Investment Ideas From the Edge of the Bell Curve

ASX LIVE | ASX 200 Closes Flat; May Fall with Wall St after Telsa & Netflix Pull NASDAQ to 4 Month Low

Have a great weekend

That’s all from me today investors.

Today I’ll leave you with an AI-generated image of Tech stock’s rough day on the markets.

Have a great weekend!

Market close update

ASX 200 closed slightly down 0.15% at 7,313.9 with a fairly quiet day in the markets.

Trading remained weighed down by uneasy sentiment from US equities, especially tech stocks, which also brought down the ASX tech sector.

Major Taiwanese chip maker TSMC posted its worst day in five months after delaying production at its Arizona project to 2025 and cut its outlook for the remainder of FY23.

ASX 200 Sector top performance

- Energy up +1.27%

- Staples up +1.16%

- Healthcare +0.59%

ASX 200 Sector biggest loser

- Information Technology down -2.73%

- Telecommunication down -0.48%

- Financials down -0.46%

New home sales remain down

HIA new home sales down 4.8%mom in June to remain very low.

(HIA chart) pic.twitter.com/hTSK3VPUob— Shane Oliver (@ShaneOliverAMP) July 20, 2023

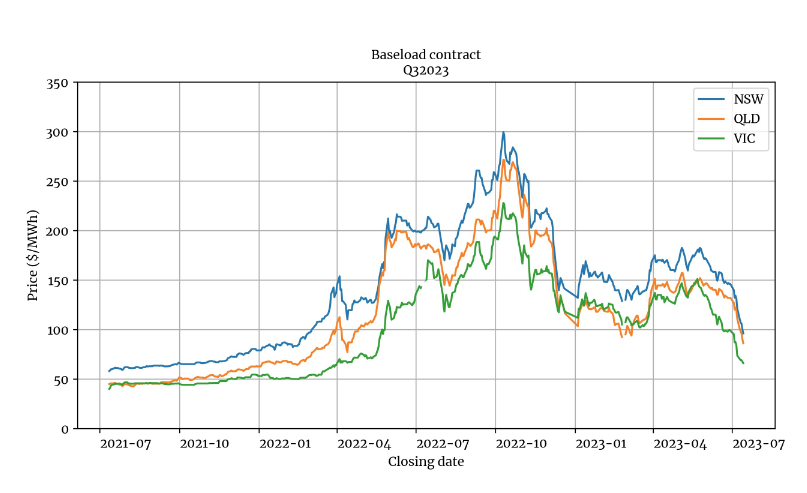

Consumers may be overpaying for power

Consumers in Australia may be overpaying for power, according to a new report.

The Australian Energy Regulator (AER) report found that wholesale electricity prices have fallen sharply in recent weeks, but retail prices have continued to rise.

Source: ABC News

The AER’s report found that wholesale electricity prices ranged from as little as $65MWh in Tasmania to $148MWh in NSW in the June quarter.

The AER attributed the decline in wholesale prices to several factors but highlighted the 1100MW of new wind, solar and battery capacity that was added to the grid during the period. There were also fewer outages at coal plants compared with the previous year.

However, retail prices have continued to rise, with some consumers facing increases of up to 25%.

This is because power retailers are basing their prices on future wholesale prices, which are still relatively high.

The AER’s report warned that consumers may be overpaying for power if they are locked into contracts with retailers that are not reflecting the current market conditions.

Retirement village co. Ingenia Communities Group posts strong day

Ingenia Communities Group [ASX:INA] share price is up 4.21% today, at $4.085 per share.

The increase in INA’s share price is a sign that underlying finances are improving for the company, and investors are starting to take note.

Ingenia’s portfolio of tourism rentals was a strong contributor to the successful 1HFY23. Demand for affordable rental accommodation is likely to remain strong in the current market.

The gains could also be attributed to fund managers who are hunting for niche property trusts that are less cyclical and own specialised assets— like retirement villages.

However, it is important to note that the company’s share price is still below its all-time high of $8 per share, which was reached before the 08′ crash.

The company currently has approximately $2.2 billion in property under management.

Ingenia is positioned to continue to grow in the years to come as the demographics shift towards an older population, but it will need to prove itself to investors that it can have another half similar to 1HFY23.

Russia’s latest moves could threaten food prices and push inflation

Russia’s recent attacks on Ukraine’s grain silos have raised concerns about the global food supply.

The strikes on the port cities come after Moscow’s announcement that it would withdraw from an agreement allowing Ukraine’s grain to be shipped to global markets.

Adding to the tension, Russia has threatened to treat any inbound grain vessels as military targets.

These actions have already driven up global food prices, with wheat prices rising by 12% in the past week.

Ukraine is a major exporter of wheat and corn, and the damage to its agricultural infrastructure could lead to shortages and higher prices that could extend food inflation for the EU and the global south.

The European Union’s foreign and defence chief, Josep Borrell, expressed grave concern over the attacks, pointing out that 60,000 tonnes of grain have already been destroyed from the bombings and the lack of storage facilities will massively disrupt trade.

Google Co-founder back from semi-retirement to work on new AI

Sergey Brin, co-founder of Google, has been spending more time at the company’s headquarters in recent months, working on artificial intelligence (AI) projects.

Brin has been meeting with researchers and discussing technical matters, as well as being involved in attracting new sought-after researchers.

The big projects he’s likely working on behind the curtains are:

- Google’s Gemini project, a new AI model that is designed to be more powerful and versatile.

- A response to Microsoft’s AI-powered Bing search functions. A new Google search that provides summaries and invites follow-up questions with AI.

Brin’s increased involvement in AI comes at a time when Google is facing increasing competition from other tech companies in the AI space.

The company is hoping that Brin’s expertise will help it stay ahead of the curve.

It is still too early to say what impact Brin’s return to work will have on Google’s AI efforts. However, his involvement is a sign that the company is taking AI seriously.

The opportunities in the space are there, but the market is frothy and full of outsized promises.

If you want to invest in the space but don’t want to be blinded by the hype, he’s a great article by writer Ryan Clarkson-Ledward.

https://www.moneymorning.com.au/20230721/how-to-invest-in-ai-follow-the-data-not-the-headlines.html

ASX tech selloff mirrors Wall St

ASX tech stocks fell today as a sell-off in technology stocks on Wall Street weighed on sentiment.

The local technology sector tumbled 2.71%, with Xero falling 3.8% to $125.00 and Megaport declining 1.4%to $9.92.

The tech-heavy Nasdaq index sank 2.05 % overnight as Tesla and Netflix delivered disappointing quarterly results.

Tesla’s shares fell 9.74% after the company reported a slowdown in deliveries, while Netflix’s shares plunged 8.4% after projecting a decline in third-quarter revenue.

Meanwhile, Taiwan Semiconductor Manufacturing Co. (TSMC) suffered a 3.8% drop in shares due to lower outlook and delayed production.

Other chip giants like Tokyo Electron, ASML Holding, Samsung Electronics, SK Hynix, and Nvidia also saw their stocks fall.

TSMC’s surprise revenue cut raised concerns about the electronics market slump persisting, impacting AI chip demand.

The delay in TSMC’s US project highlighted challenges in reducing reliance on Asian supply chains, which is part of Biden’s chip strategy.

Mosaic Brands shares soar after strong full-year profit

Mosaic Brands shares are up by 25% today, trading at 2o cents after the fashion retailer said it swung to a full-year profit in FY23.

The company expects to report a $17 million EBITDA profit for the full year, a $33 million turnaround to the prior financial year’s EBITDA loss of $16 million.

Mosaic said store-only comparable sales finished the period up 9.6% on the prior year, while online sales were down 6%.

The company expects to report total sales of around $519 million when it delivers its full-year audited results next month.

The strong results were driven by a number of factors, including the company’s focus on cost-cutting and its investment in its digital platform.

Mosaic Brands CEO Scott Evans said the company was ‘pleased with the results‘ and that they ‘demonstrate the progress we have made in transforming our business.’

‘We are confident that we are well-positioned for future growth,’ he said.

The news is a boost for the Australian retail sector, which has been struggling in recent years due to the rise of online shopping.

Mosaic Brands is one of the largest fashion retailers in Australia, with a portfolio of brands that includes Noni B, Rockmans, Katies and Crossroads.

Global markets update

Midday market update

ASX 200 remains flat after its initial drop, it’s currently down 0.39% trading at 7,296.7

The only sectors significantly up are Staples up by 0.99%, and Energy up by 0.57%.

Australia’s Tech sector is the worst performer as of midday, down 2.95%

Here are today’s gainers and losers.

Gold Coast’s punt at Commonwealth Games unlikely

The Gold Coast’s offer to host the 2026 Commonwealth Games is unlikely to receive federal funding, with the Albanese government focused on investing in the 2032 Brisbane Olympics.

Gold Coast Mayor Tom Tate has launched a late bid for the Games after Victoria pulled out of hosting the event.

However, Queensland Premier Annastacia Palaszczuk has ruled out her state coming to the rescue of the Games, meaning any bid would be contingent on federal funding.

Federal cabinet minister Jason Clare has poured cold water on the move, saying the government is focused on the 2032 Olympics.

‘I just think that this is unlikely given the focus and the investment that we are making in Brisbane in the lead up to 2032,’ he told Seven’s Sunrise program on Friday.

The decision is a blow to the Gold Coast, which hosted the 2018 Commonwealth Games and was seen as a strong contender to host the 2026 event.

The 2026 Commonwealth Games are now without a host city after Victoria pulled out earlier this week due to concerns about the financial cost of the event.

The Game’s cost has been a contentious issue, with Victorian Premier Dan Andrews claiming the cost could be upwards of $7 billion if Victoria went ahead.

A claim that games organisers and the opposition challenged.

The Commonwealth Games Federation is now in talks with other potential host cities, including Kuala Lumpur, Malaysia; Hambantota, Sri Lanka; and Erzurum, Turkey.

A decision on the host city is expected to be made in the coming months.

Treasury unveils ‘wellbeing report’ to influence next budget

Treasurer Jim Chalmers unveiled what he called the wellbeing budget.

He claims it refocuses the conversation on well-being, but it is already being criticised as many of the data points chosen are ‘stuck back in the pandemic’, commented one market analyst.

Fifty indicators are used to measure well-being under five themes:

- Healthy

- Secure

- Sustainable

- Cohesive

- Prosperous

The report says that over the recent decade, 20 of the 50 indicators have improved, while seven have remained stable. Eight have mixed trends, and 3 lack data.

WATCH LIVE: Treasurer Jim Chalmers speaks about the wellbeing budget; he says it refocuses the economic conversation on the wellbeing of real people. Follow updates here. https://t.co/OoH1NQbwR3

— Financial Review (@FinancialReview) July 20, 2023

ASX 200 opens down

ASX 200 opened down 0.38% today, trading at 7,297.2.

Coronado Global jumped this morning, up 3.74%, after maintaining production guidance and reporting a run of mine (ROM) coal production of 7.2Mt in the June Quarter, up 15.3%.

Mineral resources opened down 4.72% after announcing that it was pulling out of a billion-dollar deal to buy Chinese battery chemicals giant Albemarle.

The deal now leaves MinRes to find other downstream lithium processing options. It says the WA government should do more to subsidise investment in Australia.

Mixed Wall Street Results

An exciting night in US equity markets as the NASDAQ fell by 2.05%, weighed down by tech stocks and Tesla falling sharply.

Tesla shares fell 9.7%, its biggest single-day drop since the beginning of the year, as its earning reports showed profit margins slipped as the carmaker cut prices to boost sales.

Elon Musk also signalled that factory maintenance would also hamper short-term future production.

Netflix saw a drop of 8.4% after missing sales estimates and postings lower guidance for the third quarter. It was the stock’s biggest trading day fall since December 2022.

Meanwhile, in industrial production, the DOW continues its winning streak — Its best run since mid-2017.

Private equity firm Blackstone became the first firm to manage over US$1 trillion in assets ($1.49t), a staggering number slightly lower than Australia’s GDP of US$1.55 trillion.

After lower-than-expected jobless claims data this week, expectations of another 0.25% interest rate hike by the Fed next Wednesday are up among analysts.

While European Central Banks echo similar expectations, some dovish remarks have moved European markets up overnight as some predict this could be near the end of their rate-hiking cycle.

Good morning investors

ASX 200 Futures point to an uncertain day, with a slight fall on open expected.

US earnings season continues, but many investors seem focused on the low jobless claims numbers, which fell to 228,000 in the week ending 15th July, the lowest level since May.

With signals pointing to a resilient job market in the US, many are convinced that the Fed will step in with an interest rate hike.

- $AUD up +0.11% at 67.76 US cents

- ASX futures down -0.05% to 7,280.5

- S&P 500 down -0.68%

- NASDAQ down -2.05%

- DOW up +0.47%

- FTSE up +0.76%

- STOXX up +0.67%

- SSE down -0.92%

- Bitcoin down -0.35% to $US 29,807.18

- Spot gold down -0.29% to $US 1,972.01

- Iron ore down -0.08% to $US 112.08

- Brent Crude up +0.20% to $US 79.62pb

All figures shown are from 09:35am AEST

Key Posts

-

5:04 pm — July 21, 2023

-

4:54 pm — July 21, 2023

-

4:45 pm — July 21, 2023

-

4:35 pm — July 21, 2023

-

4:01 pm — July 21, 2023

-

3:12 pm — July 21, 2023

-

3:01 pm — July 21, 2023

-

2:25 pm — July 21, 2023

-

2:03 pm — July 21, 2023

-

12:40 pm — July 21, 2023

-

12:05 pm — July 21, 2023

-

11:55 am — July 21, 2023

-

11:47 am — July 21, 2023

-

10:44 am — July 21, 2023

-

10:22 am — July 21, 2023

-

9:35 am — July 21, 2023

Footer

About

Investment ideas from the edge of the bell curve.

Go beyond conventional investing strategies with unique ideas and actionable opportunities. Our expert editors deliver conviction-led insights to guide your financial journey.

Get in Touch

All advice is general in nature and has not taken into account your personal circumstances. Please seek independent financial advice regarding your own situation, or if in doubt about the suitability of an investment.

The value of any investment and the income derived from it can go down as well as up. Never invest more than you can afford to lose and keep in mind the ultimate risk is that you can lose whatever you’ve invested. While useful for detecting patterns, the past is not a guide to future performance. Some figures contained in our reports are forecasts and may not be a reliable indicator of future results. Any actual or potential gains in these reports may not include taxes, brokerage commissions, or associated fees.

Fat Tail Daily is brought to you by the team at Fat Tail Investment Research

Copyright © 2024 Fat Tail Daily | ACN: 117 765 009 / ABN: 33 117 765 009 / ASFL: 323 988