Two things I’m thinking about today…

1) Unintended consequences from Labor’s tax on big balances…

I found myself in the Melbourne CBD yesterday chatting to Robin Widdup.

He’s the executive chairman of junior resource fund Lion Selection Group ($LSX). The topic of Labor’s new tax came up.

Robin made an interesting point. That kind of wealth grab could reduce the amount of capital available to a high risk sector like mining juniors.

It’s no easy thing to get a mining project funded.

As it happens, I was in Melbourne to listen to the CEO of a small gold mining developer called Saturn Metals ($STN).

Saturn is in an awkward phase of their journey. They have a nice big gold deposit in Western Australia.

The approvals, native title and other paperwork are gradually falling into place.

Now they need to convince investors to stump up hundreds of millions to fund the construction and development of the project.

Like all developers, they’ll put together the feasibility studies and projections.

But investors know these are built on assumptions and variables that can change because the development time frame is so long.

Often the CEO and management team are untested at this scale of project. It’s why investors love – naturally – people who have been successful before.

There’s also the famous Lassonde Curve to think about. This illustrates the typical journey of a development project.

The theoretical “best” part of mining projects are at either end…either the discovery phase or the production phase.

The bit in between is usually sterile for the share price. But that’s when our typical CEO needs capital the most.

He (or she!) needs to sell the dream of the big money on the table from their project. It helps to be a salesman at this point, with charm and confidence to burn.

A rising mineral price helps more than anything. A buoyant outlook is a big bonus. Investors are more likely to part with their cash in good times than bad. That’s why there’s a cycle you can exploit.

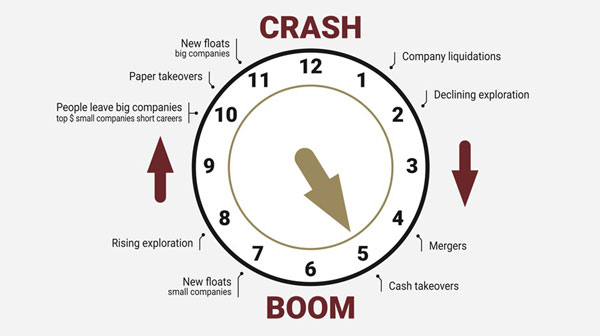

2) I showed you the Lion Investment Clock yesterday. There’s more to add on this…

Here it is again if you didn’t see it yesterday…

|

|

| Source: LSX |

The team at Lion Selection tells us that liquidity drives the mining cycle.

Liquidity, they report in their latest quarterly, is improving but not yet buoyant.

Hedley Widdup, Lion’s chief investment officer, writes…

“Exploration activity is a great indication of how readily companies can replace cash. Exploration doesn’t have an immediate cash return, so it needs to be funded and when the market is tight, exploration falls. The most recent Australian Bureau of Statistics figures for mineral exploration in Australia (December 2024) show exploration expenditure is still within a falling trend, albeit expenditure on gold exploration making up a growing proportion.”

We can also look to the IPO market to gauge this. There were 105 resource IPOs in 2021. They were 15 in 2024. They are no new resource listings so far in 2025.

Point being?

Now is the time to be investing and following into this sector. According to the clock, now’s the time to scoop up what you can and surf the rising liquidity wave.

There are risks to this, of course. Maybe liquidity doesn’t recover. Mineral prices could collapse. You know the usual ones, I’m sure.

This dynamic will likely trump Robin Widdup’s observation at the top of today’s missive.

Should the Lion clock play out, eventually investor greed will chase the mining upturn.

Considering the general lack of investment we’ve seen into resource projects over the last ten years, we could be shaping up for a big run over the next 5 years.

Now that’s something to get excited about.

Best wishes,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

*****

Murray’s Chart of the Day

– S&P 500 Moment of Truth

| |

| Source: Tradingview |

Recently I gave you a range between 5,800-6,000 in the S&P 500 futures as the sell zone of the big sell-off we saw recently.

By the time prices head into the sell zone, traders are becoming bullish again and traders with short positions have probably been squeezed out.

By that I just mean that traders who made bets that prices would go down have been forced to get out of their positions, which adds to buying pressure.

It is the moment of truth for the market because it is an area where professional traders will step in and start selling if they believe another leg down could begin.

The high of the current rally hit 5,993, just 7 points below the top of the sell zone.

So I remain on tenterhooks waiting for signs of weakness.

If the buying continues and prices blast through the top of the sell zone and threaten the all-time high, the weekly trend will probably change to an uptrend.

That will lower the odds that we are close to another wave of selling pressure and increase the odds that a large rally could be in the wings.

We need to wait until a weekly sell pivot is confirmed and prices head below the 10-week moving average before the odds of a sharp sell-off increase markedly.

So we watch and wait.

Regards,

|

Murray Dawes,

Editor, Retirement Trader and Fat Tail Microcaps

Comments