If you’ve been following me for some time, you know how precious metals assets can help protect your purchasing power and increase your wealth over time.

To protect your purchasing power, consider buying gold ETFs or bullion bars and coins.

Once you’ve secured your foundational wealth, you can branch out to increase your wealth. This means buying stocks in precious metals mining companies. They’re riskier but can potentially deliver exciting benefits…and I’ll share a key insight with you today.

Silver, the litmus for economic extremes

Most precious metals investors follow gold’s moves when making their trading decisions.

However, these investors also love silver, sometimes more than gold. That’s because silver has historically delivered better gains than gold at certain stages of the bull market.

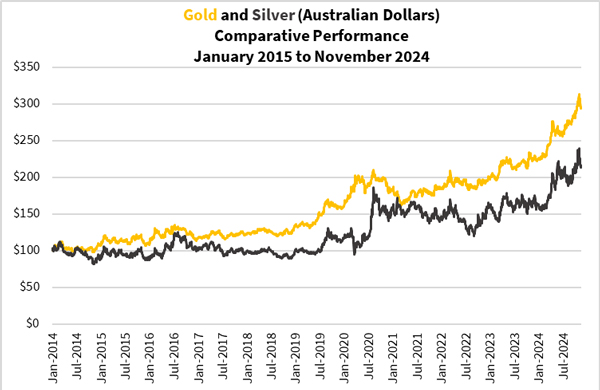

For several years, we’ve seen gold rally. Meanwhile, silver has fallen behind. That’s at least until recently, as you can see in the comparative figure below:

| |

| Source: GoldHub Australia |

What’s interesting about silver is that it trades in a narrow range for a few years before suddenly spiking.

That’s what happened in mid-2016, mid-2020 and again earlier this year.

Despite the recent rise, being an impressive 46% since the start of the year, silver would need to rally 30% or more to catch up to gold’s returns over these last 11 years.

I’d suggest that silver is a good indicator of a financial system under extreme pressure. When the global economy is facing a recession, governments around the world act to avert a disaster. Invariably they engage in massive spending fuelled by borrowing from the central banks and the private sector.

The tsunami of funds will flow, with excessive liquidity finding its way into different assets. For precious metals, these funds will go first to gold and eventually find their way into silver when gold appears overbought.

That’s why silver behaves as it does – nothing much for years before a rush of buyers sends silver into a parabolic run.

If that’s not extreme behaviour, I don’t know what is.

Gold stock investors: Take your cue from

silver, not gold

In my recent analysis of gold, silver and gold stocks, I came across an interesting insight.

Here are two figures. The first shows the price of gold and the ASX Gold Index [ASX:XGD] over the last twenty years:

| |

| Source: GoldHub Australia |

Here’s how silver and the ASX Gold Index performed over the same period:

| |

| Source: GoldHub Australia |

These figures speak for themselves, don’t they?

Clearly, gold stocks move with silver more than they do with gold. For one, gold has been breaking all-time highs in the past five years. Meanwhile, silver and gold stocks have been on a rollercoaster ride, with both only making new highs recently.

Growing interest from general investors is what gives silver and gold stocks the momentum to rally.

And this is the knowledge you and I now have over other investors.

As you read this, gold is down over 5%, while silver is down by more than 10% from its highs last month. Meanwhile, gold stocks retreated over 15%. This is because the market has bought the US dollar in favour of precious metals after the news of President Trump’s victory.

All this happened in less than a fortnight. From a technical perspective, these seem oversold so a recovery is likely.

Even if the Trump administration makes good on its promise of America First, I expect global debt levels will increase for some time. The US Federal Reserve and central banks worldwide will continue to cut interest rates going forward. All these favour gold, silver and gold stocks.

To see how they could recover from here, look at what happened to them after a cyclical low two years ago.

You shouldn’t miss this chance. If history is any indication, now may just be a great opportunity for you to move before the general investors jump in.

I suspect many investors will chase this rally when they should be taking profits, which is what we’ll be aiming to do.

Do you want to be in the know and with a chance to benefit or someone with a story about a missed opportunity?

To find out more about how to build a precious metals portfolio, check out The Australian Gold Report.

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

Comments