I’ve been trying to converge a bunch of information running through my head this week.

And I’m trying to bring it all together to figure out exactly when we really hit the depths of economic ruin. This is of course all thanks to the extreme measures put in place by central banks and governments.

And it’s because right now we’re all under government-imposed house arrest.

The knock-on effect is a destabilisation of the financial system and the ruin of millions of people around the world, which Australia is not immune from.

You might think the causal effect of all this is the coronavirus. That’s part of it. The other part is incompetent fiscal and monetary policy that started years before the point we’re at today.

Remember, the Australian economy had been pushed to the brink of recession well before the coronavirus hit.

In fact in late 2018/early 2019, I had a running bet with my esteemed colleague Shae Russell about when Australia would enter a recession.

Here’s How to Survive An Upcoming Currency Crisis. Claim your Free Guide

Who owes the beers?

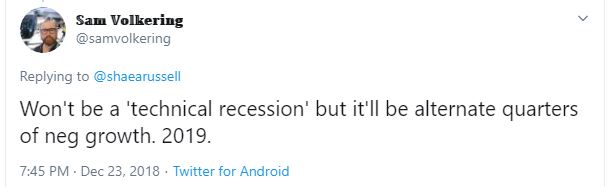

The question was, a recession in 2019 or 2020?

To which I replied:

|

|

| Source: Twitter |

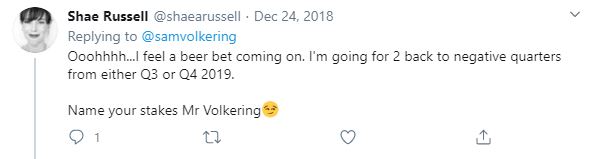

Shae then responded with:

|

|

| Source: Twitter |

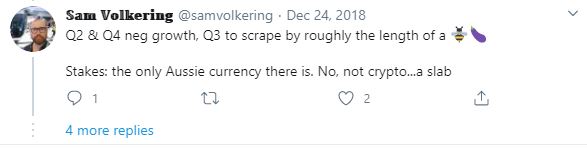

And I replied:

|

|

| Source: Twitter |

Well, we were both wrong.

But not by much.

As it stands the Aussie economy dodged the recession bullet in 2019, albeit barely. And there’s a pretty good chance that 2020 would have led to an economic recession in Australia even without the coronavirus.

However, now it’s a certainty.

I don’t like using absolutes like that. But some things you just can’t deny. And while we haven’t got the official growth figures yet, the outcome is going to be a negative quarter.

It’s coming and it’s going to be brutal. While we wait for the numbers we can look to other countries to give some indication of just how bad it’s going to be.

France released their economic figures yesterday. Here’s what France24, France’s state-owned news broadcaster reported:

‘In its worst performance since 1945, the French economy shrank around six percent in the first quarter of this year as the coronavirus pandemic decimated business activity, the Bank of France said Wednesday.’

Their last quarter of 2019 saw negative growth of 0.1%, so yes, they are now technically in a recession. And to add even more pain, the Bank of France said that for every two weeks of lockdown the economy will likely shrink another 1.5%.

Next Tuesday we’ll be two weeks into the new quarter. Hence, France’s economy will have shrunk another 1.5%.

The hurt is still coming

Expect the case to be remarkably similar in Australia. The fourth quarter of 2019 saw the Aussie economy grow 0.5%. It’s going to shrink in the first quarter of 2020. While that won’t take the country ‘technically’ into a recession (you need two consecutive quarters of negative growth for that), it will be a devastating drop off.

And expect similar negative growth in the second quarter of 2020 from April to end of June. We’re already into the next quarter and so far, lockdown is still in full effect.

JobKeeper payments haven’t even started hitting bank accounts yet. That’s because the legislation only passed yesterday. Now the real test starts to see how much of that $130 billion actually makes it out to those who’ve been stood down while on lockdown.

And it’s not about to open up like JB Hi-Fi’s doors on Boxing Day and see a rush of people return to normal life. Lockdown is lasting for some time.

The current guidance is that schools will return to class on 15 April — that’s according to the Victorian Education Department. But I’m already hearing from parents that at a minimum Term 2 is now also going to be home-schooling.

That’s another three months of parents having to figure out how to manage work (if they’ve still got work) and educating the kids. This also indicates the government isn’t really any closer to opening up the flood gates and letting people spread disease all over each other.

If they have successfully ‘flattened the curve’, the last thing they want to do is let it spread with vengeance because of relaxed social restrictions. And note, there’s still no vaccine. Without that there’s no way we’re returning to life pre-coronavirus as we knew it.

So, sorry to say that recession is looking certain.

Those unemployment numbers are only going to rise. And this is all going to lead to a very dark period for the next few months. And in my view, it will drag the markets to lower lows.

The bounce we’ve seen on the ASX in the last couple of weeks does not fully factor the economic hurt that’s coming.

We’ve seen market bounces like this in almost every previous crash. This won’t be any different. It’s when we find the new lower lows that we’ll really find out what the repercussions of these draconian measures are.

Then, and only then will it be time to plunge in and flick back to mega-bull. Markets will turn and we will surpass the levels we saw pre-crisis. But not yet, not with so much economic hurt on the way.

The darker days are still coming. And you’ll want to make sure you don’t get caught in the second crash when it hits.

Regards,

Sam Volkering,

Editor, Money Morning

PS: In this free guide, discover how a currency crisis could drain the supply of circulating cash…and how you can keep your standard of living when going through it. Download the free guide now.

Comments