Shares for lithium and precious metals miner IGO [ASX:IGO] were moving upwards more than 4% after the company revealed that it will, alongside TLEA enterprise co-owner Tianqi Lithium Corp [ASX:TLC], move to acquire Essential Metals [ASX:ESS].

The takeover has emerged as a Scheme Implementation Agreement (SIA) valuing ESS at 50 cents a share, which suggests ESS’s equity value is to reach $136 million.

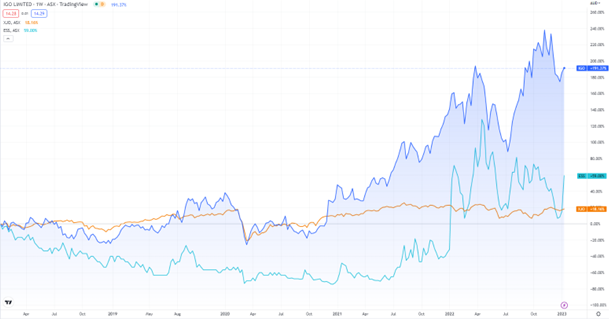

IGO has dropped in share value over the last month by 6%; however, since last January, it has increased its value by 19%.

The resources miner is up more than 22% against the ASX 200 Index [ASX:XJO], while the news also spiked ESS’s shares by 38%.

Source: TradingView

The Scheme of Arrangement between TLEA and Essential Metals

IGO, alongside enterprise co-owner Tianqi Lithium (together forming Tianqi Lithium Energy Australia Pty, TLEA), has made the move to acquire 100% ownership of Essential Metals.

In doing so, ESS has been valued at 50 cents a share by way of a Scheme of Arrangement detailed in a binding Scheme Implementation Agreement (SIA), signed both by TLEA and Essential, a full total equity valuation of $136 million on a fully diluted basis.

This transaction will represent a 36.3% premium to ESS’s 30-day volume-weighted average price (VWAP) and is to be funded by cash generated by TLEA.

ESS’s board of directors have unanimously recommended that ESS shareholders vote in favour of the scheme, subject to various conditions, including shareholder approval, at a Scheme Meeting proposed to be held in April 2023.

TLEA currently owns an integrated lithium business, including a 51% interest in the Greenbushes Lithium Operation (Albemarle Corp, 49%) and 100% of the Kwinana Lithium Hydroxide Refinery, both located in Western Australia.

Incorporating ESS, a lithium exploration company that owns 100% of the Pioneer Dome Project in Western Australia, will add an area of 450 km2 JORC compliant spodumene lithium resource (11.2 Mt @ 1.16% Li2O1) to the overall portfolio, securing additional lithium resources and growth potential.

The SIA includes the usual conditions, as well as a break fee under certain circumstances.

IGO’s Acting CEO, Matt Dusci, commented:

‘Both IGO and TLC are committed to progressing and growing our lithium joint venture business. The ESS transaction provides an opportunity to accelerate lithium exploration to bring new resources to production. It also complements the significant growth opportunities within the TLEA business which include the continued expansion of the Greenbushes operation, the successful ramp up Train 1 of the lithium hydroxide facility at Kwinana and progressing towards the financial investment decision for Train 2. We look forward to supporting TLEA with future work programs over the ESS assets, as the joint venture seeks to bring new resources to production to address the market deficit of raw materials critical for clean energy transition.’

The transaction is expected to conclude in May.

An incoming boom for commodities

Our resources expert and trained geologist, James Cooper, thinks the Australian resources sector is set to enter a new commodities boom brought on by the ‘Age of Scarcity’.

Similar patterns that occurred 20 years ago are happening again.

James is convinced ‘the gears are in motion for another multiyear boom in commodities’.

A boom where Australia (and ASX stocks) stands to benefit…

The next big mining boom is predicted to happen in the next few years.

You can access a recent report by James on exactly that topic, AND access an exclusive video on his personalised ‘attack plan’ — right here.

If that isn’t enough to sate your curiosity, we can also share with you a recent interview with James and Greg at Ausbiz at the end of last year.

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia