One of the best pieces of advice I received early in my financial advisory career came from a seasoned investment professional.

His words still ring in my ears…

‘Vern, whenever you hear this five-word preface “you can’t go wrong buying…”, that’s the moment when everything can go wrong.’

Why?

Because once every man and his dog thinks something is a sure bet, can’t fail, one-way trip to assured wealth, it means that all risk has been discounted out of the investment equation…and that’s when an investment contains its most risk.

The only thing that’s guaranteed in this business is there are no guarantees.

There are two components to an investment…income and capital gain.

Neither is assured.

For example, in April 2020, during the COVID meltdown, APRA Chairman, Wayne Byres, penned a letter to the banks, stating:

‘APRA expects ADIs [Authorised Deposit-taking Institutions] and insurers to limit discretionary capital distributions in the months ahead, to ensure that they instead use buffers and maintain capacity to continue to lend and underwrite insurance…’

As reported by IG Capital at the time…

‘In response to APRA’s letter; Macquarie analysts today said that the big four banks may be forced to either reduce or suspend their next wave of dividends completely.

Looking at a stressed scenario; Macquarie posits that bank losses could run as high as $25–27 billion — per bank. In this possible world, the banks’ ability “to pay dividends (without raising equity) materially diminishes,” it was noted.’

Recent history has taught us that other sources of income are not set in stone either.

In 2010, with the RBA cash rate around 5%, who would ever have thought a decade later, money in the bank would earn next-to-nothing?

Who could have anticipated how work-from-home would upset the commercial property applecart?

With higher vacancy levels, per-square-metre rent rates have come under pressure.

Landlords have suffered a double whammy…falling rental income and lower property values.

Nothing is ever absolutely guaranteed

Things happen that can change market dynamics.

And what was once placed in the category of ‘you can’t go wrong buying,’ suddenly shifts to ‘how did we get this so wrong?’

Of the two types of investment returns, income is perceived as the ‘bird in the hand’, while growth is the ‘two in the bush’.

So, how do you increase the odds of holding onto that bird in your hand?

With the guidance of someone who has been there and done that.

This is an unashamed plug for my good mate, Greg Canavan

I’ve been in this business for 37 years and have seen a lot of investment professionals.

Greg is up there with the very best.

And, if you’re thinking, ‘Gowdie would say that, wouldn’t he?’, then you do not know me and how much I value my independence…as evidenced by my strident criticism of cryptos.

Greg’s been in the investment business for 25 years.

His time in the stock selection and (just as important) rejection business has helped him fine-tune a process that combines fundamental factors (like financial statements, valuation ratios, etc) AND charting analysis.

However, in my opinion, his humility sets Greg apart from the majority.

He is constantly questioning, thinking, challenging and advancing concepts and ideas.

Because nothing is guaranteed, and Greg takes nothing for granted.

This brings me to Greg’s latest endeavour…the ‘Royal Dividend Portfolio’.

The research for the ‘Royal Dividend Portfolio’ includes this observation from Greg…

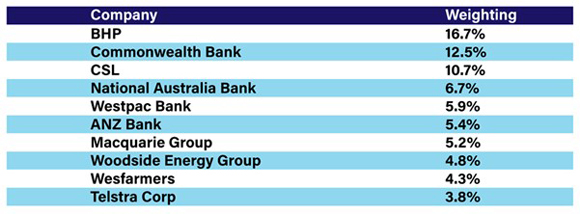

‘Take a look at the top 10 holdings of the Betashares Australian Top 20 Equity Yield Maximiser Fund (Managed Fund) as of 28 April:

|

|

| Source: Betashares |

‘On the face of it, that’s a rock-solid portfolio.

‘But it’s not one that’s going to give you outperformance. At least, there’s a low probability of it.

‘And…as we’ve mentioned…there are many hidden traps on some of the best dividends on offer right now.

‘BHP Group [ASX:BHP], for instance, has also thrown off big dividends over the past few years…thanks to a robust iron ore price.

‘But prices have come under pressure lately, and this will have a flow-through effect on BHP. In other words, the dividend forecasts are risky.

‘The banks are similar. Their earnings cycle has peaked in my view. And earnings will be under pressure going forward. While the dividends look okay at this stage, you’re seeing pressure on share prices.’

The stocks in the BetaShares Australian Top 20 Equity Yield Maximiser Fund are ones the vast majority would consider ‘you can’t go wrong buying’.

However, according to Greg’s extensive research, some of these stocks look to be beyond their earnings peak.

Greg’s thorough approach to stock selection (and, rejection) has whittled down the universe of ‘birds in the hand you can hold onto’, to a handful (no pun intended) of quality companies…with the added potential to possibly give investors ‘two more birds in the bush’.

If you’re seeking genuine, independent, well-researched advice on how to generate a quality dividend stream for your portfolio from one of the smartest and nicest guys in the business, then do yourself a favour and take a look at Greg’s ‘Royal Dividend Portfolio’ right here.

Until next week.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia