The acronym FANGAM was made famous in the Everything Bubble.

Facebook (now, Meta). Amazon. Netflix. Google. Apple. Microsoft.

The dominance of these mighty six spawned widespread belief in their pricing invincibility.

You could not go wrong buying FANGAM.

The investing public’s absolute conviction in FANGAM was music to the investment industry’s ears. FANGAM ETFs were rushed to market. Ka-ching!

Sit back and take the ride to higher and higher prices.

Oh, if it were only that easy.

Since the S&P 500 Index peaked in early 2022, this is how the FANGAM cohort has performed:

|

|

| Source: Yahoo! Finance |

Each one has underperformed the broader S&P 500 Index. As you’ll see shortly, this comes as no surprise.

But first, I’d like to share a lesson a very experienced investor shared with me more than 20 years ago.

Whenever a sentence is prefaced with ‘you can’t go wrong buying…’, whatever follows is destined to disappoint.

Why?

Because once every man, his dog, and pet budgie accept and fervently believes you can’t go wrong buying X, Y, or Z, all risk has been discounted out of the investment equation.

Which means the investment proposition (whatever it is that’s captured investor imaginations) is at its…RISKIEST.

Such was the impact of this lesson; I was compelled to pass it on in two of my books.

In A Parent’s Gift of Knowledge (the book written for my daughters in 2011), I wrote (emphasis added):

‘There are a number of accepted truisms relating to investing in shares. A couple of these are:

- In the long-term shares always go up; and

- You can’t go wrong buying blue-chip shares.

‘Both of these statements are only partially correct and should not be treated as gospel. In my experience, these statements have been marketed by self-serving groups such as share brokers, financial planners, investment institutions, and media commentators with vested interests. If they say it often enough, the average person will believe these are statements of fact without questioning the premise.’

Also, from Chapter One of the book I wrote in 2017, How Much Bull Can Investors Bear? (emphasis added):

‘The unquestioned belief in the trend continuing without disruption inevitably causes its demise. At the mature stage of the trend, it’s common to hear phrases such as: “This time it is different” and “you can’t go wrong buying…”, “There is no alternative” — complacency-bred contempt.’

‘You can’t go wrong buying’ is a half-truth (along with a few others) that goes unchallenged in roaring bull markets. The mindless acceptance of these easy-to-roll-off-the-tongue clichés happens (with an all-too-predictable repetitiveness) every single cycle.

You can’t go wrong buying…these are five words you should be alert to.

When to believe half-truths

When is a half-truth true?

In the second half of the cycle…the down phase AFTER the up phase.

In July 1932, after the Dow Jones had lost almost 90%, ‘you can’t go wrong buying’ would’ve been brilliant advice. But who was saying it then? And, even if someone was, who listened?

Yet, three years earlier, in mid-1929, ‘you can’t go wrong buying’ was being touted on every street corner.

The story of Joe Kennedy (father of JFK) liquidating his portfolio after receiving stock tips from the shoeshine boy has become part of market folklore.

A much lesser known story is the one told by Bernard Baruch (a highly successful financier that left Wall Street to be an adviser (for four decades) to a succession of US presidents):

‘Taxi drivers told you what to buy. The shoeshine boy could give you a summary of the day’s financial news as he worked with rag and polish. An old beggar who regularly patrolled the street in front of my office now gave me tips and, I suppose, spent the money I and others gave him in the market. My cook had a brokerage account and followed the ticker closely. Her paper profits were quickly blown away in the gale of 1929.’

CNN Money

Towards the peak of a bull market, the shout of ‘you can’t go wrong buying’ is almost deafening.

At the bottom of a bear market, ‘you can’t go wrong buying’ is said in whispered tones.

Happens every cycle

This 20 January 2023 tweet from Jeff Weniger, Head of Equities — WisdomTree Asset Management, shows that ‘what happened in 1929, DID NOT stay in 1929’.

The ‘you can’t go wrong buying’ mentality was repeated in the early 1970s, dotcom bubble, and the Everything Bubble.

The top 20% of stocks (those the investing public fell in love with at any price) in the boom, subsequently underperformed in the bust:

|

|

| Source: Twitter |

Almost three years ago, the June 2020 issue of The Gowdie Letter delved into past episodes of market infatuation with ‘hot’ stocks…the titans of their generation.

Here’s an edited extract:

‘“In the United States, the term Nifty Fifty was an informal designation for fifty popular large-cap stocks on the New York Stock Exchange in the 1960s and 1970s that were widely regarded as solid buy and hold growth stocks, or ‘Blue-chip’ stocks. These fifty stocks are credited by historians with propelling the bull market of the early 1970s…”

‘Wikipedia

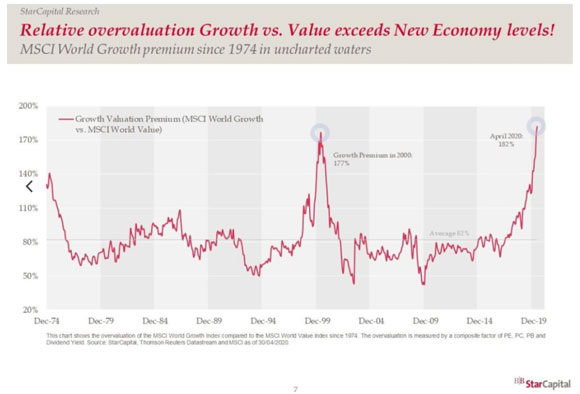

‘The popularity of the “solid buy and hold growth stocks” is evident in this chart…comparing the performance of Growth versus Value stocks since 1974.

‘The buying momentum (and belief) in this cohort of growth companies, pushed share prices of “solid buy and hold growth stocks” to an excessive premium.

|

|

| Source: Star Capital |

‘As always, the pendulum eventually swings from “over to under”.

‘When (far more reasoned) fundamental valuation metrics prevailed, that excessive premium subsequently collapsed to a significant discount.

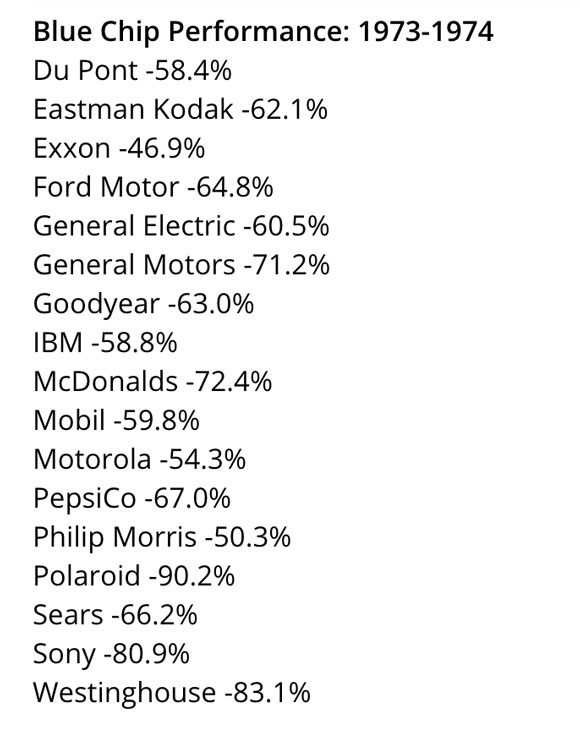

‘The swinging of the pendulum acted like an executioner’s axe on the share prices of high-profile growth stocks:

|

|

| Source: Hussman Funds |

‘After the carnage on Wall Street was over, post-mortems were conducted.

‘In 1977, Forbes published an article titled “The Nifty Fifty Revisited”.

Here’s an extract (emphasis added):

‘“The Nifty Fifty appeared to rise up from the ocean; it was as though all of the U.S. but Nebraska had sunk into the sea. The two-tier market really consisted of one tier and a lot of rubble down below. What held the Nifty Fifty up? The same thing that held up tulip-bulb prices long ago in Holland – popular delusions and the madness of crowds. The delusion was that these companies were so good that it didn’t matter what you paid for them; their inexorable growth would bail you out.”

‘Getting caught up in market hype appears to be a generational rite of passage.

‘It would take another 25-years before we saw the next major disconnect between Growth and Value stocks.

‘A new generation of investors believed — like they did in the 1970s — this time was different.

‘Why?

‘The Industrial Revolution was about to be replaced by the Technological Revolution.

‘Different theme, but same old animal spirits.

‘When a boom is in full swing, there’s no (perceived) limit to the share prices of popular growth stocks.

‘No amount of reason can persuade investors of the folly in this thinking.

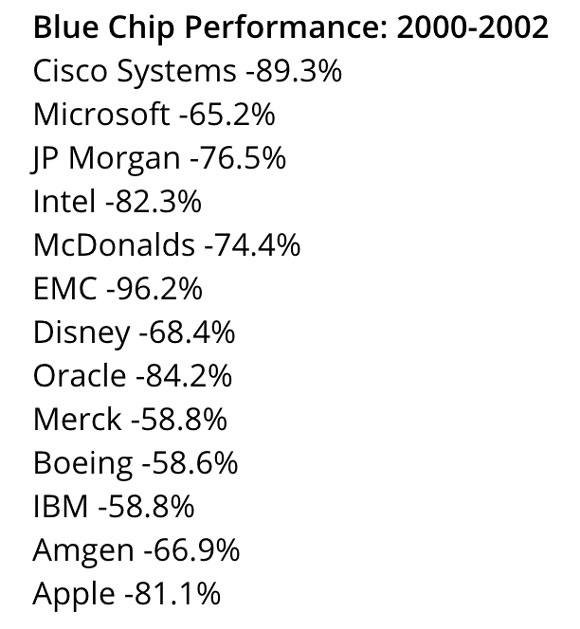

‘Especially when you have dominant players like IBM, Cisco, Microsoft, Intel, Oracle, and Apple.

‘These were not your run-of-the-mill dotcom start-ups…they were the titans of tech.

‘Throw in big pharma like Merck and a banking giant like JPMorgan and a fast food whopper like McDonald’s, and how could you go wrong?

‘And therein lies the small but very critical tell-tale sign of a market close to its peak.

‘Any sentence prefaced with “you can’t go wrong buying…” is the closest you’ll get to a bell ringing at the top.

‘Whatever that universally recognised risk-free investment is…then you can be assured it’s at a point of MOST risk.

‘As the Growth versus Value chart shows, the growth stock excessive premium was once-again plunged into the deeply discounted zone.

‘Here’s how it happened:

|

|

| Source: Hussman Funds |

‘And, here we are, 20 years later, with a new generation of investors.

‘It’s somewhat fitting that the most overvalued market in history is now registering the most excessive premium in Growth versus Value.

‘Very poetic…a spectacular climax to precede (what will be) an equally spectacular collapse.

‘I know people think “it’s different this time”. But it’s not.

‘Popular thinking is the current generation of high-profile growth stocks are unlike any that have gone before us.

‘And, given their market dominance, it’s easy to see why that view is held.

‘In the midst of this absolute belief in FANG[AM] prices growing to the sky and beyond, the prospect of a 50, 60, or even 80% fall in their share prices is not only inconceivable…it’s laughable.

‘Investors in the 1970s and early 2000s thought the same thing about the growth stocks of those eras.

‘But fall they did.

‘The pendulum always swings.

‘The mistake investors made on each previous occasion — and this also happened in 1929 — is they believe these dominant companies operate in some parallel universe…one that’s not connected to real economic activity.

‘Facebook. Apple. Netflix. Google. Amazon. Microsoft.

‘Each one if these companies generate revenue from businesses and consumers in the real economy.

‘If people out in the real economy are doing it tough, that pain finds its way to the bottom lines of FANGAM.

‘Flat to falling earnings multiplied by a shrinking PE ratio, produces the blue-chip carnage of 1973–74 and 2000–02.

‘Look what happened to the Microsoft PE ratio after peaking in 2000:

|

|

| Source: Y Charts |

‘Unless it’s different this time, expect to see FANGAM leading the charge down…and taking the market-weighted S&P 500 Index with them.

‘With history telling us how this “market darling” phenomenon ended in 1929, 1973, and 2000, FANGAM should take on a whole new meaning for investors…

‘Fearful. Anxious. Nervous. Guarded. Alert. Mindful.’

As the FANGAM versus S&P 500 performance chart shows, what was identified in June 2020 appears to be playing out.

Alerting investors to how these episodes of infatuation with popular stocks end was, in hindsight, 18 months too early.

Such is the nature of this forecasting business.

You can identify trends, draw parallels with history, and then you have to wait for human nature (be it greed or fear) to exhaust itself.

How near or far that point of exhaustion might be is an unknown.

And, believe me, waiting can try your patience.

But what we do know is this…the ‘Fable a New Generation Accepted Mindlessly’, never has a fairy-tale ending.

And, for those who think the worst is over for FANGAM, don’t bet on it.

With a (most likely, very nasty) US recession ahead, both earnings and PE ratio (the multiple applied to earnings) are likely to go through a process of contraction…at least, that’s been the lesson from history.

In the fullness of the cycle, my experience is these lessons tend to be highly predictive.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia