Junior lithium developer Core Lithium [ASX:CXO] provided a business update and drill results for its Finniss Lithium Project and disclosed its FY22 accounts.

CXO shares are down more than 5% at the time of writing this update (Tuesday afternoon, 27/09/2022).

Commenting on the latest drill results, CXO CEO Gareth Manderson said the spodumene-bearing pegmatites intersected in the latest assays would ‘likely contribute to a positive Mineral Resource update’.

As for its FY22 results, CXO ended the year with $135 million in cash and cash equivalents after collecting $150 million from equity raises.

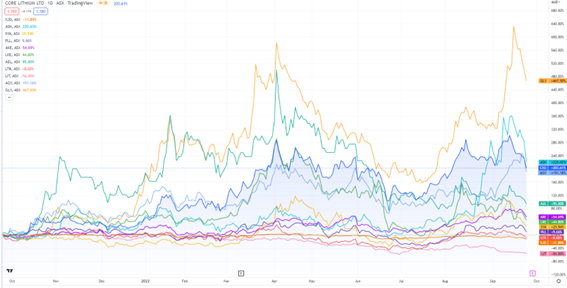

Year to date, CXO shares are up 85%.

www.tradingview.com

The latest at Finniss

On Tuesday, CXO updated investors on its Finnis Direct Ship ore (DSO) shipment and its BP33 diamond drilling results.

CXO said it uncovered the first spodumene ore at its Finniss operation earlier this month, with DSO shipment preparations now underway.

Meanwhile, Finniss’s crushing and screening plant approaches the commissioning stage, with night shifts added to spur progress.

As for its BP33 exploration, CXO reported ‘high grade spodumene bearing pegmatite interested in multiple holes at BP33, up to 830m below surface.’

The highest grade intersections CXO reported included:

- ‘22.85m @ 1.59% Li2O in NMRD032

- ‘31m @ 1.62% Li2O in NMRD034’

While five of CXO’s chosen drill holes were said to hit mineralised pegmatites, NMRD038, NMRD035 and NMRD039 hole intersections are expected to double the depth of the pegmatite mineralisation at BP33.

Gareth Manderson, Core’s CEO, commented:

‘Core Lithium continues to demonstrate progress towards building a great lithium business through the delivery of the Finniss Project to production and the ongoing work to prove up our resources to support future operations.

‘Finniss will come online at a time of high lithium demand.

‘Core has significantly increased exploration and resource expansion funding to grow the resource at Finniss. The diamond drilling results from BP33, the second lithium mine planned at Finniss, demonstrates the value of this investment.

‘Spodumene bearing pegmatites were intersected in multiple holes at BP33. Importantly, these intersections sit well outside of the current BP33 Mineral Resource and will likely contribute to a positive Mineral Resource update.’

Overlooked lithium stocks

In 2021, lithium stocks dominated the ASX — eight of the 10 best-performing stocks on the All Ordinaries in 2021 were lithium stocks.

But lithium stocks haven’t fared as well in 2022, with many of last year’s high-flyers trading well below their 52-week highs.

Is it too late to tap into the lithium sector, then?

Not quite.

Money Morning has published a research report on three overlooked ASX lithium stocks. Access it for free here.

Regards,

Kiryll Prakapenka,

For Money Morning