My colleague Callum Newman wrote a good piece last week pointing out how weird it was that he was an outlier for being bullish.

As he noted, doomsaying sounds smart.

It sounds like you’re doing the research, you’re aware of the risks, and you see the trap ‘everyone else’ is falling into.

Yet history shows that most money in markets is made by the optimists.

Even worse…

When the bears do get it right, profiting from the falls is very hard to do in practice.

Even the hyper-intelligent Michael Burry of ‘Big Short’ fame, was losing money hand over fist for around two years before his big bet on a US housing crash finally came good.

Anyway, my point is I feel a bit like Callum, but in a slightly different way…

Respect the pump

When you tell people you invest in things like crypto, AI, battery tech, or any other hot technology field, most in the professional investing community roll their eyes at you.

It sounds smart to instinctively label such industries ‘fads’ or ‘bubbles.’

And plenty do.

I mean, I read some commentary this week from one long (and wrong!) time doomsayer referring to the collapse of the tech bubble in 2000 as a sound rationale for not investing in technology stocks.

Give me a break!

Thanks to the internet, the past two decades has seen technology stocks become the market giants of our time.

Check out the chart of the Nasdaq to see what I mean:

| |

| Source: Yahoo Finance |

The fact is…

Investing in tech stocks over the past 20 years has been the number one play any investor could’ve made.

That’s not going to change.

And the individual stories tell an even more fantastic tale for investors.

Investing in the right internet era companies would’ve yielded insane gains for the optimists.

Take Netflix for example.

$1,000 invested in Netflix 20 years ago would’ve been worth close to $200,000 at its November 2021 peak (and still around $120,000 today).

By comparison, a $1,000 investment in the S&P 500 index would’ve yielded just $6,139 over the same time period.

My point is, investing in fast-growing technology is how you make outsized gains.

Of course, that doesn’t make it easy.

You’re dealing with the uncertainties of exponential growth, the extremes of market psychology, occasional hap-hazard government intervention; all in a hyper competitive environment.

But what the staid doomsayers and worry warts forget is that it’s precisely that uncertainty that creates the opportunity.

The trick is to find the hidden value beyond the balance sheets and cashflow statements.

As tech investor Jake Ryan puts it:

‘This is the type imagination it takes to become a savvy investor and entrepreneur. You need to be able to see opportunity where no one else is seeing it.’

And it’s not for the faint-hearted.

You need to be able to handle being wrong a lot, in order to find those few hidden gems.

And you also need to be able to handle the scorn of people who will say you’re just ‘speculating’ in fads.

They don’t understand the process of how some fads can become reality, especially in a fast-changing tech-driven world.

Those early money flows into a new area — that initial pump — are actually a big clue.

As one crypto persona famously said during the last crypto bull market, ‘you’ve got to respect the pump.’

What he was meaning was that when money flowed fast into a sector, you should pay attention.

Because despite any short-term over exuberance it was often a signal something big was indeed up.

Which brings me to AI today…

The AI infiltration

I know plenty of people are underexposed to AI right now because it feels like a bubble.

A lot of commentary in the financial press says as much too.

Remember it sounds smart to be a sceptic.

I mean, how can a stock the size of Nvidia Corp [NASDAQ:NVDA] — it’s now worth US$1.2 trillion — quadruple in value in just one year?

Such a move doesn’t make sense to most people so they write it off as a ‘bubble’.

Easier to do that than do the hard work to work out what’s really going on.

Meanwhile, Nvidia came out with earnings results last week that surprise investors once more to the upside!

As The Information newsletter reported:

‘As the tech world remained riveted by the OpenAI soap opera, the real artificial intelligence money machine was demonstrating the fine art of printing greenbacks. That would be Nvidia, which reported on Tuesday that its revenue soared 206% in the October quarter, to $18.1 billion from $5.9 billion a year earlier.

‘That’s what happens when you essentially corner the market for the specialized AI chips that are a must-have commodity for tech firms right now. And this growth is continuing. ‘Nvidia projected that revenue would soar to $20 billion in the January quarter, which would be an increase of 230% over the year-earlier number of $6.05 billion.’

Why is this a big deal?

Well, Nvidia chips are the work horse of the AI movement. Demand for them signals that demand for AI services is on the up.

The data supports Nvidia CEO Jensen Huang’s assertion earlier this year that AI is ‘at an inflection point’.

I agree 100%.

AI isn’t a fad — it’s an infiltration!

These inflection points are rare

AI will seep its way into every single facet of daily life.

It’s early days so we’re not feeling the full effects…yet. But make no mistake, Nvidia’s latest results show the race is heating up.

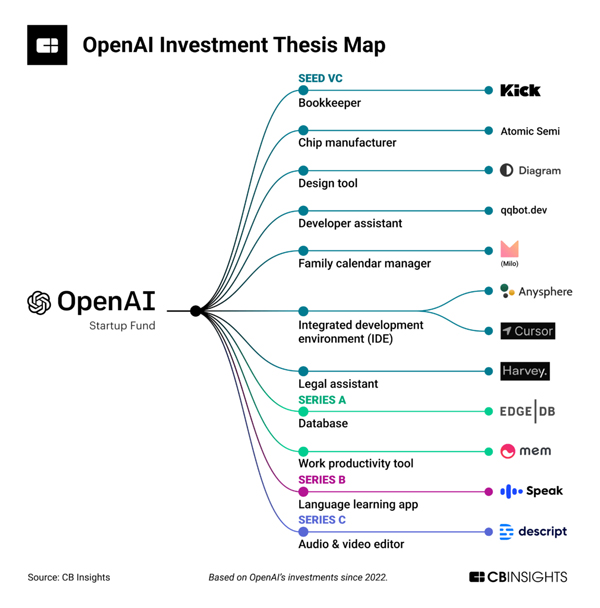

Another clue to how widespread AI tech is going to be is to look at what OpenAI is up to.

Remember, OpenAI is the start-up that launched the ChatGPT chat bot that kickstarted the whole shebang.

They’re a major leader, so I always pay attention to what they’re doing.

With that in mind, check out the breadth of their start-up investment eco system:

| |

| Source: CB Insights |

The US$100 million fund — which is also backed by Microsoft — is investing in a diverse range of end use cases.

I expect to see a further widening as they fine tune AI models for different areas.

Your own AI fitness trainer.

An AI tutor for your kids.

Your own AI Doctor…

The possibilities are endless.

So sure, you can ignore AI and write it off as the latest tech ‘fad’.

Or you can get busy.

For my money, these rare tech inflection points are the most exciting and profitable areas of the market to invest in.

Don’t ignore them.

Good investing,

|

Ryan Dinse,

Editor, Fat Tail Daily

Comments