KFC and Taco Bell operator Collins Foods [ASX:CKF] is among the best performers today after the company reported higher revenue, same-store sales, and earnings.

The company operates within Europe and Australia and has seen strong growth as consumers favour budget meals.

The share price is up by 7.43% today, trading at $10.85 per share.

After a slow start to the year, the company’s FY23 results in June caused a spike in share price. These results gave an early indication of what was reported today.

KFC and Taco Bell chains have enticed more consumers who have tightened their budgets through aggressive ‘value bundling‘.

The share price has seen a 50.9% gain YTD, outperforming the sector by 6.7%.

Can this performance persist with looming economic headwinds?

Source: TradingView

Profits up with digital approach

Collins Foods continues expanding its franchises despite warning of harsher economic conditions next year.

The company is building 12 new restaurants in Australia this fiscal year to add to its existing 275. The company has three new restaurants in the pipeline for Europe in FY24, bringing its total up to 75.

KFC Europe was the stand-out performer for the company, with revenue up 36.5% to $148.5 million. The company also improved its margins to 13.6% from 12.1% last year.

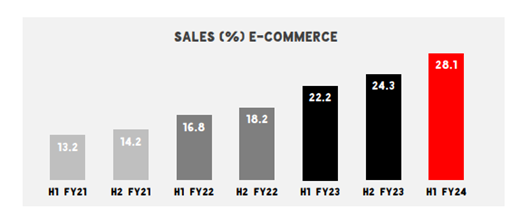

Within Australia, the company pointed to digital initiatives as the critical growth driver. E-commerce now makes up 28.1% of sales, up from 22.2% in the same period last year.

The company invested heavily in digital kiosks, apps and delivery across its stores to offer value bundles and combos.

Source: Collins Food FY24 Half Year Report

Collins Foods announced revenue climbed 14.3% to $696.5 million for the half year ending 15 October.

Underlying earnings from continuing operations climbed 16.7% to $109.9 million, with a statutory net profit of $50.5 million.

Compared with the net profit of $11 million in HY23, the company has clearly seen strong brand resilience as consumers adjust spending in the face of rising costs of living.

In the company’s past year, inflationary pressures on wages and energy prices had weighed on profits.

It had also seen a slow start to growth in its Taco Bell chains as it competed with the already crowded Mexican fast-food market.

CEO Drew O’Malley had been adamant after the prior poor performance that Taco Bell could perform, saying:

‘New brands can take time to gain traction. We have seen similar trends in other markets in the early years, where the brand [Taco Bell] is now thriving today.’

The HY24 results have seen that traction beginning, with revenue up 18.9% to $25.1 million.

The Taco Bell chain now has 27 restaurants, with profitability trending upwards. Another strong indicator has been same-store sales, which are up by 5–10% across its brands.

Commenting on the results, CEO Drew O’Malley said:

‘Performance in the first half has highlighted the underlying strength of our business, and the resilience of the QSR sector in challenging economic conditions. Our approach to value has continued to deliver solid topline, same store sales, and earnings growth across the Group.’

The company declared a dividend of 12.5 cents per share, payable on 28 December.

Outlook for Collins Foods

Mr O’Malley was upbeat about future growth for the fiscal year’s second half but warned about continuing pressures.

The results today highlight the resilience of the fast-food sector in challenging economic times. When families are tightening budgets, the prior brand investments begin to really pay dividends for the company.

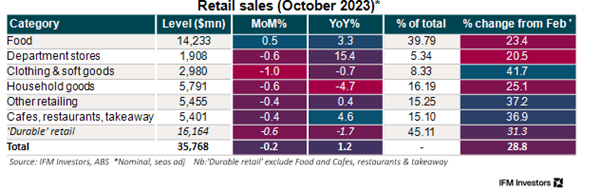

The latest retail data showed a slight dip in restaurant spending, but this was likely focused within the higher-cost brands.

Source: IFM Investors

The continued expansion of the KFC network should also be positive for the company’s growth. KFC’s current deals resonate with consumers who receive deals via phones and the new kiosks.

For the European segment, there will likely be margin squeezes in the months ahead as new minimum wage increases come into effect.

The Netherlands, where many of their chains reside, is increasing its minimum wage by 9.5%. The Australian restaurants handled the wage increase in July well with proactive procurement strategies.

They will likely be replicated across Europe, but margin pressure’s the thing to watch in upcoming results.

Overall, the company’s brands and outlook remain bullish for the rest of the fiscal year.

Is growth the thing to look for in stocks?

With the state of the market, growth isn’t many people’s priority — people want income.

Despite the ASX 200 benchmark being down -2.83% in the past 12 months, people are still making money.

That income is from dividend companies that don’t require you to speculate on ‘the next big thing’.

Dividend stocks are the ‘Stealth Wealth’ makers of a market going sideways — simple, safer, and stress-free.

But finding the right ones takes more than just finding the best dividend payers.

Editorial Director Greg Canavan has written a simple guide to helping people find the right ones.

If you think your position is too aggressive or is missing safer income— you may need a change.

Click here to find out how to access the report.

Regards,

Charlie Ormond

For Fat Tail Daily