Updated August 2023

Cobalt, that brilliant azure blue found in flecks of opals or PowerShell.

Its visage sets it apart from gold, silver, copper or other earthy tones and resources.

But aside from its brilliant colouring, cobalt’s true gift is what it does for what it does for us.

Cobalt might not be your first thought when sizing up Australian commodities, but this metal can be found in most modern industries.

While you don’t often hear about its use, its importance to modern life and industry allows you to invest in something equally unique and valuable.

Its value is slowly being understood by everyone — including thieves — with one group famously sneaking into a Rotterdam warehouse owned by Vollers Group in 2018.

They went on to steal 112 metric tonnes of the stuff.

The loot was then worth around US$10 million.

So, what is it about this blue resource that makes it so special?

Well, it might surprise you just how many everyday things have the element hiding within them.

So, here are a few interesting facts about cobalt before we get into its investment potential.

A bit about cobalt

Cobalt was first discovered in 1739 by Georg Brandt and was so named after the German word for goblin, ‘kobald.’

The name comes from a German superstition that goblins would lurk in the mines, intent on leading the miners astray as they searched for tin.

As metals go, cobalt is quite strong, has high corrosion resistance, and can take a lot of heat.

Its melting point is at 1495°C, or 2723°F. That is very, very hot.

Cobalt is found mixed with other minerals and elements like nickel, iron, and copper.

As a result, it’s usually found while mining for other things.

Because of its rich blue hue, it is believed the Persians used cobalt to dye their neck beads in the Bronze Age, while Egyptians and Chinese civilisations made blue glass artistry with it.

Source: theodoregray.com

These days, we put it to different uses. Thanks to its highly magnetic compounds, it has become essential for the powerful magnets needed in hard drives and generators.

With it’s heat resistance and strength, see it used in superalloys for jet engines and advanced machinery.

And then we have the role cobalt plays in the future.

Not only might cobalt replace precious metals like platinum and iridium with its nontoxic-serving elements in adhesives and pharmaceuticals, but there’s also the big buzz of renewable energy.

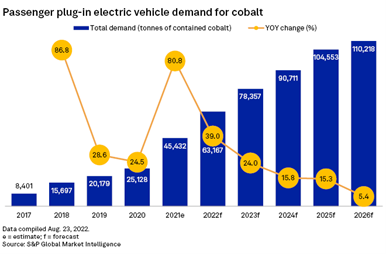

Cobalt is considered one of the minerals heralding the age of electric vehicles (EVs) as a key to the big shift to renewable energy and lower carbon emissions.

In 2021 cobalt-containing batteries accounted for 74% of global EV batteries.

Being one of the core components of lithium-ion batteries, it has gained significant attention in recent years as demand for EVs and renewable energy storage systems is expected to ramp up to dizzying highs over the next decade.

This report will give you an overview of the cobalt market, including its supply and demand dynamics and applications.

We will explore these ideas and their relation to investment opportunities for Australian investors.

So read on to find out more.

An overview of the cobalt market and its major players

Global cobalt production is heavily concentrated in the Democratic Republic of Congo (DRC).

The DRC accounted for approximately 70% of the world’s cobalt production back in 2020, when it mined more than 90,000 metric tonnes.

It remains the world’s largest producer of cobalt and still accounts for 70% of the 130,000 metric tonnes mined in 2022.

But ethical concerns within mining operations in the DRC have pushed manufacturers to look elsewhere for their supply.

This has opened the door for other significant producers like Russia, China, Australia, and Canada.

In fact, Australia is the third largest producer of cobalt in the world, a position only expected to grow as more and more companies look for ethical cobalt sources.

To this end, Australia has a significant cobalt reserve base. But we’ll get more into Australian cobalt companies later when we take you through some investment options found on the ASX.

Let’s turn to look at some of the major players.

Glencore is at the top of the pack, a Swiss multinational company with an Australian counterpart not listed on the ASX.

Glencore is known for mining almost anything, from coal, copper, nickel, zinc, lead, silver and gold, across 25 mining operations across Australia and around 60 internationally.

Glencore is the largest cobalt producer in the world and has a whopping US$74.6 billion market cap.

Global players like Vale SA, Gécamines, ERG, and CMOC hold the lion’s share outside the Australian market and resource base.

Brazilian miner Vale SA is the next biggest cobalt mining company by size rather than production with a US$64.4 billion market cap.

Vale focuses on nickel, but it also produces high levels of cobalt as a by-product of its mining operations.

Vale has done well to recover from the post-pandemic shutdowns that caused some disastrous impacts to the industry. Supply chain disruptions were rife over the pandemic and construction had been halted.

Vale produces Electrolytic Cobalt Rounds, a high purity, primary form of the metal — made by ‘electrowinning’, also known as electroextraction.

Back in 2018, Vale struck up a significant deal to sell the by-product cobalt it mined from its Voisey’s Bay nickel mine in Canada from 2021 onwards.

Gécamines came in as the third biggest cobalt producer in 2022 — worth US$33.69 billion at around the same time.

La Générale des Carrières et des Mines (Gécamines) is a Congolese commodity trading and mining company headquartered in Lubumbashi — in the Katanga region of the Democratic Republic of Congo.

ERG, The Eurasian Resources Group, is a Luxembourg-based company formed in 2013 — by the end of 2022, it was worth $33 billion.

CMOC is a Chinese Government-owned mining giant that self-proclaims as the world’s leading producer of tungsten, cobalt, niobium and molybdenum.

In 2022, it was the second-largest producer of cobalt in the world, with most of it heading for the mainland. Its market cap was $24.1 billion by the end of 2022.

Back then, CMOC had plans to double its output in the Congo by investing $2.5 billion to start a new production line in one of its largest mines — the Tenke Fungurume mine.

But in July 2022, the Congolese Government closed exports from the mine, claiming the company had lied about the reserves and owed $7.6 billion in royalties.

A deal was struck in April this year to end the dispute for $800 million and at least $1.2 billion in payments.

These stories of shady deals and unreliable governments highlight the opportunity for ethical producers to step in and fill the gap — but more on that later.

Cobalt’s many applications and drivers of demand

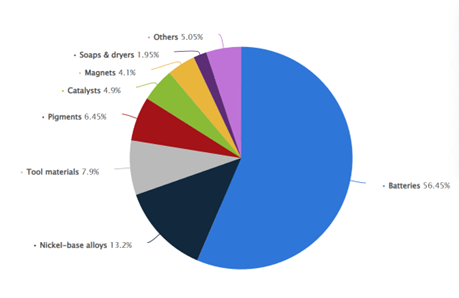

Cobalt has a wide array of applications, giving it robust demand from many sectors.

Demand that forecast to grow as we move towards a more carbon-neutral future.

Its primary use is in lithium-ion batteries, crucial for smartphones, EVs and renewable energy storage systems.

Thanks to cobalt’s high thermal stability and ability to improve battery performance, it was found in 68% of all EV batteries in 2022.

Cobalt is also used in the aerospace and defence industries for its high-temperature resistance and magnetic properties.

Its incredible properties mean you can also find it in alloys, tools, paints, car catalysts and even soap.

Source: Statistica

Now we’ve covered some of the uses, let’s dive more into the supply.

Cobalt’s supply and production

As we covered earlier, the DRC still dominates cobalt production. Still, concerns over the country’s political instability and ethical mining practices have also led to efforts to diversify the global supply chain.

This presents an opportunity for Australian investors.

With Australia’s ample cobalt resources, we are well-positioned to play a significant role in meeting the growing demand for cobalt.

Australian cobalt projects, such as the Sunrise Energy Metals [ASX:SRL] Sunrise project and the Cobalt Blue Holdings [ASX:COB] Thackaringa project, located in the Broken Hills region in NSW, are expected to contribute massively to global cobalt supply.

The Sunrise project alone holds the biggest nickel-cobalt deposit outside Africa and the largest scandium deposit in the world.

Although these companies have begun projects in some cobalt-rich areas, these companies have modest market caps and can be referred to as small-caps, representing higher-risk stock options.

You will want to research companies like these if you hope to take on the high risk, high reward.

It’s also worth noting that small-cap stocks can run into problems due to them not being as strongly regulated as larger-cap stocks, which often trade on reputable exchanges like the NYSE or NASDAQ.

In any case, when it comes to the major cobalt-producing countries like the DRC, Australia, Russia and Canada, it quickly becomes apparent that cobalt production is concentrated in specific geographical areas. Remember, the DRC alone accounts for around 70% of global cobalt production.

As far as the DRC goes, the country’s rich cobalt resources and low production costs only contribute to its dominant position in the market.

Even with political instability, those low production costs mean solid competition for other significant cobalt-producing countries in Russia, Australia, and Canada.

But with those low costs comes the ethical concerns of what is dubbed ‘artisanal miners’.

The term hides the reality of thousands of miners, including children, who scrounge for the toxic metal for around a dollar a day.

Trends in cobalt production

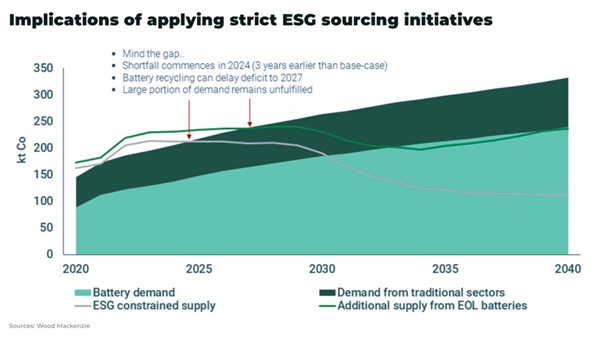

There are a few things to think about when considering cobalt trends. For one, the industry, like much of the mining sector, has seen changes in ethical and sustainable mining practices.

As public awareness of the environmental and social impacts of cobalt mining grows, pressure on mining companies to adopt ethical and sustainable practices has come from governments and large manufacturers.

Known as ESG — Environmental, Social, and Corporate Governance. This has become a growing consideration for corporate policies towards ethical production.

Companies are now investing in responsible sourcing initiatives and technologies to improve their transparency in the cobalt supply chain.

Source: Wood Mackenzie

This trend is particularly prevalent in the DRC where artisanal mining practices have been linked to human rights abuses and environmental degradation.

The change has opened the door for Australian cobalt projects.

Several cobalt projects are under development in Australia. This could significantly increase the country’s cobalt production, contribute to a more ethical global cobalt supply, and provide investment opportunities for Australian investors.

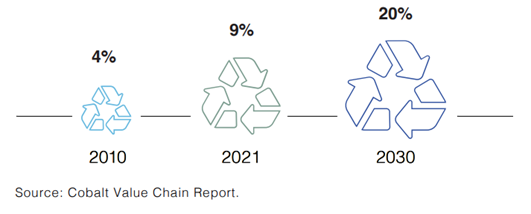

Lastly, there’s recycling and secondary production — as cobalt demand grows, there is an increasing focus on recycling and secondary production to improve resource efficiency and reduce reliance on primary production.

Cobalt is highly recyclable and has seen its share of recycling increase as more battery recycling plants come online globally.

Recycling and reusing cobalt from end-of-life lithium-ion batteries can help meet demand, alleviate supply chain risks, and reduce the environmental impact of mining.

By understanding the cobalt supply landscape and monitoring trends in production, investors can identify potential opportunities and challenges in the market, helping them make informed investment decisions.

Cobalt price history and drivers

Cobalt prices have experienced significant fluctuations due to supply-demand imbalances and geopolitical factors.

Factors affecting cobalt prices include production levels, political developments, and demand from end-use industries — particularly in the smartphone and EV markets.

Price forecasting methods can include fundamental analysis, technical analysis, and econometric models — but that’s getting a bit technical for this piece.

You can find more on analysis methods in other areas of our publication. Or when you sign up for our services, our experts, editors, and analysts do that hard work for you.

But just as a brief summary of price movements for cobalt, let’s look at its historical price trends.

Cobalt prices have experienced significant fluctuations over the past few decades. In the early 2000s, cobalt prices were relatively stable, hovering around $10–$15 per pound.

However, in the mid-2000s, prices rose, driven by increased demand for lithium-ion batteries and limited supply growth.

Cobalt prices peaked at over $50 per pound in 2008 before declining sharply during the global financial crisis.

Prices recovered in the following years, driven by strong demand from the emerging electric vehicle market and supply constraints due to further geopolitical tensions.

Source: Trading Economics

In 2018, cobalt prices peaked at around $95,000 per metric tonne as smartphone markets grew and EV expectations were high.

At the time, few alternatives to the cobalt-heavy lithium-ion battery were considered viable.

However, prices then quickly came back down. This is as the early EV-fuelled price rally met the reality of expensive early models of EVs and slower-than-hoped growth in these new cars.

The lower demand met rocketing supply as the high prices had spurred massive investment in operations previously mined by hand.

The second significant spike in the cobalt price occurred in 2022.

This was due to the furore between the Chinese CMOC and DRC officials, which shut down the Tenke Fungurume Mine’s exports — leaving it to accrue stockpiles worth 7% of last year’s production over nine months.

The halt was eventually lifted, which brought the price plummeting back down as oversupply came at the same time China ended its EV tax credits — which saw EV demand plummet.

The halt in exports and the second spike in price also had the long-term effect of shifting China’s strategic vision of cobalt.

As a response, China pushed research and production of lower-cobalt battery chemistries[4].

The use of cobalt-free batteries in China has surged from 18% of the EV market in 2020 to 60% this year.

Source: S&P Global Market Intelligence

Today’s cobalt prices are still on the lower side, cobalt having decreased US$17,025 per dry metric tonne, or 29.5% since the start of 2023.

We’ve seen several factors influencing cobalt prices; a rise in global cobalt production or decreased production costs tends to lower prices.

Whereas production disruptions or declining ore grades tend to push prices higher.

When it comes to pricing for cobalt, it’s important to remember that political instability, regulatory changes, and trade policies in major producing countries (like the DRC) can all significantly impact the cost of cobalt. These factors are like those that affect other commodities.

This is because issues like these essentially affect the mineral’s supply, which will always swing around to price changes.

Stock levels can also impact cobalt’s pricing, with various fluctuations ongoing in global stock levels, particularly in China, the largest cobalt consumer and refiner.

However, what’s really been gunning for a push in cobalt pricing is the demand from end-use industries, more of which should surface soon.

The primary driver of cobalt demand is its use in lithium-ion batteries for EVs and energy storage.

As these markets grow, demand for cobalt increases, potentially pushing prices higher.

However, there’s also a risk of a slowdown in demand growth in this theme that can lead to price declines.

What won’t help matters much is the possibility of element substitution in batteries.

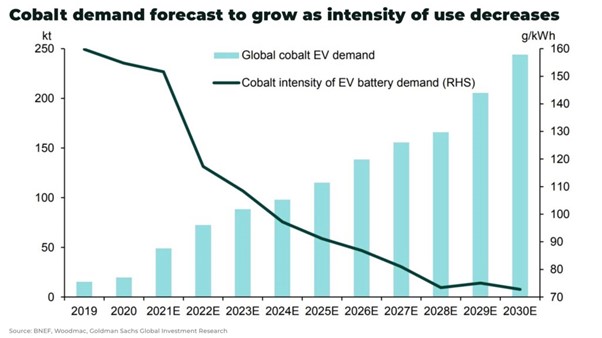

Technological advancements have emerged that reduce the reliance on cobalt in battery chemistries such as nickel-rich cathodes, sodium-based batteries, and hydrogen-based power systems.

The development of different kinds of rare earth metals can also impact cobalt demand and prices once certain breakthroughs change the game and inject more competition into the space.

While there may be a fall in the market share of cobalt-intensive batteries, the transition to low-cobalt batteries will be gradual globally, and the overall expected increase in demand for batteries is forecasted to offset the lower EV battery cobalt intensity.

Source: Goldman Sachs Global Investment Research

Australia’s latest report on critical metals estimates that demand for cobalt could rise by 20 times by 2040.

Australia’s role in global cobalt supply

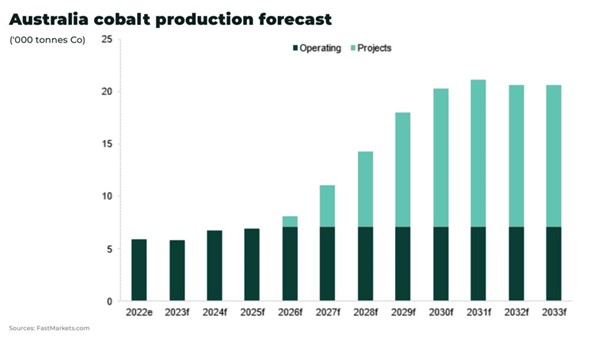

So, we know Australia is an essential player in the global cobalt market as it ranks third in the world for cobalt resources with an estimated 1.5 million MT reserves tallied for 2023.

However, Australian cobalt production is much smaller than the DRC, representing about 5% of global output in 2020.

Despite tracking much lower than the DRC in cobalt production, Australia still produced 5,900 MT of cobalt in 2022. With more political and tax concerns surfacing in the DRC, Australia’s position is looking reasonably strong.

Source: Fastmarkets.com

Australia has the potential to play a significant role in meeting the growing demand for cobalt, particularly as concerns over the DRC’s political instability and ethical mining practices prompt efforts to diversify the global supply chain.

Adding to the table is the growing call for EV manufacturers to increase lithium-ion battery production outside of Africa — and Australia is standing out as a fine contender for the limelight.

This country has several cobalt projects in the pipeline that are expected to contribute to global cobalt supply in the coming years.

Australia’s healthy copper and nickel mining industry is undoubtedly helping the cobalt by-product supplies.

Let’s look at some of the ASX-listed cobalt investing options and projects out there right now.

Cobalt companies on the ASX

We’ve talked about cobalt-producing countries and some prominent companies leading the charge. But what about some ASX-listed cobalt producers worth checking out?

Several ASX-listed companies are involved in cobalt exploration and production, and there are some big movers worth looking at here too.

These companies offer investors exposure to the growing cobalt market, with some focusing on ethical and sustainable cobalt production to meet the demand from responsible sourcing initiatives.

IGO [ASX:IGO]

IGO highlights its focus on critical metals for clean energy and exploring ways to advance the global transition to decarbonise, including exploration investments.

This group owns and operates the Nova nickel-copper-cobalt operation, the Forrestania Nickel operation and the Cosmos Nickel operation — all in WA. In its nickel mining, IGO collects cobalt as a by-product of those projects.

The miner is a good bet for its nickel and cobalt prospect. It also has plans to develop lithium with Tianqi Lithium Corporation, with a 51% stake in the Greenbushes Lithium Mine and 100% interest in a downstream processing refinery at Kwinana.

IGO has an $11.25 billion market capitalisation, making it one of the big players. This generally means more stability in operations and financial backing.

For its 2023 financial year guidance, the group expects to mine 24,000–27,000 tonnes of nickel, 11,000–12,000 tonnes of copper, and 900–1,000 tonnes of cobalt from its Nova Operation alone.

Cobalt Blue Holdings [ASX:COB]

On the other hand, Cobalt Blue Holdings has an $85.11 million market cap and, as its name suggests, is all about cobalt mining and refining.

This company was founded in 2016 and feels strongly about the role cobalt is bound to play in Australia as the world adapts to renewable energy. Hence, it has applied its efforts in building up operations here.

The company is committed to its Broken Hill project in NSW where it plans to expand into the world’s premier producer of ethical cobalt to meet the global demand for energy storage.

Cobalt’s Broken Hill operation is a low-cost project involving separating over 80% of the waste from the ore at the first step and significantly refining the material — something usually done in China.

Broken Hill plans to begin production in 2026 with an expected output of 4,000 tonnes annually over 20 years.

The mine schedule also considers a production target comprising 98 metric tonnes of cobalt sulphur mix. It includes a production target of approximately 20% of Inferred Mineral Resources as captured by the final pit designs.

Australian Mines [ASX:AUZ]

Australian Mines is also a fair contender, though right now, a bit of a minnow with an $11.77 million market cap.

This mining group is at the predevelopment stage of battery metals projects in Eastern Australia, and cobalt is a big part of those plans.

This company focuses on the Sconi Cobalt and Nickel Scandium Project, the Flemington Cobalt and Scandium Project, and its own Broken Hill and Bell Creek Nickel-Cobalt Project.

Jervois Mining [ASX:JRV]

Lastly, another cobalt-producing company worth looking at could be Jervois Mining. Jervois has a market cap of $162 million. It’s known for its combined cobalt and nickel operations, which it aims to source responsibly to cater for the growing battery and chemical markets supply chains.

Jervois has projects spread over a diverse geographic landscape with its Kokkola cobalt refining business in Finland, Idaho cobalt operations in the US, São Miguel Paulista nickel and cobalt refining in Brazil, and Nico Young nickel-cobalt project in NSW.

If you are interested in looking at cobalt companies to invest in on the ASX, these options could be an excellent place to start your research.

As cobalt and commodity prices are currently low, many of these companies share prices are trading very low presently.

Investing in these ASX companies should be seen as a high-risk, (potentially) high-reward investment that should be done with your personal financial considerations in mind. Always conduct your own research and never invest more than you are prepared to lose.

The wrap on cobalt investments

When investing in cobalt stocks, it is essential to analyse company financials, project feasibility, and management capabilities.

Investors should also consider potential risks and opportunities such as commodity price volatility, exploration success, geopolitical factors, and technological advancements[12].

It would be wise to keep in mind Australian mining regulations which can impact the development and operation of cobalt projects, with environmental considerations and responsible mining practices playing a crucial role.

Environmental, Social, and Governance (ESG) factors are increasingly important in investment decisions as they can affect a company’s cost of capital and overall performance[14].

Cobalt investment involves commodity price volatility, exploration and development risks, currency fluctuations, and competition from other metals and technologies[15].

Investors should carefully assess these risks and their potential impact on investment returns.

In conclusion, cobalt presents a compelling investment opportunity for Australian investors given its importance in lithium-ion batteries, renewable energy storage, and EV markets.

The growth potential in renewable energy storage and the EV market presents significant opportunities for cobalt demand[16].

Technological advancements, innovations in cobalt applications, and the potential for increased demand in aerospace and defence industries also contribute to a positive outlook for the cobalt market[17].

Australian cobalt projects and ASX-listed companies stand to benefit from these trends, offering potential investment opportunities for those looking to gain exposure to this critical metal[18].

By carefully assessing the market dynamics, understanding the risks and challenges, and evaluating the potential opportunities in ASX-listed cobalt companies, investors can make informed decisions and potentially capitalise on the growth potential in the cobalt sector.

We hope you’ve found this information helpful and wish you luck if you choose to continue your cobalt investment journey.

As always, happy investing!