Inflation is still trying to find its peak in the US, with CPI figures overnight coming in at an eye-watering 9.1% level.

The US bond market is all in a tizzy, with short-term rates jumping on expectations of higher rates from the Fed and the long end failing to jump much, leading to a flattening and inversion of the yield curve.

The market is saying that the economy can’t handle rates going much higher. Everyone is coming out with their predictions about when the Fed will start cutting rates after the economy has cried uncle and keeled over.

Let’s face it, the Fed is in a tight spot.

|

|

| Source: Imgflip.com |

The major thing to understand at the moment is that there are some huge capital flows happening as a result of the rapidly changing interest rate dynamic around the world.

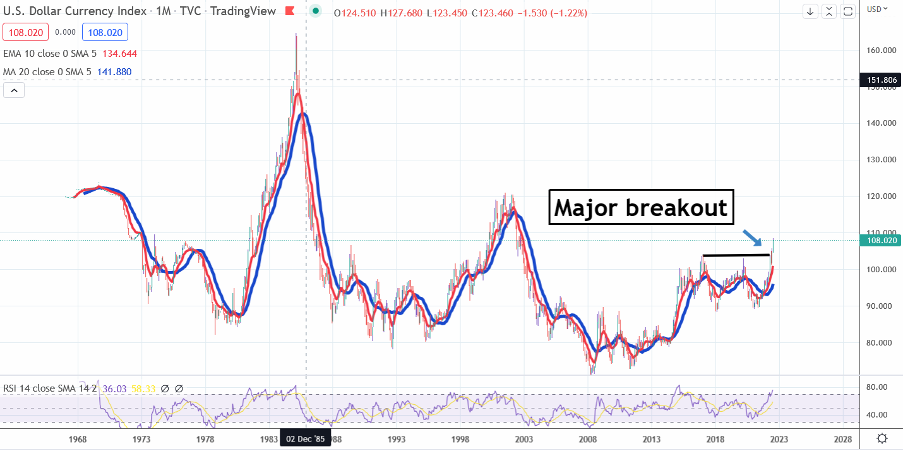

The US dollar has broken out of a seven-year trading range and looks like it will head much higher.

US dollar explodes

|

|

| Source: Tradingview.com |

This is a chart of the US dollar going back to 1968. It doesn’t take a genius in technical analysis to notice that we are seeing a major breakout to levels that haven’t been seen in 20 years.

The last two times it got this high, the trend continued to the upside for another 2–3 years.

The euro is nudging up against parity with the dollar and looks sick as big money flees to the safety of US bonds.

Flight to safety

I guess a risk-free 3% a year looks pretty good when you look around and see asset prices plummeting everywhere.

Perhaps the rally in US 10-year bonds is showing a flight to safety prior to a serious crash, rather than a prediction that the Fed will start cutting rates soon.

With inflation running at 9%, that’s a 6% loss of purchasing power over one year, which hurts when you are talking many billions of dollars. But that’s the best offer in town.

We are getting to a point where there is literally nowhere to hide.

Commodities were thought to be the perfect spot in an inflationary environment, and the ASX 200 was punching above its weight for the past year with strong banks and resource stocks.

But as economies slow down rapidly, demand shrinks, and a spiking US dollar just rubs salt into the wound.

Dr copper has caught pneumonia and is in free fall.

Copper plunges

|

|

| Source: Tradingview.com |

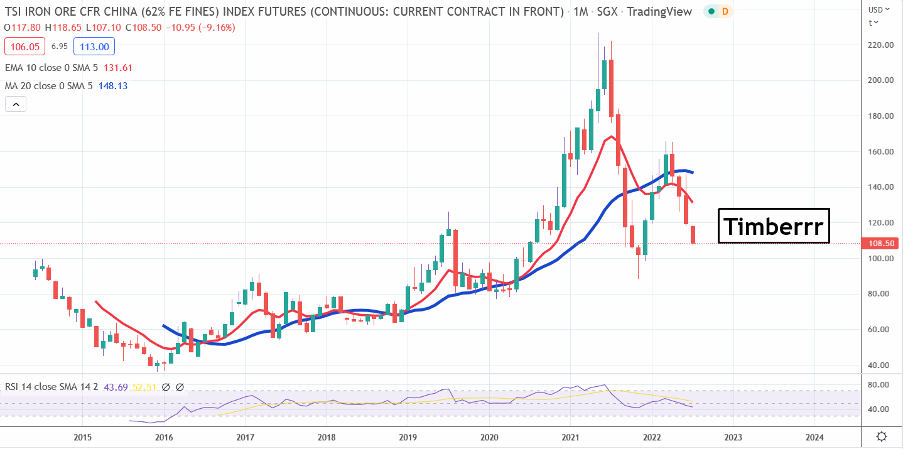

Iron ore has been defying gravity for a long time, but it has cracked and looks likely to head a lot lower.

Iron awful

|

|

| Source: Market Watch |

Gold is also feeling the heat and must stay above the low of the correction from the past two years (US$1,677). Otherwise, we could see a major fall.

Teetering gold

|

|

| Source: Market Watch |

Oil is also retreating after a stellar run over the past few years, and even market darlings lithium and rare earths are faltering.

US equities keep threatening to rally from oversold levels, but the selling pressure remains. This is a new development in a market that has rewarded the buy the dippers for a decade.

A vicious short squeeze can develop at any moment from here, which makes trading from the short side dangerous. But there are no signs yet that a major or even minor low is in place.

No man’s land

We are officially in no man’s land.

Last night’s price action in the States after the CPI figures came out was quite impressive, with early weakness giving way to a slow grind higher over the day. But is the fact equities didn’t collapse last night bullish? Not really.

The S&P 500 is only 4% above the low of the correction. We could see another large wave lower below there, so the bargain hunters need to have their skates on, ready to run away at any signs of trouble.

There are so many bombed-out stocks out there that you can’t help but lick your lips, thinking you must be able to find a few that will deliver brilliant returns for you at some point. But many of the stocks that are down 70–80% from the ridiculous levels they reached during the boom will never recover.

You have to be very careful you don’t end up jumping into the fray at exactly the wrong moment before a really serious sell-off occurs. Then you will be scrambling out of bad positions near the low of the correction like everyone else, rather than standing there with dollars in hand, ready to pick up stocks for a song.

Cash is king

Patience is the name of the game at the moment, and that is by far the hardest thing to learn as a trader or investor. Having money in cash is a position. During a time like this, it’s a brilliant position because the value of that cash is going up as the value of stocks is going down.

We are now in a phase of the market when the really big money is starting to move, as you saw in the US dollar chart above. When that starts happening, the swings in the market can be incredibly large.

The little guys like us need to jump out of the way of the elephants and make sure we are making decisions that ensure we will still be standing at the end of the carnage.

Regards,

|

Murray Dawes,

For Money Morning