Today Core Lithium Ltd [ASX:CXO] released results from its definitive feasibility and scoping studies, showing a 30% increase in ore reserves.

The updated feasibility study was encouraging for CXO, with the company saying it is ‘well positioned to be the next lithium producer in Australia.’

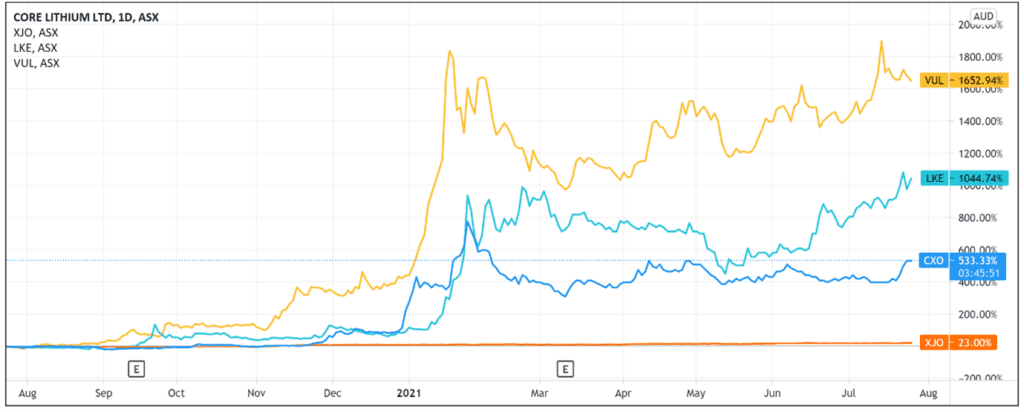

This optimism, mixed with the hot ASX lithium sector, has seen Core Lithium shares rise 100% year to date and 550% over the last 12 months.

Despite the recent gains, the market’s reaction to today’s announcement was modest. Core Lithium share price was up 1.5% at time of writing.

Updated DFS increases ore reserves by 30%

While Core Lithium released a lot of information to the market, a major takeaway was the revision of its definitive feasibility study (DFS) for the Finniss Lithium Project.

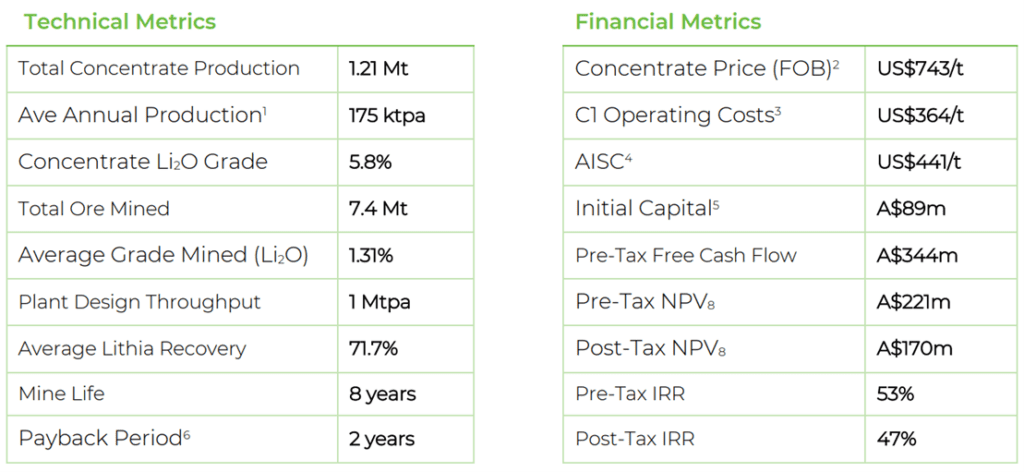

The DFS resulted in a 30% increase in ore reserves, now coming to 7.4Mt @ 1.3% Li2O.

This underpins an eight-year Life of Mine (LOM).

CXO suggested that the LOM could potentially be extended with ‘additional mineral resource inventory’.

The revised ore reserves, combined with the LOM, indicate ‘excellent DFS economics’.

The economics involves a pre-tax internal rate of return (IRR) of 53%, pre-tax net present value at a discount of 8% (NPV8) of $221 million, and life-of-mine EBITDA of $561 million from revenue of $1.3 billion.

CXO also suggested its Finniss project could be one of Australia’s ‘lowest capital intensity lithium projects.’

Why?

The DFS implies Core Lithium can pay back the project’s costs in two years due to ‘low initial capital expenditure of $89 million (including pre-production mining costs).’

Core Lithium’s LOM average C1 Operating Cost comes to US$364/t concentrate. This implies a ‘robust’ average operating margin of more than US$370/t.

CXO share price outlook

Core Lithium released plenty of information to the market today.

An updated feasibility study, two updates from a completed scoping study, and an investor presentation to boot.

That’s a lot of information to digest and potentially turn into actionable investment ideas. The market’s tepid reaction to CXO’s slew of announcements could be a sign the market is still processing all the information.

So it would be interesting to see how the market responds over the next few days as investors begin to fully absorb the implications of today’s announcements.

Like I’ve covered last week, as a resource company, CXO rides the wave of market demand for its product.

A producer of a commodity like lithium can be classified as a price taker — it accepts the price the market sets.

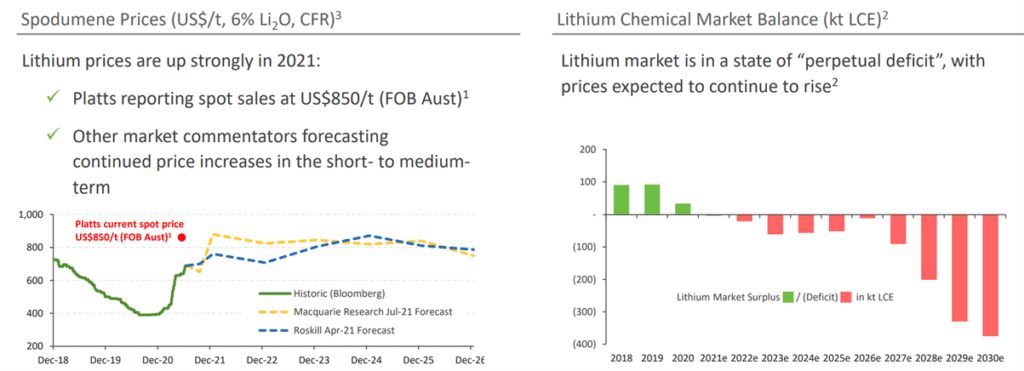

So while expanded ore reserves and quality lithium grades are important, CXO’s ‘excellent’ project economics rest on strong demand that doesn’t get outpaced by supply.

Addressing the issue of demand, Core Lithium’s presentation today cited research suggesting that the lithium market is in a state of ‘perpetual deficit’.

This deficit is expected to lead to — according to forecasts cited by CXO — ‘continued price increases in the short to medium term.’

Lithium stocks are on a lot of investors’ minds. But with so many news items coming out almost daily, it’s hard to keep up and know where to look for lithium investment ideas.

I think this free report on ASX lithium stocks is a great place for anyone who wants further information and ideas.

Additionally, governments and private interests alike are converging on electric vehicles and renewable energy.

But if you’re wondering exactly what this trend means for savvy private investors, I recommend reading our free report on the renewables revolution.

There, our energy expert Selva Freigedo reveals three ways you can capitalise on the US$95 trillion renewable energy boom.

Regards,

Lachlann Tierney,

For Money Morning

PS: In this new report, Money Morning’s Ryan Dinse reveals why he is convinced that lithium is going to rebound in 2021. Get the FREE Report