Shareholders for Core Lithium [ASX:CXO] were upvoting the lithium explorer early Monday after the group reported its BP33 Mineral Resource Estimate (MRE) has more than doubled.

Final drilling was also said to also have revealed extensions along strike and down depth at BP33, and so an ‘aggressive’ drilling program is planned for 2023.

Core’s shares were surging as high as 11% early on Monday, evening out to a more moderate 7% by mid-morning.

The commodity stock has moved up 8% in the last full year and is just ahead of its sector by 5%:

Source: TradingView

Core’s doubled MRE creates further potential

The Australian lithium miner was cheerily touting its significant upgrade to Mineral Resource Estimate (MRE) at BP33, one of its major deposits found at the Finniss Lithium Project in the Northern Territory.

The group said that more than 11 drill holes targeted extensions along strike and downdip to existing ore areas for BP33, with mineralisation appearing both open down plunge and along strike.

This has therefore increased the potential for future drilling programs at BP33 Mineral Resource for 2023.

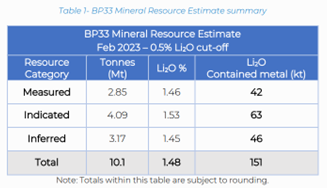

In July 2022, Core reported an MRE of ‘4.37Mt @ 1.53% Li2O’, which has now been updated and bumped up to ‘10.1Mt at 1.48 % Li2O’, more than doubling the original count.

There’s now 6.94Mt of mineral resources, at 1.50% Li2O, within the measured and indicated categories, representing 69% of the total MRE:

Source: CXO

Core Lithium’s CEO Gareth Manderson said:

‘This upgrade is a credit to our exploration and technical teams, who are systematically exploring the Finniss tenements while the business moves into production. These results provide further confirmation of the prospectivity of Core Lithium’s ground holding.

‘Importantly, BP33 remains open at depth. Exploration to extend mine life at Finniss and identify growth opportunities is a priority for the business, with an expanded drilling program for CY23.’

Core initially began drilling to determine continuity of grade and thickness of current mineralisation areas. The results today present further opportunities while reinforcing Core’s existing confidence in the BP33 deposit.

Throughout 2022, Core completed an expanded drilling program alongside the development of its Grants Mine, which saw the shipping out of its first DSO.

Core plans a further expansion of the exploration program across its Finnis projects area for 2023 in order to identify and define additional mineral resources and ore reserves that could lead to the development of mining options over the Finniss tenements.

Contributing to the doubled MRE, Core had also undertaken RC drilling to better focus on defining southern limits of mineralisation and targeting strike extensions.

This was completed late in 2022, with the results incorporated into the current MRE, the drilling data reported as ‘8m @ 0.63% Li2O in FRC362 from276m’ and ‘3m @ 1.09% Li2O in FRC363 from 290m’.

CXO stated:

‘The results are in line with expectations as it has previously been recognised that the BP33 pegmatite and mineralisation thins to the south and decreases in grade. However, these RC drilling results have provided valuable information in helping to model this transition.’

Australia’s next commodity boom

Speaking of critical metals, our resources expert thinks the Australian resources sector is set to enter a new era based on the world’s transition to carbon-emission-free energy.

It could be an era that paves the way for commodity corporations to make big gains, just like Fortescue Metals when it struck gold — well, iron — the last time around.

James Cooper, trained geologist turned commodities expert, is convinced ‘the gears are in motion for another multi-year boom in commodities’…and the best part is that Australia and its stocks are in prime position to reap great benefits.

You can access a recent report by James on exactly that topic AND access an exclusive video on his personalised ‘attack plan’ right here.

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia