The Creso Pharma Ltd [ASX:CPH] share price rose today after acquisition target Halucenex expands clinical trial recruitment.

Creso shares were up as much as 6.25% in early trade before retracing somewhat to trade at 16.5 cents a share, up 3.1%.

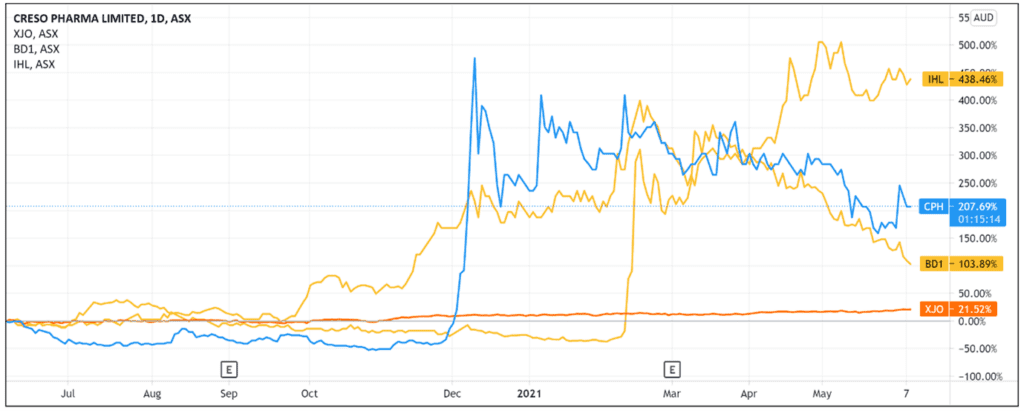

CPH is enjoying a solid week, with a string of well-received announcements seeing CPH shares gain 13% over the last seven days.

However, the volatility attached to pot stocks also saw the Creso stock down 8% year-to-date.

Halucenex expands recruitment

Creso’s target acquisition company Halucenex Life Science will expand recruitment of its Phase II clinical trial to include participants who have not served in the military or undertaken roles as first responders but still suffer from treatment-resistant PTSD.

As we covered last month, Creso flagged this possibility when it announced Halucenex acquired more psilocybin.

Halucenex chose to expand the trial after receiving an ‘overwhelming amount of inbound enquiries’ from sufferers of debilitating mental health conditions who are seeking ‘alternative treatment methods.’

Halucenex thinks the expanded participant set will provide ‘real world examples of the efficacy of psilocybin when used as an alternative treatment route.’

CPH ASX outlook

According to Bloomberg, substances like psilocybin ‘have an even better shot than cannabis at disrupting the $70 billion market for mental health.’

Creso cited evidence suggesting the market for PTSD therapeutics is expected to grow to US$10.5 billion by 2025.

The company is also targeting the Canadian market, claiming that ‘mental illness in Canada more broadly has an economic burden of C$51 billion per annum.’

There are already real-world examples of psilocybin treatments for illnesses like depression.

In 2018, the US Food and Drug Administration fast-tracked Compass Pathways’ psilocybin-based treatment.

When Compass floated in 2020, its shares spiked 71% on the first day of trading.

Such instances have likely incentivised further psilocybin research by companies like Creso and Halucenex, hoping to strike upon a treatment that can be approved by the FDA and the market at large.

Creso said the expanded trial would yield richer data expected to progress discussions with potential partners, including drug developers, large pharmaceutical companies, and insurance providers.

Despite the expansion of Halucenex’s trial, the company must still overcome a few regulatory hurdles.

It must receive a Dealer’s Licence from Health Canada and then apply for Clinical Trial Authorisation before commencing with the trial.

Halucenex does anticipate securing its Dealer’s Licence shortly.

If you would like further insights into the evolving regulatory picture regarding cannabis, as well as a discussion of three different ASX-listed cannabis companies, then be sure to check out this free report.

Regards,

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here