The Lithium Australia NL [ASX:LIT] today secured $1.78 million by issuing a 15 million LIT share price to Acuity Capital.

LIT shares were up as much as 4% in early trade before pulling back at noon. At time of writing, the LIT share price was down 2%.

The controlled placement agreement with Acuity Capital comes after the lithium stock yesterday announced its subsidiary was granted an Australian patent for battery cathode powders.

LIT secures $1.78 million

Using its controlled placement agreement (CPA) with Acuity Capital, Lithium Australia today raised $1,775,000 (including costs) by issuing 15,000,000 fully paid ordinary shares to Acuity at an issue price of 11.83 cents.

The price represents a 5.3% discount to LIT’s last closing price of 12.5 cents a share.

The fresh capital will fund commercialisation of LIT subsidiary Envirostream’s recycling business, and the funding of a feasibility study for LIT’s other subsidiary — VSPC.

For context, in its latest quarterly report released last month, the company posted a net cash loss from operating activities totalling $1.37 million and $4.85 million year-to-date (12 months).

LIT ended the quarter with $11.37 million in cash and cash equivalents.

Finally, the lithium stock revealed it raised its maximum available capital under the CPA by $12.5 million, bringing the total CPA facility to $25 million.

LIT subsidiary granted battery patent

A day after strengthening its intellectual property protection over its battery recycling process, LIT announced the grant of a patent for producing cathode powder that is free of nickel and cobalt.

Lithium Australia’s wholly owned subsidiary VSPC was yesterday granted an Australian patent that will provide 20 years of intellectual property protection in Australia.

LIT said VSPC’s IP portfolio now includes patents covering how its cathode powders are made and what they are made of.

According to the company, VSPC’s proprietary nanotechnology processes are ‘simpler, cheaper, and more energy-efficient’ than its competitors.

This edge makes LIT think its subsidiary is well-placed to ‘cater for forecast growth in the rapidly expanding global market for phosphate-based battery cathode materials.’

LIT share price outlook

While the market reacted positively to LIT’s announcement in early trade, noon saw the market selling off the LIT stock.

This could partly be explained by putting the pullback into context. Lithium Australia was not the only lithium stock to trade down today.

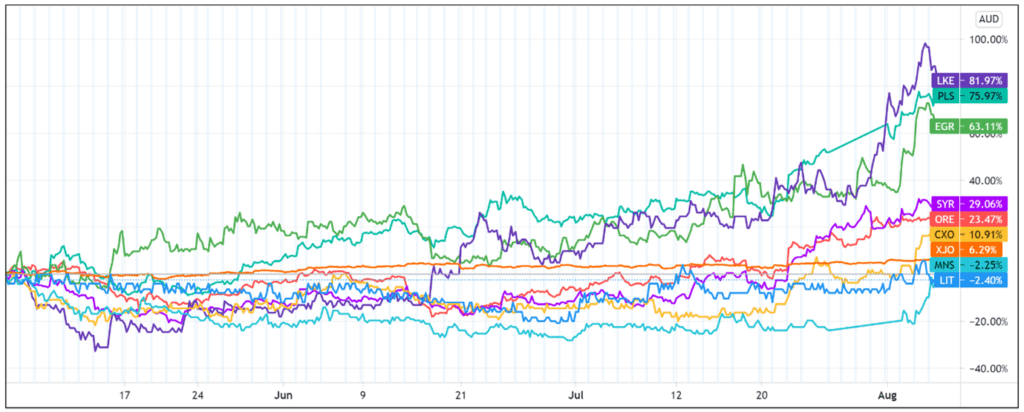

At time of writing, EcoGraf Ltd [ASX:EGR] was down 5%, Core Lithium Ltd [ASX:CXO] was down 3%, and Lake Resources NL [ASX:LKE] was down 6.5%.

But it is also true that LIT has underperformed some of its peers in the last three months, as the below chart illustrates:

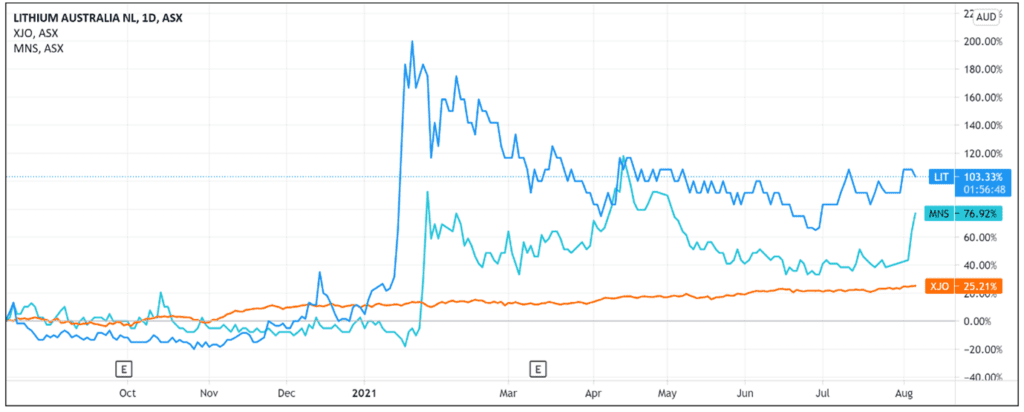

While the ASX lithium sector as a whole is trading with renewed momentum, Lithium Australia has been trading sideways since March.

Although LIT is doing a good job of securing patents and shoring up intellectual property protections, investors may be wondering when these patents will translate to commercial success and competitive advantage.

Touching on this yesterday, Lithium Australia Managing Director Adrian Griffin said the company is ‘seeking partners to establish commercial production facilities.’

Securing such partners may be the boost LIT’s share price needs.

If you’re researching lithium stock investments and want more information or ideas, then I’d recommend reading Money Morning’s free 2021 lithium report.

If you’re keen for more reading, this report on energy disruption is also a great resource. It goes through finding promising energy stocks and discusses why the energy market is ripe for massive disruption.

Regards,

Lachlann Tierney,

For Money Morning

PS: In this new report, Money Morning’s Ryan Dinse reveals why he is convinced that lithium is going to rebound in 2021. Get the FREE Report