Updated July 2024

After much searching, I’ve finally found it!

You see, for some time, I’ve been obsessed with a particular theme: the crossover of mining and AI.

It was an unlikely partnership, with thus far few prospects.

But I knew if I found that rare ASX mining stock that could soar with the AI boom, I’d be on to something.

For months, I had no luck.

Though I did find a few ‘AI adjacent’ stocks (just like this ‘pick and shovel’ AI disruptor)

But now, I think I may have finally found the big X on the treasure map:

An ASX miner providing a key raw material for the AI boom.

And in today’s Fat Tail Daily, I’ll tell you more about this hidden gem…and why it could be one of the top AI stocks to watch in 2024.

The AI Stock Mining the ‘Metal of the Future’

The AI stock I’m talking about is one of the few miners on the ASX involved in what I call the ‘metal of the future’.

To understand why, let’s look at the semiconductor industry.

As you know, the semiconductors have been one of the earliest — and thus far — biggest beneficiaries of the AI boom.

The best example is Nvidia, which rose from relative obscurity to become the most valuable company in the world with a $3.04 trillion market cap — in only a little over a year!

That’s crazy! And an absolute outlier.

Although this trend in itself is actually nothing new.

As my colleague Callum Newman points out in his article, semiconductors also went through the roof during the last massive technological revolution — the birth of the Internet in the mid 90s.

| |

| Source: Bloomberg |

And the reason for this is that semiconductors are considered as the ‘pick and shovels’ of tech revolutions like the AI boom.

See, AI models like ChatGPT involve massive amounts of number crunching and processing. That requires powerful, specialised hardware, and Nvidia’s GPU chip just happens to be the best fit for the job.

Simply put: without semiconductors, there would be no AI revolution.

So it goes without saying that as AI continues to grow rapidly, demand for semiconductors will only continue to grow as well.

As an investor, a sound AI stock trading strategy is to buy solid semiconductor companies.

What’s the Investment Opportunity with Semiconductors?

Of course, the big problem is that the semiconductor space is quickly becoming saturated.

Ever since Nvidia’s breakaway success, every investor in Wall Street want in on this sector. Most have already swooped in on “top AI stocks to buy” like Intel, Advanced Micro Devices, and Taiwan Semiconductor.

As a mining insider, I see a smarter alternative:

Why not invest in the key metals used in producing semiconductors?

In essence, it’s like investing in the ‘pick and shovel’ of the ‘pick and shovel’ of AI!

The three most critical metals in semiconductor manufacturing are silicon, gallium, and germanium.

Right now, China holds a firm grip on global supply of these minerals, and uses its dominance to hit back on Western pressure.

Given the country supplies almost 80% of the global market, the announcement of China’s germanium and gallium restrictions last year created a major stir in the market.

Unfortunately, beyond a couple of tiny explorers, few ASX AI stocks exist in this China-dominated market.

However…

I’ve uncovered another critical — yet overlooked — material used in the manufacturing of semiconductors.

And one homegrown Aussie company is gunning to be a world-leading producer of it.

The metal is known as High Purity Alumina, or HPA for short.

What’s High Purity Alumina?

HPA is an ultra-refined form of aluminium oxide with a purity exceeding 99.99%!

You see, unrefined aluminium tends to hold small amounts of trace elements like silica and iron. This gives it vastly different properties to HPA.

But once these ‘impurities’ are removed, the magic of HPA begins to emerge.

High transparency, chemical inertness, high thermal conductivity and resistance to thermal shock…these are some of the properties that make HPA ideal for semiconductor manufacturing.

The material is used to build the tiny wafers and insulating layers that surround the chips.

And that’s not the end of it.

In fact, HPA is an exceptionally versatile material with lots of different applications.

For example, it’s used for optical lenses, medical equipment and specialised windows thanks to its glass-like transparency and superior strength.

In fact, purified alumina is so strong it’s used as ‘transparent armour’ for the military, and perfect for scratch-resistant camera lenses and smartphone screens.

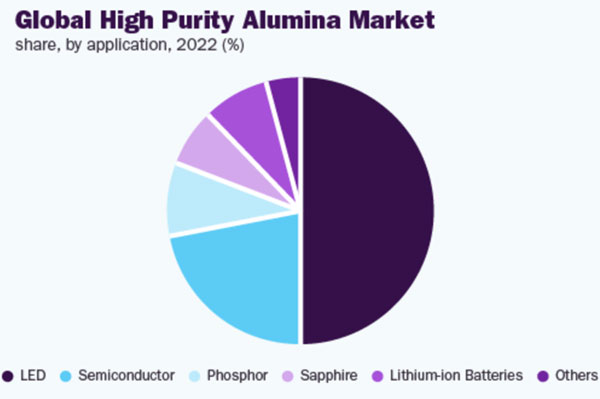

HPAs are also used heavily in LEDs. In fact, the sector is one of the commodity’s biggest demand drivers, accounting for 49% of overall demand according to Grand View Research.

You can see the full breakdown, below:

| |

| Source: Grand View Research |

You might also notice another exciting role of HPA in the diagram above — lithium-ion batteries.

Here, HPA acts as a critical component called a ‘separator’ that allows free flow of ions during charging and discharging battery cycles.

Without HPA, EV batteries would short circuit and spontaneously explode.

In other words, HPA is a critical driver in two of the biggest trends of tomorrow — AI and renewables.

Now you know why I call HPA as the ‘metal of the future’!

And the market thinks so, too.

According to Grand View Research, the global HPA market was valued at around $US3.2 billion in 2022. But that’s expected to see a compound annual growth rate (CAGR) of around 22% from 2023 to 2030.

Yet surprisingly, very few investors understand or know about the important role of high purity alumina.

That’s the big opportunity in front of you right now.

Which brings us to the ASX-listed stock I mentioned.

A reminder that investing in mining stocks can be high risk, so it’s important to do your research and never invest more than you are prepared to lose.

Introducing Alpha HPA [ASX:A4N]

The stock is NSW-based Alpha HPA [ASX:A4N].

Alpha is currently one of the lowest-cost producers of HPA in the world. They’re already delivering a small volume for specialised clients, and set to serve major tech firms and EV markets throughout Asia and beyond.

Their ‘secret sauce’ is a technology called solvent extraction, or SX.

This process involves the use of chemical solvents to separate metals from the impurities found within the aluminium oxide ore.

Now, SX is not a new technology per se, as it’s already used extensively across mining for metal processing and refining.

But according to the company’s managing director:

‘Solvent extraction has long been a method for extracting and purifying metals, but it has not been successfully applied to aluminium until now.’

Solvent extraction offers key advantages including the ability to produce an ‘ultra’ purified form of HPA.

According to the company there’s only two other sites in the world that are able to replicate Alpha’s high purity capability. And both require far more energy than Alpha’s method.

That gives Alpha a huge competitive advantage and a chance to cement a commanding lead in this niche.

Alpha’s Growth Plan

Alpha has bright growth prospects ahead of it.

They’re set to build one of the world’s largest high purity alumina processing facilities in Gladstone, Queensland that’s expected to output 10,000 tonnes per year.

Now, one of the biggest risks associated with companies like this are the costs involved in reaching production.

But Alpha is not a project bubbling past the $1 billion mark, like that of many hopeful critical metal developers.

They have laid out a clear road map to full-scale production that’s far more realistic and achievable.

Right now, they’re already going past Stage 1.

The company has already installed a small-scale production plant that generates around 500 kgs of HPA material weekly. They’re also shipping the product to market and receiving modest income from the shipments.

They’re now ready to kick off ‘Stage 2’ of their development plan.

And the big goal is to produce a high-value product from its HPA material known as ‘synthetic sapphire glass.’

This hard transparent material is used in camera lenses, semiconductor wafers, laser components, missile domes, windows for high-pressure chambers (including aircraft), and optical senses.

The specialised glass is manufactured in what’s known as ‘sapphire growth units.’ Each unit can produce a certain volume of glass throughout the year.

And the way they’re going to achieve this is through three phases:

- Phase A involves the purchase and installation of 2 synthetic sapphire growth units.

- Phase B is the installation of a further 48 synthetic sapphire growth units.

- Phase C involves the installation of a further 50 synthetic sapphire growth units.

Alpha’s clear scalability plan is one of the reasons I like this stock.

And they’re already making good progress through this plan.

They began to make inroads last year through its ‘strategic share placement’ raising around $40 million.

That allowed the company to access a further $30 million from the Queensland government’s Critical Minerals and Battery Technology Fund.

And management believes it already has sufficient funds to construct Phase A & B developments. In fact, Phase A is already underway.

Once these units are in operation, the company plans to deploy future cash flow to complete the final Phase C construction.

In other words…

The company is strategically staging its development rather than building out full capacity from the outset. That eliminates the need for complicated debt instruments or additional capital raisings.

For me, this is smart planning that shows the company’s genuine interest to its investors.

A Look at Alpha’s Financials

Let’s first look at Alpha’s current and potential clients.

Since July 2023, Alpha has been delivering small scale sales of HPA powder to an end-user in the South Korean semiconductor market.

That includes around 40-50kg per month at US$30/kg.

According to the company, these sales have been completed under a Letter of Intent which includes expanding sales to 1 tonne per month from January 2024.

This will increase to 1,000 tonnes per annum by 2026 generating around $30 million in revenue.

Alpha claims it’s also in negotiations with end users in the US semiconductor industry. These prospects have requested test samples and depending on the outcome, may feed into a potential deal sometime in 2024.

Securing US contracts would give the company high profile validation. That could have a significant impact on Alpha’s share price.

Seems well enough but how about their cash flow?

Alpha held $36 million as of 31 December 2023.

While that offers decent liquidity, the company would need to manage its cash burn rate during the capital-intensive phase of its development lifecycle.

In 2022, Alpha spent $14 million on capital investments.

Much of that was directed into commissioning its Stage 1 development facility.

Over 2023, the company allocated a further $10 million into Phase A of its Stage 2 development.

The remaining available cash will fund the completion of the Phase A and B developments.

That should cause a steep rise in the company’s capital expenditure over 2024.

Very early estimates put EBITDA returns of US$500K to US$690K per annum for each sapphire growth unit.

That means this business portion should generate at least $50 million annually once fully operational.

Based on Alpha’s strategy, production is expected to reach full capacity by 2026.

We’ll have more clarity on the company’s projected earnings once its releases its Definitive Feasibility Study (DFS) this year.

For now, I don’t believe the company holds a high profile in the market. That could change rapidly on the back of its DFS or a major supply deal with a US customer.

The Resource Sector is Shifting in Australia

Alpha shows that there are enormous opportunities among niche commodity markets, especially those tied to minerals with unique properties and wide technological applications.

That’s a big change from the last commodity boom of the early 2000s, where the focus was on base metals like iron ore.

It makes me believe that the coming resource boom may not be a tide that floats all boats, like it did during the last cycle.

This time, specific commodities will feature prominently, just like lithium has over the last few years.

So, investors will need to be much more targeted with their investment choices… and find companies that can value add in a specific niche in the market.

That’s the focus of my premium advisory Diggers and Drillers.

Every day, I scour the markets for small stocks that could become the next big thing in the commodity and mining sector. And I guide you in investing in them, including alerts on when to buy and sell, hopefully for tidy profits.

If you’re serious about success in the Aussie mining sector, this is the resource for you.

Click here to learn more about Diggers and Drillers.

Regards,

|

James Cooper,

Editor, Diggers and Drillers

Comments