Markets have been giving investors whiplash recently.

The sharp sentiment shifts over the past few weeks make the certainty of the 2022 bear market appealing.

Mad months of trading are nothing new in the grand history of markets; periods of choppy trading have existed as long as humans have had goods to trade.

But this past month, a few trends have emerged that bear a striking resemblance to the early 2020s.

One of those trends directly relates to investors like you and me.

And like any trend, being aware of it is half the battle.

CNN’s Fear and Greed Index gave me the idea for this essay.

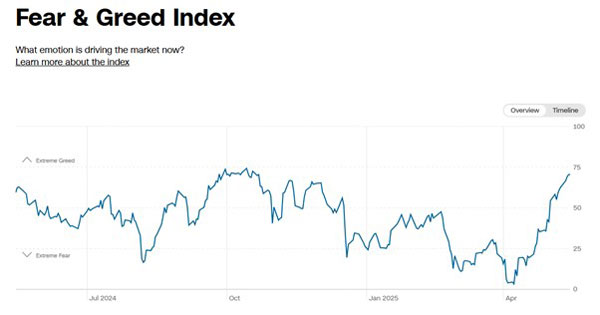

As you can see below, investor sentiment has seen some incredible swings this year. In the past month or so, it’s bounced from April’s ‘extreme fear,’ to just shy of ‘extreme greed’.

| |

| Source: CNN |

This is obviously not the first time we’ve seen markets careen from existential dread to rapture. And this index is just one imperfect measure.

The Fear and Greed Index began in the aftermath of the 2008 financial crisis as market commentators struggled to grasp the ‘vibe of the market’ as it melted down.

It uses seven indicators, including the VIX, options contracts, and demands for safe-haven assets like gold and bonds.

While it’s not a robust indicator, it’s more reliable than the one retail traders have been swept up in recently — social media.

New studies show that one-in-three retail traders are now relying on social media to gauge the market and get stock advice.

And as further studies have shown, the results are resoundingly poor.

The Herd Goes Online

Markets are notoriously unpredictable.

As economist John Maynard Keynes often said, they are ‘propelled by animal spirits,’ the spontaneous human urge for action, rather than inaction.

That urge can be seen by individual investors, who speculate on stocks with little research or abandon caution with risky bets.

Keynes said it was :

‘Characteristic of human nature that a large portion of our positive human activities depend on spontaneous optimism rather than mathematical expectations.’

But when those individual actions move into the collective, the result is chaotic at best. As Agent Jay from Men in Black, put it:

‘A person is smart. People are dumb, panicky and dangerous animals and you know it.’

Markets have always reflected this chaotic behaviour, but today’s markets operate in an environment fundamentally transformed by social media.

What Keynes couldn’t have foreseen was how platforms like Facebook, Reddit, Twitter/X, and Tik Tok would supercharge these animal spirits into what researchers are calling ‘acute herding behaviour’.

A recent study by Eliner and Kobilov (2023) found that approximately 60% of younger generation retail investment decisions are based on social media.

That’s compared to just 7% of baby boomer investors. This shift represents a dramatic change in how trading information flows through the investment community.

The classic example is the ‘meme stocks’ from a few years back. In 2021, traders stirred up headlines as they attempted a short squeeze on the retail dinosaur GameStop.

Unsurprisingly, most retailer investors were left holding the bag.

You’re seeing similar behaviour now as investors first panicked out, and then panicked back into the market.

But here’s the important question: Were institutions left flat-footed, missing the rally, or will ‘buy the dip’ retail investors be left holding the bag as they rush in with the crowd?

Only time will tell.

Navigating the Social Media Age

So, how should you approach investing in an era where market sentiment can switch from fear to greed in a single viral post?

First, recognise your own emotions when trading. Even before social media, market panics were rife. Accepting that you can be greedy and fearful is an essential first step.

Being conscious of your own thoughts and emotions when trading can also improve returns.

Next, realise that the internet and social media are a double-edged sword. While they have democratised access to financial information, they have also created echo chambers that can tug at your fear and greed impulses.

Second, be wary of the FOMO (fear of missing out) that social platforms are designed to generate.

Finally, consider that the most successful investors often zig when others zag. Warren Buffett famously said, ‘Be fearful when others are greedy, and greedy when others are fearful.’

This timeless wisdom may be even more relevant in today’s social media-driven markets.

Regards,

|

Charlie Ormond,

Editor, Alpha Tech Trader and Altucher’s Early-Stage Crypto Investor

Comments