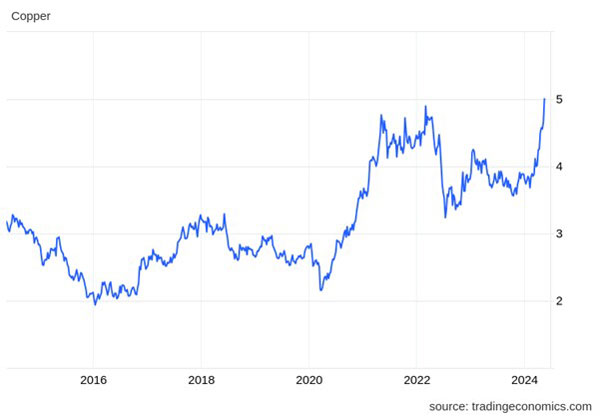

Overnight, copper reached a major milestone, recording its highest-ever price and (briefly) breaching major resistance of US$5 per pound.

| |

| Source: Trading Economics |

By market close, copper was sitting back below $5 per pound. Nonetheless, this has been a remarkable come-back story.

With prices tearing higher, it’s easy to forget how bad things looked last year.

Evergrande Group, China’s second-largest property developer, was facing bankruptcy.

Many believed this would be the canary in the coal mine for a much deeper problem in China’s real estate market.

There was virtually no reason to be bullish on copper last year.

A banking collapse in the US and a never-ending rate-rising cycle in the West.

But despite all the negativity, copper prices held firm.

And with that, we continued to build exposure.

But there’s no point being a contrarian for contrarian’s sake.

You need a strong thesis to support your conviction. Like last year, that will get you through the darkest times as an investor.

Cut supply and prices will rise

If you’re a long-term reader, you probably know that the copper story revolves around a lack of supply.

Fundamentally, this was why the copper market HAD to turn.

Here’s what I had to say amid the bearish sentiment for copper, last year (emphasis added):

‘Neglect to invest in new projects, including exploration, means ageing mines are being pushed past their use-by date.

‘Large miners have focused more on shoving low grade marginal ore and waste material through processing plants, rather than spend capital on finding new high-grade deposits.

‘The effects of the last commodity cycle — from extreme peak to low — continue to play on the minds of mining executives who remain adverse to risk.

‘But that will come at a major cost…mines are a depleting asset.

‘As commodity prices rise and decade-old mines finally expire, mining giants will be forced into a fierce bidding war to secure the next generation of deposits.

‘Except these deposits are yet to be discovered.

‘Given there is a 15–20-year time lag from discovery to production, a critical supply gap looms.

‘The coming crisis has been fuelled by LACK of investment in new discovery.’

If you wish, you can read the full article here.

This thesis, based on a lack of supply, gave us the strength to buy during last year’s terrible bear market for junior mining stocks.

So, is now the time to buy?

So, here we are today; the tide has shifted on the copper story and resources broadly.

But today’s much more bullish mood comes with a word of caution…

Copper has had an incredible run over the last 6 months, up a staggering 36%.

This is a hot market. Perhaps too hot.

The best action for those already holding copper stocks is to sit tight.

But if you don’t hold copper stocks, be wary of chasing this market higher. Be patient and wait for a decent pullback.

This remains a long-term theme; there’s no need to rush. Opportunities will come.

That said, you should be preparing for that outcome right NOW—not necessarily buying but researching and understanding which stocks to buy.

Again, this is what I have shared with my paid readership group.

We will welcome any pullback from here… An opportunity to build our exposure.

Why?

Rising prices over the last two months will have a negligible impact on long-term supply.

According to Blackrock, price incentives to expand production and develop new mines will kick in once copper reaches at least US$12,000 per tonne.

The development of copper mines is extremely capital-intensive.

That means miners will need a price that REMAINS at elevated levels for some time to incentivise new development.

But if you are looking to add resource stocks right now, which sector should you be targeting?

Simple. Oil and gas.

Stocks here remain depressed.

Yet primed for a comeback, just like copper has done over the last 6 months.

This is the opportunity investors should be looking at as the NEXT major turnaround story.

It’s part of a recent report I put together, focussing on oil and gas investments and why this could be one of the biggest comeback stories of 2024.

You can access that for free here.

Enjoy!

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

Comments