Everyone is scrambling around trying to work out what a Trump presidency means for markets and the economy.

I’ll share some ideas with you today.

But before I get into that, I want to tell you about one of the most amazing trading stories I’ve heard in a long time.

It was a trade made by an anonymous French trader we’ll call ‘Theo’.

Here’s what happened…

A few weeks back, Theo placed a massive US$50 million bet on Trump winning the election through a decentralised prediction market called Polymarket.

(I’ll have more to say about Polymarket in a second, as that’s an interesting story in itself, too.)

Theo – the so-called ‘Trump Whale’ – put this bet on at a time when both mainstream media and the professional pollsters had Kamala Harris as a close but firm favourite to win.

Now, Theo is clearly a rich man.

But no one throws away $50 million on a coin toss.

So, how did he have the confidence to lay down such a hefty sum on the outside bet?

How Theo came to this decision was absolute genius.

And it provides a fundamental lesson every investor and trader should heed closely.

Namely that, in your search for ‘alpha’ – your source of advantage in the markets – you need first to find out the truth of things.

That means confirming your own facts and not just letting the mainstream pundits tell you what is true.

Let me explain how Theo did it…

The Neighbour Trade

Theo had a hunch that the polls were wrong. However, he needed firm data to support this theory.

So, he commissioned his own poll – but with a twist.

You see, his pollsters didn’t ask people who they were voting for.

No, instead, they asked people who they thought their neighbours were voting for!

The idea was that people might not want to reveal their own preferences but would indirectly reveal them when asked to guess who their neighbour would vote for.

This absolute baller move revealed a very interesting discrepancy.

The data he gathered showed voters were “mind-blowing to the favour of Trump.”

He had his confirmation; his source of ‘alpha.’

He made the bet and the rest is history.

The important lesson for investors?

You cannot trust the mainstream media these days. They are mostly partisan and captured by one political party or the other.

They get so much wrong, and they’re very slow at disseminating new information.

I mean, get this…

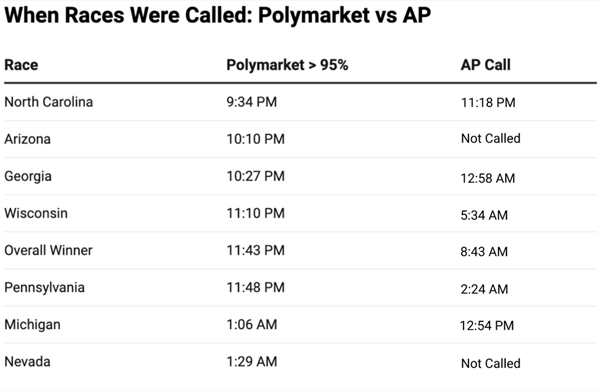

The prediction market that Theo used to place his bet, Polymarket, was hours ahead in confirming Trump’s victory.

Check out this data:

| |

| Source: Polymarket |

Incidentally, in the days before the election, Polymarket had Trump as a clear favourite, too.

These probabilities on Polymarket weren’t decreed by some ‘expert.’

Instead, they were set by millions of individuals laying down real money – with skin in the game – on the outcome.

The ‘wisdom of the crowd’ trumped the egos of the elite!

That matters to you as an investor because many people still get their investing news from mainstream publications.

Here at Fat Tail Investment Research, we pride ourselves on coming up with ideas that the mainstream often thinks are crazy!

Indeed, one of our early slogans back in 2006 was ‘not the AFR!’

To be clear, we don’t pick ideas because they are ‘crazy’, but we don’t discount ideas that sound crazy if that’s where the evidence takes us.

Finding out the truth of a situation is your first task as an investor. From there, the investment opportunities will reveal themselves.

Anyway, I thought that was a point worth making today.

But as promised, let’s finish off with some investment ideas – crazy or otherwise – that a Trump presidency might take us…

Bitcoin, AI, and Drill Baby Drill

First up, Trump’s win was massive for Bitcoin [BTC]. It’s already hitting new all-time highs.

Meanwhile, you have Trump’s son Eric tweeting things like this:

| |

| Source: X.com |

As long-time readers might know, I’ve been banging on about Bitcoin in this publication since 2017.

Back then, Bitcoin was only for ‘criminals and crazies’ – if you listened to the mainstream financial advice industry.

And yet, here we now have the first pro-Bitcoin president about to enter the White House.

And what he does next could shock those who haven’t been paying attention.

You see, during the campaign, Trump pledged to set up a Bitcoin Strategic Reserve.

That’s massive, and while I don’t know for certain what this could mean for bitcoin in the future, I’ve never been more confident that we could be about to embark on an epic bitcoin bull run.

It’s still not too late to grab a stake in this.

Check out my Bitcoin Investors Launchpad series here ASAP to get started.

Another area likely to do well is AI…and that’s to do with Trump’s new best buddy, Elon Musk.

As I wrote to subscribers of my Alpha Tech Trader service last week:

‘Even before the election Musk was investing heavily in Artificial Intelligence (AI).

‘His company, xAI, is in the midst of raising several billion dollars at a US$40 billion valuation.

‘I reckon he’ll raise this easily, given his newfound political influence.

‘But it got me thinking…

‘How might Musk use AI in his role as chief government budget slasher?

‘Recent remarks give us some clues…’

I went on to explain how AI will be front and centre of Musk’s plans to help slash up to US$2 trillion in government spending.

Certain companies in the AI space could benefit immensely from Musk’s efforts to drive AI adoption in healthcare and other government sectors.

A last idea for you to consider today…‘drill, baby drill!’

This was a slogan Trump used last time, and he’s brought it out again. He’s pledged to kickstart the US oil industry and get energy costs down.

As our in-house geologist James Cooper pointed out in an update last week:

‘As the clock ticks and global leaders run out of solutions, you, as an investor, have an opportunity to potentially capitalise on this monumental blunder of ignoring the importance of oil and gas as our primary energy source.

‘Investing in unloved O&G stocks remains a solid long-term strategy despite promises of flooding the global economy with new supply.

‘But you can go one better…

‘Look at those select few companies that have invested in exploration and new development.

‘As supply runs dry, untapped oil fields could become liquid gold (again)!’

Whatever ideas you decide make sense to you, make sure you learn the lessons from Theo…

There’s Alpha in Truth

To find a source of advantage – your alpha – in markets, you need to make sure you’re getting your facts right first.

There’s no advantage in mainstream thinking.

If it’s in the news, it’s in the price.

You have to do the work to find real opportunities.

So, take those extra few steps down an investment rabbit hole, find alternate sources of information that contradict the mainstream, and above all do you own research.

Above all, remember this…

No idea is too crazy if that’s where the evidence leads. Some of my best investments – like Bitcoin – have come from hated or derided sectors.

As Benjamin Franklin once said:

‘An investment in knowledge pays the best interest.’

That’s the real truth about investing…

[Editor’s Note: In a related piece of important news, the Australian parliament is trying to rush through a new piece of legislation called the Misinformation and Disinformation Bill (the MAD Bill!), with apparent support from the opposition.

This ridiculous legislation is an affront to basic freedom of expression and will restrict what you can say online. The quest for truth relies on sometimes violent disagreements. But with the certainty that reality ultimately wins out.

Funnily enough, this Bill exempts mainstream media and politicians. Think back about how much they get wrong or blatantly lie about. Oh, the irony!

Anyway, you can sign a petition to voice your strong opposition to this bill and I strongly urge you to do so. Read more here and sign today!]

Speak soon…

Regards,

|

Ryan Dinse,

Editor, Crypto Capital and Alpha Tech Trader

Comments