In recent weeks, we’ve seen gold fever break out in the streets. People queued up outside bullion dealers worldwide to buy or sell their gold and silver.

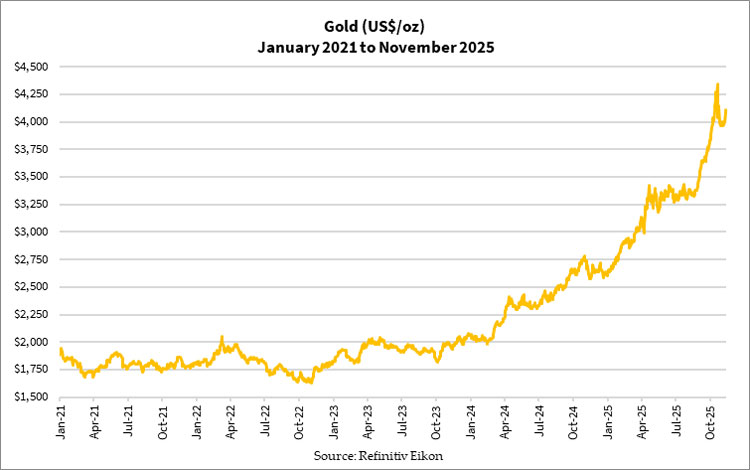

Gold broke above US$4,000 an ounce (~AU$6,050) for the first time in October this year:

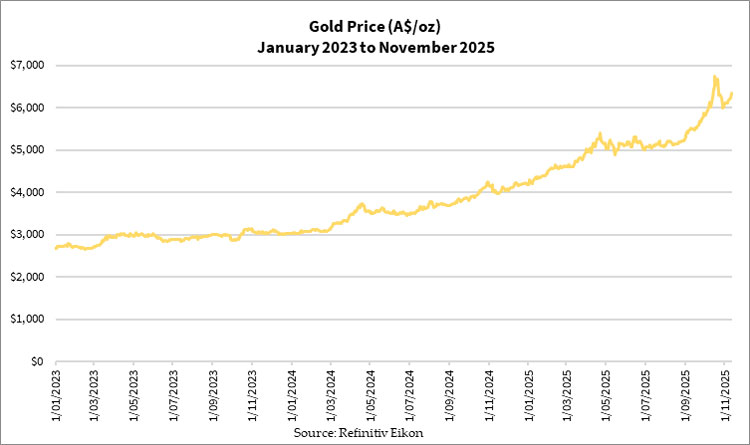

Only a year ago we saw gold cut through AU$4,000, also in October. At that time, it was quite surreal:

To think that gold’s meteoric rise happened in such a short time. The horse started bolting in early 2024 after gold broke above US$2,100 an ounce and we’ve seen it set new milestones in rapid succession.

Gold’s clearly enjoying its time in the limelight. Gold is pretty much in pole position.

However, it wasn’t long ago that things were nowhere near as shiny for gold. More precisely, gold was as dull as lead and probably just as uninspiring only two years ago.

I remember attending the 2023 Australian Gold Conference and experienced the somewhat subdued atmosphere. It wasn’t a reflection of the event, not at all. Rather, gold was a rather unloved commodity and those attending the event were genuinely passionate enthusiasts of the world’s oldest form of money.

What commodities were the darling at the time?

Lithium, rare earths and critical minerals.

So desired they were that many gold explorers sought to attract investors to pay attention to their companies by mentioning that they found veins of these metals in their drilling. And some companies such as Delta Lithium [ASX:DLI], Meteoric Resources [ASX:MEI], Wildcat Resources [ASX:WC8] decided to slow their exploration for gold and pursue in earnest lithium and rare earth elements. For this, they enjoyed a significant boost in their share price in 2023, becoming star performers.

I remember cheekily saying to a session chair at that conference that many gold explorers were picking up lithium and rare earths like having affairs with their mistresses. She liked that reference and mentioned it in her opening address.

But as is typical of a relationship with a mistress, they can be short, tumultuous and sometimes very costly…

The rise and fall of lithium

and critical metals

I want to clarify at this point that even though I jokingly referred to lithium and rare earth elements as mistresses, I don’t disdain them. All these metals have their uses and are strategic for a good reason.

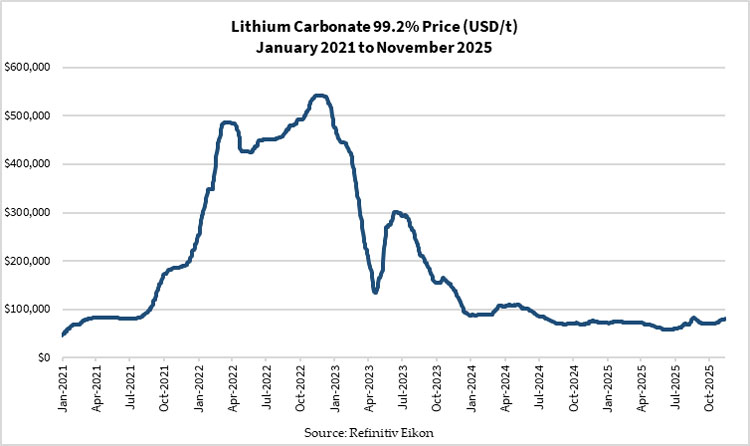

At the height of the Green Agenda and the push to decarbonise, lithium and rare earths prices soared. Let me show you the rise and fall of lithium in the last five years:

By mid-2023, lithium prices started to buckle. There was an increasing awareness of the deficiency in rolling out Net Zero around the world. This put the brakes on the push for clean energy and battery technology, what lithium, rare earth elements and other critical minerals rely upon to thrive. At the same time, demand for fossil fuels continued to prevail. The Russia-Ukraine conflict revealed how many European nations relied heavily on gas from Russia to run their society. When that stopped flowing and their clean energy sources proved inadequate, it was the beginning of the end of that critical minerals boom.

So while the lithium boom was clearly on the way out at the time, the enthusiasm in the mining investment space and public discourse remained strong. But fast forward to today, they’re as popular as gold was two years ago: shunned.

Remember how I mentioned that a couple of gold explorers and early-stage developers abandoned their focus on gold to chase after lithium and rare earth elements? Well, they reaped much less inspiring returns and, in some cases, earned disdain from investors for being disloyal and chasing after the flavour of the month.

I can’t emphasise the irony enough.

The author of bull and bear markets

Before you accuse me of being smug for gold at the expense of lithium, rare earth elements and critical metals, let me emphasise that commodities are cyclical.

Also, I want to bring up a statement by renowned gold and mining investment legend, Rick Rule, about commodity investments – ‘the author of a bear market is a bull market’, and vice versa.

Yes, what goes around comes around!

As much as I’m bullish about gold, it’s important to understand that these critical metals could be primed for a rebound.

Western countries generally don’t have trouble with mining and producing gold. There are still many deposits and the technology to extract them isn’t complex. However, that’s not the case for lithium and rare earth elements. Many western countries have passed the processing to China and a few developing nations because of costs and environmental issues. The increasing tension between the US and China has therefore created a bottleneck and a supply chain issue. This is because the two country’s allies have had to take sides. China’s response has been to restrict exports of critical minerals and other materials to countries that it deems uncooperative or hostile.

These trade wars have a real impact on many nation’s economies. It’s not just mere posturing anymore as the stakes are high.

Lithium and rare earth elements aren’t rare in the strictest sense. Australia has many deposits of such metals, especially boosted by new discoveries in the last five years.

However, the challenge is that they don’t always exist in a chemical form that makes them easily extractable. In other words, there are fewer companies in this space that are investable. And even fewer investors who even understand that difference.

Invest in a comeback story…

Those who can distinguish such companies have a distinct advantage now. The potential rewards could be huge if one plays this correctly through smart stock selection and discipline in timing one’s entry and exit.

Just as those who signed up for my newsletters on precious metals in 2022-23 picked up quality companies and avoided many dud ones and waited to reap their rewards. This is the same playbook for those wanting to get into lithium stocks now.

I’m glad to tell you that some of my colleagues are qualified to guide you on this journey. One of them recently returned to our team. He’s Lachlann Tierney and he’s currently in charge of the Australian Small Caps Investigator newsletter service. He was quite early in identifying the revival of lithium and critical metals. He’s researched this space and found a few companies you can buy now.

Why not check out his investment case and sign up while this recovery is in its early stages? If there’s any time to do it, it’s now.

That’s all from me for today, have a good weekend ahead!

God Bless,

Brian Chu,

Gold Stock Pro and The Australian Gold Report

Comments