Real estate investment trust focused on hospitals, aged care, childcare, and life sciences HealthCo Healthcare and Wellness REIT [ASX:HCW] rose by 4% in share value earlier on Tuesday morning after it announced a net valuation gain of $71 million on its December 2022 portfolio.

The REIT said it had a $90 million net gain on the recently acquired Healthscope Knox Private Hospital development project and $7.5 million from the greenfield private hospital, the George Centre — another 8.7% increase from December.

Trading for $1.45 a share at the time of writing, HCW has gone down 15% in share value so far in 2023’s calendar year and is down 12% compared to other companies on the ASX 200.

It may take more than this short-term bumper in shares to lift the REIT to safer waters in the longer term:

Source: tradingview.com

HealthCo posts higher net gains

The health sector REIT provided its June quarter 2023 highlights for investors to assess a report that resonated well with shareholders, who were resultantly upvoting its stock by 4% in the early afternoon.

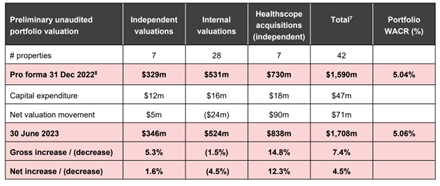

In keeping with the group’s valuation policy of HCW, preliminary unaudited valuations for all its 42 owned properties in the portfolio have been completed, comprising 14 independent valuations representing 73% of properties by value and 39% by number, with the remaining 28 properties valued internally.

Among the highlights, HealthCo said it had calculated its preliminary unaudited net valuation gain of $71 million, representing a 4.5% increase on the pro forma December 2022 portfolio value.

The REIT also said it had earned a $90 million net gain on its recently acquired and settled Healthscope Knox Private Hospital development project.

Healthscope has retained its acquisition price value, displaying a positive re-valuation which is expected to be realised once the settlement of Tranche 3 assets has been completed — as linked to the development at Knox.

Additionally, the REIT posted a $7.5 million net gain on its other recent acquisition, the greenfield private hospital (The George Centre) in New South Wales. This was an 8.7% increase on the December valuations.

These results were slightly offset y a $26 million net valuation decline across other properties in the portfolio, of which $11.9 million was attributed to the Genesis Care portfolio as individual cap rates went up 70 basis points.

HealthCo provided an update on its HMC Capital institutional fundraising for the Unlisted Healthcare & Life Sciences Fund (UHF) also remains on track to reach first close by September this year. The Nepean Private Hospital brownfield expansion is also tracking to plan, scheduled to be completed in Q1 FY24.

Lastly, the REIT declared a distribution of 2 cents a share for the quarter that ended 30 June, which has resulted in a full-year FY23 distribution of 7.6 cents a share. This is in line with the company’s guidance.

Sam Morris, HealthCo REIT’s Senior Portfolio Manager, stated:

‘The valuation results reflect the resilient nature of our portfolio, supported by favourable megatrends which will underpin long-term demand for healthcare services and the supporting infrastructure.

‘The positive valuation outcome we have achieved at The George and Healthscope Knox highlights our ability to create value for our shareholders via the accretive development pipeline. Importantly, this provides compelling future valuation upside potential for the balance of the Healthscope private hospital portfolio which we recently acquired on attractive terms.’

Source: HCW

Tik-Stocks— viral trends expected in 2024

With the cost of living and inflation increases, political conflict and the energy crisis taking enough of the attention, you might be thinking…is it really worth taking any risks?

But think about this unassuming small-cap Stemcell United [ASX:SCU] catapulted 8,284% in two days when it decided it would chase down a medicinal cannabis opportunity.

Cann Group [ASX:CAN] began at 30 cents and ballooned to $4 in a matter of months in another viral explosion.

This is why our experts bring you Tik-Stocks, a sort of cousin to ‘meme stocks’ predicted to be the next big thing…and how to use them.

If you would like to know more about Tik-Stocks, click here.

Regards,

Mahlia Stewart,

For Money Morning