Dear Reader,

The more I read, research, and write about the current state of flux in the global economy and how precariously positioned global asset markets are, the more I want to shout from the rooftops…‘Get your house in order…ASAP.’

A decade of good times has made us (as in society) complacent…we’ve forgotten that good times DO NOT last forever.

Ever since Jesus played fullback for Jerusalem, investment cycles have rotated from positive to negative…this time will be no different.

The longest and strongest period of positive returns EVER, is likely to be followed by a destructive force of equal and opposite intensity.

To assist you in preparing for the worst (and hoping for the best), this three-part series shares with you the important lessons I’ve learned from almost four decades in the financial planning business.

Patience

Patience truly is a virtue. In this fast-paced world, instant gratification has become embedded in our society. Taking 20 years to pay off a home or 40 years to build retirement capital is completely at odds with the ‘want it now’ attitude.

Buy in haste and repent in leisure is so true. Exercise patience when considering investing — rarely are ‘once-in-a-lifetime’ opportunities the shortcut to riches you thought they’d be. Whenever I hear ‘once-in-a-lifetime opportunity’, my retort is ‘so never again in my life will there be another opportunity to profit?’.

You also need a great deal of patience after you’ve invested. Markets do what they do in their own sweet time. What you want and when you want it, are of no consequence to markets.

At present, my strategy is to be overweight in cash and term deposits.

Waiting patiently in cash (earning less than 1%) is not easy when shares have enjoyed such strong returns.

However, with global markets now highly vulnerable to a mauling by one seriously angry bear, waiting and watching from the sidelines is no longer the frustrating exercise it once was.

The problem confronting the majority of self-funded retirees who want to adopt a cautious investment approach, i.e. cash and term deposits, is: ‘how to fund their living expenses’.

The investment industry’s solution is to recommend high-yielding shares, REITs, and/or hybrids.

My question is: What cost does the extra few percent come with?

If share markets fall 50%-plus in value, was the reach for extra yield worth it?

Waiting patiently in cash may mean using some of your capital to subsidise living expenses. Then so be it.

However, when markets do correct (and they will), you’ll be able to deploy your cash to buy even higher-yielding assets at significantly discounted levels.

Don’t chase returns

This is a natural follow on from patience.

If interest rates are low, the temptation is to leave the bank’s safety and chase an extra few percent. Invariably (unless you sell early), the cost of pursuing a higher return comes with the loss of capital — this loss is usually far greater than the few percent you earned.

Investments can be like icebergs — it’s what you don’t see that usually causes the most damage.

This is what I mean about understanding investments, the simple rule of thumb is that if the return offered or implied is above the bank term deposit rate, you’re potentially placing some or all of your capital at risk. If you cannot quantify this risk, DO NOT invest.

During the boom times, so many opaque investment products — offering various rates of return — come to market. While different in some ways, they all have one common denominator — the underlying investments are ‘geared up’ to enhance yield, AND due to the complex investment structure, higher management fees are charged.

Simple and transparent investments may not set the adrenalin racing during your waking hours, but you will sleep a whole lot better.

Always take profits

You never go broke taking a profit. The greed in our DNA often blinds our objectivity.

The desire to squeeze the last drop out of a winning investment can be overpowering. Ignore the voice of greed in your head and be happy to leave some for the next person.

Besides greed, people don’t take profits because they think: ‘I’ll pay too much tax!’.

This is just plain dumb, dumb, dumb.

Paying tax is a cost of successful investing. Live with it. Under capital gains tax (provided you’ve held the investment for 12 months), the taxman will extract a maximum of 24.5% (including the Medicare levy) of your gain. You keep the balance of the gain…75.5%.

On the other hand, the market doesn’t give you a formula on what it will extract; it can take away all your profits and some or all your capital. The market can be far more brutal than the taxman.

Taking profits locks in your gains and adds to your capital base. Even if you take out your original capital and leave the profits to ‘ride’, at least this way, you’ve protected your financial position.

If you’re investing with borrowed money, then taking money off the table in a boom is crucial.

In late October 2007, my weekly newspaper column ‘The Big Picture’ warned investors with margin loans to be prudent and sell enough shares to pay down their debt. Sadly, this advice was ignored or dismissed as lunacy, and as mentioned above, the capital destruction from the losses on margin loans in 2008/09 are well documented.

Busts always, always follow booms

Since Tulip Mania became folklore, we know booms always bust.

Yet, when the animal spirits capture society’s emotions, this logic is abandoned in the chase for the almighty dollar. Night follows day, and booms always bust. When the heat is on in the market — get out and stay out. The market may get even hotter, and you may experience seller’s remorse — get over it. The hotter the market becomes, the more violent the snap back to reality will be.

In the space of 15 months, the GFC wiped out 12 years of gains on the US market.

Knowing how quickly gains can be erased is why you should never be afraid to take a profit.

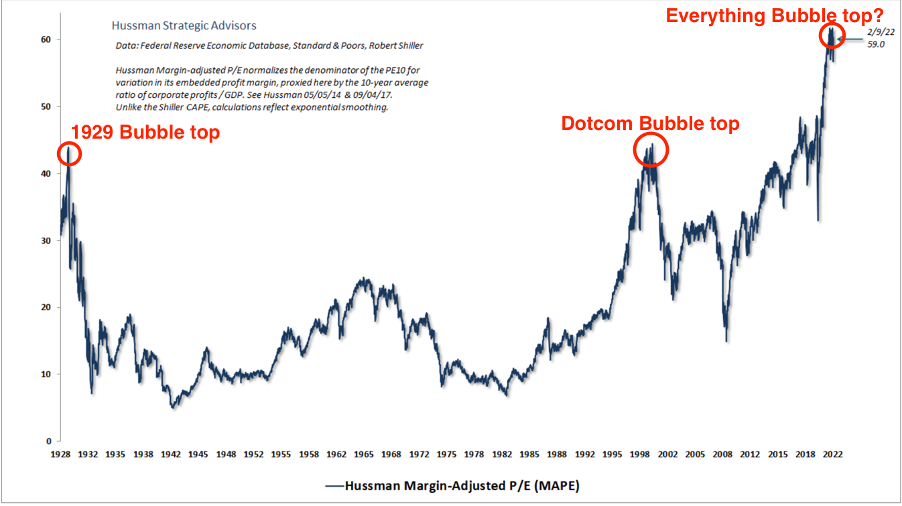

The points zone where the S&P 500 is likely to revert to is based on John Hussman’s extremely accurate Margin Adjusted P/E (MAPE) model.

To quote from the latest issue of The Gowdie Advisory:

‘Hussman’s valuation methodology has served him well in the past.

‘In 2000 and 2007, he pretty much nailed how much downside investors would experience when the bubbles busted.

‘This is from Hussman’s January 2022 Market Comment (emphasis added):

“Having correctly projected the extent of prospective market losses at the 2000 and 2007 extremes (including a March 2000 pr ojection of an 83% loss in technology stocks), we can project that the S&P 500 would have to lose about 70% of its value…”’

|

|

| Source: MacroTrends |

Never in the course of history has there been a boom without a bust.

That bust is coming, and when it does, the luxury of thinking about taking profits will be replaced by concerns about protecting capital and minimising losses.

Transparency of investments

Only invest in something you understand. There are so many ‘iceberg’ investments out there. You think you see the risk, but most investors have no idea what lurks beneath the surface.

The rule of thumb is: If you don’t understand it, don’t do it.

Simple, easy to understand investments — cash, term deposits, an index fund tracking the ASX 200, gold bullion, etc. — may be boring, but what you see is what you get.

There are no exorbitant management fees, no fancy promises, and no nasty surprises.

Sure, an ASX 200 Index fund can fall heavily in a bear market, but you know that’s a risk.

Whereas an individual share could fall much further due to internal gearing levels, poor management, or other corporate shenanigans. Unless you are on the inside, you are not fully apprised of these matters.

Worse still, are the option trading programs that paint the picture of you laying around the pool while earning an easy living.

In my circle of contacts, I know a few serious traders and they don’t lay around the pool. They spend an inordinate amount of time tracking elaborate momentum models, undertaking research, and executing trades.

Every day is a day of learning for these guys. So delving into a specialised area you have no experience or knowledge in is sheer madness and a guaranteed way to lose money.

KISS is the overarching style in my model portfolio. If you feel tempted to pursue a once-in-a-lifetime opportunity, invest only what you can afford to lose.

Higher risk can mean greater loss

Have you heard the saying ‘High Risk/High Return’?

It’s not entirely true.

In some cases, high risk pays off handsomely. However, high risk can mean greater losses.

Financial planners must (as a matter of compliance) undertake a risk assessment on clients. This usually involves a series of questions designed to unearth the inner risk taker or risk avoider.

Some risk assessment questionnaires are more detailed than others. But in my opinion, there’s a flaw in this assessment process.

Social mood tends to ebb and flow with market movement.

In 2007, after nearly four years of 20%-plus per annum returns, investors subconsciously tended to gravitate towards the higher end of the risk curve.

Ironically, the client risk profile indicates their willingness to accept greater risk at exactly the same time when the market contains the most risk.

The common perception (consciously or not) is: ‘If I accept higher risk, I will participate in the higher returns’.

Unfortunately, accepting higher risk at a market top is a recipe for greater losses. Just ask anyone who invested in the Aussie market with a margin loan in 2007.

Conversely, when a market has performed abysmally for an extended period, investor risk appetite is almost negligible. History repeatedly shows us the best time to invest is when markets have gone through the worst of times.

Personally, I prefer a low-risk/high-return investment profile.

How is this possible? Buy low and sell high.

Unfortunately, funds flow analysis shows most investors do the opposite…buy high and sell low.

A disciplined approach to value investing, using several long-term valuation metrics, can assist in determining when markets are a ‘buy low’ or ‘sell high’ proposition.

Based on the MAPE valuation model, the US market is most definitely in the ‘sell high’ zone:

|

|

| Source: Hussman Strategic Advisors |

Next week will be the final instalment in this series on getting your house in order…NOW!

Until next week…

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia