The old nugget of wisdom ‘sell in May and go away’ might apply again in 2023.

For the first half of the month, the broad market maintained a bullish trend. Despite fears over a US debt crisis waxing and waning, investors leaned on the prospect of a negotiation being reached between the Biden Administration and the Republican-controlled House.

However, as the weekend drew closer, dark clouds returned as it was reported that the Republicans walked out of a discussion. The markets thus returned to being bearish once more.

So begins the drama of ‘will they or won’t they?’.

Fanning the fears over a debt ceiling impasse

But none of this should surprise us.

It’s not like the US hasn’t experienced a partial shutdown before.

The last time it occurred was in December 2018 just before Christmas. It lasted 35 days — the longest on record.

No, the country didn’t fall into complete disarray. The electricity grid and water system continued to run. As did the country’s infrastructure (though inconveniences mounted over time). The impasse ended in late January 2019, largely sparked by several airports experiencing flight delays due to a lack of air traffic control staff.

In retrospect, that government shutdown showed the robustness of the US, contrary to the mainstream media headlines. There was no apocalypse. The US state and local governments, and the private sector, kept everything moving. And the government continued to raise the debt ceiling, causing prices in the markets and Main Street to rise.

In the short term, you’ll no doubt hear about how it’s going to be a catastrophe, and the markets will react accordingly. Don’t fall for it!

The barometers of the economy point to a bleak short-term outlook

As much as we can see through the prevailing drama that’s happening around the world, we’re still unable to avoid the consequences of mass hysteria.

The herd still commands momentum.

Thinking ahead a little, where will the herd take the markets after the debt ceiling drama ends?

We know that the central banks are desperately trying to engineer some soft landing by seeking the right mix of interest rates and inflation to stave off a crash or hyperinflation. But the see-sawing price levels across the market — be it shares, properties or commodities — show that the balancing act is looking worse with each passing day.

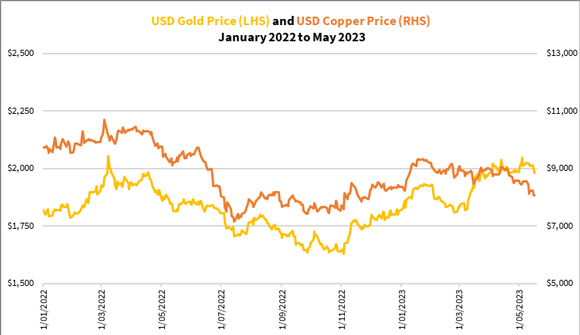

Take gold and copper for example.

Gold acts as a barometer to the viability of the fiat currency system. As the price of gold rises, it demonstrates the eroding public trust. In the short term, that fluctuates due to emotions over the latest goings-on. But more importantly, the figure below shows that the system is decaying as gold invariably rises:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

Meanwhile, copper acts as a barometer of the real economy. As a critical metal used in industry, the demand for copper reflects the confidence of businesses and consumers. A rising price of copper usually reflects growing building activity, implying economic expansion.

How have gold and copper fared in the past year? Let’s look at the figure below:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

In 1H2022, both metals fell as the US Federal Reserve rapidly raised rates, making the US dollar more valuable against everything else. While gold and copper both rallied in 2H2022, they’ve diverged since March 2023.

As you can see, gold is rising while copper remains weak. There’s eroding trust in the fiat currency system while business and consumer sentiments are falling.

Now that rate rises are almost behind us, the trends in gold and copper are painting an ominous short-term outlook. And the smart money knows this as they palm off their assets to the suckers, convinced that it’s smooth sailing ahead.

Opportunities where one least expects

Most investors look for safety in times of uncertainty.

Gold is well-known to be a refuge, and this is where many are going to head for some peace of mind.

But I believe that this time round, there’s another place within gold that offers a much better opportunity.

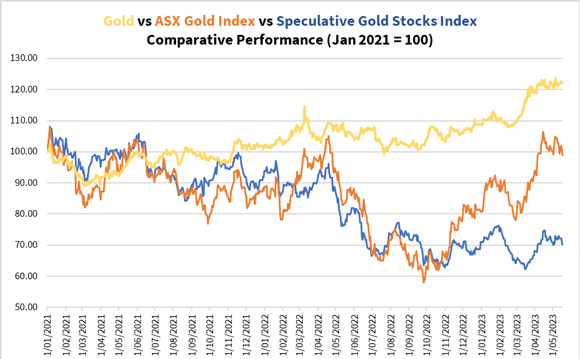

Have a look at the figure below showing the relative performance of gold bullion, established producers, and gold explorers:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

Gold bullion has been rising steadily in the last two years. Gold stock investors have had a bumpy ride. Those invested in the more established producers, as reflected by the ASX Gold Index [ASX:XGD], enjoyed good gains as they’ve rallied by 70% over the last eight months.

But this rally hasn’t really flowed down to the explorers, being the more speculative end of the gold stock space. In fact, many are trading at 52-week lows.

This is why I believe that gold explorers may deliver exceptional gains in the future.

Therefore, we’ve decided to relaunch The Gold Power Play Summit. We first unveiled this in February and some of you jumped on board — buying many explorers at rock-bottom prices.

Since the tide hasn’t quite lifted the boat right now, there are plenty of gains to be made.

Want to learn more? Watch the video presentation here!

God bless,

|

Brian Chu,

Editor, Fat Tail Commodities

Comments