‘Let them eat cake.’

Marie Antoinette’s (apparent) response when told peasants were complaining about having no bread prior to the French Revolution.

The ill thought-out pursuit of virtue signalling and trendy causes has wreaked havoc across the globe.

Germany’s green zealots — shutting down coal-fired and nuclear-powered plants — are responsible for a manmade energy crisis. With winter approaching, the need to conserve whatever gas Putin decides to send to Germany has become a priority. Therefore, alternative sources of heating are needed.

Guess what? The sale of wood burning stoves has gone through the roof. Households are now scrambling to stockpile wood. Hmmm…won’t this mean an increase in logging activity (forest degradation and all the CO2 emitted by loggers, wood mills, truckers, and shipping)?

How does this fit in with making the world a greener place?

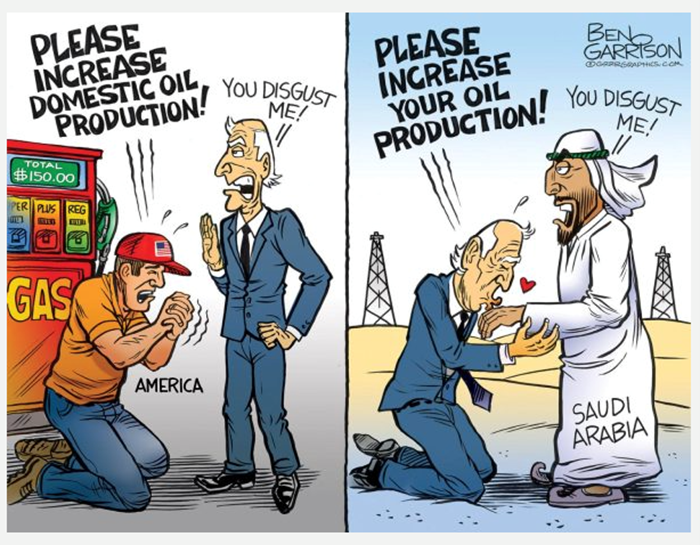

The hypocrisy of Biden going cap in hand to the Saudis for more oil is captured perfectly in this cartoon:

|

|

| Source: Armstrong Economics |

The rabid pursuit of ideologic policies that are so utterly lacking in common sense or logic, will come home to bite the West…big time.

An attitude of indulgence leading to complacency is why these (and many other) blatantly stupid policies have been allowed to take hold. While things are going well, the public is prepared to ‘do their bit’. But when households get really squeezed and costs rise, and supplies of the basics become scarce…then watch out.

There will be a public backlash. When the US’s ‘it’s NOT a recession’ actually becomes so bad that not even Sleepy Joe or ‘we’ll never see another financial crisis’ Yellen will be able to ignore, expect to see people take to the streets in protest.

How can I be so sure?

Stupidity works its way up the economic food chain

Countries that can ill-afford such ego-driven, grandstanding idiotic policies, pay the price first.

Look at Sri Lanka. This is a tragedy rooted in corruption, incompetent financial management, and one really stupid policy.

Not having sufficient funds to pay for fuel is one thing. But to deliberately kneecap the sector producing the country’s staple food (rice) and primary export (tea) was beyond idiotic. Green zealots convinced the Sri Lankan President Rajapaksa to fast track the country’s transition to ban synthetic fertilisers and pesticides in favour of organic fertiliser.

In April last year, Rajapaksa imposed the nationwide ban on the country’s two million farmers.

Within six months, rice crop production fell by at least 20%. Sri Lanka went from self-sufficiency to needing to import rice at a cost of US$450 million…money the country DID NOT have. The lack of available supply and importation cost fuelled a 50% increase in the price of rice.

The ban also devasted the production of tea…the country’s major export. Cutting off the source of badly needed export revenue.

Guess what happened after the people took to the streets? Yep…the ban was partially lifted on key export crops — tea, rubber, and coconut.

DUMB. DUMB. DUMB.

Sri Lanka has now defaulted on its Sovereign debt obligations.

But Sri Lanka isn’t the only country on shaky financial ground.

The Financial Times on 20 July 2022:

|

|

| Source: FT |

Which other country is facing financial difficulty?

El Salvador…headed for the trap door

On 22 July 2022, Foreign Policy published an article titled:

|

|

| Source: Foreign Policy |

To quote:

‘In Latin America, no country is more vulnerable to defaulting on its debt than El Salvador, according to a projection released this month by Bloomberg Economics. The International Monetary Fund (IMF) has vocally criticized the financial management of the government of President Nayib Bukele, who since coming into office in 2019 has allowed public debt levels to mount and gambled on accepting bitcoin as legal tender. The IMF says the latter poses risks to financial stability, financial integrity, and consumer protection.’

In the midst of feverish speculation in 2021, El Salvadorian President Nayib Bukele announced, to the delight of the crypto faithful, that he would legislate to make Bitcoin [BTC] legal tender in his highly indebted and impoverished banana republic.

True to his word, the former marketing executive used his majority to pass the Bitcoin Law.

A whooping and a hollering went up from the happy clappers in the crypto cult. Finally, they had their mainstream acceptance.

Today, El Salvador, and tomorrow…another pillar of economic success…the Democratic Republic of the Congo (with a population of 90 million and a GDP that’s less than half of what Bill Gates is worth).

Speaking of Bill Gates, this is what he had to say in a recent interview about cryptos…they are ‘100% based on greater fool theory’.

In pre-empting the (oh so tired and unoriginal) crypto defence of ‘he just doesn’t get it’, let’s all acknowledge that when it comes to technology, Bill really doesn’t know much at all.

Happy now, cult members?

If we use the cult’s unique (and blockchain secured) tech IQ scoring system, El Presidente Nayib Bukele tops out at the genius level…who knew he was one of the sharpest tools in the shed?

There’s a part of that assessment I’m in total agreeance with. He is…a tool.

The July 2021 issue of The Gowdie Letter took an in-depth look into El Salvador’s financial position and its adoption of bitcoin as legal tender.

This was the conclusion we reached:

‘Here’s my guess on what happens

‘When its foreign reserves are being drained to support the “smoothing” reserve, El Salvador will repeal the Bitcoin Law.

‘With insufficient funds to pay for the shortfall in goods and services its economy imports, our laser eyed El Presidente goes cap in hand to those foreign powers he told to butt out of his country for a loan…one with generous repayment terms.

‘Budget restraint will be exercised. The economy will contract.

‘The poor and down-trodden (the ones this grand scam — sorry, scheme — was supposed to help) will be even poorer and more downtrodden.

‘When El Salvador’s dalliance with bitcoin is revealed as a giant con, then this fanciful idea of Bitcoin being an alternative currency or method of payment might finally be exposed for the fraud that it is.’

It’s been 12 months since the man who knows more than Bill Gates ever will introduced his legislation.

How’s it going?

As reported by CNBC on 25 June 2022 (emphasis added):

‘El Salvador bet its economic salvation on bitcoin, but so far the gamble isn’t paying off like President Nayib Bukele hoped it would.

‘The government’s crypto coffers have been cut in half, bitcoin adoption nationwide isn’t really taking off, and crucially, the country needs a lot of cash, fast, to meet its debt payments of more than $1 billion in the next year.

‘This comes as the price of bitcoin has fallen more than 70% from its November 2021 peak, and more than 55% from the time Bukele announced his plan.

‘Meanwhile, El Salvador’s economic growth has plummeted, its deficit remains high, and the country’s debt-to-GDP ratio — a key metric used to compare what a country owes to what it generates — is set to hit nearly 87% this year, stoking fears that El Salvador isn’t equipped to settle its loan obligations.

‘Pair these economic woes with a renewed war on gang violence, and you have all the fixings of a country on the brink.’

Shock. Horror.

Who would have guessed this would happen?

Actually, anyone who scored in the ‘dumb-as-dog-poo’ range on crypto’s unique IQ test could see this coming a mile away.

But, as we’ve seen in Sri Lanka and other countries, the ruling elite who foisted these idiotic, ego-driven, and deeply flawed plans upon the public, won’t be the ones who pay the price.

Germany’s ruling class will NOT be burning wood to keep warm this winter. They’ll have plenty of taxpayer funded gas powered warmth to access.

Biden won’t have to worry about the cost of filling up Air Force One, or his motorcade, or keeping the White House at just the right temperature.

Sri Lanka’s Former President Rajapaksa fled the country on a military jet bound for a luxurious exile.

And what of the country the crypto genius presides over? This is what awaits…

‘The poor and down-trodden (the ones this grand scam — sorry, scheme — was supposed to help) will be even poorer and more downtrodden.’

If you think what’s happening in Sri Lanka and El Salvador can’t possibly occur in the developed world…you’re wrong.

Our highly indebted governments have imposed upon us similar policies of economic sabotage.

If, as I suspect, we’re headed into another (and even worse) debt crisis and severe global recession, then the chickens of the ego-driven, arrogant, and ill-conceived central banker and government policies will come home to roost.

In fact, if you listen closely, the faint sounds of cluck, cluck can be heard now…shortage of natural gas in Australia next year.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia