‘Money is emotional. Because all value is subjective, money is worth what people feel it’s worth. They accept it in exchange for goods and services because they have faith in it. Economics is closer to religion than science. Without millions of individual citizens believing in a currency, money is coloured paper.’

The Mandibles

It’s one of my favourite quotes from The Mandibles, a novel by Lionel Shriver. The book follows the Mandibles family in 2029, a time when the US Government is battling against a debt crisis and economic collapse.

Shriver’s book may be a dystopian fiction, but it does have some elements of reality…like the fact that confidence is everything in our system.

Something that we — once again — got a harsh reminder of last week. Silicon Valley Bank (SVB), the 16th-largest bank in the US, had to be shut down after a bank run.

I won’t go into too much detail, but if you want to know how the whole thing happened, my colleague Kiryll wrote a great piece on this yesterday. You can read it here.

Bottom line was that the bank didn’t manage risk well. Depositors got wind of it and withdrew a whopping US$42 billion in one day (25% of the bank’s deposits).

When a bank loses confidence, things can happen pretty quickly.

The banking system can’t afford a bank run…because of the fractional system

What I mean by fractional system is that banks are only required to hold a fraction of their deposits in the bank.

When they lend money out, they don’t take it out of your savings and give it to the borrower. Instead, with a few keystrokes, your money stays in your account and the borrower receives their loan.

This is how commercial banks create new money — by giving out loans. That is, when you deposit money in your account, the bank keeps a part of it and then lends out the rest.

The problem is that this leaves the whole system exposed if there’s a loss in confidence.

That is, if everyone goes to the bank at the same time to ask for their money (like what happened with SVB), the bank would not have enough cash to honour the deposits it holds.

The whole system is based on confidence, on the firm conviction that not every depositor will run to the bank at the same time to withdraw their money.

Now, investors are worried about contagion. After all, SVB was one of the largest banks in the US. And, with Silvergate and Signature, this makes for three failed banks in just a short time.

While the US Government has stepped in and guaranteed that all depositors will be made whole along with announcing a Bank Term Funding Program, there’s the feeling that things aren’t that strong out there.

Is this where the Fed reverses?

SVB got into trouble because they didn’t anticipate the Fed rising rates as fast as they did. The Fed has raised interest rates quickly, from 0.25% to 4.75% in just a little over a year.

In fact, interest rates have been rising quickly all around the world. You can see the global fast turnaround from cuts to hikes in a short span below:

|

|

| Source: S&P Global |

While the US Government has quickly stepped in to keep confidence, SVB’s collapse and the fact that things are looking fragile could mean a change in policy for central banks.

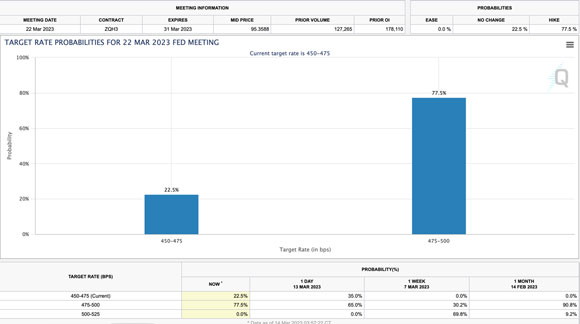

The CME FedWatch Tool is showing that while 77.5% expect a rate hike in the next US Fed meeting of 0.25%, 22.5% of the market is betting that rates will stay the same.

|

|

| Source: CME FedWatch Tool |

This is quite a change from last week, when 0% of the market was betting on no change and close to 70% on a half point.

To add to the already murky waters, US inflation rates came out last night.

And while inflation came in at 6% as expected in February, down from 6.4% in January, it’s still way too high and far from the Fed’s 2% target rate.

So it’ll be interesting to see what the US Fed does in the next week.

While inflation is still too high, my feeling is that we’ll see a softening of interest rate policy. There’s too much debt in the system, and more fragility when the basis for all of this is trust.

It’s why precious metals like gold and silver have such a pull. With gold, what you see is what you get. It’s real money that’s been around for a very long time.

In fact, as soon as we heard about the SVB collapse, investors began flocking into gold and silver. So having some exposure to those metals isn’t a bad idea.

Best,

|

Selva Freigedo,

Editor, Money Morning

PS: In case you missed it, here’s a link to watch our special livestream event we hosted this morning.