Household goods retailer Harvey Norman [ASX:HVN] suffered a 10% slash to its share price after announcing that its pre-tax profits were 11.7% lower year on year.

The group reported $430.7 million in profit before tax (PBT) over the last six months ending December 2022.

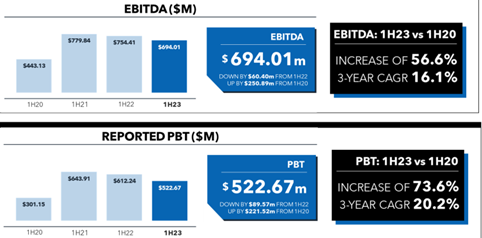

EBITDA (earnings before interest, tax, depreciating and amortisation) also went down 8% on the first half of FY22 by $60.40 million.

HVN shares were trading at $3.75 after taking a 10% hit from its last closing price.

The furniture and homewares retail stock has plummeted 28.5% in share value over the last full year:

Source: tradingview.com

Harvey Norman falls into bad profit period

For the FY23 half-year period ending 31 December, Harvey Norman reported a PBT of $522.67 million, which was a decrease of $89.57 million on the PBT result of $612.24 million in 1H 2022.

Excluding net property revaluation adjustments and leases, PBT was $430.71 million, a decrease of 11.7% (or $57.02 million).

The group asserted that in comparison with pre-COVID levels (1H 2020), the PBT result was well above pre-pandemic levels, having increased by 73.6%.

In 1H 2020, PBT was $301.15 million, nearly half the company’s earnings in the last six months.

HVN pointed out that — excluding the effects of net property evaluations and leases — the increase has resulted in a CAGR of 14.6% over the last three years.

EBITDA reached $694.01 million, an 8% decrease from $754.41 earned in the first half of last fiscal year — but up 56.6% from the $443.13 million earned the same time in 2020.

HVN commented that 1H23 saw operating expenses rise in all regions after being abnormally low in 1H22 when COVID restrictions cut down the normal running of business.

Gerry Harvey, Harvey Norman’s Chairman and Group Founder, said:

‘Our balance sheet is robust, anchored by a strong, tangible property portfolio totalling $3.94 billion that continues to deliver growth in terms of rental returns and capital appreciation. We have sufficient liquidity and we continue to maintain a low net debt to equity ratio of 12.17% giving us the capacity to access additional liquidity should we require it. Amid the macroeconomic headwinds of the past year, we have grown our integrated retail, franchise, property and digital business across eight countries to nearly $5 billion in system sales for the current half-year period.’

Overseas retail profitability declined by $28.88 million in the last half to $99.60 million. HVN said this was primarily due to difficult New Zealand trading conditions, and business and consumer confidence continue to deteriorate, given the current climate.

Harvey Norman also revealed that miscellaneous expenses increased by $18.77 million (47.3%) as the company distributes higher levels of gift cards aimed at boosting customer loyalty during these unprecedented times.

The group’s basic earnings over share came to 29.37 cents each, down from 34.58 cents at the same time in the prior fiscal year but up 17.70 cents from 2020.

The group posted a fully franked interim dividend per share of 13 cents.

HVN said that its assets went up 3.9% to $4.46 billion in the half year.

Source: HVN

Australia faces big changes

Australia has serviced 30 years of abundant, robust trade…but that’s now broken and can’t be put together the same way.

The global supply chain has been twisted — that’s why there’s less on our supermarket shelves, inflation is running rampant, and banks are closing branches.

The change is all around us, and the clues and signs are everywhere.

Jim Rickards, one of the world’s top financial and geopolitical analysts, has joined the dots nobody else has — certainly not the mainstream media.

He says, ‘no one is talking about how this could end the Australian economy’ as we know it, as soon as within the next 12 months.

If you want to know more about the biggest geoeconomic shift of our lifetime, click here for more.

Regards,

Mahlia Stewart,

For The Daily Reckoning