Mirror, mirror on the wall, who’s the fairest of them all?

Is it lithium? Is it graphite? Is it copper?

Today I want to investigate these critical materials.

What is their demand outlook? Their supply outlook? What is the long-term consumption trend? And how is the market assessing lithium, graphite, and copper stocks?

We can turn to that last question first.

Lithium stocks take a beating

Lithium stocks dominated the ASX and investors’ minds for a while in late 2021 and early 2022.

Lithium miners were hitting new highs left, right, and centre.

The bidding was ferocious and speculative paper gains were massive.

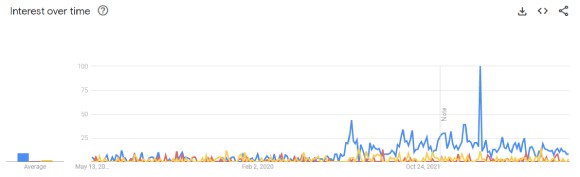

The white metal was the talk of the country. Just look at the search volumes Australians have directed to lithium stocks in recent years.

|

|

| Source: Google Trends |

The yellow trend line represents search interest in copper stocks. Red represents graphite stocks. Blue, of course, is lithium.

That interest peaked in around June 2022.

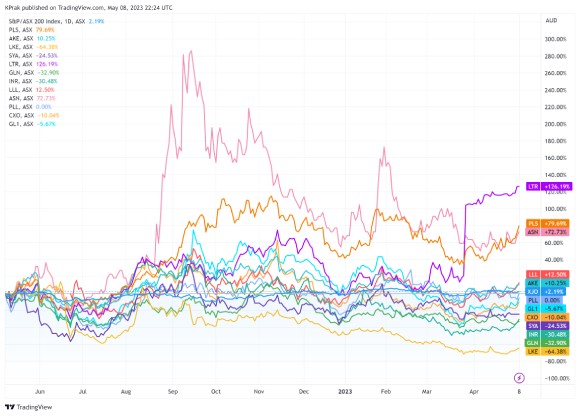

Since then, lithium stocks have largely underperformed:

|

|

| Source: TradingView |

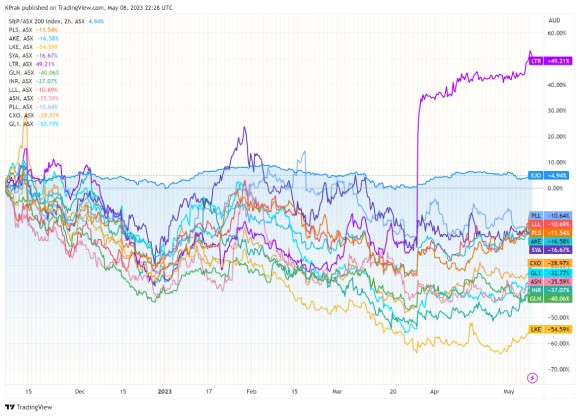

The last six months or so have been especially dire as stocks followed lithium prices lower:

|

|

| Source: TradingView |

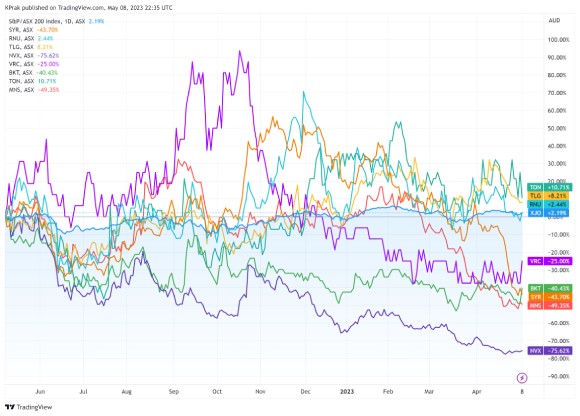

It’s been a similar story for ASX graphite stocks:

|

|

| Source: TradingView |

Established graphite producer Syrah Resources [ASX:SYR] has especially suffered, down 50% year to date.

ASX copper stocks — the few that remain — have also faced selling pressure over the past year:

|

|

| Source: TradingView |

But what do these snapshots really tell us?

The past few years have been roiled by macroeconomic chaos. And for commodity stocks, the macro is king.

But are materials like lithium, copper, and graphite not a little different? Have we not been told this trio is critical to the energy transition?

Despite any near-term economic hiccups, the transition to greener energy is, like Thanos, inevitable.

So what does that inevitability mean for the long-term outlook of our three materials?

Let’s turn to that now.

Lithium consumption outlook

Here’s something you’ve heard many times before:

- Electric vehicles (EVs) run on lithium-ion batteries

- EVs are set to be the dominant passenger vehicle

- The world will need plenty of lithium

- Therefore…

Therefore, what?

Therefore, the price of lithium will soar? Therefore, lithium stocks are the go-to investment?

Not necessarily.

Demand is only half of the equation. Supply matters just as much.

In the great book Capital Returns, economic historian Edward Chancellor reiterates this point:

‘Most investors spend the bulk of their time trying to forecast future demand for the companies they follow. The aviation analyst will try to answer the question: How many long-haul flights will be taken globally in 2020? A global autos strategist will attempt to forecast China’s demand for passenger cars 15 years hence. No one knows the answers to these questions. Long-range demand projections are likely to result in large forecasting errors.

‘Demand is more difficult to forecast than supply. And changes in supply drive industry profitability. Stock prices often fail to anticipate shifts in the supply side.’

If we were to synthesise the demand and supply side of lithium consumption, what would we see?

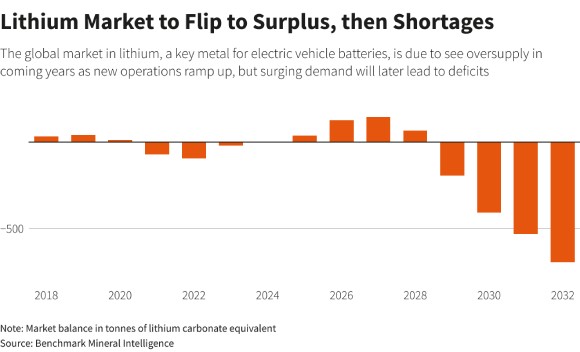

According to Benchmark Mineral Intelligence, a global lithium deficit is expected for the rest of this year, with supply surpluses likely from 2024 before entering another supply deficit beginning in 2029.

‘There will be a few years when there should be enough supply, and that’s a function of some of the investments that have happened in the last few years,’ said Benchmark’s Caspar Rawles.

|

|

| Source: Reuters |

In April, the Department of Industry, Science and Resources released its resources and energy quarterly for the March quarter, outlining the forecasts for key commodities.

The Department noted the large supply gap that sent lithium prices rocketing over the past two years is expected to narrow:

‘The large supply gap evident over the past 2 years is expected to narrow, as additional supply from mine and brine operations in Australia and overseas comes online. However, prices are likely to remain volatile, given the immaturity of the lithium market and the potential for shortages — due to low lithium stockpiles.’

High prices incentivise more supply.

The Department continued:

‘The strong demand outlook for lithium chemicals is attracting capital to build global supply. Several expansions and new projects have been announced over the past year, with exploration and drilling activities picking up in many countries over recent months.

‘High lithium prices are driving smaller, lesser-known projects around the world to speed up production. Production in the southern cone of Africa is likely to rise in 2023. Late last year, production started in the Arcadia project in Namibia. Although some projects are likely to be marginal (in both cost competitiveness and size), rising global lithium demand means they will likely have a place in the supply chain over the outlook period.’

Economists at the Department forecast lithium prices to peak in 2023 and fall in 2024 — stabilising into 2028:

|

|

| Source: Department of Industry |

Graphite consumption outlook

Forecasting trends in graphite consumption is harder since the graphite market is opaque and dominated by China.

China accounts for more than two-thirds of natural graphite mining and most graphite processing.

It has cornered the market. Such dominance distorts market pricing.

Graphite figures as a major material for the global EV future, given that the average EV battery contains more graphite than lithium.

Graphite is the EV battery’s largest input by weight and is the main material for the battery’s anode.

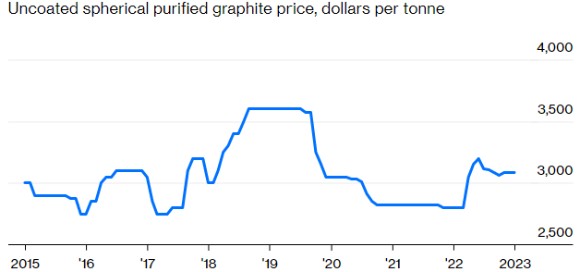

But the price of this critical material hasn’t really taken off like lithium.

|

|

| Source: Bloomberg |

ASX-listed graphite producer Syrah Resources may have provided a clue in its March quarterly. In an update on market conditions, Syrah said Chinese producers are flooding the market:

‘Over the past two years, the two largest Chinese anode producers increased production by five times and two times, respectively, but have seen margin contraction of 30% and 20%, respectively. Lower graphitization and needle coke costs, and competition from recently completed synthetic graphite production capacity, has led to a lower price premium for synthetic graphite-based AAM compared with natural graphite-based AAM.

‘Immediate customer concerns in the anode and natural graphite markets are inventory levels and price, with availability of natural graphite fines from inventories and the future market balance fears abating for now. The short-term outlook for natural graphite demand volumes and price does not support higher capacity utilisation at Balama [Syrah’s Mozambique graphite operation].’

Syrah is not seeing a raging graphite market. In fact, it is cutting production until market conditions improve.

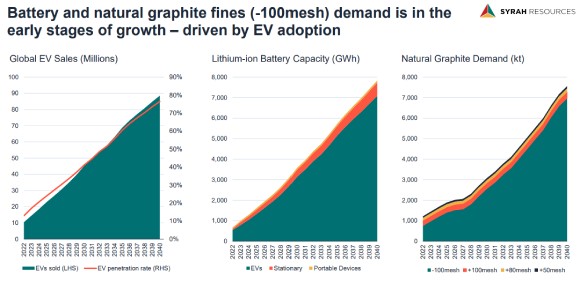

In its recent investor presentation, Syrah excitedly pointed to graphite’s strong demand outlook, but its March quarter update shows the importance of not forgetting to consider supply:

|

|

| Source: Syrah Resources |

Copper consumption outlook

So what about copper?

Our resident commodities expert and former geologist James Cooper is quite bullish on the metal.

Of the energy transition metals, he puts copper ahead of them all.

As James wrote earlier this year:

‘Nickel, aluminium, copper, REEs, zinc, and cobalt have varied demand drivers that go beyond EV batteries and in many cases, outside the green energy transition more broadly.

‘However, there’s one metal that sits uniquely among all others…

‘Copper.

‘As the only viable option for conducting electricity, copper holds unique physical properties that make it the critical metal for the ages.

‘This is NOT a one hit wonder commodity.

‘In a future ‘electrified’ world, copper cannot be replaced with an alternative metal.

‘The laws of physics all but guarantee that.

‘It sits at the heart of the green energy transition but is also crucial for traditional manufacturing and construction.’

Echoing Chancellor, James thinks the case for copper’s long-term upside rests exclusively on supply:

‘As the Canadian billionaire mining magnate and CEO of the Ivanhoe Mines [TSE:IVN] puts it, the outlook for copper rests on one-third demand and two-thirds supply.

‘Supply (or lack of it) will be the primary driving force behind what I believe will be a new copper boom, one that could rival perhaps the largest ever recorded…

‘That was way back during the US Civil War, more than 160 years ago, when copper reached a staggering $8 a pound!’

The Department of Industry, Science and Resources agrees, stating in the latest Resources and energy quarterly:

‘However, it is forecast that [copper] demand will outpace supply from 2026, resulting in market deficits and upward pressure on prices. Higher production costs (partly due to declining ore grades), higher capex and higher financing costs (see production section) will add to upward pressure on prices.’

Mirror, mirror on the wall, who’s the fairest of them all?

Copper, it seems.

Stay tuned for more on this in the coming days…

Regards,

|

Kiryll Prakapenka,

Editor, Money Morning