In today’s Money Morning…it starts with currency devaluation…it accelerates when inflation starts to run hot…it goes into overdrive when commodities are used as a hedge…and more…

Editor’s note: In today’s video I take a closer look at the global currency wars and what it means for the USD, AUD, and ASX mining stocks. I also look at the charts of three metals and the stocks-to-commodities ratio. If you are interested in the resources sector, it’s well worth a watch. Click the thumbnail below to see what I’m talking about.

It’s a strange thing to ponder for sure.

Punting on mining stocks in Australia is like baseball for Americans; a national pastime.

What I’m going to suggest today is that this trend may come back in a big, big way.

And it could put the tech-led rally in the US to shame.

We saw some of the US market action feed through to our shores as well.

After the NASDAQ pushed to lofty heights the focus quickly shifted to ASX-listed, small-cap tech stocks.

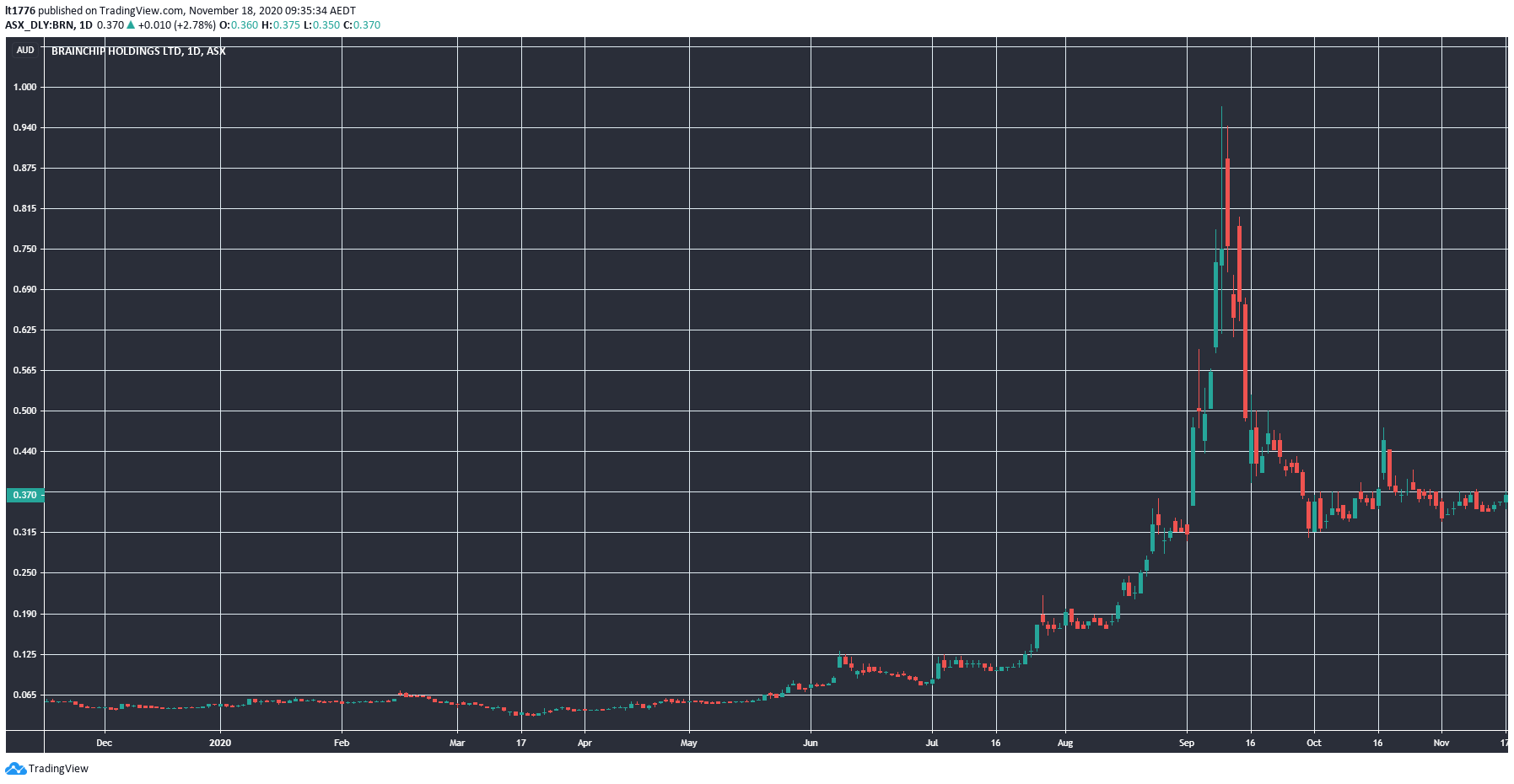

By way of an example, take a look at the chart for BrainChip Holdings Ltd [ASX:BRN]:

|

|

| Source: Tradingview.com |

You can see a mammoth spike in September for the AI edge computing company.

I noticed significant volume on a number of other smaller ASX tech stocks as well.

But how on Earth could we see this kind of activity flow through to ASX-listed mining stocks?!

Let me break it down for you.

[conversion type=”in_post”]

It starts with currency devaluation

There’s a global ‘race to the bottom’ happening right now.

By that I mean, a combination of across-the-board interest rate cuts, recessions, high unemployment, and reduced lending is forcing central bank hands.

The US Federal Reserve’s balance sheet is starting to balloon again, dwarfing the RBA’s comparatively small QE measures.

There’s a good explanation in the Australian Financial Review from Robert Guy (emphasis added):

‘Reserve Bank of Australia governor Philip Lowe must hope some of the world’s leading currency forecasters have got it really wrong.

‘But if Goldman Sachs and Citigroup are on the money with their call for the US dollar to continue to weaken into 2021, then the RBA’s hopes of capping any strength in the Australian dollar will be challenged despite its embrace of lower rates and a $100 billion quantitative easing program.

‘Leading banks are forecasting more US dollar weakness.

‘That Citi sees potential for the greenback to fall as much as 20 per cent in 2021 highlights the tough road ahead for policymakers hoping for a weaker Australian dollar.

‘The next year will expose the power imbalance in the evolving global currency war, one where might — expressed in the form of muscular central bank balance sheets — equals the right to enjoy a lower currency.

‘The RBA’s efforts to steer the Australian dollar lower will have to contend with the reality of a Federal Reserve that can out-dove all contenders with its seemingly unconstrained balance sheet.

‘The latest data shows the Fed’s balance sheet is only $US2 billion shy of its October record.

‘But at above $US7.17 trillion ($9.8 trillion) it towers over the RBA’s $300 billion-plus balance sheet, while the $US120 billion a month tempo of its bond-buying program makes the RBA’s $100 billion over six months look a little puny.’

Currencies are a complex beast but here’s the punchline…

Central banks around the world are having their hands forced by Fed policy, not just Australia.

It’s a ‘competitive feedback loop’ to debase your currency to keep people in a job and prop up manufacturing exports, and for the countries lucky enough to have them, resource exports.

Enter the ‘luckiest’ country of them all.

It accelerates when inflation starts to run hot

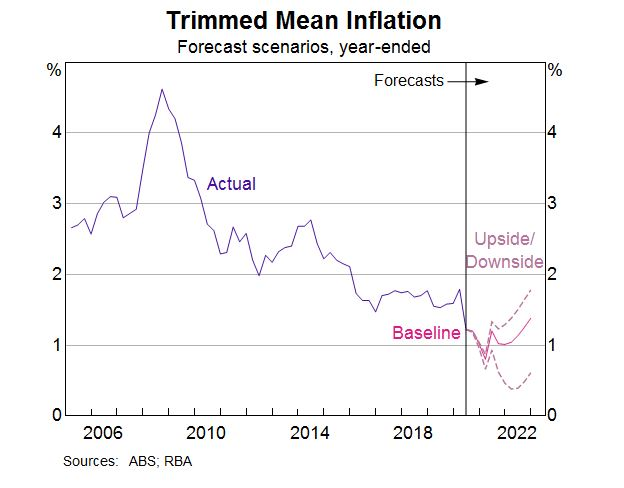

Here’s the inflation forecast from the RBA in three different scenarios:

|

|

| Source: RBA |

See the sharp uptick in inflation in the baseline and upside scenario through 2022?

What if it’s stronger than that? What if it’s hard to stop?

We know the US Fed is happy to see 2%-plus inflation as again, Robert Guy explains:

‘And then there is the Fed’s recent embrace of average inflation targeting (AIT).

‘AIT is code for allowing inflation — if it can be revived in a recovery — to run hotter than central bankers have historically been happy to tolerate as the price for navigating a path back to full employment.

‘With US rates near zero and the Fed clearly signalling a tolerance for 2 per cent-plus inflation, that leaves investors facing the prospect of negative real — or inflation-adjusted — rates of negative 2 per cent.’

Now I’m not saying that we are going to see a Weimar Republic-like scenario play out in Australia or the US.

That is, one where people have to cart home their cash wages in a wheelbarrow.

But what I am saying is that the endless QE and negative rates may cause inflation to run hot come two–three years’ time.

There’s debate about deflationary and inflationary scenarios within our business, but with the positive vaccine news, deflation looks more unlikely now (in my opinion).

Which means the next thing on the agenda is this…

It goes into overdrive when commodities are used as a hedge

The market has a long track record.

And market behaviour is not always rational, but it can be predictable.

Crisis? Load up on USD.

Lower rates? Pour money into the market.

But what about inflation? In this case, the answer the market often throws up is to use commodities as a hedge.

As an S&P Global research document explains (emphasis added):

‘One of the most common justifications for a long-biased exposure to commodities in a diversified portfolio is that commodities have historically proven to be a reliable hedge against inflation. However, it is probably more realistic to consider commodities as inflation sensitive. They are often touted as being particularly effective when it comes to unexpected inflation.’

Not all commodities will rise as one in an inflationary scenario though.

Which means you have to be particularly selective.

In the case of Exponential Stock Investor, we’ve gone after a few select companies that are particularly geared towards tech-driven demand.

This is how you could see tech-like rises in resource stocks in the next few years.

No guarantees of course, but it’s a possibility you should be prepared for.

You can learn more about our commodities ‘Supercell’ thesis, right here.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: In this free report, Money Morning’s Ryan Dinse reveals why he is convinced that lithium is going to rebound in 2020. Get the FREE Report.

Comments