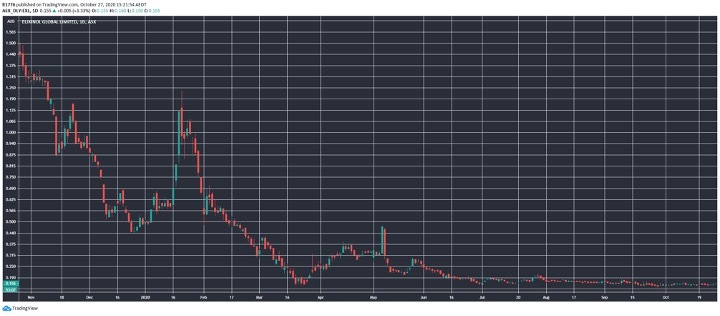

After a ripper period in early 2019, the Elixinol Global Ltd [ASX:EXL] share price went on a long-term slide.

You can see what this looks like on the EXL share price chart below:

Source: tradingview.com

On a day where the EXL share price was up 3.33% to trade at 15.5 cents, we take a look at the numbers from EXL quarterly update.

EXL share price chart in context of latest numbers

After the heady days of early 2019, Elixinol now has a market cap of less than $30 million.

I’ve seen charts like this before — they can be a grim omen.

But there are a couple (small) rays of light at the end of the tunnel for Elixinol.

Here are the headline numbers from their latest quarterly:

- ‘Q3 FY2020 revenue 1 of $4.0m – 18% quarter on quarter improvement vs Q2 FY2020 of $3.4m, exceeding the previous guidance of 10-15% growth

- ‘Cost reduction measures implemented in H1 FY2020 have reduced net cash used in operating activities in Q3 FY2020 to $3.5m – down from $6.2m in Q2 FY2020 and down from $9.0m in Q1 FY2020’

So, a small revenue guidance beat, and costs coming down.

Looking at the other numbers in the quarterly, you can see it has $12.7 million cash on hand as well.

Outlook for EXL share price

Elixinol has faced a long string of challenges, and their ability to surmount them will determine its future.

A progressive reduction of operating expenses helps, but I’d say that revenue growth is also really important in addition to simply bringing costs down.

They are now a retail presence in Ireland and the UK, which complements their ecommerce pivot.

It may be a long wait for an EXL share price renaissance.

Or it may not occur at all.

Given prior experience, the EXL share price chart indicates that those still clinging on may be resigned to an all-or-nothing outcome.

Regards,

Lachlann Tierney

For Money Morning

PS: Four Well-Positioned Small-Cap Stocks — These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.

Comments