Fortescue Metals Group [ASX:FMG] shares faced a significant setback today as $1.9 billion worth of its shares flooded the market in a massive block trade.

The sale, first reported on the Australian Financial Review’s ‘Street Talk’, was orchestrated by JPMorgan’s equity capital markets team and took place after Monday’s closing bell on behalf of an undisclosed institutional investor.

Shares are now down by -9.39% to $18.44 per share, that’s the lowest they’ve been since November 2022.

This massive offloading of shares suggests growing scepticism among institutional investors towards Andrew Forrest’s mining giant.

The company is grappling with multiple challenges, including C-suite instability, slumping iron ore prices, rising operational costs, and unrealistic hydrogen ambitions.

Should shareholders join the exodus for greener pastures, or is this a temporary setback for the $56 billion market-cap giant?

Source: TradingView

Declining Production and Executive Exodus

Recent high-profile departures have raised concerns about leadership continuity within Fortescue. The company has seen a slew of high-profile departures in the past 18 months.

In June 2024, Julie Shuttleworth, a trusted Forrest lieutenant for a decade and former deputy CEO, resigned.

This followed the earlier departure of Guy Debelle, former Reserve Bank of Australia deputy governor, who left his position as CFO of the green energy division after just five months.

In total six executives have left FMG In less than a year, a troubling sign for a company that is trying to enact big internal changes.

Lower commodity prices and exports have also pressured the company’s primary revenue source, iron ore.

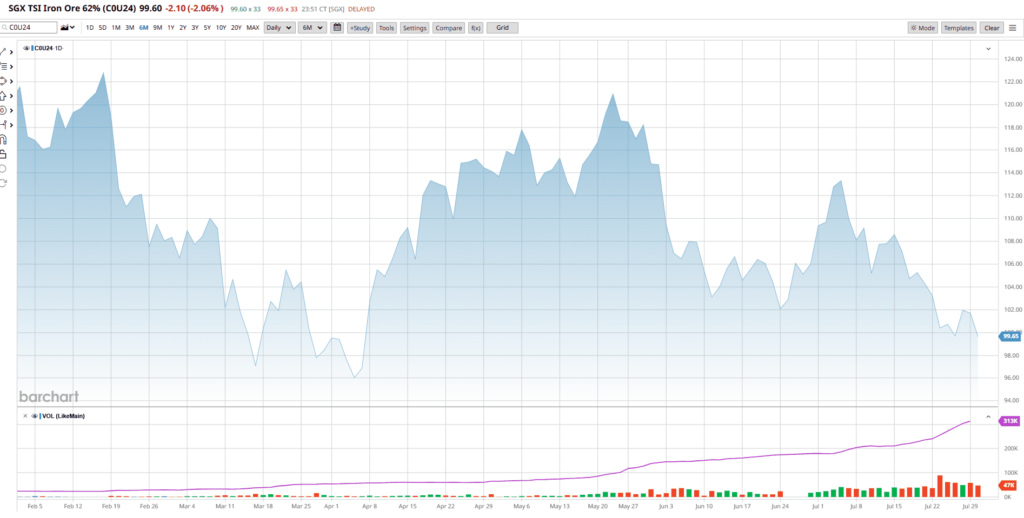

Iron ore futures are currently sitting just below US$100 per tonne, a three-month low for the metal.

Fortescue reported shipping 191.2 million tonnes of Australian iron ore in the fiscal year ending 30 June 2024.

This marks the first time in five years that the company has seen a sequential decline in export volumes, down from 192 million tonnes in the previous financial year.

FMG has also recently warned of higher expenses across its Western Australian iron ore operations.

Adding to these woes, Fortescue has abandoned its ambitious target to produce 15 million tonnes of green hydrogen by 2030, a goal that had been making headlines for nearly six years.

In an attempt to right the ship, chairman Andrew Forrest announced a cost-cutting focus across the business and cut 700 jobs.

While in the latest production report, Fortescue’s CEO, Dino Otranto, said:

‘Looking ahead to FY25, we’re seeking to achieve record shipments with guidance of 190 – 200Mt. As part of bringing together Metals and Energy into One Fortescue, we are simplifying our structure and removing duplication that will ensure Fortescue is lean, impactful and can move quickly to seize opportunities.’

But is this enough to change course?

Fortescue’s Outlook

Fortescue’s share price has taken a significant hit, with a 15% decline in the past 12 months.

This downward trend reflects a growing unease of the company’s ability to deliver on its promises of change while remaining profitable.

The massive block trade and share price slump highlight that both institutional and retail investors share in their concerns.

In fact, it’s not the first time we’ve seen a sizeable block trade from large holders. On 18 June, another $1.1 billion block trade was seen at a 6% discount.

What has changed since then is a continued slump in the Iron ore prices.

Source: barchart (SGX iron ore futures)

With ongoing challenges in the Chinese economy and a clear reluctance to throw stimulus at the problem, it is unlikely that we will see a rebound of our major export partner.

While China’s economic and property sector woes continue, medium-term demand for iron ore still appears weak.

A tough time in the iron ore sector then looks like a challenging time to reshape its energy reliance.

While admirable, FMG’s scrapped hydrogen push has sadly played out like Germany’s heavy industry, which had promised similar sweeping changes only to scrap their plans eventually.

It’s unclear if these energy pushes have upset some of the leadership and pushed them out or if other internal politicking is at play, but it’s clear something isn’t right at the top.

As Fortescue grapples with operational challenges, leadership instability, and a shifting focus on its green energy ambitions, it faces an uphill battle to regain investor confidence.

Investors should closely watch Fortescue’s response to these challenges and its ability to stabilise its core iron ore business in the coming months.

For my own thoughts, I would consider Fortescue’s recent share price drop as a warning, rather than an opportunity.

Trading opportunities

If you are overwhelmed by the quarterly reports coming out this week or never bother to read them, we have the latest tech for you.

It’s called Scarlett AI, and it has the potential to unlock your trading to the next level.

Made in mind for both seasoned traders and those new to the game, Scarlett combs over 2000 ASX companies daily, looking for opportunities.

In fact, it could find 10 trades before you finish your coffee in the morning.

If you want a glimpse at the latest in AI, it’s worth your time to CLICK HERE and see what the future of trading looks like.

Regards,

Charlie Ormond

For Fat Tail Daily

Comments