are commodity prices not surging like they did in 2005–13? Have a look at the figure showing the cumulative performance of the Bloomberg Commodities Index:

|

| Source: Thomson Reuters Refinitiv Datastream |

The problem is that this so-called boom is rhetoric-driven rather than reality. I wrote about this back in early July.

Commodity prices got ahead of themselves before they came back down. Meanwhile, mining companies are struggling with thinning profit margins, causing several to suspend production to preserve their capital.

That doesn’t sound like a boom to me when they’re battening down the hatches!

Depending on whether you trade the momentum or look for bargains, knowing this fact will help you formulate your winning strategy. This is what I want this article to accomplish.

Let’s delve deeper into this unusual situation.

If this really is a commodities boom, it’s the weirdest boom. You’d have to believe it against the evidence from the companies.

I’ve tracked the performance of gold producers in the 2023 June quarter, which was largely underwhelming with lower production and higher costs.

It seems like this trend has been playing out for other metals too. Iron ore, copper, aluminium, zinc, nickel, everything!

Don’t get me wrong, I’m not pouring cold water on commodities. But I’m saying that there are plenty of signs to say that the narrative about a boom playing out right now just doesn’t jive with reality.

Earlier last month, the ABC reported that Australian export revenue from resources for 2023–24 could decline by over 15% from $460 billion ($455 billion according to the Minerals Council of Australia) in 2022–23 to $390 billion. This comes as coal and gas exports might decline by 25–50% while critical metals for wind turbines and electric vehicles such as cobalt could increase for the following year.

In short, declines in revenues from fossil fuels will likely overshadow the increase in revenues from resources associated with renewable energy.

Correct me if I’m wrong, but the past booms we’ve had come largely from a surge in demand causing supply to increase. So, the supply shortage is a response to people wanting more. As this happens, the price of the required material rises and slowly falls as producers gradually bridge this gap.

https://commodities.fattail.com.au/how-this-time-is-different-for-commodities/2023/08/28/

A repeat of 1960s in on the cards and why you should care: Ryan Dinse

There’s a US$14 trillion market you’ve likely never heard of.

It’s called the Eurodollar market, and it’s a hidden world of US dollar loans made outside the regular banking system.

When things break in the financial world, often the Eurodollar market can accentuate — or even cause — events to move much quicker than expected.

This opaque world of ‘cloak-and-dagger’ banking started up in the aftermath of the Second World War.

US dollars were the main game in town, but not everyone had access to the US banking system.

This meant that those who did have access had an extremely profitable piece of leverage to exploit.

Here’s the thing…

I think just such a market is opening up again.

Like the Eurodollar market, it’ll likely rise regardless of government policy or regulations. In fact, impending regulations may drive the big banks towards it.

The good news?

You can stake your claim here before the real money starts to flow in.

Let me explain more…

https://www.moneymorning.com.au/20230828/a-repeat-of-the-1960s-is-on-the-cards.html

Brainchip hits 52-week low, continues to burn cash

It’s a bad day for once-favoured hot stocks.

Sayona Mining and Appen are sinking.

And Brainchip is, too.

Brainchip, developer of neuromorphic processors, inauspiciously released its 1H23 financials after hours on Friday.

1H23 revenue fell 98% (!!) to US$115,606, down from US$4.8 million.

The net loss widened to US$17.1 million. BRN has now accumulated US$162.3 million in losses.

Why the massive and near-total collapse of revenue?

Management called out the ‘volatility of revenues in the early years of commercialisation and noting that several active customers elected to defer their evaluation of BrainChip’s technology until after the expected release of Akida 2.0 in August 2023.’

In 1H23, license revenue was non-existent, with product and development service revenue both down on 1H22.

Source: Brainchip

Brainchip now has US$21.8 million in cash and cash equivalents remaining.

Sayona Mining sinks on abrupt CEO resignation, flags ‘review of operations’

Struggling lithium hopeful Sayona Mining [ASX:SYA] hit a new 52-week low after announcing the abrupt resignation of managing director and CEO Brett Lynch.

Lynch departed for personal reasons with immediate effect.

Lake Resources and Stephen Promnitz redux?

But the ominous news didn’t stop with Lynch’s departure.

Sayona said it will ‘undertake a thorough review of operations and the strategic direction of the Company to further enhance shareholder and stakeholder value’.

$LKE and Steve Promnitz redux? $SYA announced the abrupt departure of MD and CEO Brett Lynch.

Lynch resigned 'for personal reasons' with immediate effect. $SYA.AX will now also undertake a 'thorough review of operations and the strategic direction of the company'. pic.twitter.com/8KmyB4ubvo

— Fat Tail Daily (@FatTailDaily) August 28, 2023

The biggest winners and losers of the reporting season

In this episode we take a look at some of the big winners and losers of reporting season…and see just how much the market is paying for certainty (it's alot).

What's Not Priced In EP14: When to Sell Stocks (It's Not Easy) https://t.co/f5Ar9tNAJJ via @YouTube

— Greg Canavan (@gcanavan2) August 28, 2023

When to sell stocks (it’s not easy!)

Catch up on the latest episode of What’s Not Priced In!

This episode was a cracker, if I can market it so myself.

This episode, Greg Canavan and I assess the winners and losers of the reporting season so far.

We profiled Coles, Woolies, Altium, WiseTech, Carsales, Data#3, and HUB24.

Even Domino’s got a mention…the tech stock disguised as a pizza merchant…or is it a pizza merchant disguised as a tech stock?

Anyway…

We then turned to one of the most important questions of them all: when to sell stocks.

Using his recent sell decisions as examples, Greg took us through the sell process.

In investing, as in life, it’s OK to be wrong, not to stay wrong.

Here’s the link to the pod.

And here’s the link to the detailed write-up.

https://www.moneymorning.com.au/20230825/whats-not-priced-in-14-when-to-sell-stocks-its-not-easy.html

Appen’s soft outlook prioritises cost savings over revenue

The theme of Appen’s 1H23 was ‘headwinds from the broader technology market slowdown’.

This bugbear had its paw prints across most of Appen’s releases to the market today.

It also shouldered the blame for a soft 2H23 outlook.

Appen said the ‘ongoing uncertainty across all customers’ led it to expect 2H23 revenue to be ‘closer to 1H23 revenue’.

The firm will only invest in a ‘smaller set of higher potential areas’ and continue to focus on cutting costs.

This retrenching — of costs and investments — ‘may have a negative impact on 2024 revenue’.

Why is Appen struggling?

Why is Appen struggling, despite hitching its wagon to the AI bandwagon?

Appen CEO Armughan Ahmad blamed the ‘challenging external environment’ (which didn’t seem to phase Nvidia one bit, mind you).

1H23 revenue fell as APX’s customers ‘cut costs and evaluate their AI strategies in response to external headwinds’.

Ahmad said there’s a ‘broader technology slowdown’, but also said ‘it is an exciting time for AI’.

He thinks Appen’s data and services ‘power the world’s leading AI models’.

But if that’s true, why the slowdown and the challenging external environment? Isn’t AI adoption in its infancy and only accelerating from here?

Despite saying its an 'exciting time for AI', $APX's 1H23 revenue fell as customers 'cut costs and evaluate their AI strategies in response to external headwinds.' $APX.AX #Appen #ASX #AI pic.twitter.com/M0HKeVfQyz

— Fat Tail Daily (@FatTailDaily) August 28, 2023

Appen down 25% as 1H23 revenue falls

AI boost, what AI boost?

Data services firm Appen [ASX:APX] is down 25% after 1H23 revenue fell 24%, leading to a US$43.3 million loss.

Revenue fell to $139 million, ‘primarily reflecting a lower contribution from Global Services which recorded a revenue reduction of 27.4% to US$100.1 million’.

Revenue from new markets also fell, ‘impacted by a lower contribution from Global Product’.

In all, the half-year net loss widened from US$9.4 million to US$43.3 million.

Appen now has US$55.2 million left in cash, but no debt.

Although at its current cash burn rate, the lack of debt is of little consolation.

Key Posts

-

4:55 pm — August 28, 2023

-

4:10 pm — August 28, 2023

-

3:47 pm — August 28, 2023

-

3:10 pm — August 28, 2023

-

2:57 pm — August 28, 2023

-

12:59 pm — August 28, 2023

-

12:51 pm — August 28, 2023

-

12:31 pm — August 28, 2023

-

12:06 pm — August 28, 2023

-

11:53 am — August 28, 2023

-

11:41 am — August 28, 2023

-

11:35 am — August 28, 2023

-

11:16 am — August 28, 2023

-

11:09 am — August 28, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2025 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988