All week we’ve been exploring the current bull market in gold. I made the case yesterday that it could easily last until 2030.

That would coincide with the second Presidency of Donald Trump.

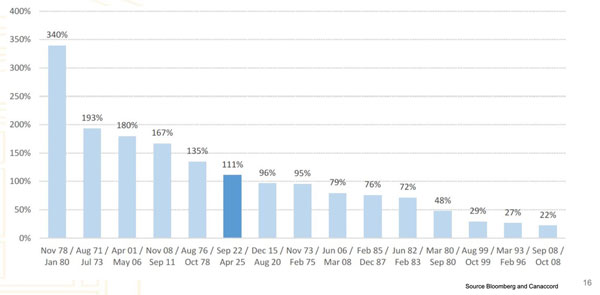

Here’s another angle on this idea. Here’s a look at the percentage moves in gold bull markets over the last fifty years or so.

You can see the current bull run highlighted too in the darker shade of blue…

| |

| Source: Lowell Resource Fund |

Hopefully, you find this encouraging. We’re a long way from the biggest move yet.

It’s certainly possible this record is eclipsed by 2030. I firmly believe that.

Why so?

Look around you. Governments all over the world are saturated in debt. Demographics are terrible.

It’s almost impossible for Western governments to meet their ballooning liabilities as the baby boomer generation retires and lives longer than their parents.

That reminds me…

Back in 2019, two economists named Charles Goodhart and Manoj Pradhan wrote a prescient book called The Great Demographic Reversal.

They show us how — for 35 years — the West coasted off two demographic tailwinds.

One was the gigantic supply of cheap Chinese labour that entered the global workforce.

The second factor was big economies like the US and Germany enjoying the ‘demographic dividend’ of a healthy number of workers relative to retirees and other dependents.

Those days are history.

The worsening worker-dependency ratio across the West is going to send aged care and pension costs on an intractable march higher…with less economic growth likely to pay for them.

Result?

We can expect chronic and growing government deficits for years to come.

These will either need higher taxes to fund them or, more likely, more central bank financing to pay for them.

This makes holding gold or gold stocks a must!

This is why you might have heard recently about Jamie Dimon.

He’s head of the biggest American bank, JP Morgan.

Señor Dimon recently stated:

“You are going to see a crack in the bond market”.

And…

“You are going to panic”.

Now, a word of caution. Just because he says it doesn’t mean it’s going to happen tomorrow.

But he can see what we see. He doesn’t say it, but implied in Dimon’s warning is you and I better have a plan in place for when this scenario goes down.

That means a permanent allocation to gold in some way, at least to me.

Go back to the chart above. The two biggest gold moves came within 10 years. They were

- August 1971-July 1973

- November 1978-January 1980

Both had a similar background. A rise in inflation from excessive government spending, financed with freshly printed dollars.

Fast forward to now.

We know that central banks created a staggering amount of new money after the Covid collapse. That led to the inflationary surge in 2022.

That slaughtered bonds and stocks for a while. But it also set the stage for gold’s recent big run. The only surprise was how long it took gold to move.

Now, inflation is cooling off again…for now!

However…

That brings us back to Jamie Dimon and the “Great Demographic Reversal”.

At some point central banks will be forced to inflate again. That will put major bond markets in a whole lot of trouble.

It will likely send gold prices higher as investors move to protect themselves.

And, please note, bond markets dwarf shares for size.

Do you get what I’m telling you?

You and I are on an asset market roller coaster

Central banks like to pontificate about ensuring “financial stability”.

That’s good public relations, but it’s simply not possible in the world we live in.

It’s all based on unsustainable government spending, rickety demographics and financial tricks to make it look like it “works”.

Your wealth, your retirement, the future of your family – mine too – are all linked to this ticking bomb. There’s no escaping the implications.

Then there’s the whole international order disintegrating around the whole shebang too.

It would only take one rogue Russian – or Iranian, or Chinese – missile into neutral territory to send America’s 21st century “Pax Romana” up in flames.

This is likely going to ensure gold’s appeal for a long time.

Inflation and geopolitical uncertainty are as certain for the next five years as anything in financial affairs can be.

Portfolio managers will allocate to the gold sector with this in mind. It helps that gold miners are minting money too.

One way to benefit from this is to get set into gold stocks now, or keep buying in if you’ve started.

The best part about the gold sector is you can move up and down the risk curve, from explorers to developers to producers.

You can even get access to royalty firms in North America. Then there’s gold coins, bullion bars and the other precious metals.

You can decide where you want to go here.

The biggest shot at wealth creation is in the discovery phase for an explorer.

A map of Australia is also a treasure map of gold finds. Now the race is on to unlock more gold deposits.

This is where I’m suggesting readers of my paid advisory start looking.

Here’s one idea to get you started.

Best wishes,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

Murray’s Chart of the Day –

S&P 500 vs Key Sectors

| |

| Source: Tradingview |

As stocks continue to run after the recent rout, I think it is instructive to consider whether market breadth is agreeing with the rally or not.

The chart above shows the percentage gains in the S&P 500, Dow Transport [NYSE:DJT], Russell 2000 [NYSE:RUT] (small caps), and S&P 500 Bank Index [NYSE:XBE], since the low hit in 2009.

I think you will agree that the sharp rise in the S&P 500 since late 2023 has been interesting because the other indices refused to jump with it.

If you look at the run since the low hit in April this year, you can also notice that the transport, small cap, and bank indices remain well below their respective highs hit in February 2025. Whereas the S&P 500 is about to hit a new all-time high.

I don’t think the above analysis is proof that US stocks are about to fall over. Now that the daily, weekly, and monthly trends are pointing up, there may still be upside left in this run.

But until we see the breadth of the rally widening, I think investors should be prepared for the music to stop and selling to return at some point.

So enjoy the rally and join it while it lasts, but remain vigilant if a sharp reversal occurs.

Regards,

|

Murray Dawes,

Editor, Retirement Trader and Fat Tail Microcaps

Advertisement:

WATCH NOW: Australia’s ‘abandoned gold’

A revolution is taking place in Australia’s mining sector.

A new type of miner is bringing old gold and critical minerals back to life…and already sending some stocks soaring.

Our in-house mining expert — a former industry geologist — has tapped his industry contacts to uncover four of these stocks that could be next…

Comments