Early on Monday, home fragrances and décor company Dusk Group [ASX:DSK] revisited its FY22 results and looked to its future of trade in the form of an AGM presentation and address from both its Chair and CEO.

Consumer patterns now face correctional metrics in the aftermath of the COVID restrictions rebound. Shoppers are pulling back from their initially desperate retail therapy.

Nevertheless, Dusk’s management is looking forward to fewer interruptions in FY23 and is confident with strong initial sales.

Dusk’s share price slid 2% in afternoon trade (21/11/2022), and despite a 4% gain over the month, the affordable luxuries retailer is down 34% year to date:

Source: Tradingview.com

Is Dusk’s turbulent trading coming to an end?

Dusk’s Chair John Joyce acknowledged the ‘turbulent year’ that was FY22, as the retail industry struggled to regain some trading normalcy.

Joyce praised Dusk’s response to the constant changes, though he anticipates more risks and challenges to come.

The candles and scents retailer experienced a 24% reduction in trading days in the first half of the year but consolidated the influx of sales and earnings experienced in the prior year, a year that ‘reflected a number of COVID-19 tailwinds’ linked to suppressed retail opportunities for shoppers previously.

Dusk’s CEO, Peter King, noted four key strategic pillars to drive the company’s long-term sustainable growth; the Dusk Rewards program (taking 62% of sales in 2022), its online shopping platform (8.3% of sales), ongoing store rollouts and, lastly, technical and skilled workforce investments.

Dusk opened 10 new stores in Australia and feels confident it is on track to break into the international market.

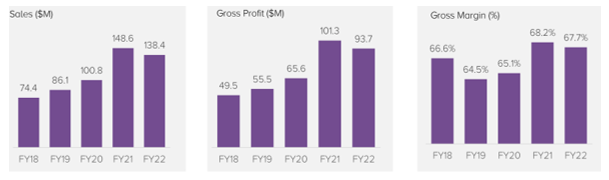

In 2022, Dusk dropped 6.9% in total group sales year-on-year with $138.4 million.

Though online sales had risen 3%, the company’s gross margin of 67.7% had dropped 44 base points compared with 2021.

And yet, Mr King celebrated the year on longer-term measures:

‘In FY22, our pro forma EBIT was well above FY20 and our EBIT margin at 19.1% was a healthy result. Our 67.7% gross margin in FY22 was only slightly below the prior year when business conditions were very favourable.

‘This illustrates management’s ability to consistently develop differentiated products that offer great value to our customers while delivering higher margins for our shareholders.’

Source: DSK

Outlook for Dusk

So far, in FY23, Dusk is experiencing a strong response in total sales, with the first 19 weeks of FY23 up 23.9%.

DSK reports its year-to-date margin rate is now in line with the prior year, and it is already experiencing a rising response to Christmas offerings.

‘While our YTD sales growth is pleasing, as we are now on the cusp of Xmas, it is prudent to reinforce the importance of December trade to dusk’s full year results,’ said Mr King.

‘Our focus now is the key Christmas trading period. We have a rigorous planning process for Christmas trade which begins each year in January. We have become the go-to brand for Christmas gifting and décor and I am pleased to report that we have opened Christmas with all products in the planned depth across the store network.’

Mr Joyce also commented:

‘As we head into our peak selling period, our Christmas product has arrived, and our teams are focused and prepared for these key trading weeks. Despite the challenging macro-economic outlook, we draw confidence from our position as category leader with a vertical business model, strong loyalty program and margins.’

Five bargain stocks

Thanks to rising rates, everyone is looking to save a pretty penny where they can.

And it’s in times like these that some real ASX stock bargains can emerge — if you know where to look.

Our small caps expert, Callum Newman, has done the hard work for you.

He’s found five of what the calls are the ‘best stocks to own in Australia’ right now.

And right now, they don’t even cost that much.

Click here to discover Callum’s top five Aussie bargain stocks.

Regards,

Mahlia Stewart,

For Money Morning